Libyan crude supply disruptions and the ramifications for Europe

Libyan crude oil supply has taken a dent in recent weeks as a result of disruptions at key export and production sites. This insight explores the ramifications of these disruptions on its largest buyer, Europe, as well as the potential alternatives to Libyan crude.

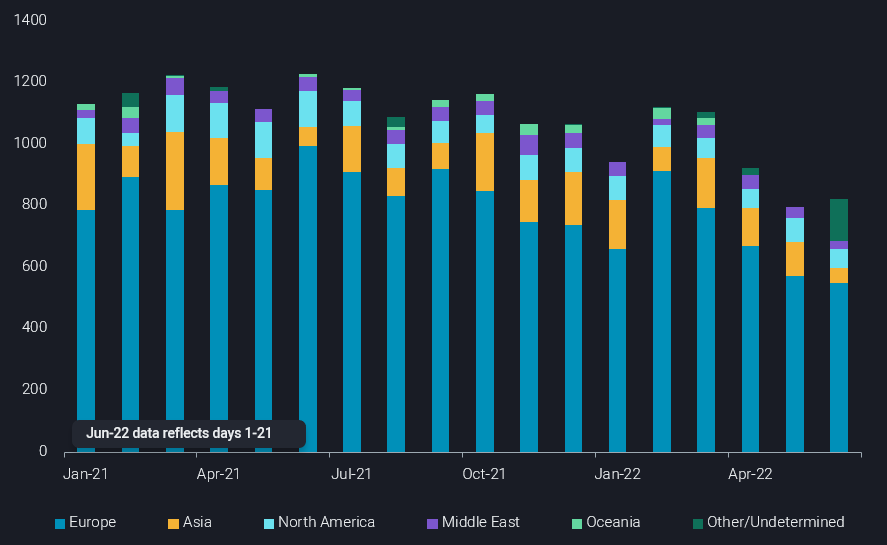

Libyan crude/condensate exports currently sit at 800kbd so far in June, unchanged from May 2022 which was a yearly low and 350kbd lower than the 2021 average. This 30% decline from February is driven primarily by oil production disruptions and port blockades, due to ongoing protests starting in mid-April 2022. The recent disruptions have resulted in the lowest export volumes to Europe since November 2020, sitting at just under 500kbd in June so far.

At latest reading, force majeure is in effect at Marsa el-Brega and Zueitina while operations have been suspended at Ras Lanuf and Es Sider. Operations at the port of Marsa el-Hariga remain open for now but are also under threat (Argus Media). As for upstream production, disruptions continue at El Sharara while force majeure is in effect at El Feel (Argus Media), and partial suspensions have been reported by local media at Sarir.

The ramifications for Europe

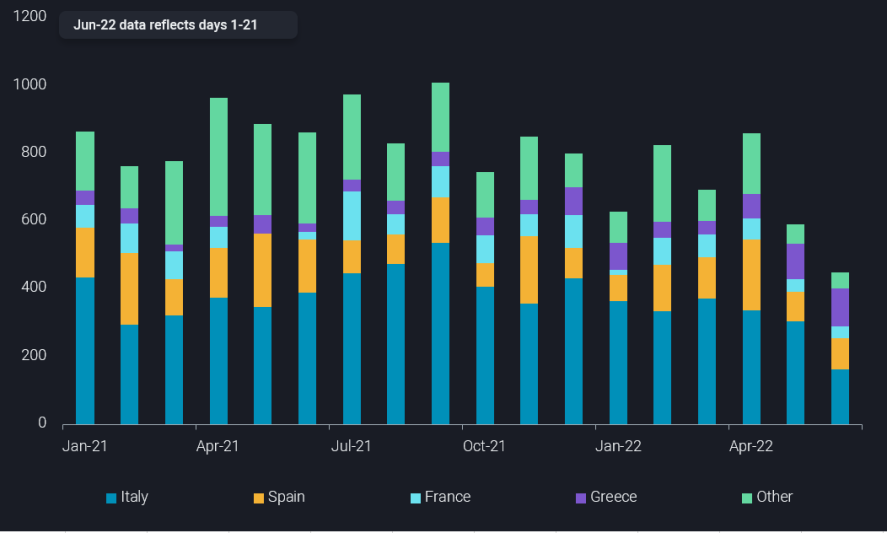

Europe has reduced Libyan crude imports so far in June by 140kbd m-o-m, and 400kbd below April – the highest month in 2022 for Libyan exports. The impact of lower Libyan exports is amplifying an already tight wider Mediterranean/Black Sea crude supply. June loadings of Kazakh CPC Blend – the most exported grade in the region – have slowed in June by 370kbd m-o-m. For comparison, competitor Libyan light grades such as Es Sider and El Sharara, have declined 50kbd and 100kbd, respectively, over the same period. This recent tightness in Mediterranean/Black Sea crude supply has pushed European buyers to look elsewhere.

Alternatives to Libyan crude

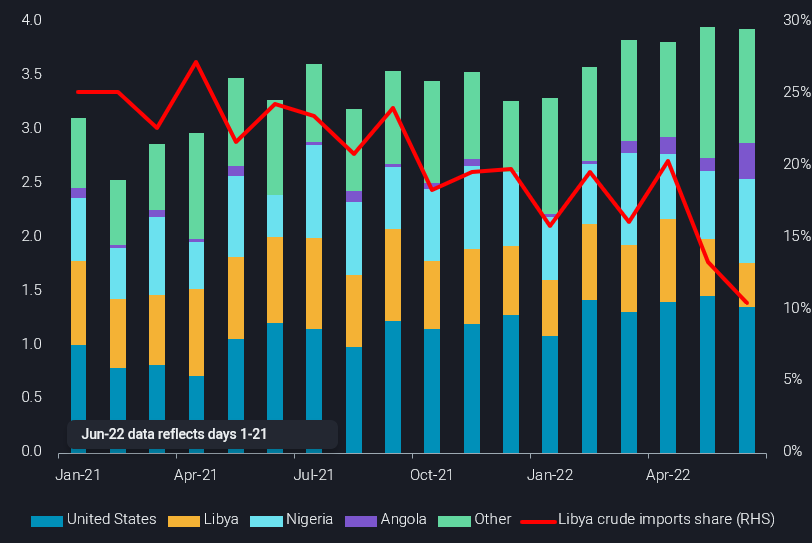

The share of European imports of Libyan crude has fallen to 10% in June compared to over 25% a year ago, raising the question – where has Europe found alternative sweet grades?

Firstly, European imports of West African sweet crude saw a significant increase in June so far, sitting at two-year highs at 1.1mbd. This is being driven primarily by imports of Nigerian grades Escravos, Forcados and Qua Iboe, which have increased 270kbd m-o-m collectively. Angolan grades have also seen a surge in demand, as Europe imported 125kbd of Clov in June so far, a 100kbd increase mo-m. The increased European demand for West African sweet grades is reflected in their widening premiums to North Sea Dated. Nigerian grades Escravos, Forcados and Qua Iboe were trading at multi-year high premiums of $8.40/b, $8.20/b and $5.80/b to North Sea Dated as of 21-June 2022, respectively (Argus Media).

Secondly, pointing attention to the Americas, Europe has increased its imports of Brazilian crude, sitting at 330kbd in June so far, a multi-year high. Medium-sweet grades such as Sururu, Tupi and Iracema are driving this supply, with imports climbing 100kbd m-o-m collectively, in June so far. Europe has also increased its imports of WTI, importing 1.24mbd in June so far, a multi-year high.

Finally, North Sea grades have also grown in demand, driven by European imports of Forties, sitting at 220kbd in June so far and climbing 80kbd m-o-m. This multi-year high in Forties imports is reflected in its widening premium to North Sea Dated (Argus Media).

In summary, whilst crude supply disruptions continue in Libya with no clear end in sight, Europe will continue to look elsewhere for sweet crude, especially given elevated refining margins. Libyan oil supply disruptions are not a new occurrence, with political instability causing disturbances at multiple points since December 2021. Looking back to previous instances of disruptions this year, the time elapsed before the start of a recovery/partial recovery has ranged from 1 week to a month. But despite the uncertainty surrounding Libya, one thing more clear is that wider premiums for Atlantic Basin crudes, especially sweeter grades, will likely remain.