Trends in US Crude Flows to Asia – May Update

Vortexa Snapshot: Trends in US Crude Flows to Asia – May Update

US crude exports to Asia in the first two weeks of May stand at 1.2mn b/d, just above January-April levels, amid resilient demand in the Asian market – particularly from East Asia. The broadly steady flow along this route also comes despite weak oil prices taking a toll on US drilling margins and production.

Southeast and East Asia lead flows in 1H May

- US crude exports to Asia between January and April averaged 1.1mn b/d, but have edged higher to 1.2mn b/d in the first two weeks of May, according to preliminary data. This demonstrates Asia’s resilient crude import appetite amid the ongoing pandemic’s impact on refinery runs.

- On a monthly basis, US crude oil exports destined for East Asia fell sequentially from 740,00 b/d in January to 480,000 b/d in April. But they picked back up in the first two weeks of May to around 750,000 b/d, as higher demand from China offset lower intake from South Korea.

- Volumes heading to Southeast Asia also rose to 270,000 b/d in the first two weeks of May, just up from average 240,000 b/d for March-April. Some of the vessels currently signalling Singapore could continue further east, which would further boost East Asia figures.

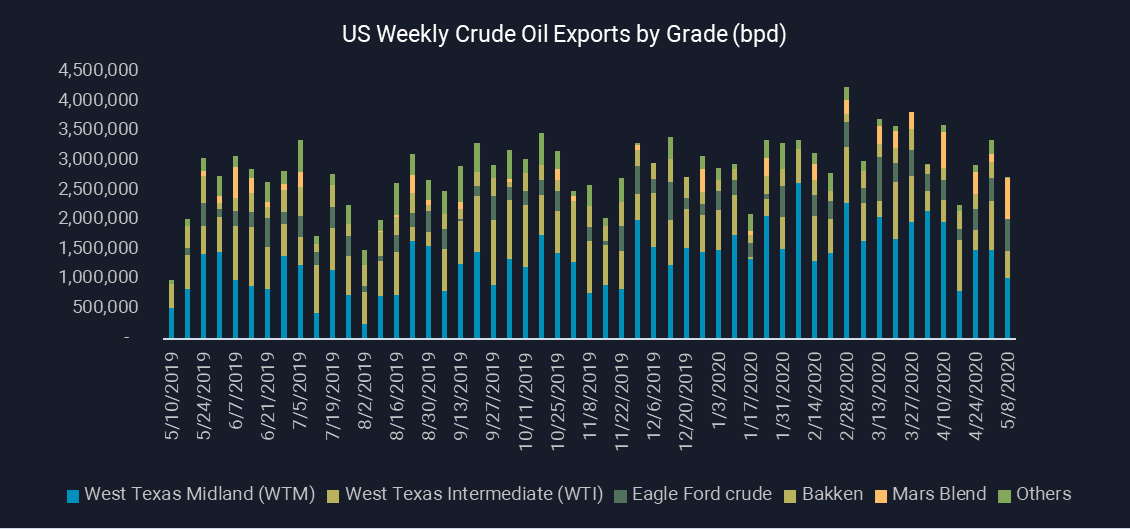

Chart 1 – US Weekly Crude Oil Exports to Asia (DoE week) – Vortexa

US crude oil exports to China rebound

- Around 11.6mn bl of US crude loaded this month is in-transit to China, a multi-year high. The recent uptick in volumes destined for China could reflect refiners aiming to take advantage of the lower prices as lockdown measures ease.

- May loading US crude cargoes are expected to arrive in China, mostly over late June-early July.

- Provisional fixtures indicate that another 8mn bl of US crude could be exported to China in June.

- Meanwhile strong buying interest from Taiwan’s CPC Kaohsiung refinery lifted US crude exports to Taiwan to a three-month high of 190,000 b/d in April. But exports have been muted in May, with no loadings to Taiwan observed so far.

South Korea’s appetite fades

- US crude exports to South Korea have slowed drastically, declining from 10.5mn bl in March, to 3.9mn bl in April and no exports observed so far in May.

- The Chevron-chartered Aframax Koro Sea has been provisionally fixed to load US crude from Houston in end-May to Korea, while the VLCC DHT Panther is also booked for an end-May voyage to South Korea.

- South Korea’s lower crude purchases in April/May is partly attributable to lower refinery runs expected in June and July amid planned refinery maintenance, as well as tighter onshore storage availability.

![]()

![]()

India’s US crude purchases to slow amidst crude oversupply

- Two VLCCs laden with 2.8mn bl of US crude loaded this month and are en route to India.

- While more loadings could take place over the next few weeks, overall exports to India are expected to slow this month compared to April as the country grapples with any oversupply of crude from its term suppliers.

- In late-April we covered that crude volumes offshore India in floating storage helped drive the Asia floating storage volumes higher overall.

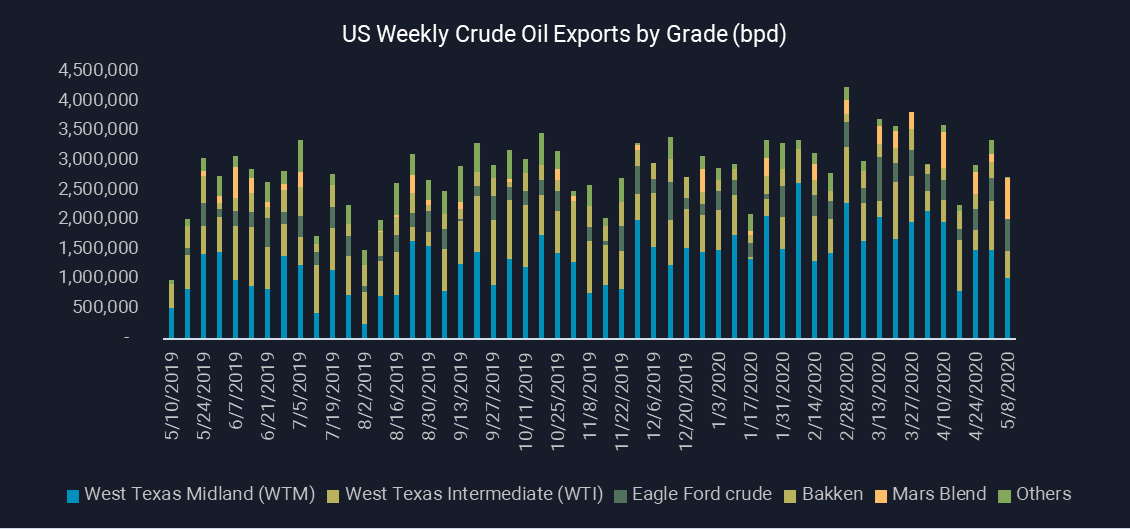

West Texas Midland dominates exports

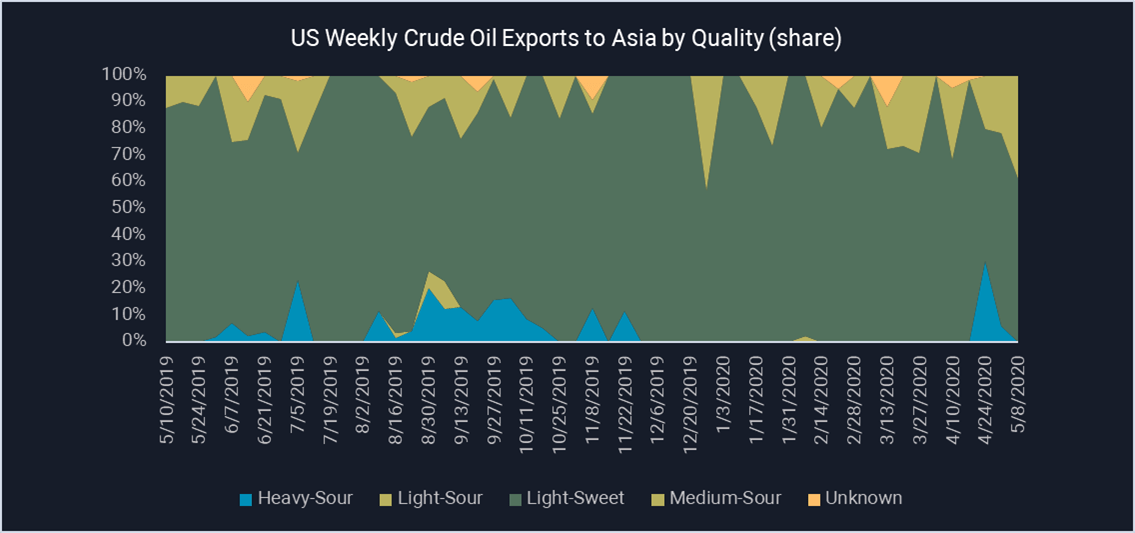

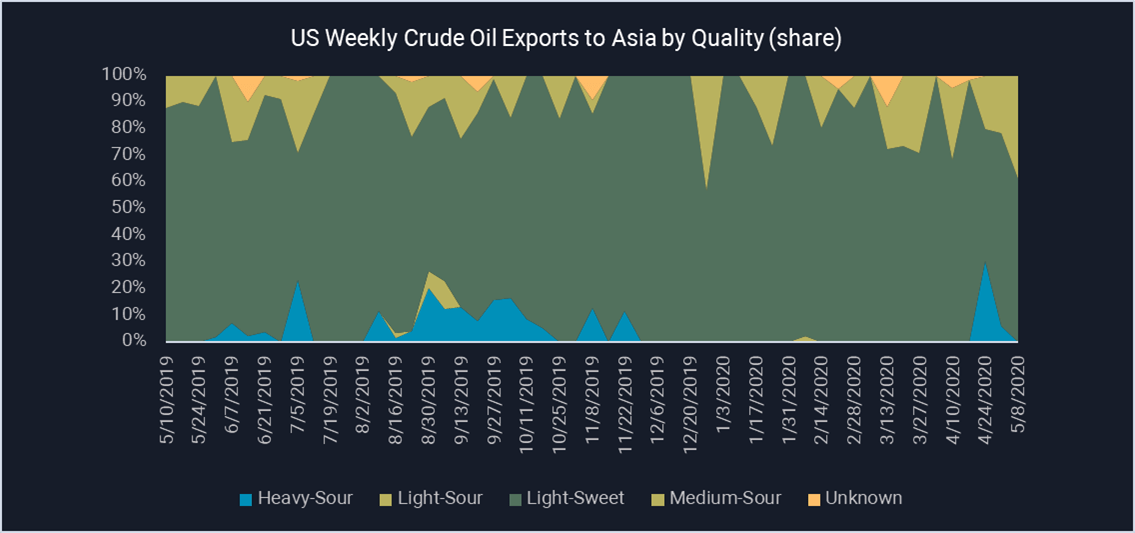

- Light-sweet West Texas Midland (WTM) crude, the top US crude grade exported to Asia last year, maintained its top spot and accounted for over 50% of total crude exports to Asia in the first four months of this year, Vortexa’s data show (see Chart 2).

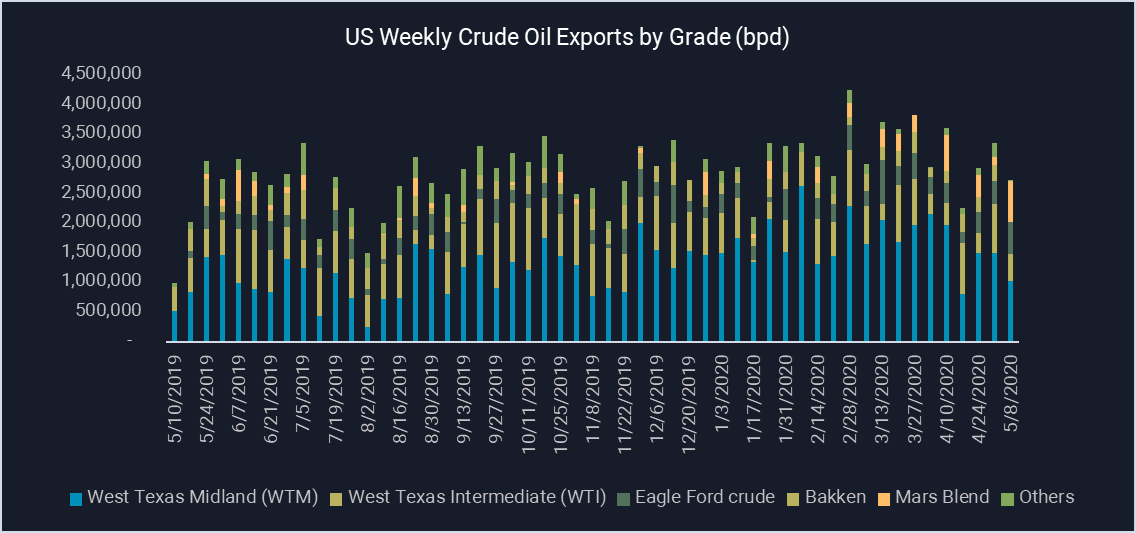

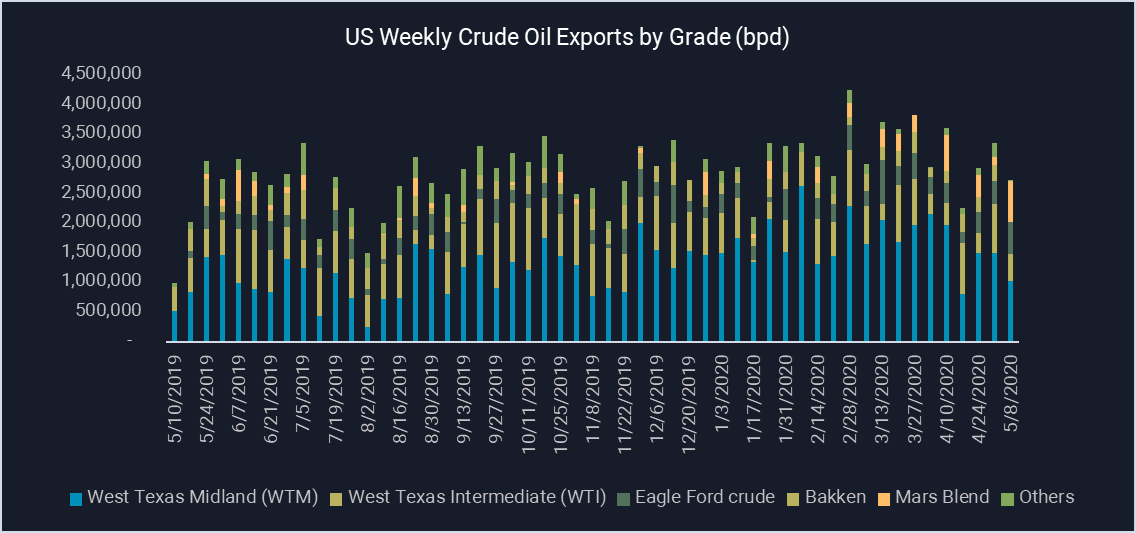

- While light-sweet grades dominate, medium-sour grades such as Mars and Alaskan North Slope have also been popular among Asian refiners (see Chart 3).

Chart 3 – US Weekly Crude Oil Exports to Asia by Quality (DoE week) – Vortexa

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}