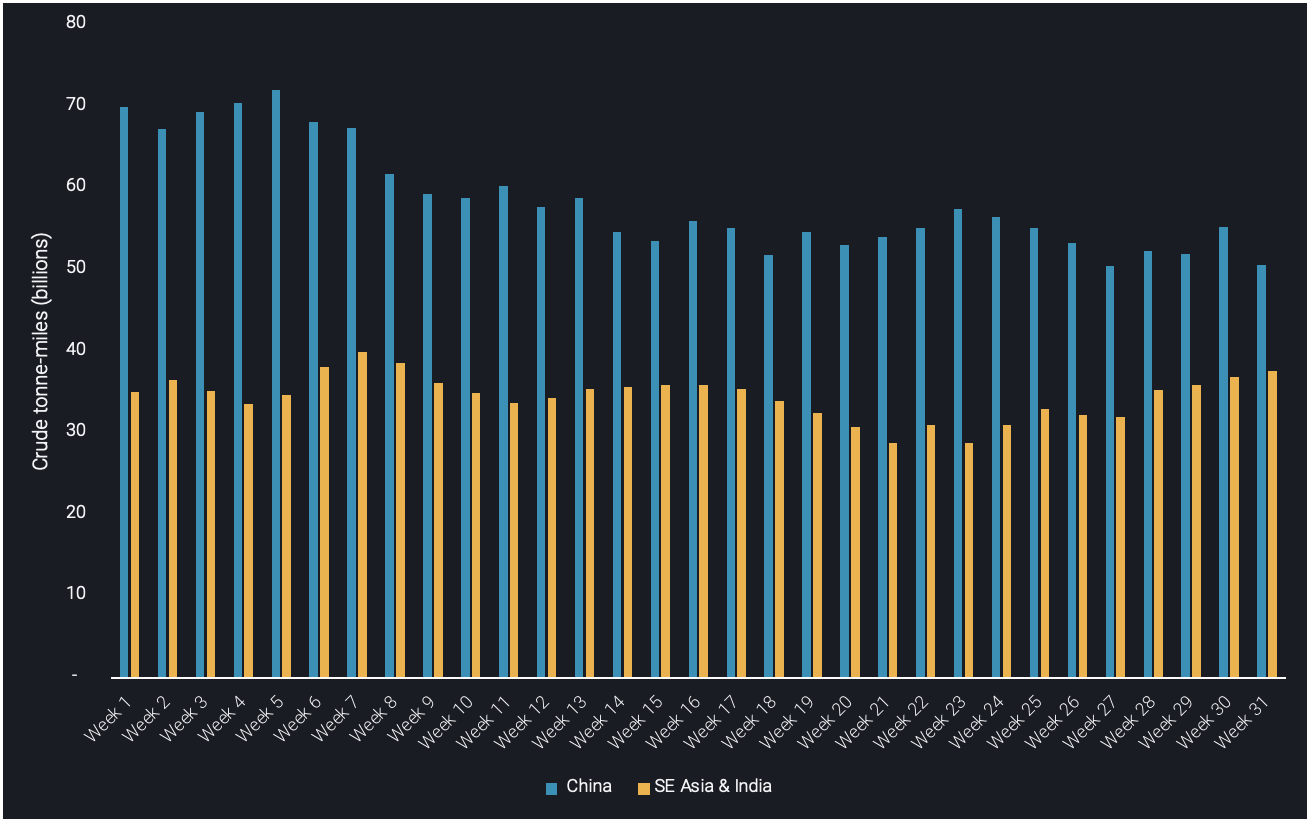

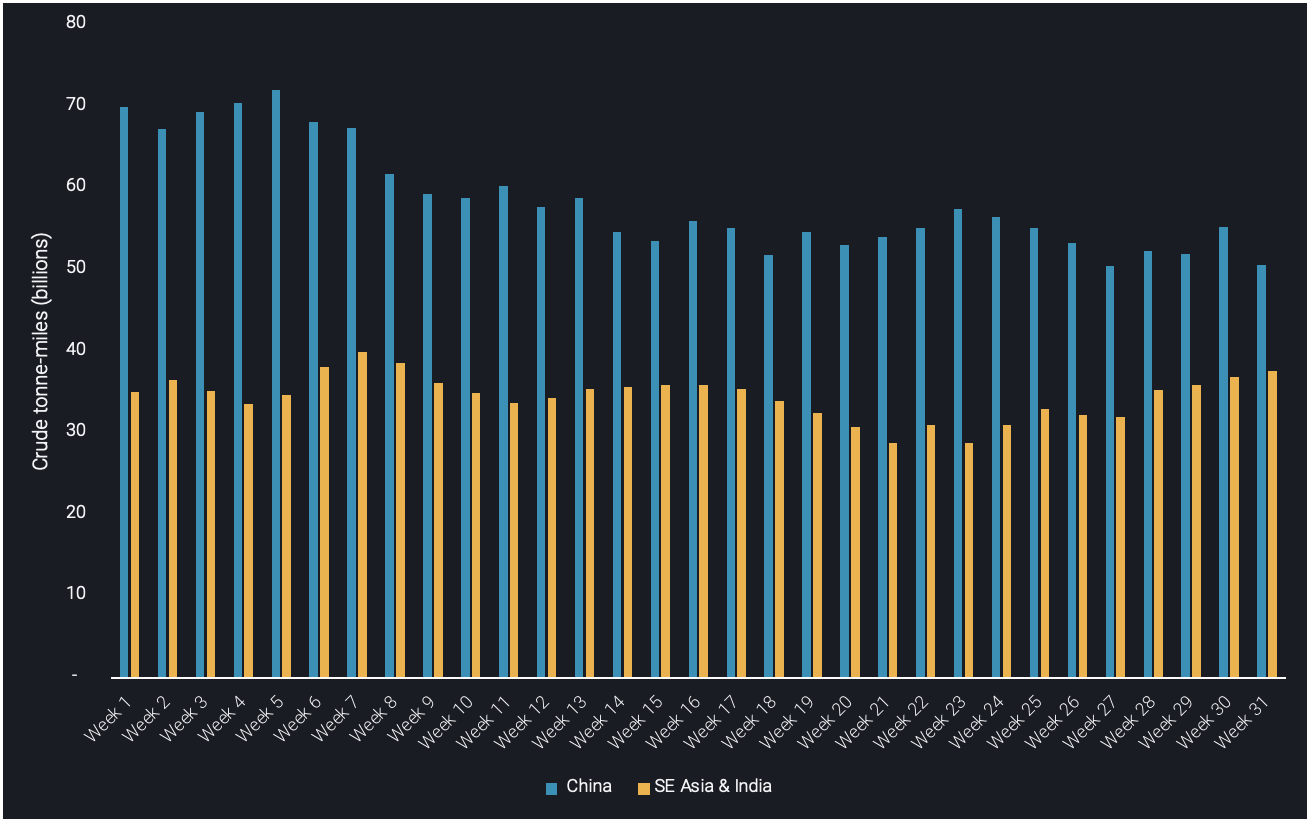

Crude tonne-miles: SE Asia & India pick up the slack where China left off

China’s contribution to crude tonne-miles has dwindled year-to-date according to Vortexa freight data as the country continues to decrease crude imports. Other nations have stepped in to fill the void as our data shows.

China’s contribution to crude tonne-miles has dwindled year-to-date according to Vortexa freight data as the country hits the breaks on crude buying. Other nations have stepped in to fill the void as our data shows.

Weekly crude tonne-miles to China vs. SE Asia & India (see this in the platform)

- Our data shows crude tonne-miles with China as a destination have reached their lowest levels in 2021 of 50bn tonne-miles for the second time in Week 31, after reaching that level in Week 27. China’s pragmatic approach to buying crude has seen it decrease imports following a rise in crude prices in recent months, coupled with government intervention on the operations of independent refiners.

- In addition, China has been steadily drawing the crude stockpiles built during the first half of 2020, further cooling crude purchases from abroad. Less crude imports have apparently also meant less refined products output, as seen via reduced exports, helping to regulate regional balances.

- Year-to-date 60% of all crude tonne-miles possess China as a destination, making it the world’s dominant player. Though its importance in dirty freight markets cannot be underestimated, neighbouring economies such as the Southeast Asian region and India have stepped in to fill the void left by decreasing Chinese crude imports.

- Southeast Asia and India’s combined crude tonne-miles reached a 6-months high of 36 bn tonne-miles during Week 31 of 2021, which coincides with a new low reaching in the steady decrease of Chinese crude imports. As Asia’s demand for refined products remaining strong in spite of various Covid-19 waves, refiners have stepped in to capture some of the crude flows that would otherwise have found a home in China.

Looking ahead, rising crude flows to India and Southeast Asia, especially from the Middle East Gulf, could benefit particularly the Suezmax tanker segment. This would provide much needed respite in a market that seems to be stuck in the doldrums. However, the biggest loser of decreasing Chinese crude imports has been without a doubt the VLCC tanker segment and these vessels could seek to encroach on the Suezmax market, throwing their hat in the ring for a cargo, thus keeping a lid on any improvement in freight rates.

Click here to register for a trial of Vortexa Freight Analytics

More from Vortexa Analysis

- Aug 5, 2021 – Naphtha strength: Atlantic Basin fails to supply Asian pull

- Aug 5, 2021 – Physical Reality Check – July 2021: Linking a horrible past with a better future?

- Aug 4, 2021 – What’s driving Russian oil exports lower in July?

- Jul 29, 2021 – Asia’s diesel market keeps a fine balance despite export headwinds

- Jul 29, 2021 – Latam emerges as key driver for road fuel strength