Saudi Arabia ramps up DPP imports in April

Saudi Arabia’s imports of dirty petroleum products are strengthening as the country gears up for peak summer demand.

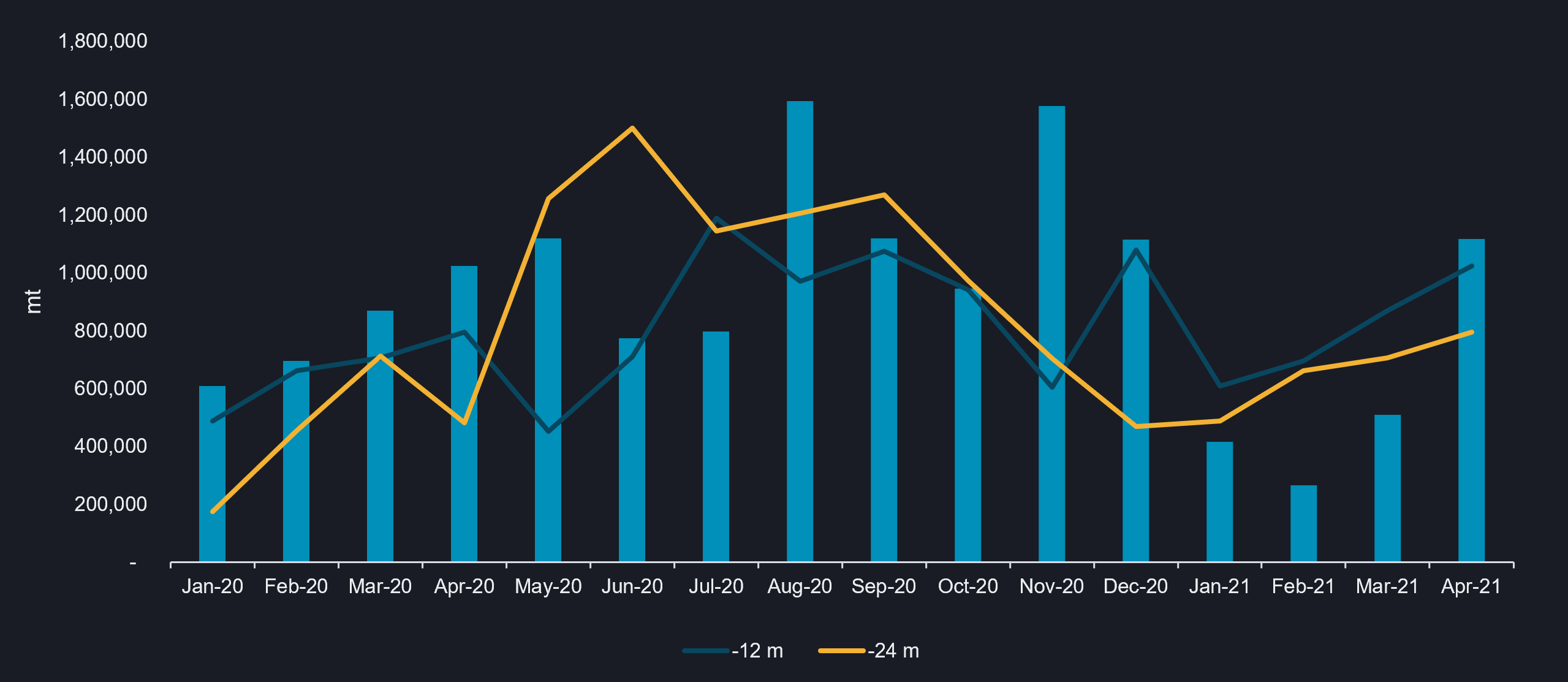

Saudi Arabia’s imports of dirty petroleum products (DPP) rose to 1.1mn mt in April, the highest monthly total since November 2020 and up by 10% on the year. The recent strength in Saudi fuel oil imports, largely composed of high sulphur fuel oil (HSFO), supports the view that imports are likely to rise further as we head into the peak demand period.

Saudi Arabia monthly DPP imports (mt)

-

Saudi Arabia typically raises HSFO imports during the summer due to a seasonal pick up in power demand. With crude supply still constrained in line with the OPEC+ policy, there may be a preference to burn more fuel oil rather than crude oil this summer. Imports in previous years have peaked in the third quarter, with Europe typically supplying the largest share. Early indications from May’s flows suggest this trend will continue this summer, and could be supplemented with flows from less usual suppliers.

-

Around half of all Saudi DPP imports in April (550,000 mt) originated from Europe and around a fifth from Egypt – another regular swing supplier of fuel oil to Saudi Arabia. But aside from these regular sources, Saudi Arabia also received an Aframax cargo in April which was loaded via STS off the Gulf of Mexico. The HSFO on board originated from Pajaritos, Mexico – the last time Saudi Arabia imported fuel oil from Mexico was in November 2020.

-

Saudi Arabian HSFO fuel oil imports from elsewhere within the Middle East fell month-on-month in April with only a single Aframax cargo arriving from Sitra, Bahrain. Middle East fuel oil flows to Saudi Arabia (excluding intra Saudi flows) have been in a steady structural decline since early 2018 as key fuel oil exporters such as Fujairah have increased LSFO production as part of the wider global shift towards low sulphur fuel oil around the IMO bunker spec change in 2020.

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa Analysis