Vortexa Snapshot: Crude in floating storage off PADD 5 builds

Vortexa Snapshot: Crude in floating storage off PADD 5 builds

The flotilla of crude oil tankers waiting to discharge along the US west coast (PADD 5) region has swelled further this week amid new arrivals – and more are on the way. The build offshore is currently supported by limited onshore storage capacity and recent refinery run cuts implemented in the region, on account of the massive drop in refined products demand in the wake of covid-19. While the floating storage fleet on the west coast is currently the largest out of anywhere in the US, the Gulf (PADD 3) region could be the next to see rising volumes held offshore given the significant number of VLCCs heading there for May arrival.

Unprecedented PADD 5 build

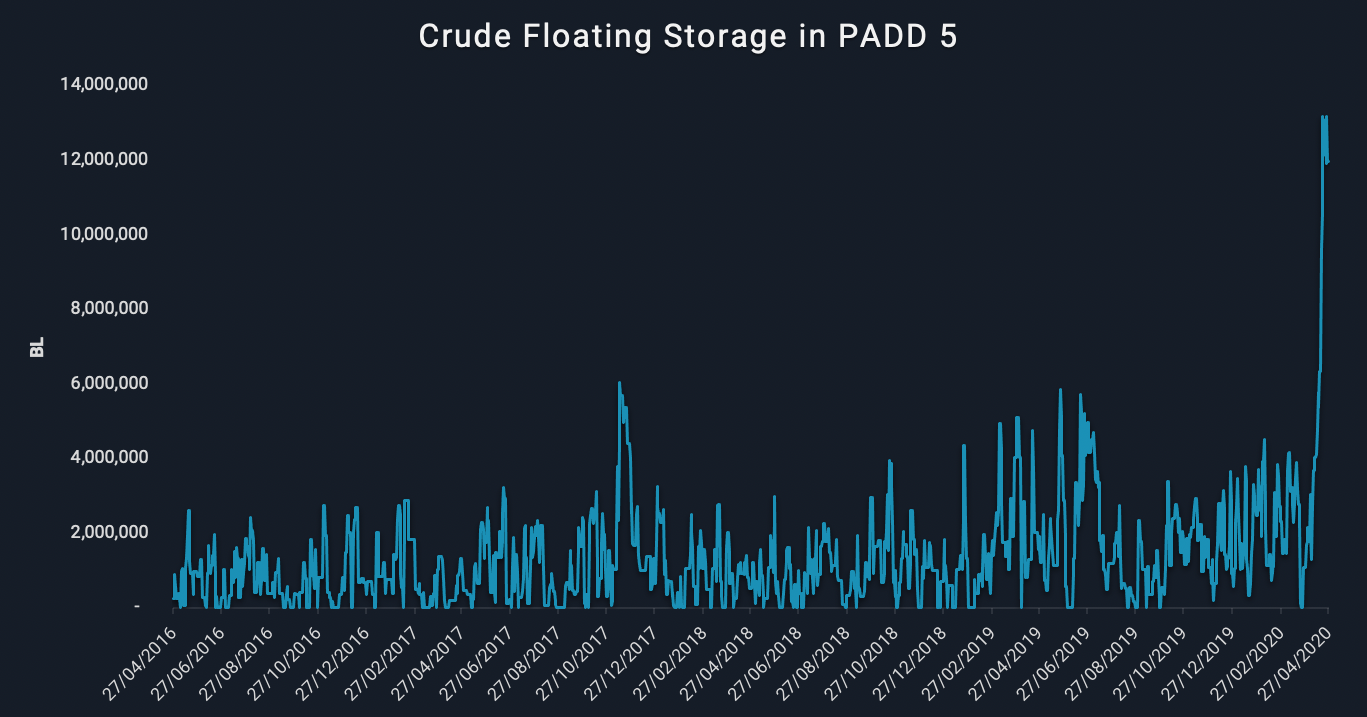

- Around 13mn bl of crude stood in floating storage offshore California on 28 April, after being stationary for seven days or more, Vortexa data show, and another 13m bl of crude that is also waiting around the wider region (but yet to hit the minimum 7-day stationary mark) could also enter floating storage soon.

- This brings the total crude held offshore PADD 5 to 26mn bl of crude across almost 30 vessels – a remarkable amount given that regional floating storage peaked at closer to 6mn bl in the past four years.

- The mix of crude held in floating storage in PADD 5 represents the typical diet feeding the region’s many refineries – from the Mideast Gulf, west Africa, Latin America, as well as domestic crude types.

- We also note a handful of refinery feedstock and fuel oil-laden tankers that are waiting off the California coast in a floating storage state.

Floating Storage in PADD 5 – Vortexa

Floating Storage in PADD 5 – Vortexa

More VLCCs on the way

- Despite the historic build in PADD 5, tankers are still proceeding to the west coast. Another 4 VLCCs that are in-transit carrying Saudi, Iraqi and west African crude are due arrive in early May. The VLCCs typically transfer cargo to smaller vessels via STS upon arrival, and so any delays to swift discharge as a result of limited onshore storage and continued lower refinery runs could add to an already tight market and drive freight rates higher.

- VLCCs Alex and Seatriumph, both co-loaded with Saudi and Iraqi crude, are making their way across the Pacific to PADD 5.

- Another Saudi-crude laden VLCC, DHT Scandinavia, is also heading across Pacific and heading in direction of PADD 5, signalling “for orders”.

- From west Africa, the VLCC Iris co-loaded with Angolan and Nigerian crude is also due to soon arrive in the region.

- Meanwhile the flow of Saudi crude to PADD 5 holds steady for June arrivals. VLCC Sea Jade loaded from the Yanbu South terminal on the Red Sea coast and is now signalling its next destination as the US west coast, as per its provisional shipping fixture. Another VLCC, Sikinos I, is also due to load from Yanbu at the beginning of May and is booked for PADD 5 delivery.

Prospects for PADD 3 and PADD 1 builds

- Crude in floating storage in PADD 3 stood at 5-6mn bl on 28 April, broadly steady week-on-week. For now it is well below the last peaks of around 12-13mn bl reached during 2016-2017, and the spike seen during the disruptions of Hurricane Harvey in Q3 2017.

- PADD 3 could be the next prospective build for floating storage in the US, however, given the huge fleet of Saudi crude-laden VLCCs due to arrive there over May. These will also need to be discharged via STS transfers, with some VLCCs booked to load US crude on their next journeys out of the Gulf.

- Meanwhile on the US Atlantic Coast (PADD 1), there are four tankers holding around 2.8mn bl of Canadian crude waiting to discharge. As of 28 April, three Aframax tankers are in floating storage off New York, and a fourth is also likely to enter a storage state soon. All loaded from Canada’s Whiffen Head terminal.

- While many of the tankers in floating storage around the US currently represent the unexpected discharge delays given the nature of the demand shock, more tankers could also enter storage in coming weeks for contango plays.

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}