US LPG exports meet Asia’s burgeoning demand

The cold snap in North Asia ensured steady LPG export demand throughout January even as US propane prices reached their highest levels in over two years.

The cold snap in North Asia ensured steady US LPG export demand throughout January even as US propane prices reached their highest levels in over two years. Robust petrochemical feedstock demand from PDH plants and crackers in China and South Korea should help to offset the expected fall in Asia’s LPG heating demand with warmer weather, keeping the market in a healthy balance.

US LPG Exports

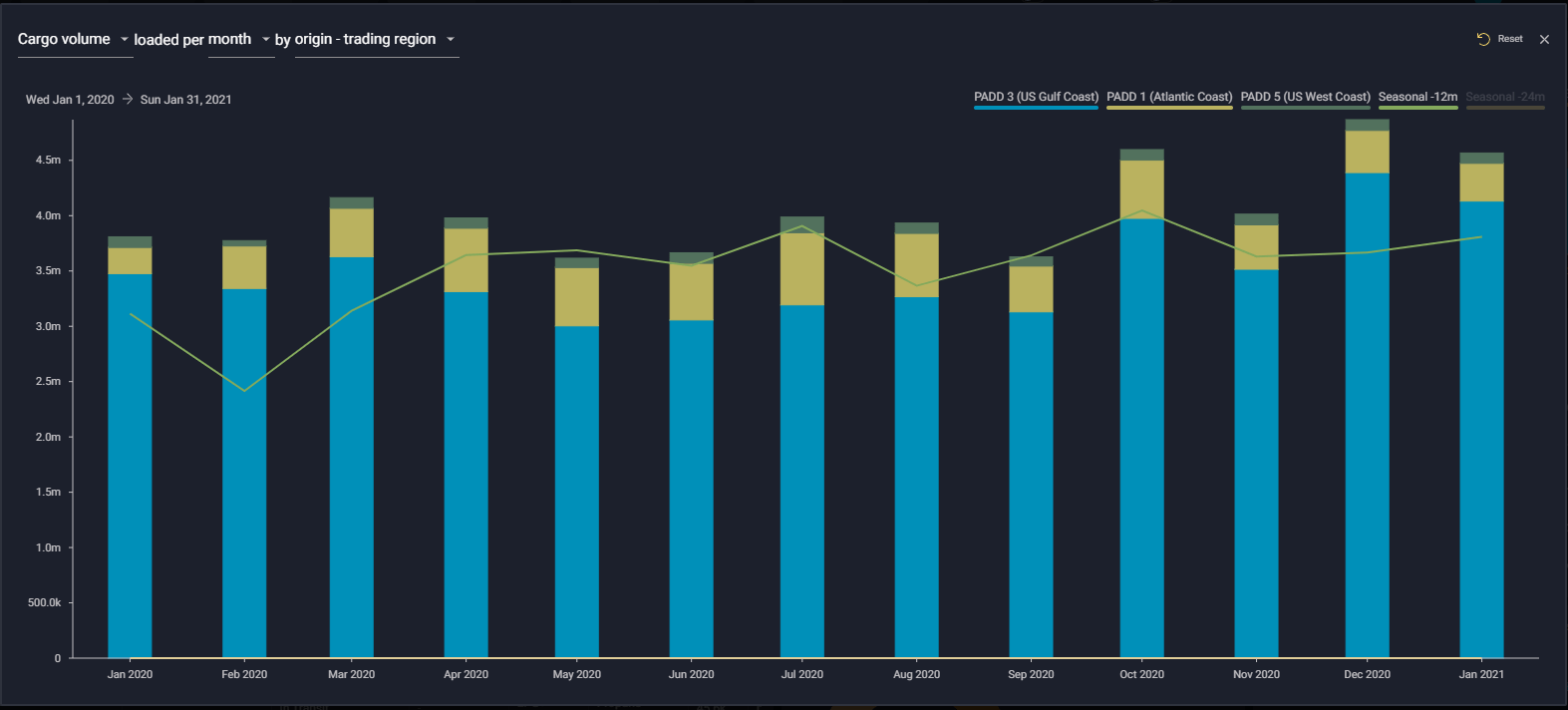

- Below-average temperatures blanketed much of North Asia to start the new year, bringing a spike in LPG demand that was partly met by US exports. The country’s LPG exports for the month of January came in at 4.55mn mt, down 300,000 mt from December 2020 but up 750,000 mt year-on-year.

US LPG monthly exports (mt)

See this in the Vortexa platform

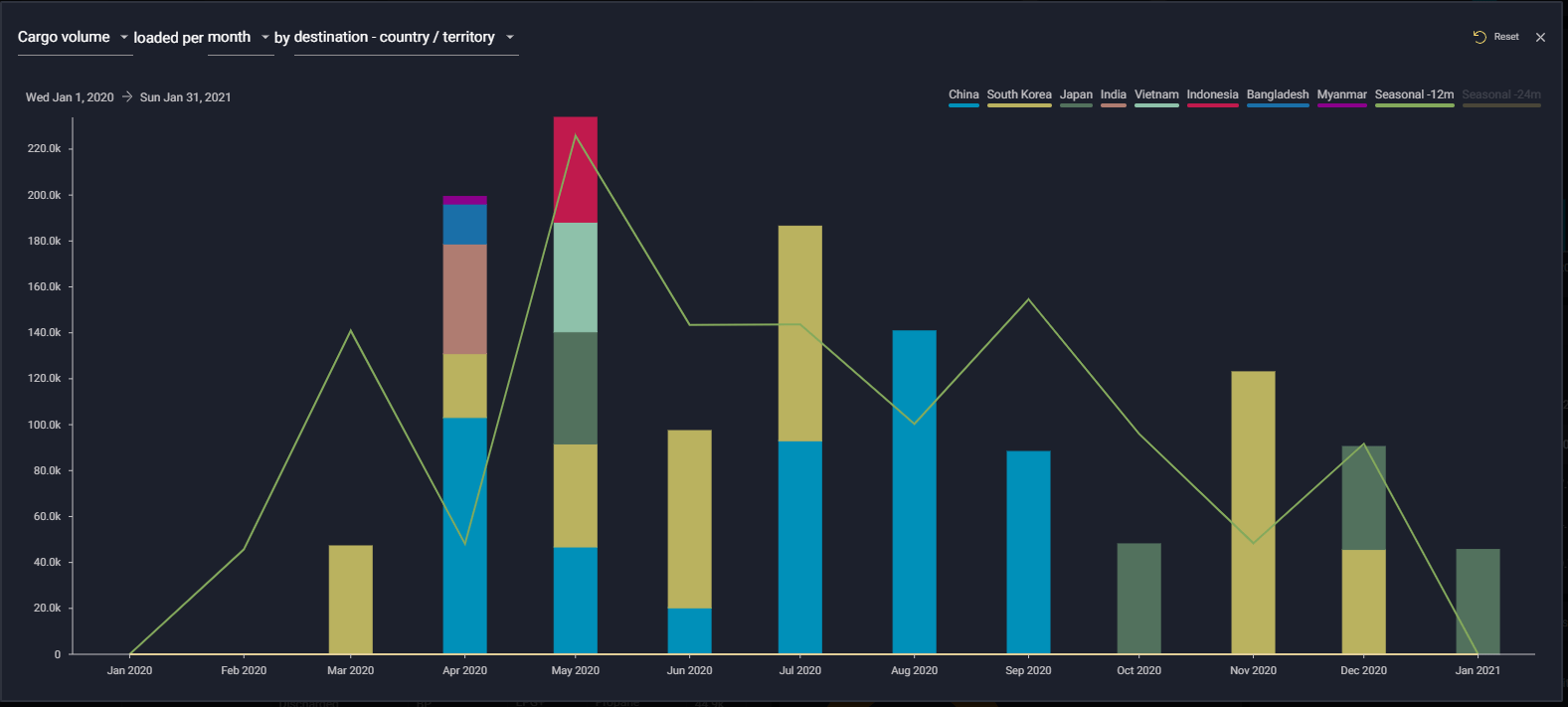

While PADD 3 accounts for more than 85% of total US LPG exports, it is responsible for over 90% of the volumes that move between the US and Asia. PADD 5 ships all its LPG exports to Asia due to locational advantages. Interestingly, even PADD 1 has become a regular shipper of LPG to Asia, sending at least one cargo per month for each of the last 11 months.

PADD 1 LPG exports to Asia (mt)

See this in the Vortexa platform

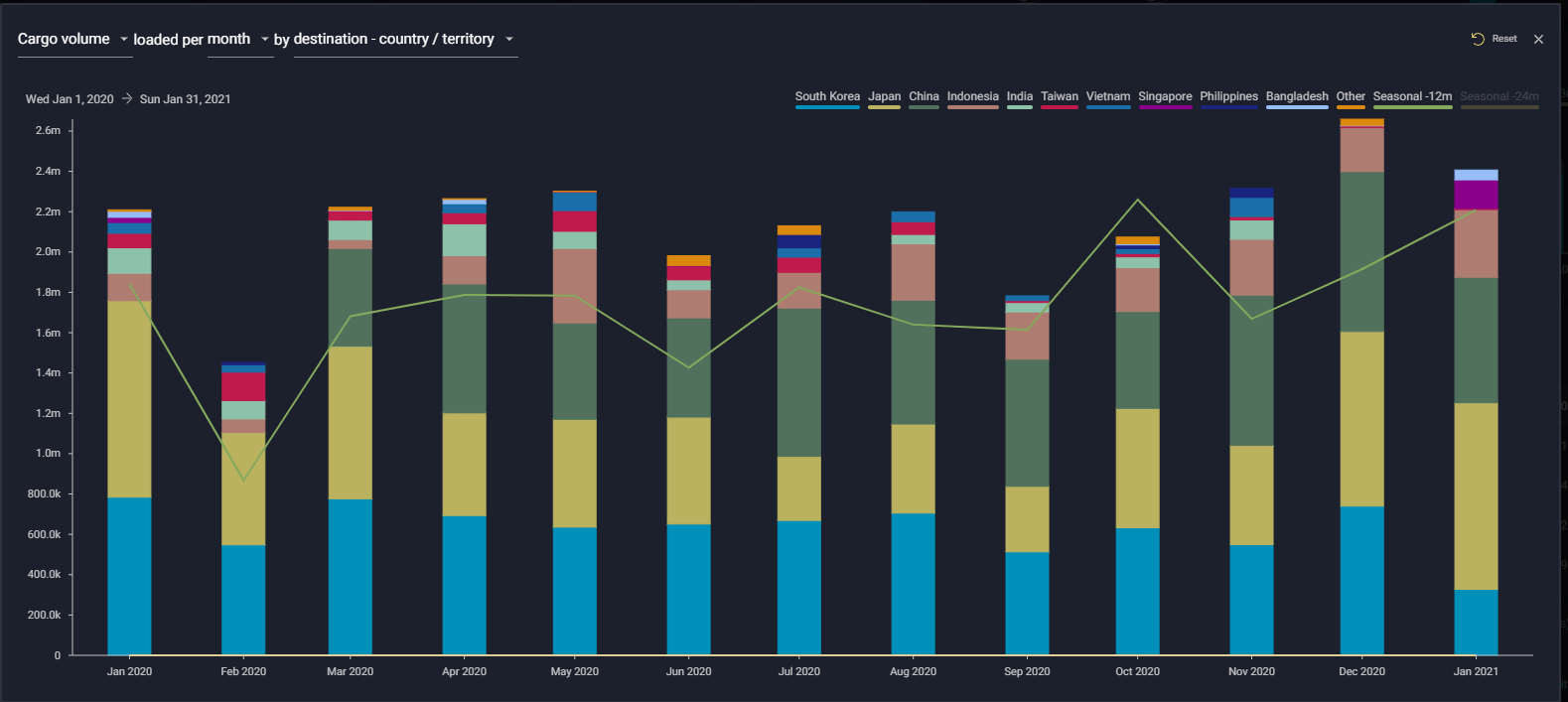

Over the last year, Asia has taken 53% of US LPG exports, followed by Latin America and Europe at 23% and 14%, respectively. US LPG exports to Asia have risen year-on-year for 12 of the past 13 months dating back to January 2020.

-

- US LPG exports to Asia (mt)

See this in the Vortexa platform

Winter demand fades, silver lining from petchems?

As North Asia’s winter season draws to an end in February/March, LPG demand for heating is expected to wane. Asia’s LPG spot prices have recently been retreating from the highs seen in early January, as spot buying interests in the market cools.

But robust petrochemical feedstock demand from PDH plants and crackers in China and South Korea is expected to partially offset the fall in regional LPG heating demand. A narrowing of Asia’s LPG vs naphtha spreads will incentivise more cracker operators to switch to using LPG as feedstock, where they have the flexibility to do so.

This, coupled with Saudi Aramco’s term allocation cuts this month, is expected to keep the market relatively balanced. This year, five new PDH plants (2.6MMTPA capacity), and two new ethylene crackers (1.4MMTPA capacity) are expected to be commissioned in China, providing more upside to LPG cracks.

Want to know more about Vortexa’s LPG flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3’)}}