China’s crude destocking pauses. Is it looking for a refill?

China’s onshore crude inventories made a U-turn after months of draws in recent weeks. Vortexa analyses the key factors underpinning the move, while giving a view of whether this stock refill trend is sustainable.

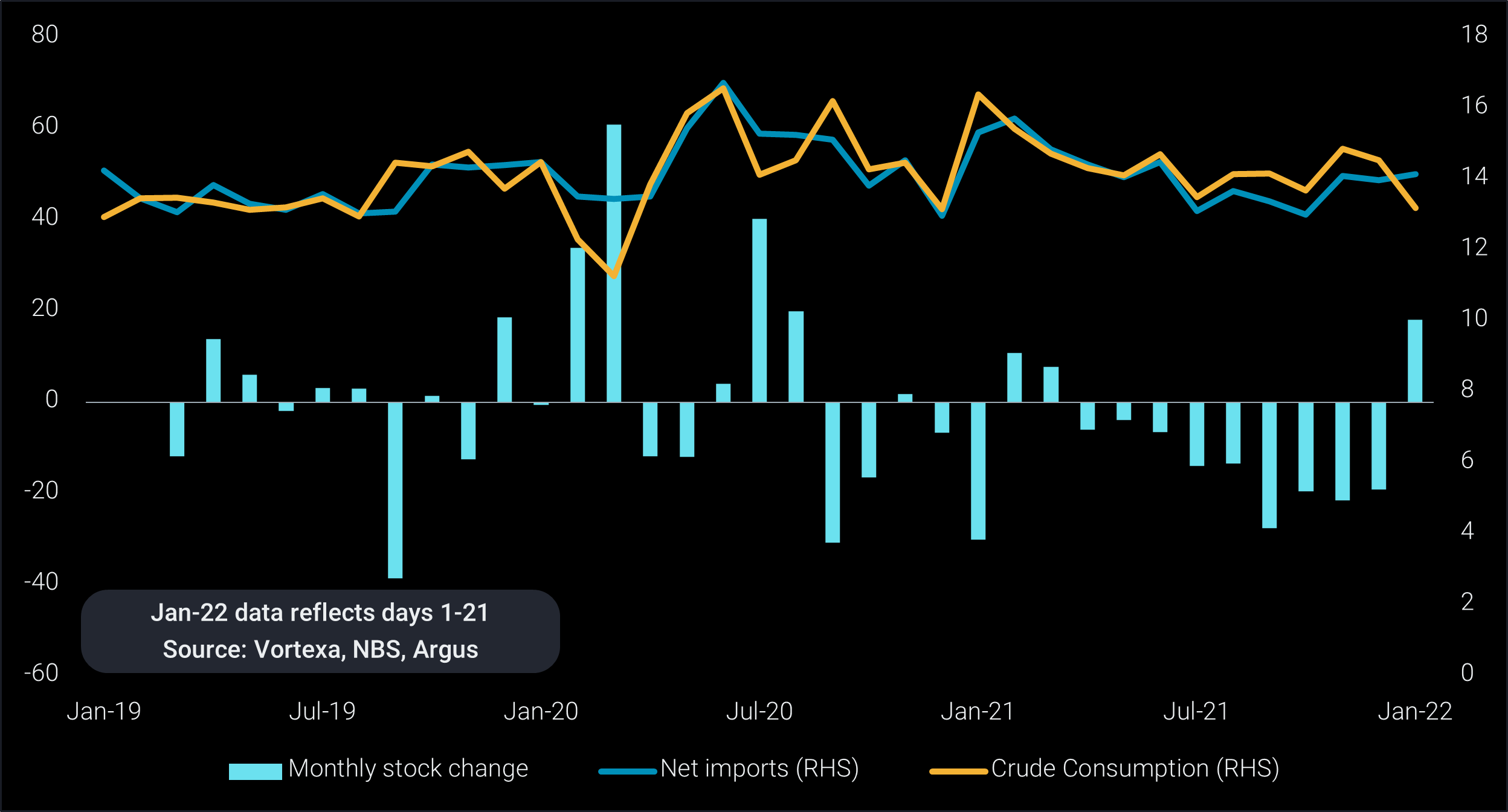

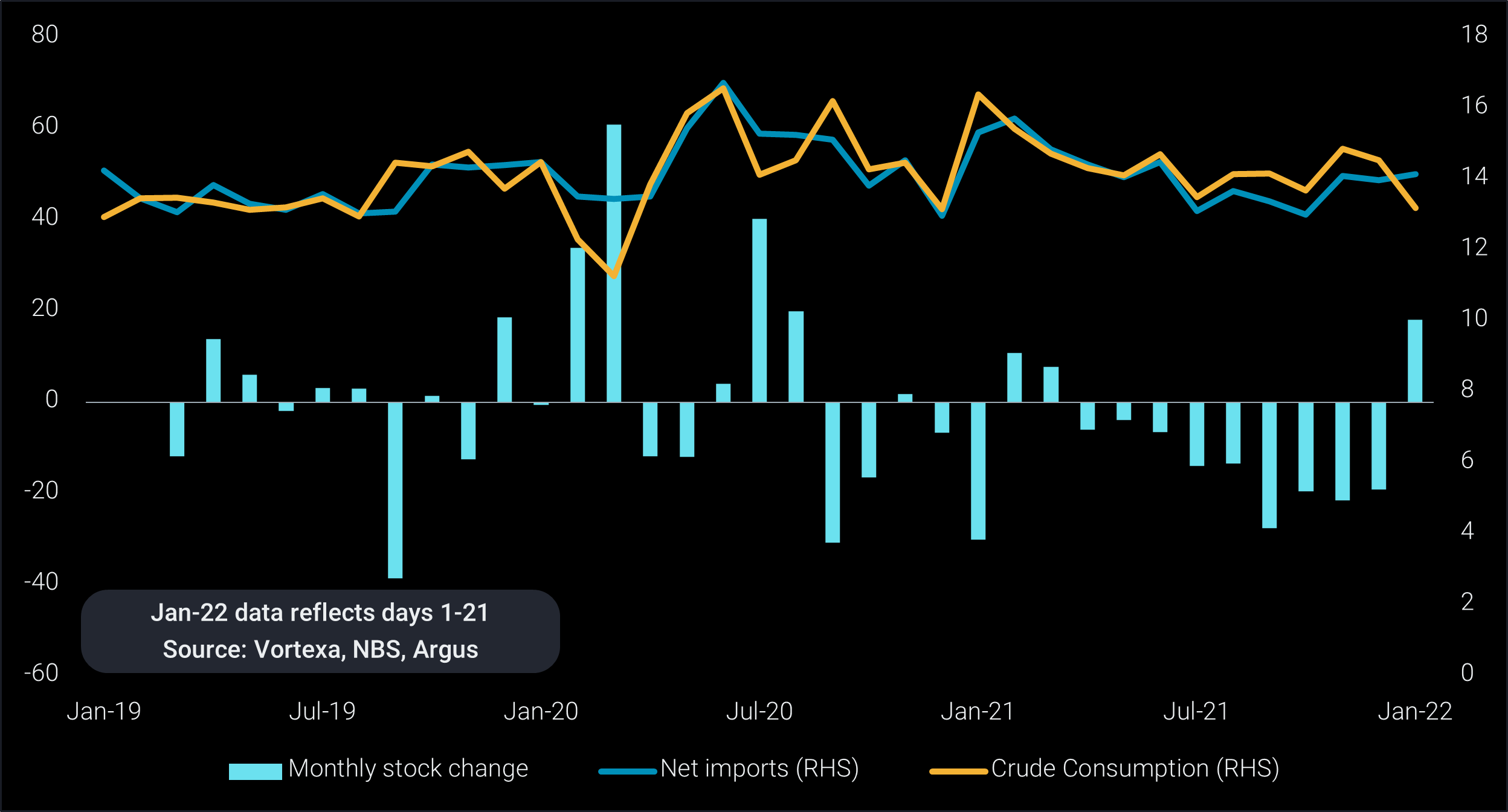

After drawing for 9 consecutive months from April last year, China’s onshore crude inventories made a U-turn and registered an uptick for two consecutive weeks this month.

Throughout 2021, Chinese refiners drew over 140mb of crude from their onshore storage, with the draw accelerating in the second half of the year as rising crude prices, a backwardated market structure and limited crude import quotas discouraged spot purchases. By the end of the year, China’s onshore crude inventories were down to 830mb with a 60% utilisation rate, the lowest seen in the last three years.

China’s crude consumption slow on more headwinds

While China’s onshore crude inventories were drawing fast, seaborne crude arrivals in the country between last July and December were also down over 10% year-on-year. Our assessment shows China’s implied crude consumption averaging 14.2mbd in the second half of last year, falling 5% from the first half of the year. A series of Covid outbreaks that led to renewed travel restrictions, coupled with the government’s refining rationalisation policies, had dealt a strong blow on domestic refinery runs, and the momentum has carried over into the new year.

Implied crude consumption in China have further slipped to 13.3mbd in the first three weeks of the year, down 10% month-on-month, and a massive 20% reduction from the same month last year. Shandong’s independent refiners saw deeper cuts compared to the state-run or larger integrated refiners as recent tax inspections and imposed adaptations impacted their refining margins. And the upside for refinery runs in the months ahead may well be limited. Domestic demand is expected to remain subdued with travel restrictions imposed in several provinces that are likely to continue through the Lunar New Year festive season, whilst refinery runs are also likely to be capped ahead of the upcoming Beijing Olympics. Afterwards, the start of spring maintenance will see several refineries taken offline. All of these factors are speaking against a strong pick-up in refinery runs and crude imports in the months ahead.

China’s monthly stock change (mb) vs. implied crude consumption (mbd)*

* The combination of our real-time cargo flows data and newly launched onshore crude inventories data with storage type, coupled with domestic crude output data from NBS and pipeline crude imports data from Argus Media, allows us to assess crude runs for one of the most opaque markets.

Is China looking to refill inventories?

The uptick in China’s commercial crude inventories in the past two weeks have come from the slowing of its refinery runs and discharge of Iranian oil into its Zhanjiang national crude reserve, one of its strategic petroleum reserve (SPRs) areas. China’s refilling of SPR with discounted Iranian crude and acknowledgment of the US-sanctioned cargo in its customs statistics comes ahead of another SPR release planned after Lunar New Year, which could potentially be another attempt by the Chinese government to cool oil prices that have climbed to a seven-year high this month and became a major impediment to China’s crude purchases. The deepening backwardation in benchmark prices, with Brent M1-M4 time spread widening towards $3/b, continues to deter refiners from refilling their inventories. But any further inventory draw will only heighten the country’s energy security risks. It cannot be excluded that this last point has a strong influence on China’s storage policy in the coming months.

More from Vortexa Analysis

- Jan 20, 2022: Maiden Crude Tanker CPP Voyages: What happened and what to expect

- Jan 19, 2022: Oil price rally is driven by lack of supply right now

- Jan 18, 2022: Global diesel market pricing in tighter supplies ahead

- Jan 13, 2022: Omicron: pre-emptive supply cuts & resilient demand draw stocks and lift prices

- Jan 12, 2022: Mediterranean light crude: volumes limited and sold locally, weighing on freight demand

- Jan 11, 2022: China sets tone for refiners with tight oil quotas in the new year

- Jan 6, 2022: Global crude exports end 2021 on a high

- Dec 31, 2021: Making Waves: Looking back at a year of Freight

- Dec 22, 2021: Omicron infiltrates tankers in the Atlantic basin

- Dec 21, 2021: Asian refiners find silver linings amidst an ominous Omicron outlook