More CPC Blend to sail to Asia in Q1 2021

More CPC Blend could be sailing to Asia in Q1 2021 driven by demand weakness in Europe and tightening UAE crude supplies to Asian refiners

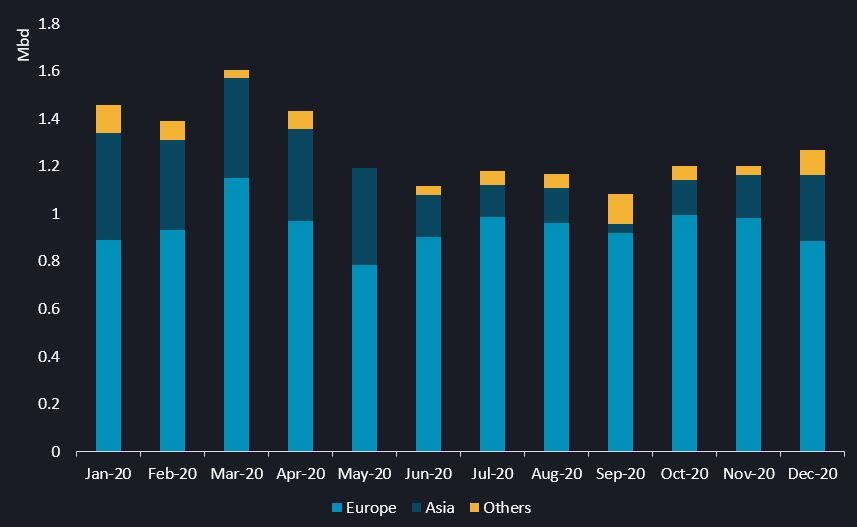

Caspian CPC Blend crude exports to Asia picked up to their highest in 7 months in December, as flows to its main customer base in Europe slowed on sluggish demand.

With an expected rise in OPEC+ member Kazakhstan’s production later in Q1, and tighter supplies of competing Middle East grades, yet more CPC Blend volumes could be making their way to Asia in the coming months.

We highlight the top things to watch on this flagship grade.

-

1. Asian vs. European demand

-

Europe’s demand weakens: Light-sour CPC Blend loaded from Russia’s Novorossiysk port is a staple crude for European refiners, with over 75% of its seaborne volumes delivered into the region last year. But European demand for CPC Blend weakened recently due to a number of factors: refiners cut back on runs amid faltering oil demand from extended regional lockdowns; competing Libyan crude availability rising sharply, and US light-sweet crude imports into Europe remaining firm.

Demand from Asia stable: Regular Asian buyers of CPC Blend include India, China, South Korea and Brunei, and demand is expected to remain robust. For most Asian refiners, the UAE’s Murban and Das are their mainstream light-sour crude diet, but CPC Blend serves as a good source of diversification especially if it offers attractive margins.

-

2. OPEC+ Dynamics

-

Kazakhstan raises production marginally: Kazakhstan received the green light from fellow OPEC+ members in early January to raise its crude production by 10,000 b/d month-on-month in February and March. We expect CPC Blend export volumes to hold stable or increase slightly over January.

UAE tightens light-sour crude supplies to Asia: OPEC member UAE, meanwhile, is rolling over term-supply cuts of its light-sour Murban crude and deepening cuts on its Das crude to Asian refiners in January and February. As these supplies tighten, Adnoc has also been inching up the official selling prices of its Murban crude vs. Dubai between last September and January, amid robust demand from Asian refiners. A further price hike in the coming months could be on the cards for Murban crude if demand sustains, thereby making competing CPC Blend relatively more attractive.

-

3. The Freight Factor

-

Freight costs as the deciding factor: Freight costs to deliver CPC Blend crude to Asia, typically on a Suezmax, are higher than that for Murban on a VLCC, by virtue of longer voyage distance and smaller vessel size. This freight cost would have a significant bearing on the crudes’ refining margins, and ultimately Asian refiners’ choice of crude. If Murban’s premium to CPC Blend widens, and the freight cost difference remains flat or narrows, the latter grade could see an uptick in demand by Asian refineries in the coming months.

-

CPC Blend exports by destination- See this in the Vortexa platform

Want to know more about the Vortexa platform?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3’)}}