Europe scoops up heavy-sweet crude

Vortexa Snapshot: Europe scoops up heavy-sweet crude

European imports of heavy-sweet crude hit record highs in May, as demand for crude grades favoured for very low sulphur fuel oil (VLSFO) was sustained by firmer bunkers demand, relative to other refined products.

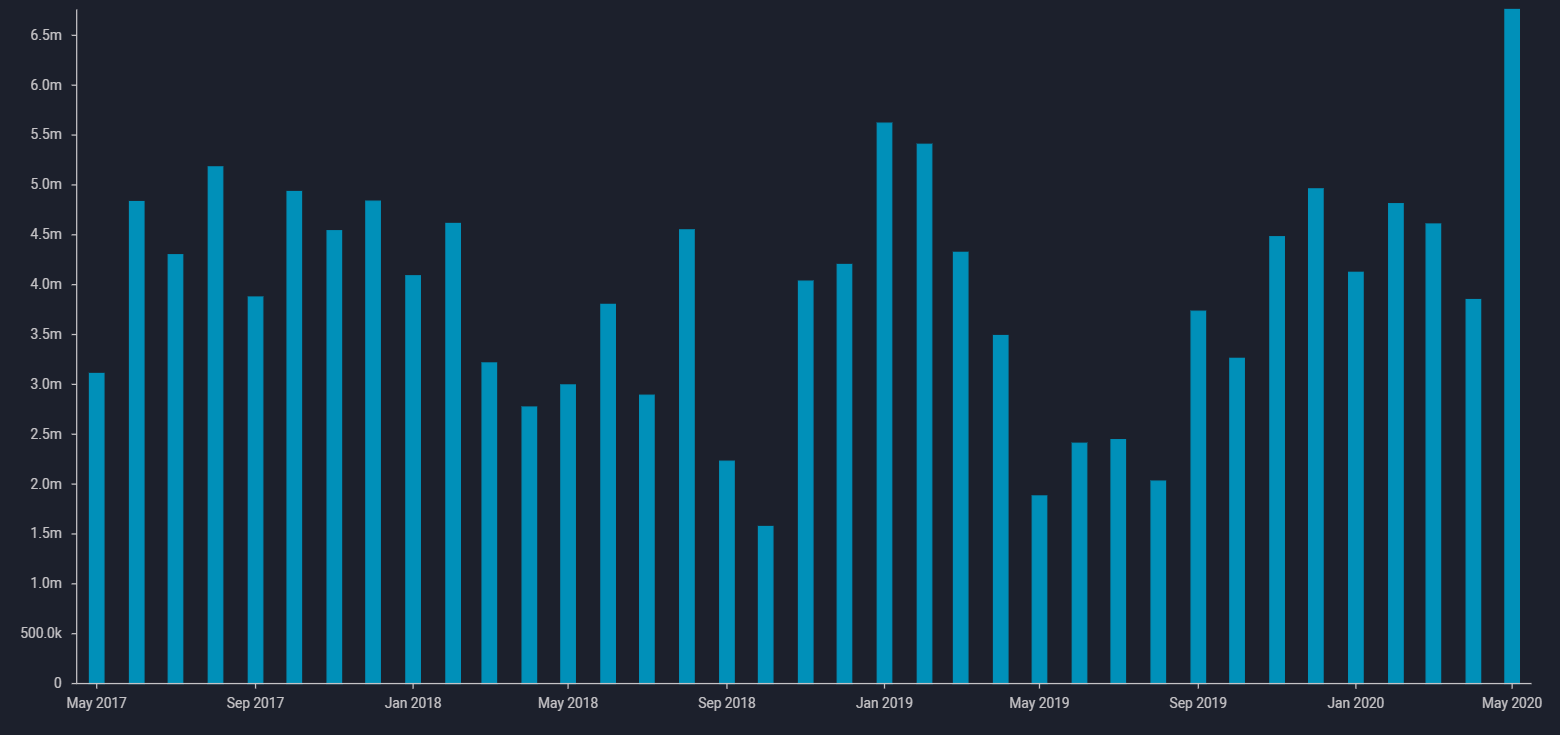

Monthly European imports of heavy sweet crude (excl. North Sea imports) – (b/d)

Record imports in May

- Europe imported almost 220,000 b/d of heavy sweet crude from outside of the region in May, the highest monthly total recorded by Vortexa since January 2016 (see chart above).

- This month saw a cargo of Chadian Doba crude enter Germany’s HES Wilhelmshaven terminal, which will be processed for VLSFO production.

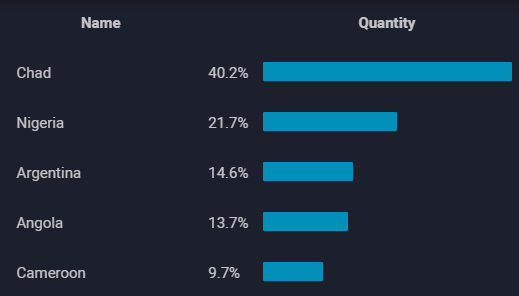

- Most of the heavy sweet crude imported by Europe originates from west Africa (see chart below), but the continent also received its third ever cargo a cargo of Argentina’s Escalante in May, which arrived into Rotterdam.

- Both Doba and Escalante are favoured among fuel oil blenders in Europe, Singapore and Fujairah to produce IMO compliant fuels.

- Aside from the west African and Argentinian imports, Europe also received around 150,000 b/d of heavy sweet crude from usual North Sea suppliers.

European imports of heavy sweet crude, by origin in May (b/d)

Interest turns to Asia

- Imports of heavy sweet crude into Europe for the first half of June remain relatively high, with around 240,000 b/d set to discharge during 1-16 June, Vortexa data show.

- Arrivals thereafter are slowing: on a departures basis, no heavy-sweet exports from west Africa or Argentina has headed to Europe since May 30, as interest has pivoted towards typical Asian buyers.

Interested in a more detailed view of our freight data and associated flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}