Libya disruption hits major crude flows

Snapshot: Libya disruption hits major crude flows

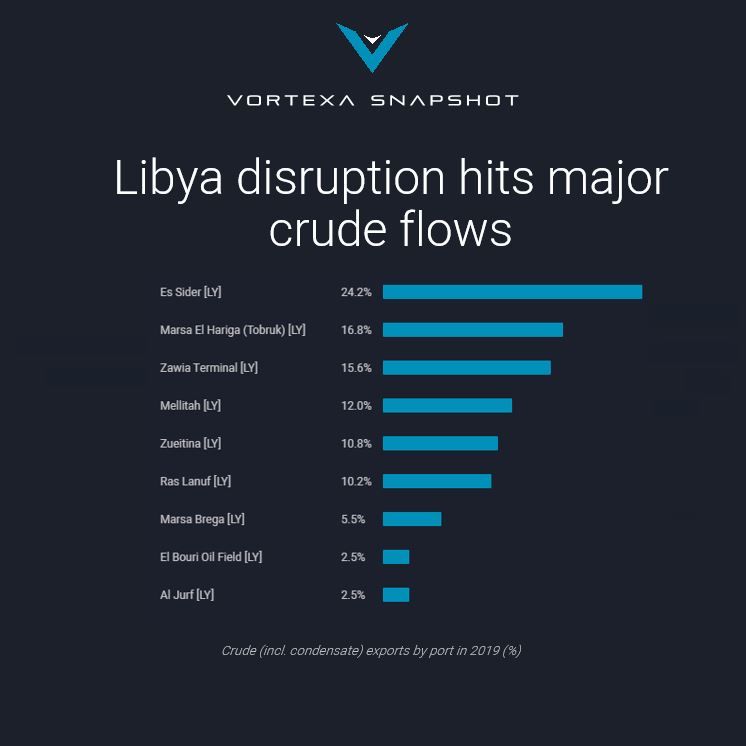

Libya’s crude and condensate exports are threatened by a stand-still with the country’s key oil export pipelines, fields and terminals still suspended by the Libyan National Army (LNA) as of 23 January, amid entrenched political turmoil. The current halt in operations from six ports – Zawia, Marsa el Brega, Ras Lanuf, Marsa el Hariga, Zueitina and Es Sider – add up to a combined crude export loss of over 900,000 b/d.

Vortexa Oil News – In Brief:

- January so far: Libyan crude and condensate exports in 1H January were just over 1.1mn b/d. Of this, 75% loaded on Aframax tankers and delivered mostly within the Mediterranean region, with Italy and Spain as top destinations. Loadings from these six ports halted after 19 January, according to observed flows.

- Impact by port: Es Sider, Marsa el Hariga and Zawia ports accounted for more than half of the country’s total crude exports last year, and are therefore most impacted.

- Companies: Firms including Repsol, Unipec and Vitol had provisionally fixed vessels to load crude from Libya in January, shipping fixtures showed. Market participants will likely look to alternative supplies from sources such as Algeria, Azerbaijan, Nigeria and the Russia-Caspian region as short-term replacements for Libya’s predominantly light-sweet crude grades.

- Condensate stream: Last year Mellitah port actively exported condensate to the UAE, averaging around 30,000 b/d in 2019. A drop in Libyan condensate loadings would therefore prompt the search for alternative supply from buyers.

- Product Flows: Libyan dirty and clean product exports are limited. But the US imported several cargoes of Libyan fuel oil during the first half of last year, while Italy, Germany and the UK were also among recipients of this small export stream in 2019. Libya exports only a small volume of clean refined products; but is a net importer of gasoline and gasoil.