Diesel is moving again eastwards

Four months ago marked the beginning of major diesel global trade flow reshuffling. We explore how market concerns have been alleviated and how diesel flows have been redirected.

Four months ago, most European countries stopped buying Russian diesel. There was a lot of doubt in the preceding year that Europe could make it without Russian supplies, while on the flip side concerns grew that Russia could fail to find alternative buyers, as well as the required shipping services. Both perceptions were adding substantial risk and uncertainty premiums to diesel prices around the globe.

Fast forward to June, it is clear that Europe can easily fill its massive diesel short, and also Russia has been very successful in finding alternative buyers, for what has turned out to be higher rather than lower volumes (with the partial exception of maintenance-affected May exports). This has taken a lot of heat away from diesel pricing. In fact, the market’s concerns have shifted from undersupply to oversupply, partly related to the start-up of abundant new refining capacity, and partly to disappointing economic activity levels pretty much around the globe.

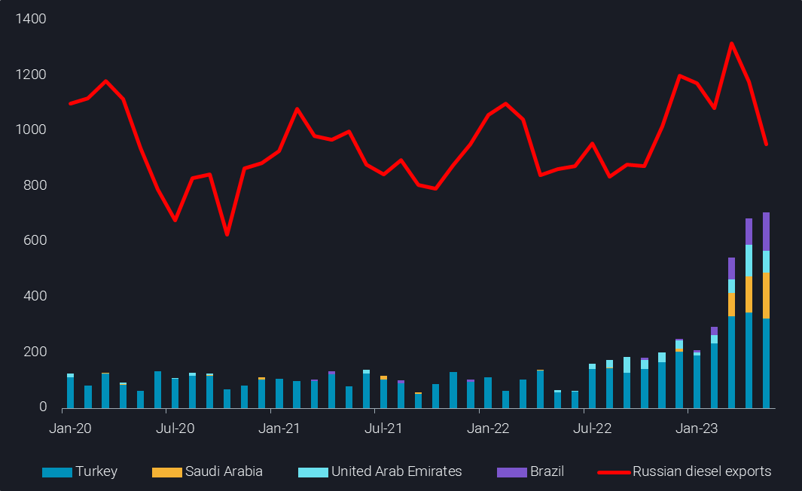

As for the reshuffling of global diesel flows, there are still adjustments happening on the way to a new (efficient) optimum amid changed (arguably inefficient) market conditions. While originally Russian diesel was rerouted to a large number of countries, the four biggest importers now take a market share of 65% (May). They are Turkey, Saudi Arabia, the UAE, and more recently Brazil.

Russian diesel exports (line) and current Top-4 importers of Russian diesel (bars) (kbd)

Brazil took 54% of its total diesel imports in May from Russia, from close to zero at the start of the year. This has nearly entirely crowded out Wider Arabian Sea suppliers and also curtails US inflows to the lower end of the historical range. With US refiners now having ramped up to seasonally high output levels post maintenance, and domestic demand being rather disappointing, a wave of US diesel cargoes has been hitting European shores in May (see chart).

Selected diesel trade flows (Russia to Brazil, US to Europe, Wider Arabian Sea to Asia, 28-day moving average, kbd)

Meanwhile, the high diesel inflows from Russia into Turkey, Saudi Arabia and the UAE are covering domestic demand needs in these markets, freeing up more of the sizable refinery production for exports, predominantly to Europe. All these volumes, plus steadily rising intra-European diesel flows are easily covering regional demand. Accordingly, the arbitrage from Asia is firmly closed and the times when Chinese diesel moved all the way to Europe are likely over for quite some time.

In fact, after a nearly complete hiatus, Wider Arabian Sea (Middle East and West Coast India) diesel is hitting again Asian markets at a rate of 380kbd over the last 28 days, with potential further upside. This reversed trade flow of highly price-competitive barrels puts already ailing Asian refinery margins even more under pressure. The latest Saudi crude price hikes for July-loading term barrels – given credence to the announced 1mbd voluntary cut – adds insult to injury.

The likely outcome of this is refinery run cuts in Asia, but possibly also in the Atlantic Basin. Some rebalancing of a generally oversupplied market should be a consequence, potentially laying the foundations for some price and margin upside later in the year.