Europe’s higher May diesel imports point to recovery

Vortexa Snapshot: Europe’s higher May diesel imports point to recovery signs

European diesel imports are on track to rise sharply in May as transport restrictions in the continent ease, paving the way for an uptick in consumption. The firmer inflows from east of Suez suppliers in May are set to continue in June. If these indicators are the mark of a recovery by the world’s largest regional diesel importing region, it could help restore global diesel flows back towards well established norms and help to draw down the glut of diesel built up in onshore and offshore storage.

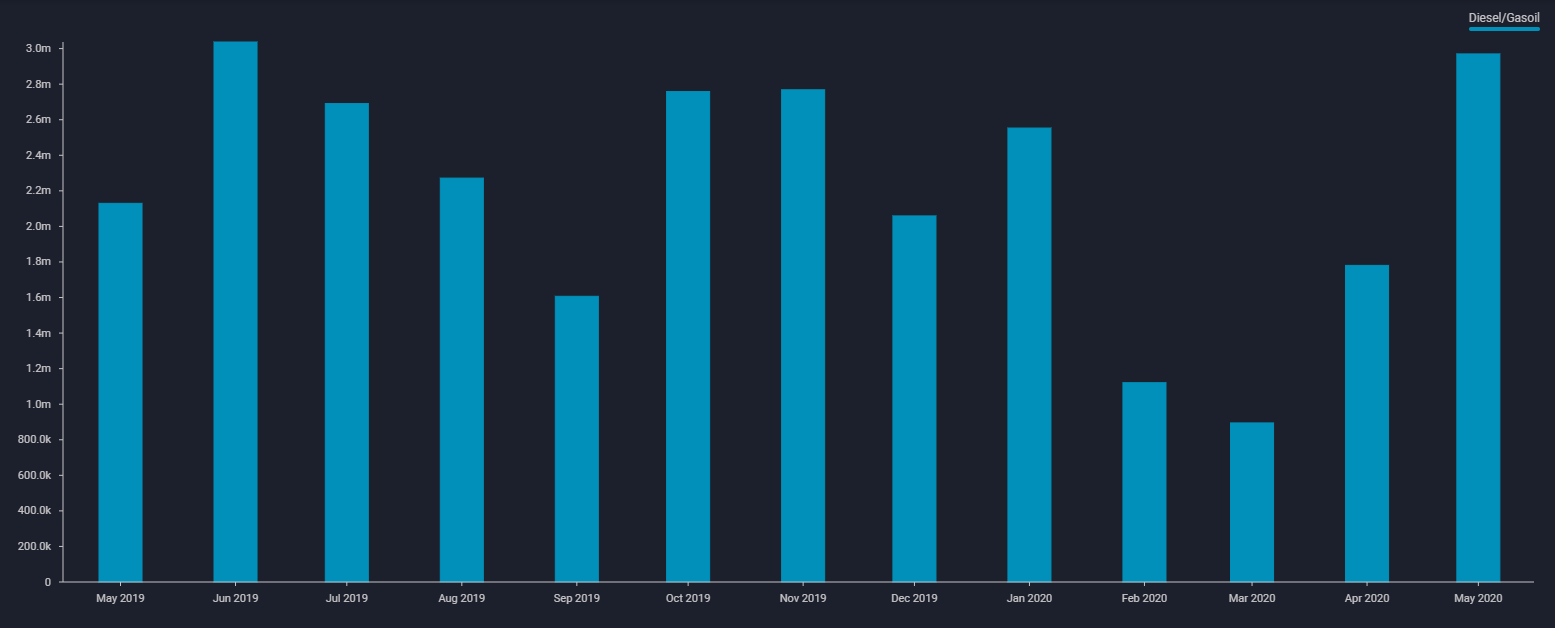

Diesel inflow uptick in May

-

As of 27 May, provisional diesel arrivals into Europe stand at 7.4mn mt for May, the highest monthly total since June 2019, and up from around 6mn mt in April. The rise in diesel imports follows the recent slump in European demand and tighter storage availability for the road fuel.

-

The shift to a more balanced supply-demand situation in the European diesel market is supported by the narrower contango for Ice gasoil futures? – the M2-M1 spread stood at $10.50/mt on 26 May, compared with $26/mt four weeks earlier.

Consumer share returns to normality

-

The largest share of European arrivals in May is to Netherlands (18%), France (13%), Belgium (13%), Germany (9%) and UK (8%). This marks a return to more normal distribution compared with April – when Sweden, typically a net exporter, was the fourth largest importer in Europe.

-

Germany’s seaborne diesel imports are expected at 660,000 mt – remaining strong after hitting an 18-month high of around 680,000 mt in April. This peak was likely supported by increased spot purchases by opportunistic consumers of diesel/heating oil from inland Germany.

- Other top European importers in May also show a month-on-month rise in diesel imports from outside of the continent.

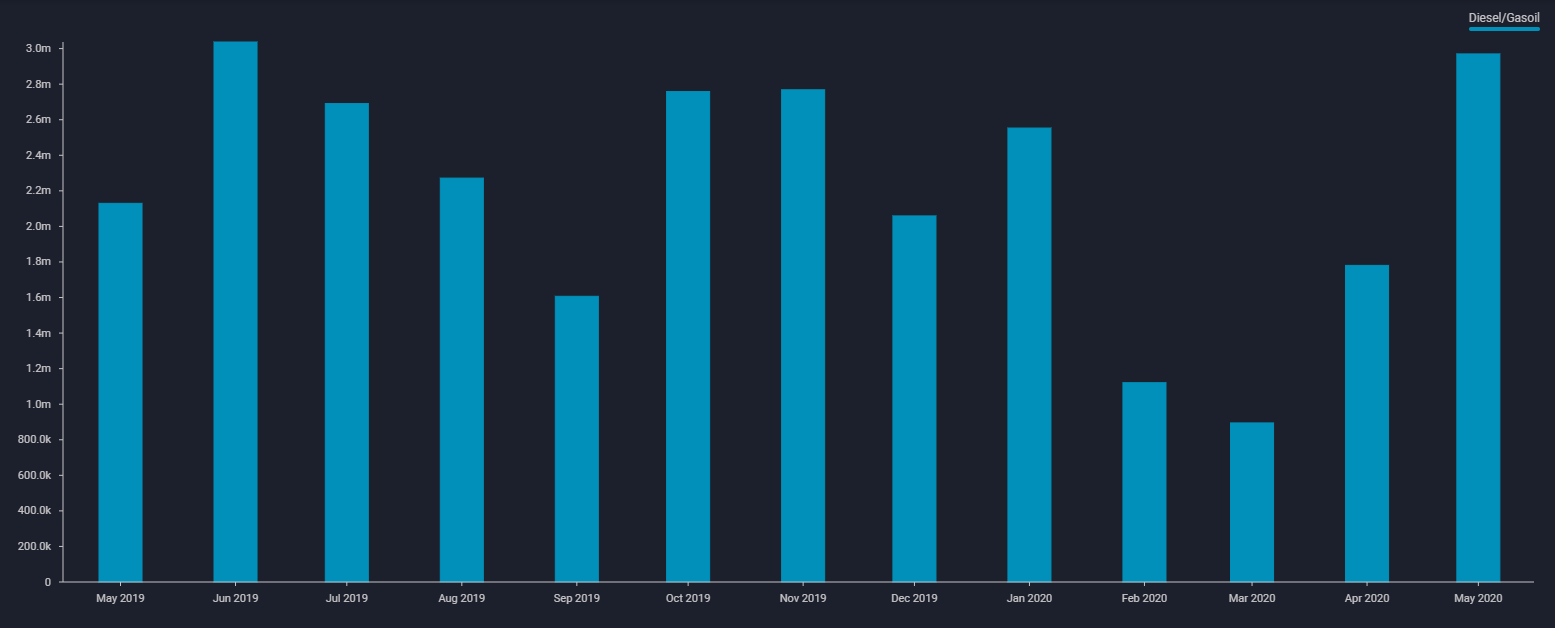

East of Suez flows holds up for May – and June

-

A key component of the rise in European imports during May is the uptick in flows from east of Suez. Middle East production and global exports are up, month-on-month, while Indian diesel cargoes are flowing towards Europe

-

As of 27 May, the Middle east accounted for around 2.1mn mt of European diesel arrivals in May, up from around 970,000 mt in April. Similarly, European imports from Asia are expected to reach 890,000 mt in May, up from 810,000 mt in April.

- Looking ahead, June imports from the Middle East and Asia are already expected to reach at least 1.8mn mt and 330,000 mt, respectively – which is already above April’s combined figure of 1.8mn mt. June imports from east of Suez could rise higher still in the coming weeks. Beyond that, rising local demand east of Suez will temper outflows as lockdown measures ease globally, though this could be offset with rising Asian refinery run rates.

European Diesel Arrivals from Middle East and Asia (mt)

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}