Putting the performance of naphtha into perspective

Vortexa outlines how naphtha has had a strong demand recovery but increasing demand for road fuels gasoline and diesel could incentivise refiners to adjust their yields to make less naphtha.

Naphtha cracks have weakened consistently over the last two months, especially when calculated on a barrel basis, as higher crude prices disadvantage the low-density light product. But is this a warning signal for the wider economic recovery or are other factors at play?

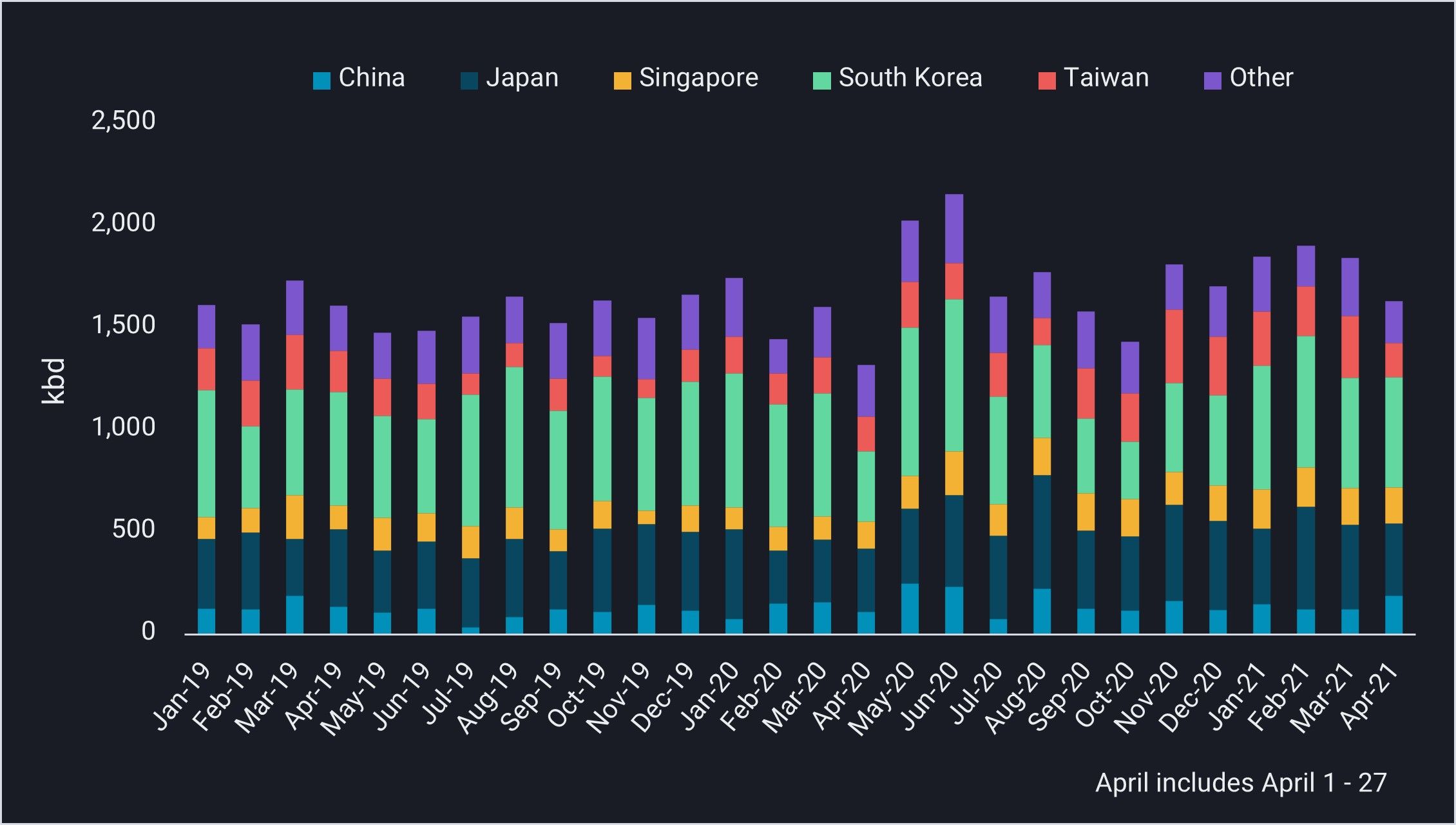

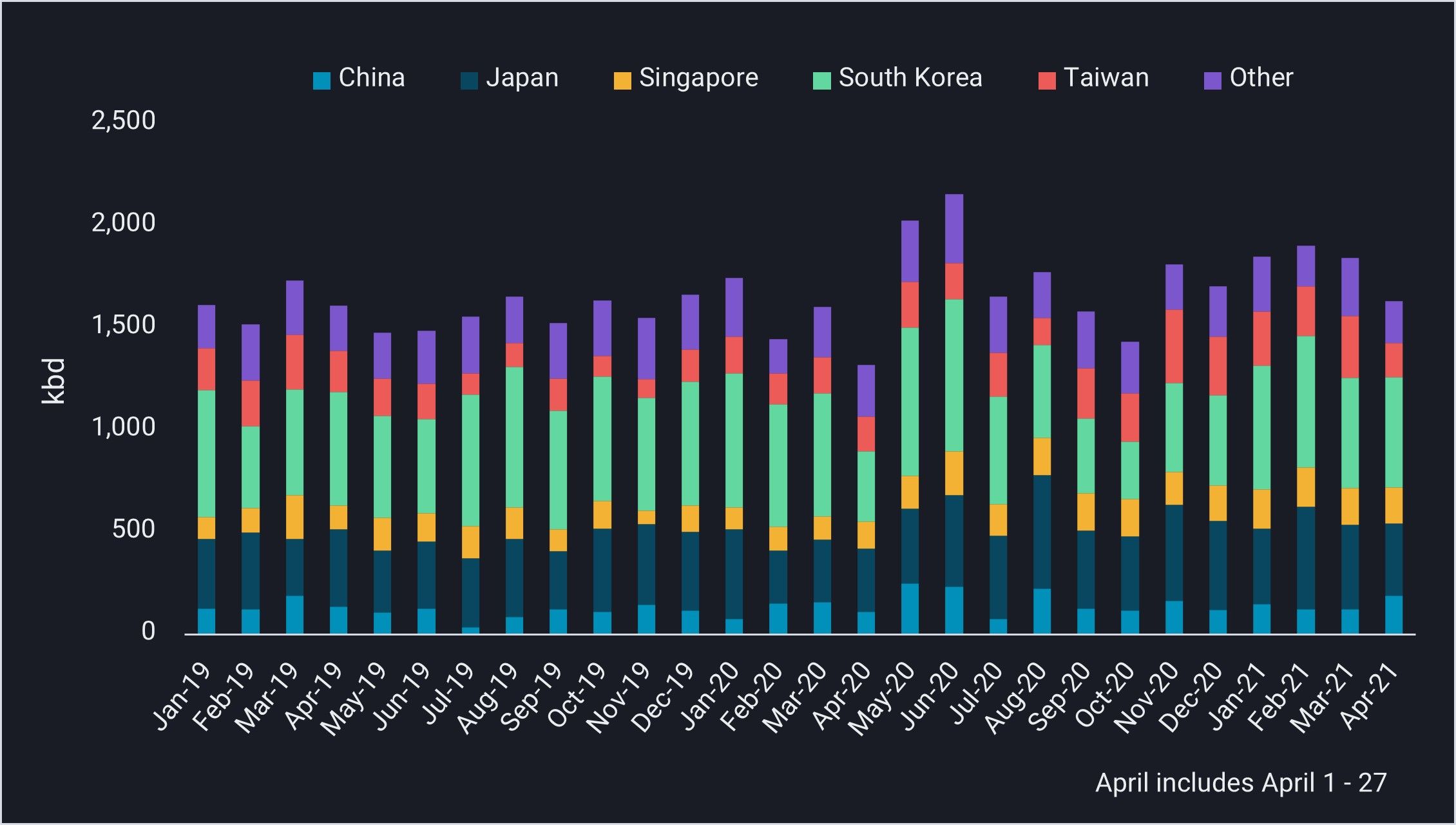

Naphtha seaborne imports strong from large Asia naphtha buyers

- At any rate, naphtha demand continues to be strong, in spite of some seasonal shifts to LPG as cracker feedstock. Import demand from the large Asian naphtha buyers in South Korea, Taiwan, and Japan has been healthy so far this year.

- Import levels averaging 1.85 mn b/d were see January – March 2021, 14% higher than January – March 2019. April 2021 imports decrease month on month but remain in line with seasonal data. Current imports for April 1-27 are at 1.63 mn b/d, higher than 1.61 mn b/d seen in April 2019.

Naphtha arrivals by destination country (kbd)

Naphtha has come under pressure from supply-side trends

-

- Looking at global seaborne arrivals in 2020 and 2021 and comparing them to the 2019 average, we find that naphtha imports have had a stellar recovery so far this year, essentially reaching pre-pandemic levels. Strong prices had incentivised refiners to make naphtha at the expense of poorly performing transportation fuels, gasoline, jet and diesel.

- In addition, the seaborne supply of condensate and light crudes recovered much faster than OPEC+ policy constrained medium and heavy crudes, thereby giving naphtha yields a further push. Accordingly, the weakening of naphtha cracks was primarily driven by a form of supply-side overshooting.

Seaborne oil arrivals vs 2019 annual average (%, 3-month MA)

Gasoline rally set to eat into naphtha availability and that could potentially induce price reversal

- Led by economic dynamics in the US and the seasonal upside, transportation fuels are staging a comeback, with gasoline in the front seat. Some market commentators are forecasting a full recovery of oil demand already by this summer.

- Better road fuel perspectives in general, and soaring reforming margins in particular should incite refiners to adjust yields away from naphtha. In conclusion, naphtha flows and pricing may steer relatively unscathed through the seasonal low period that is affected by the switch to LPG as a cheaper feedstock.

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa CPP Analysis

- 11 March 2021, US gasoline demand moulds the Altantic MR market

- 4 March 2021, Infographic: The freeze on Texas refined product exports

- 11 March 2021, US gasoline demand moulds the Atlantic MR market

Vortexa In the News – CPP

- Reuters, 16 March 2021 – Asia’s Fuel Exporters Target Sales Bump As Refineries Shut Down Under

- Argus Media, 10 March 2021 – BP to close Australia Kwinana refinery in March

- Reuters, 9 March 2021 – Diesel storage in Scandinavian caverns unwinding