FSU dirty products exports to US falter in January

Fuel oil and dirty feedstocks exports (DPP) to the US from Russia and the Former Soviet Union (FSU) region are on track to fall sharply in January, preliminary Vortexa data show.

Fuel oil and dirty feedstocks exports (DPP) to the US from Russia and the Former Soviet Union (FSU) region are on track to fall sharply in January amid a weaker transport fuels demand environment.

-

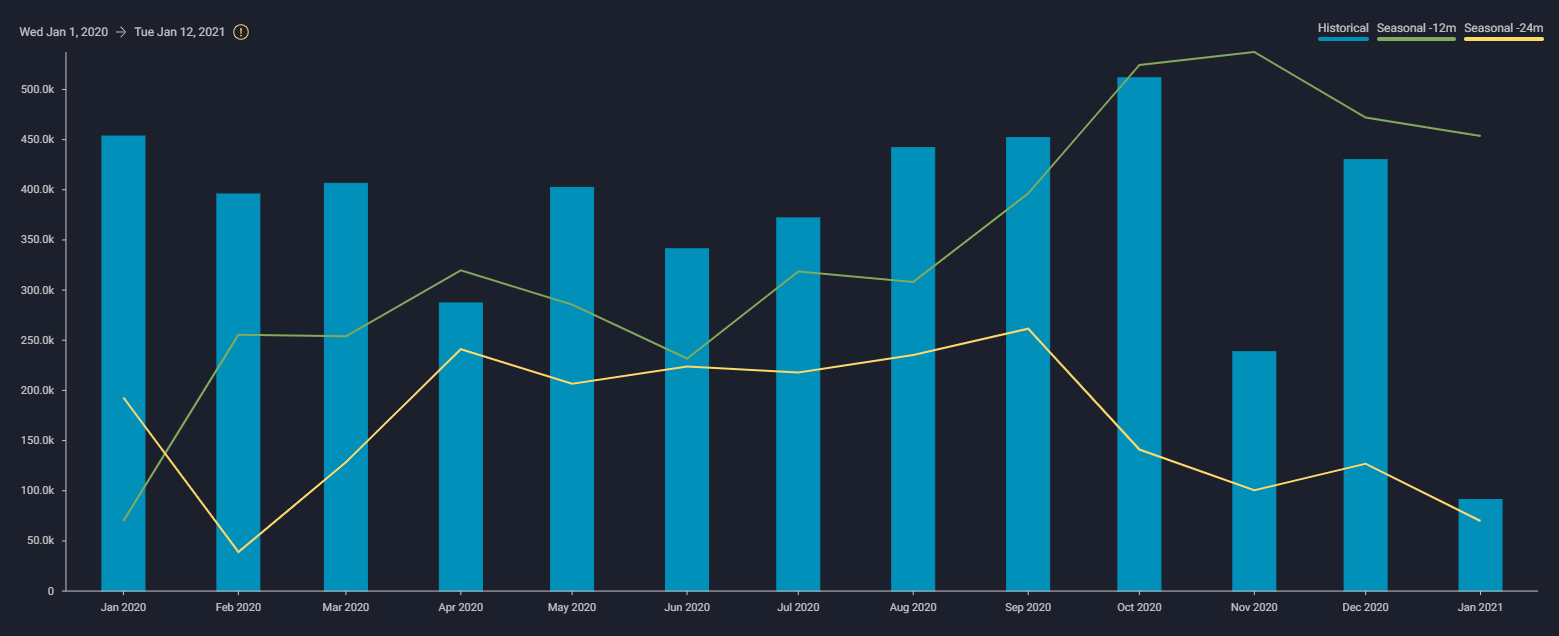

As of 12 January, total DPP exports to the US from the FSU region stood at around 90,000 b/d month-to-date, down from 430,000 b/d in December 2020 and 450,000 b/d a year ago (see chart).

- FSU fuel oil and dirty feedstocks exports to the US

- See this in the Vortexa platform

-

Aframax tankers Serene Sea and Astro Saturn are the only observed FSU-origin, US-bound DPP cargoes this month. The tankers are expecting to discharge into St. Charles and Houston, respectively, by end-January.

Meanwhile, fuel oil-laden Suezmax Nordic Light, diverted away from its previous destination of Corpus Christi and is now heading toward St Eustatius, likely for storage, additionally underlining a weaker pull from the US.

-

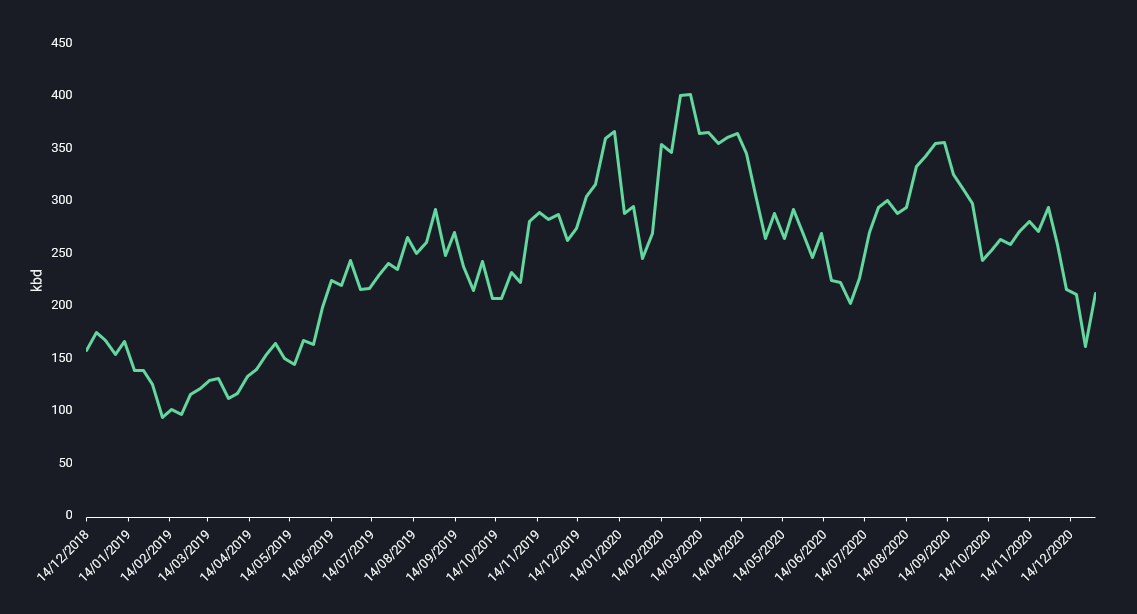

The subdued level of January FSU loadings towards the US will feed through to weaker arrivals in February. The recent drop in flows along the transatlantic route highlights a strategy shift in the diet of US Gulf Coast refiners (PADD 3) amid faltering transportation fuels demand in the US. And PADD 3 intake of feedstocks other than crude oil – products such as high sulphur fuel oil (HSFO) and vacuum gasoil (VGO) – has sharply declined in recent weeks, as seen in EIA data.

- PADD 3 Refinery Gross Inputs Minus Crude Intake (4-week average) – EIA

The lack of fuel oil and VGO export opportunities to the US for FSU region producers is likely to drive more FSU flows into the ARA region in the near term.

But with European demand for transport fuels also weighed down by rising Covid-19 cases, a continued build up of FSU product in the European market would pave the way for increased flows elsewhere. This would be either transatlantic – to the US or Caribbean – or to east of Suez destinations in Asia and the Mideast Gulf.

Keep track of these flows on the Vortexa platform

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3’)}}