China’s oil exports sail to storage and long-haul markets

China’s oil exports sail to storage and long-haul markets

This piece is accompanying Vortexa’s Pyhton SDK Jupyter Notebook on China oil flows during the Covid-19 outbreak. Click to access the Notebook and explore the data on this topic.

China’s gasoline, jet and diesel exports were steady on the month in March, as ongoing regional demand weakness supported exports to regional onshore storage hubs and to long haul destinations. We also observe that amidst the growing supply glut around the world, some Chinese clean products exports that loaded last month have turned into floating storage as they wait to discharge at their end-destinations, or have taken longer journeys to reach buyers – as we outline below.

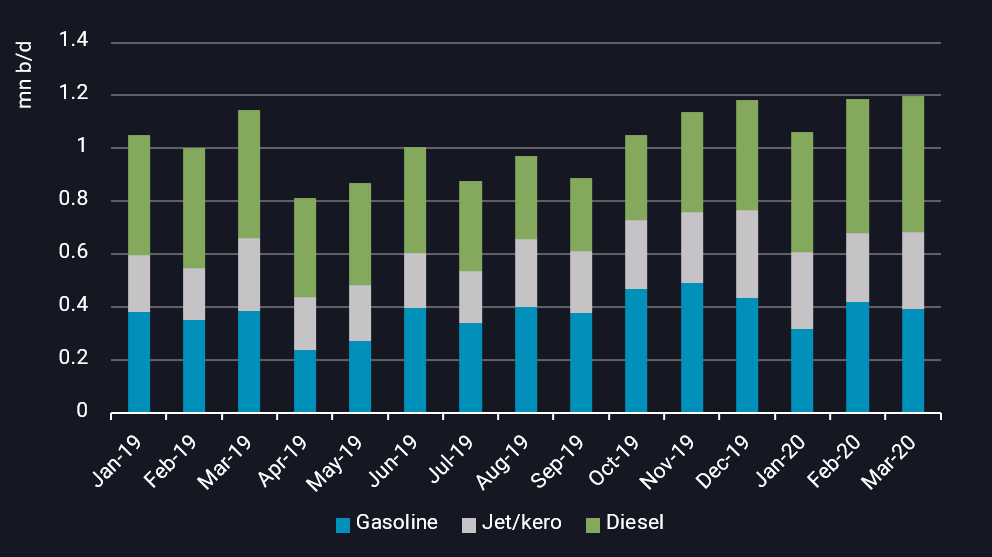

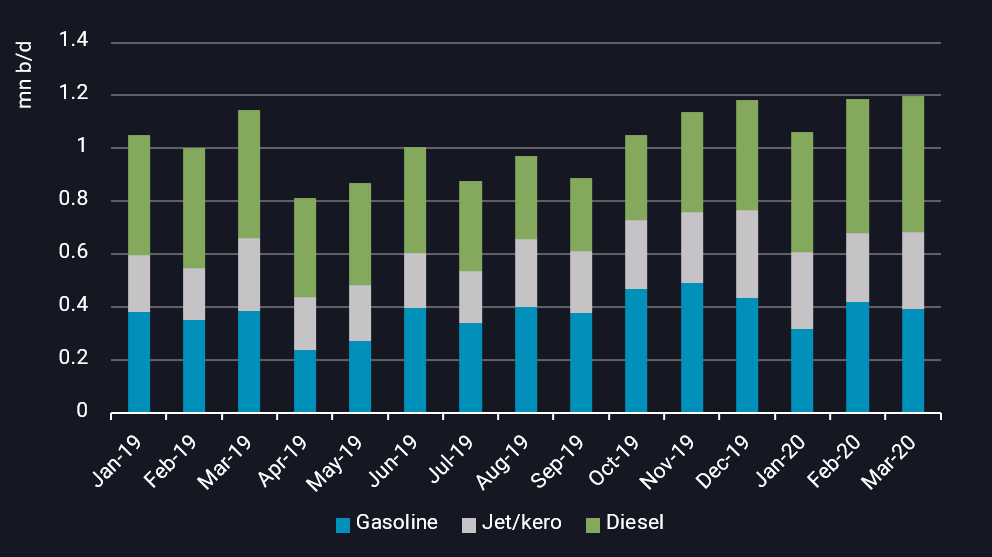

China’s gasoline, jet fuel and diesel exports Jan 2019 – Mar 2020

Gasoline exports stable, more to storage & long-haul markets

- China’s gasoline exports in March were 390,000 b/d, Vortexa data show, marginally lower versus 420,000 b/d in February and flat versus year-ago volumes. A more recent recovery of domestic demand with the partial lifting of travel restrictions has matched higher refinery supply and kept exports relatively stable.

- Drilling into the trends, exports to Malaysia, China’s second largest market after Singapore, doubled in March to 70,000 b/d. Over 90% of this volume headed to storage terminals in Tanjung Pelepas, Tanjung Langsat and Pengerang. The stronger March-loading exports to Malaysia have partially offset declines to Singapore, which too, is brimming with light distillate stocks.

- The Petrochina-chartered MR tanker Orient Innovation, and the Saudi Aramco-chartered Eternal Diligence, which loaded gasoline from China in March, have both sailed to Singapore/Malaysia and turned into floating storage since early April due to being stationary for at least seven days.

- Provisional fixtures as of 16 April indicate at least 9mn bl of gasoline exports to Singapore and Malaysia in April, nearly 2mn bl higher than March volumes – a sign of continued gasoline demand weakness in end-use import markets in Southeast Asia and Oceania.

- Meanwhile another 820,000 bl of Chinese gasoline headed to west Africa in March, a multi-year high according to our data, all loaded from Petrochina’s Dalian petrochemical terminal. Chinese gasoline exports to west Africa are historically a more unusual sight, and total year-to-date exports of 1.5mn bl have already surpassed observed 2019 volumes of just over 1mn bl.

- In other long-haul markets, we observe that some 1.4mn bl of gasoline from China is currently headed for Mexico’s west coast. But in a sign of the potential supply glut in the destination regions and limited onshore storage space, four MR tankers – Boxer, Nave Pixis, Khasab Silver and Chelsea Providence – which loaded Chinese gasoline in February and March, are currently observed floating near Mexico and Ecuador.

Jet exports find home in regional storage hubs

- Despite rising refinery runs and prolonged weakness in domestic jet demand, China’s jet fuel exports in March were up slightly at 290,000 b/d over February levels of 260,000 b/d.

- Nearly half of March’s total exports were observed to be headed for storage hubs in Singapore, Malaysia and South Korea, Yeosu, a near 50% rise compared to February.

- A strong flow of jet fuel from China also moved towards Europe and the Med in March – some 1.8mn bl, likely highlighting the severity of the glut that built up earlier in the first quarter in Asia, and also offsetting lower inflows into Europe from the Mideast Gulf on account of heavy planned refinery maintenance.

Diesel exports reach multi-year high, amid arb flows to Europe

- China’s diesel exports marginally surpassed February levels to reach a multi-year high of close to 500,000 b/d March, underpinned by robust refinery runs and strong jet regrade margins. Diesel exports mirrored similar trends seen in gasoline and jet, with close to 100,000 b/d moving into Singapore’s storage last month.

- A strong contango structure in the European market has supported a rise in diesel cargoes moving west.

- We see this in action in Aframax STI Gallantry, which loaded China-origin diesel from Yue Chi and SC Guangzhou in Tanjung Pelepas STS area, and is now taking the longer route around Cape of Good Hope instead of the Suez Canal, towards Rotterdam.

- Furthermore, close to 1.3mn bl of diesel has also been exported to Chile in March and early April, amid the seasonal rise in demand in the run up to winter in the southern hemisphere. The outlet also offers a relief to the Asian market, while Chinese diesel to Chile year-to-date has already exceeded 2019 export levels.

Interested in more of our data and analysis?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}