March 2023 was an extreme month. Russia exported crude and products at record levels and also managed to place the barrels without major difficulties. The United States also sent a record amount of crude oil on the water, about 750kbd above February levels, which itself had already set a record. Except for diesel, product imports into major consumption hubs in Asia, Europe and North America came in at very low levels, signalling a slowdown in economic growth. And for diesel, collapsing cracks suggest that the high arrivals are simply too much to digest. Add on top of that the banking crisis, which pushed outright prices solidly below the $80/b threshold, and the voluntary production cuts by eight OPEC+ countries do appear to make quite some sense and actually look less surprising than initially perceived.

However, March 2023 was an extreme month. So deducting forward guidance from the above observations may well be misleading. Let’s start on the crude/export side. Russian exports are surely not sustainable at the March level, which was inflated by delayed loadings from the February schedule in the Black Sea due to severe winter storms. Russian exports are always falling strongly from about March/April onwards, as domestic consumption recovers after winter and the refinery maintenance season kicks in. Also, Russian crude production is struggling against natural decline and a lack of foreign technology and investment. All these factors should be taken into account when considering Russia’s announcement of a deliberate 500kbd product cut as of March (nothing is really indicating that it happened in that month).

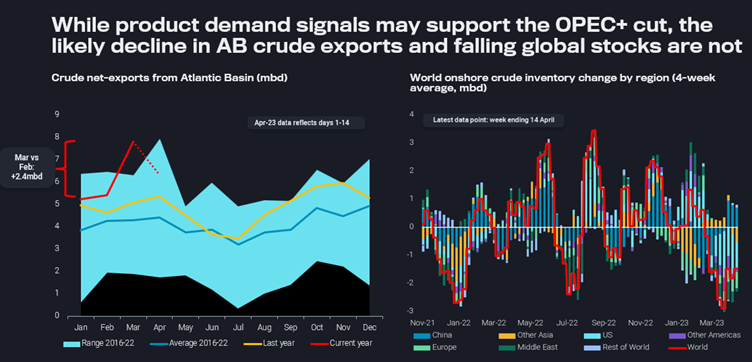

It is also crystal clear that US crude exports have to come down from the massive March peak. Our satellite-measured inventory data shows that substantial stockdraws were needed to make the exports possible over recent months, as domestic refinery runs trended upwards, domestic production is more or less stable and net-exports are surging. At the same time, more and more market observers revise their expectations on future production growth from the US shale sector downwards, and it is well possible that this segment will peak around the turn of the year. With demand and refinery operations seasonally peaking over the coming months, exports are set to decline markedly.

As for oil product demand, some signals, such as US trucking/import activity and Asian product import needs are surely concerning. Also European imports are down massively, but again a mix of seasonal and one-off factors should be taken into consideration. The past winter was supposed by some to be the worst since WWII for Europe, and our data and common sense suggest that market participants across the board (power, industry, commercial, transportation, agriculture) were filling up their tanks late last year. They are likely still drawing down the related tertiary stocks (which do not show up in any trustworthy statistics), weighing on current procurement. French strikes and port blockades also impacted March import levels substantially. Furthermore, Q2 typically marks the seasonal low point of oil demand, and major agencies expect oil demand in H2 2023 to be more than 2mbd higher than in H1.

Looking forward, the eight OPEC+ voluntary cut countries are set to curtail market supplies in May, when Russian and US oil exports will be much lower than in March, and Northern Hemisphere refiners are supposed to procure their feedstock barrels for peak refinery runs over the summer month. This could work if somebody else comes in with massive supply growth (not happening) or if the crude balance in H1 would be markedly on the long side. As for the latter, we understand that this is how many analysts show their balances, but our global onshore crude inventory data shows a different picture. In 10 out of the last 11 weeks we recorded global stockdraws, averaging 1.6mbd over that period.

We will as always only learn in the future what it brings, but the two more extreme scenarios are the following:

- The world moves into recession and oil product demand falls by so much that the OPEC+ voluntary cuts are justified and may even be followed up with more action (be aware short-sellers!).

- The seasonal upside to demand (especially for private travels) and China’s ongoing comeback are resilient enough to overcome wider economic challenges. Then the world may run out very quickly of crude oil as our export data suggests that so far OPEC+ countries have implemented very limited if any production cuts (as announced since October 2022) and the global inventory cushion is also low, including depleted US SPRs. OPEC spare capacity estimates are up to everybody’s individual judgement, but it may well be very low.

In other words, what we currently observe is a battle between bearish refined product markets (supported by a bleak macro picture) and bullish crude fundamentals. Economic refinery run cuts are probably already materialising as a consequence, but they need to be substantial for bearish products to knock out bullish crude.

Get live data (imports, exports) Get live data on platform