Global jet fuel recovery running late, US emerging as bright spot

Vortexa data shows global jet fuel flows still remain well below pre-Covid norms, but the US is emerging as rare bright spot for import demand.

Vortexa data shows global jet fuel flows still remain well below pre-Covid norms, with little sign of a meaningful demand recovery so far this summer. Flows heading to key demand centres in Europe and Asia remain flat, but the US is proving to be a rare bright spot for import activity.

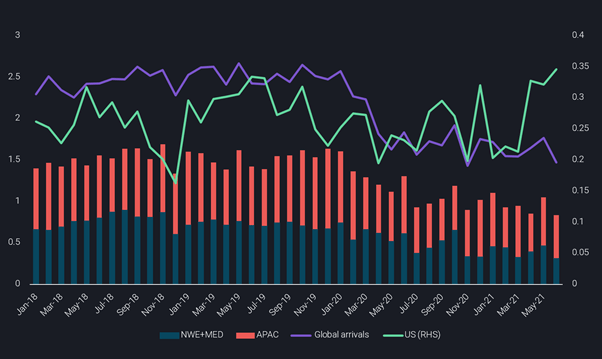

Global jet/kero arrivals from all origins so far in June stand at around 1.5mn b/d, slightly below the 1.6mn b/d average seen for the previous 5 months of 2021 and sharply down from the 2.4mn b/d seen in June 2019 (see chart).

Jet/kero arrivals by location (mn b/d)

The previously anticipated boost to European jet fuel demand this summer is either running very late or unlikely to materialise with arrivals into northwest Europe and the Mediterranean region (combined) actually below pre-Covid and Q4 2020 levels.

-

Combined flows heading to the key jet fuel pricing ports in northwest Europe (Le Havre, Rotterdam and Thames) reached 230,000 b/d in May, the highest monthly total since October, but in a broader context, such volumes are still significantly below the 340,000 b/d imported in June 2019.

-

For all the success seen in Europe’s vaccination rollout, the current restrictions imposed by the region’s governments on air travel still continues to weigh heavily on jet fuel imports.

In the Asia Pacific (APAC) region, the rise of the Delta variant of Covid-19 is crimping air travel in key consumer markets such as India and the large international hub of Hong Kong. Total jet/kero arrivals into APAC stand at around 520,000 b/d so far in June, still over 25% below June 2019 volumes.

-

Hong Kong, the largest single port for jet fuel imports in the region, has only imported 70,000 b/d so far in June, almost half of import levels seen two years earlier.

-

Elsewhere in APAC, Australia is a relatively small outlier in seeing import demand growth. However that growth is a function of the nation’s recent refining capacity rationalisation, not just a demand uptick. Should June’s preliminary import level of 88,000 b/d hold to the end of the month, it would mark the highest monthly total since March 2020. Nevertheless it would still have some way to go to reach the pre-Covid historical upper threshold of around 140,000 b/d.

Running counter to the trends seen more broadly for Asia and Europe, US jet fuel imports are rising to pre-Covid levels. Despite limited international travel activity, stronger demand from domestic travel is driving seaborne imports higher on the US Atlantic and West Coasts (PADD 1, PADD 5).

-

Combined jet fuel arrivals into the top three US ports importing jet fuel – Los Angeles, Port Everglades and Tampa – hit 220,000 b/d so far in June, just above the 210,000 b/d imported during June 2019.

-

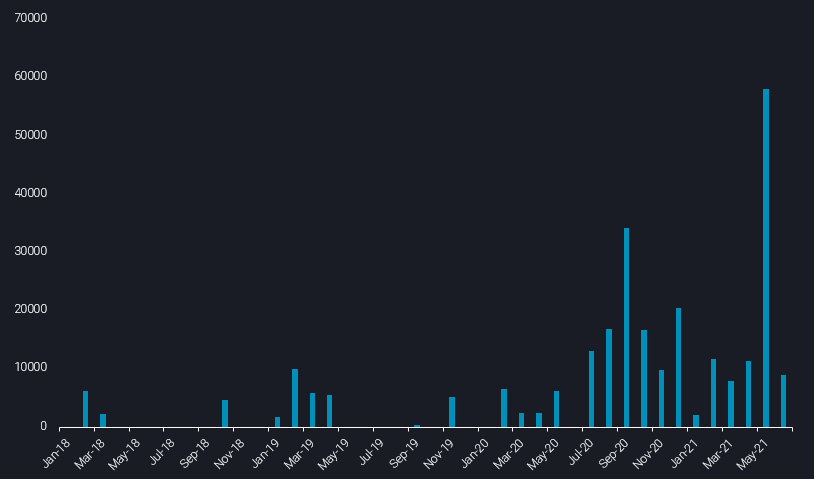

Stronger US demand for jet fuel has also pulled European cargoes in record volumes, even though the latter is a historical net importer of the product.

-

Around 60,000 b/d of European-origin jet arrived into the US in May, the highest monthly total Vortexa has on record (see chart). Vortexa data shows smaller volumes booked to ply the route during June, suggesting arbitrage opportunites have since narrowed.

US jet/kero arrivals from Europe (b/d)

(NB: *June to date figures referred to above include flows during 1-20 June)

More from Vortexa Analysis

- Jun 18, 2021 Crude markets diverging in Atlantic Basin

- Jun 16, 2021 Question marks for freight rates in a largely supportive global LNG picture

- Jun 15, 2021 China’s independent refiners maneuver new diluted bitumen tax

- Jun 10, 2021 Transatlantic gasoline flows are here to stay

- Jun 7, 2021 Role reversal? West of Suez in the driving seat

- Jun 4, 2021 North American LPG shipments to Asia face pressure

- June 2, 2021 China’s new consumption tax turns tide of gasoline and diesel exports

- Jun 2, 2021 Suezmax tankers infiltrate Europe-bound transatlantic crude flows