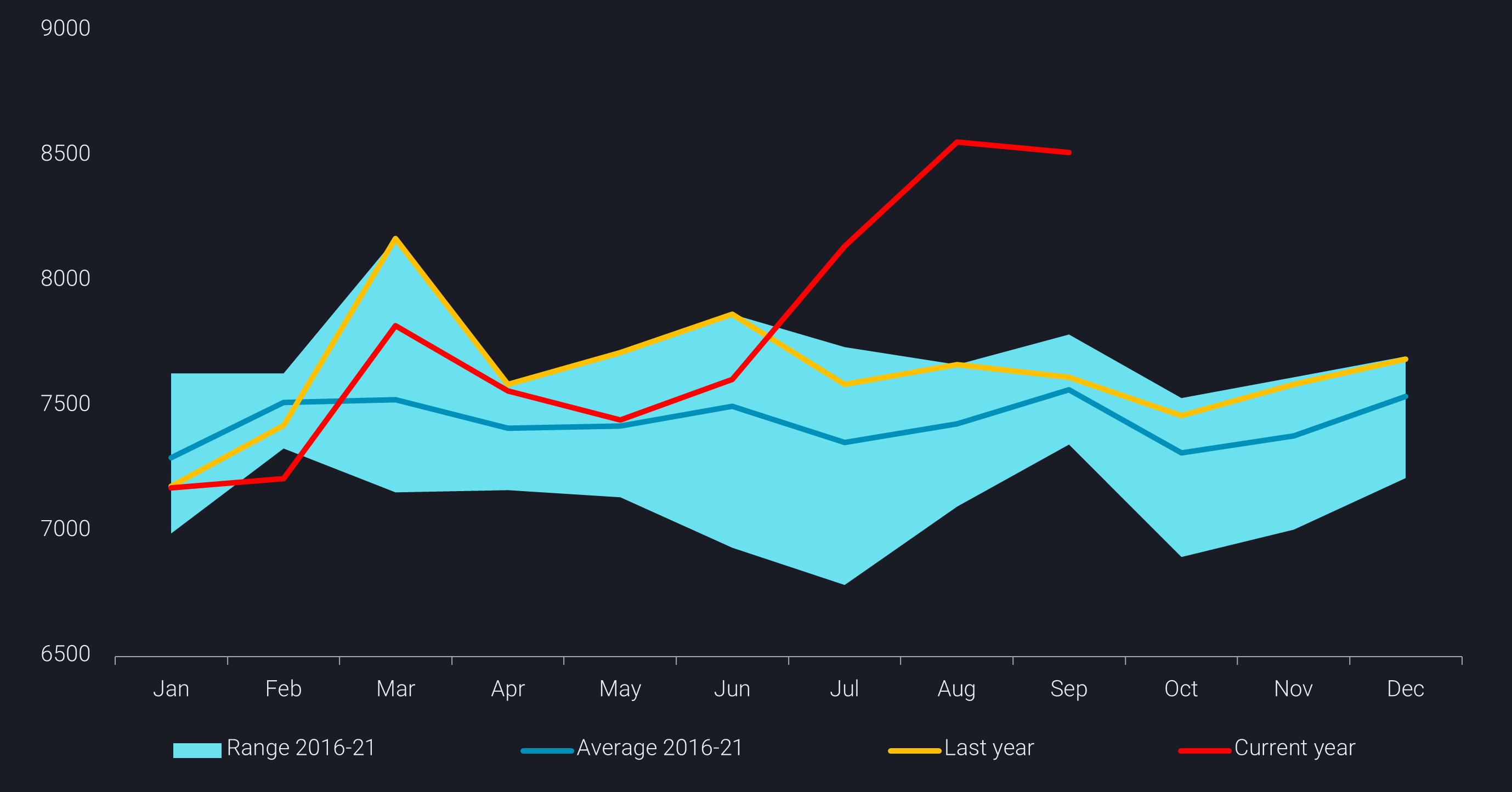

Exceptionally high global diesel exports continue through September

We look at the drivers behind the augmented East of Suez diesel exports and the demand factors keeping volumes moving toward the Atlantic Basin

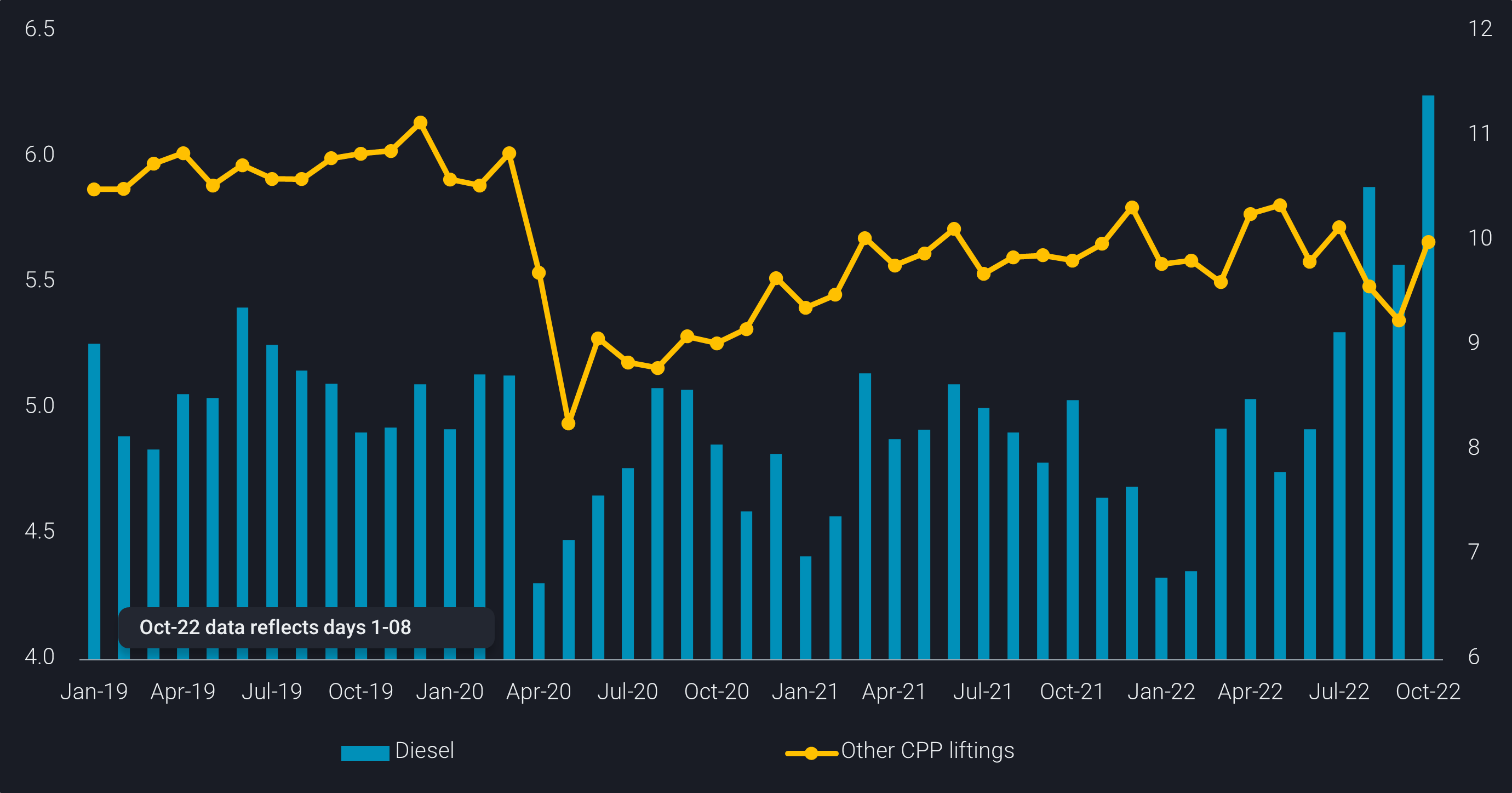

Global producers are responding to the growing global diesel tightness by exporting historical record high volumes of diesel. Asia liftings observed in August and September reached multi-year highs, notably from India, South Korea and Malaysia as refineries run to capture the elevated product cracks amid a backdrop of building inventories and higher product export quotas in China.

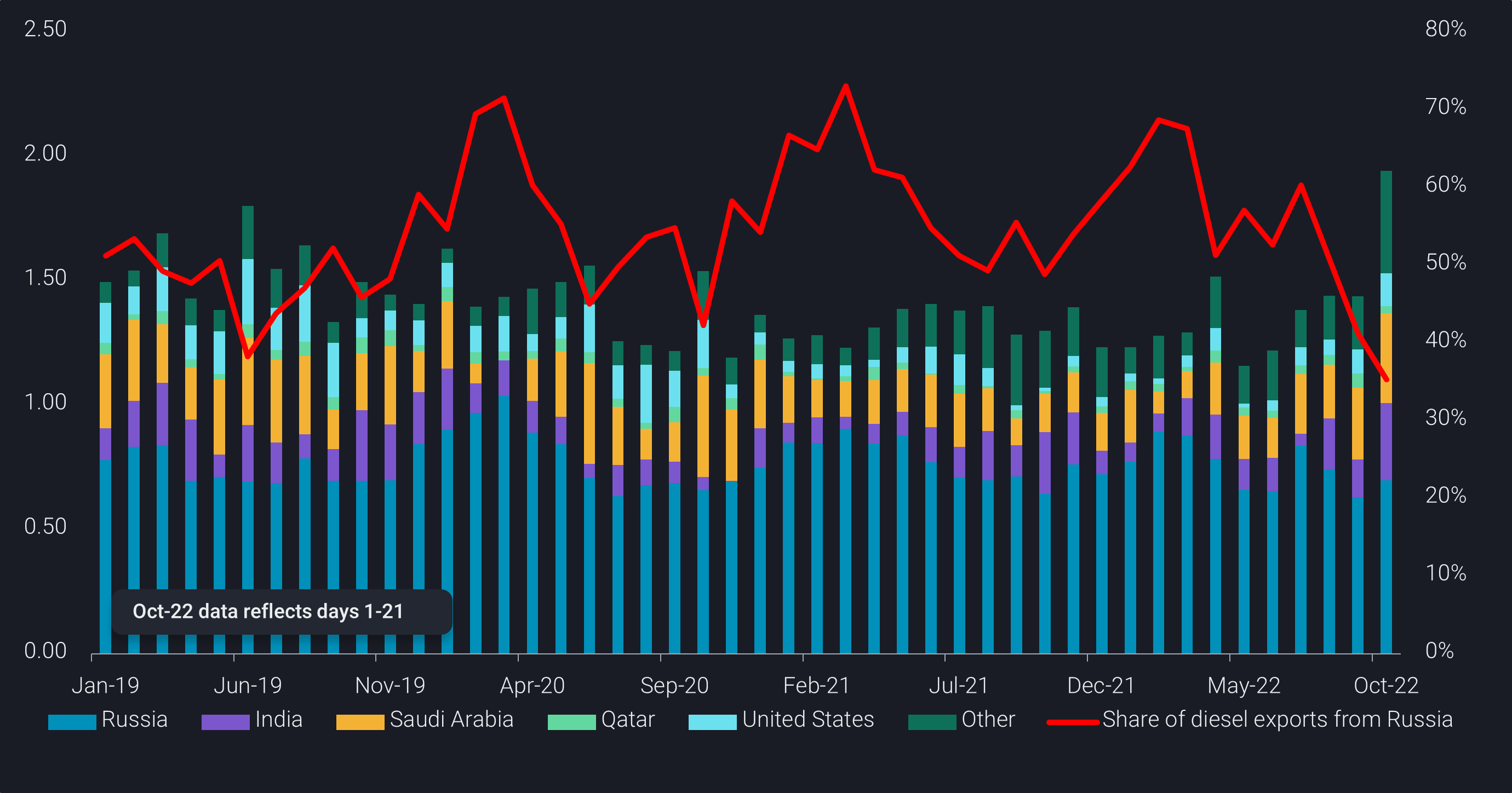

Middle East diesel liftings have torqued up this year compared to previous years, with a 30% increase from Jan-Sept 2022 compared to Jan – Sept 2019 while Russia liftings remain relatively steady despite the recent redirection to “friendly” European locations namely Turkey.

And since the US hit a multi-year peak in August 2022 for seaborne diesel exports, we have continued to see high seaborne export levels despite critically low inventories in US PADD 1 and PADD2 (EIA).

World diesel exports (kbd)

Clearly, global refineries have responded to the persistently high global diesel crack spreads to adapt their yield structure and crude input to produce more diesel, at the expense of lower performing refined products. The record volumes of diesel expected to land in Europe from Asia in October has nearly doubled m-o-m and underpins the increased reliance on imports seen across the wider Atlantic Basin.

Diesel (LHS) vs other CPP liftings (RHS) from US Gulf, NWE, Med, SE Asia and NE Asia (mbd)

Atlantic Basin diesel pull driven by strong and persistent factors

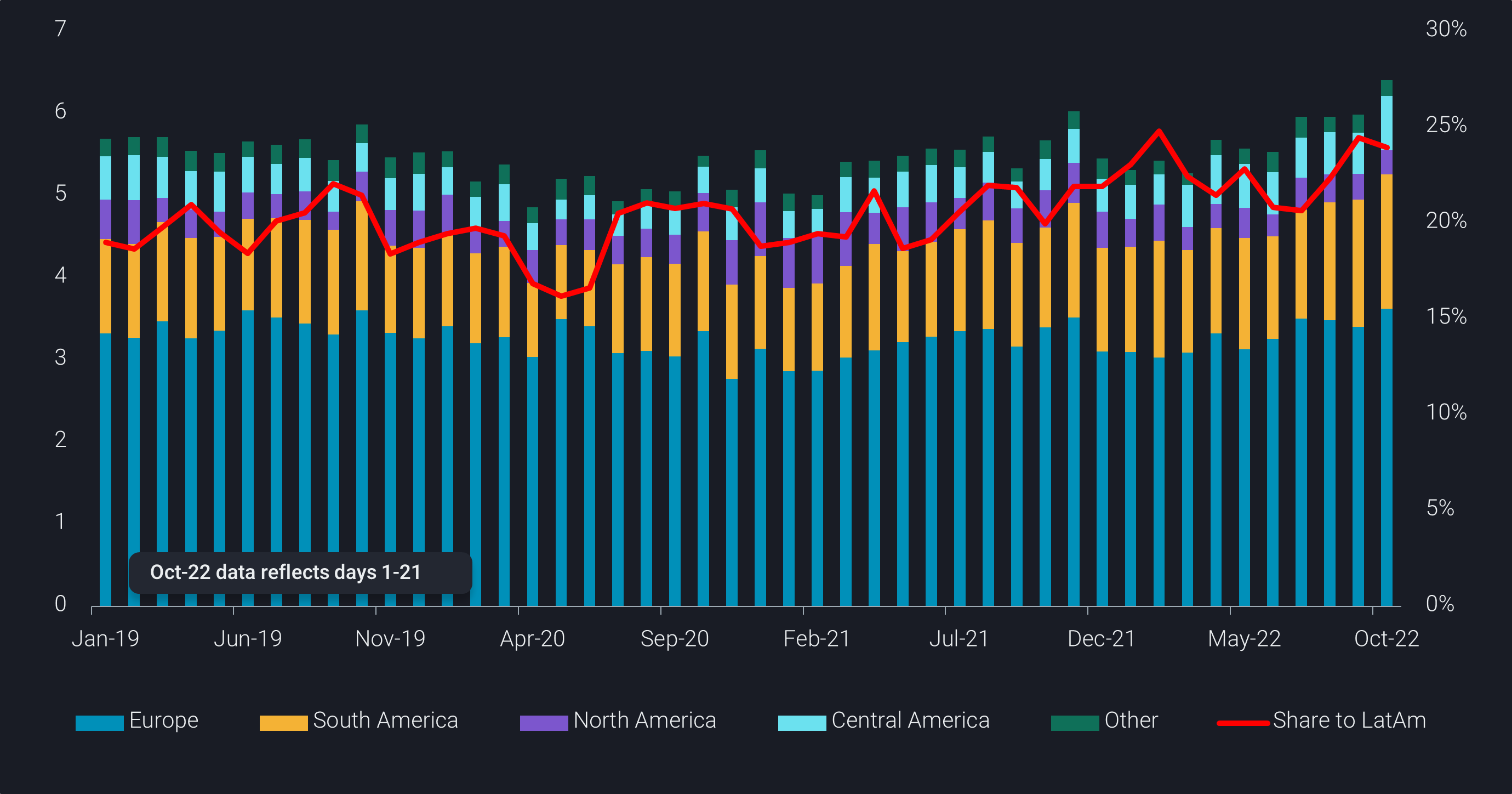

Refinery outages, diesel demand for gas to oil switching, booming LatAm demand (ags, power generation) and European energy security will all likely keep the Atlantic Basin’s reliance on seaborne diesel imports from West of Suez escalated.

As we are catapulted into the seasonal autumnal maintenance season in Europe and the US, we are blindsided by unplanned refinery outages in France where now over 75% of the refinery system is down as of early October after the recent announcement that the Donges refinery (219kbd) will join the already widespread strike action. France is even in more need for diesel to cover gas to oil switching to cover the large volume of power produced by outages at nuclear plants, which builds upon its already established domestic heating oil market for gasoil.

Europe increases imports of sweet crudes for diesel production

The high demand for diesel in the Atlantic Basin markets can also be observed in the crude flows where we see Europe continuing the trend of increasing imports of light to medium-sweet grades driven by persistent high diesel cracks and high natural gas prices forcing European refiners to manage desulphurisation costs whilst trying to increase diesel production. However it is also important to stress another key driver for increased light/medium-sweet European crude imports is simply the fact that most of the closely available supply (i.e. from within the Atlantic Basin).

Since the OPEC+ news of a targeted 2mbd production cut was announced, diesel pricing (crack spreads and jet regrades) have strengthened and will likely have a disproportionate impact on the supply of high gas oil yielding crude for the global refining system in the medium term.

Will seaborne diesel exports East of Suez continue at this level?

The biggest question in the market (other than Russia price cap agreement) is uncertainty around China’s product export quotas:

- What the outright volume will be

- Whether the quotas get carried over to 2023

- If Chinese refineries respond to the government encouragement to run harder

Meanwhile, refinery turnarounds elsewhere in Asia suggest diesel exports, and therefore east-to-west flows could soften in the near term.

Japan’s refineries are moving into a high maintenance season with a relatively large volume of capacity offline and the lack of barrels (which mainly feed Australia) could price diesel flows to stay within the region. South Korea’s SK Energy (275kbd) is also on maintenance for October (Reuters), along with India’s Vadinar refinery (400kbd) – which plans to shut for a month in November (Business Standard). The collective result of these outages will likely translate to fewer export barrels available to Europe.

European buyers will continue to look towards the Middle East and Asia for an alternative source for diesel, imports from East of Suez have already hit a multi-year high in September with flows from Saudi Arabia alone reaching nearly 300kbd. Although China could alleviate the global diesel tightness if refineries boost runs and increase diesel exports, it is likely that these export barrels will stay in the region which would free up diesel from the Middle East and India, possibly from storage in Singapore/Malaysia to head west.

The Atlantic Basin region has seen a dramatic spike in diesel imports over Q3, especially in LatAm which competes with the European Union’s for US origin cargoes. Going forwards, as Europe steps up efforts to replace diesel imports from Russia, high diesel crack spreads are the natural consequence. South American countries are often named as key future buyers for Russian diesel but in August and September only marginal volumes (20kbd) have been observed along this route. And although European imports (excluding Turkey) of Russian diesel have declined since July, Europe will still need to find alternative diesel supplies to the tune of 450-500kbd and with the expected European ban for Russian diesel in February, time is running out.