US crude waits in floating storage

Vortexa Snapshot: US crude waits in floating storage

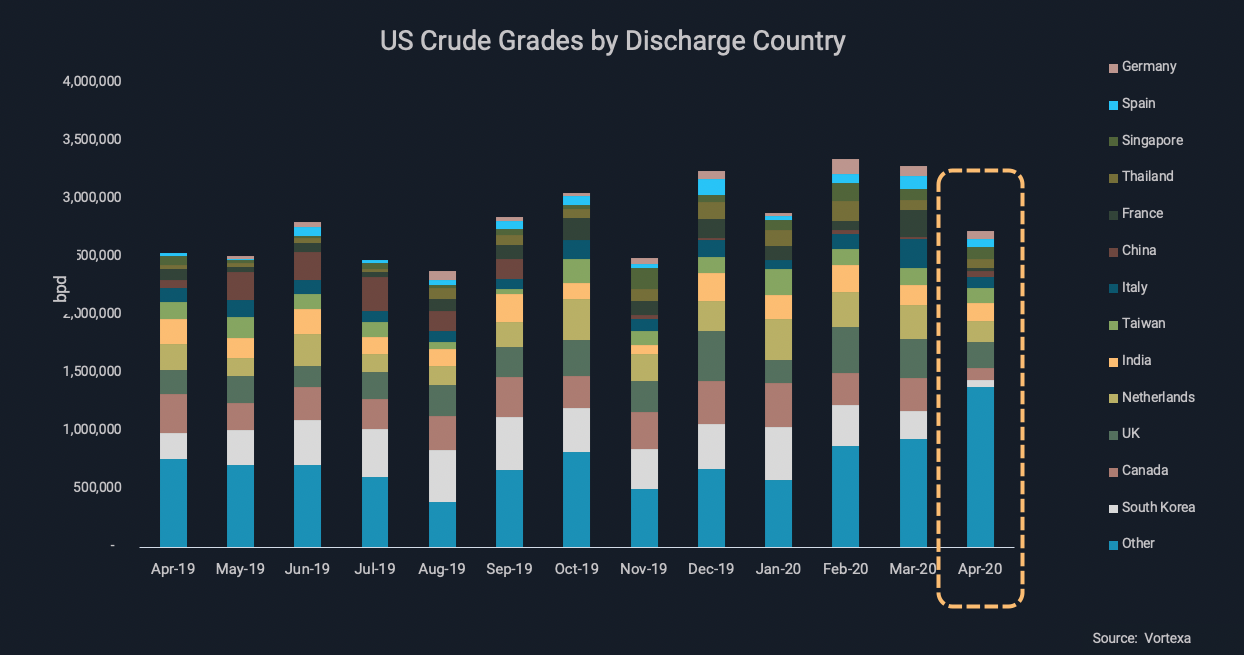

The rise of US crude exports along with the widening of its customer slate in recent years means that more US crude finds itself floating around the world as part of the broader global build of offshore stocks. Around 11mn bl of US crude is currently observed in a floating storage state, Vortexa data show, joining the raft of other crude grades unable to swiftly deliver to buyers due to tighter onshore storage capacity. With April US crude exports only slightly below the Q1 average, we could see this trend persist in coming weeks.

US crude floats in storage

- Global attention is focused on the huge volume of crude in floating storage currently offshore PADD 5. At the same time, as one of the world’s top exporters, we note that the amount of US crude in floating storage (i.e. stationary for at least 7 days) has risen rapidly with the global demand drop in the wake of covid-19.

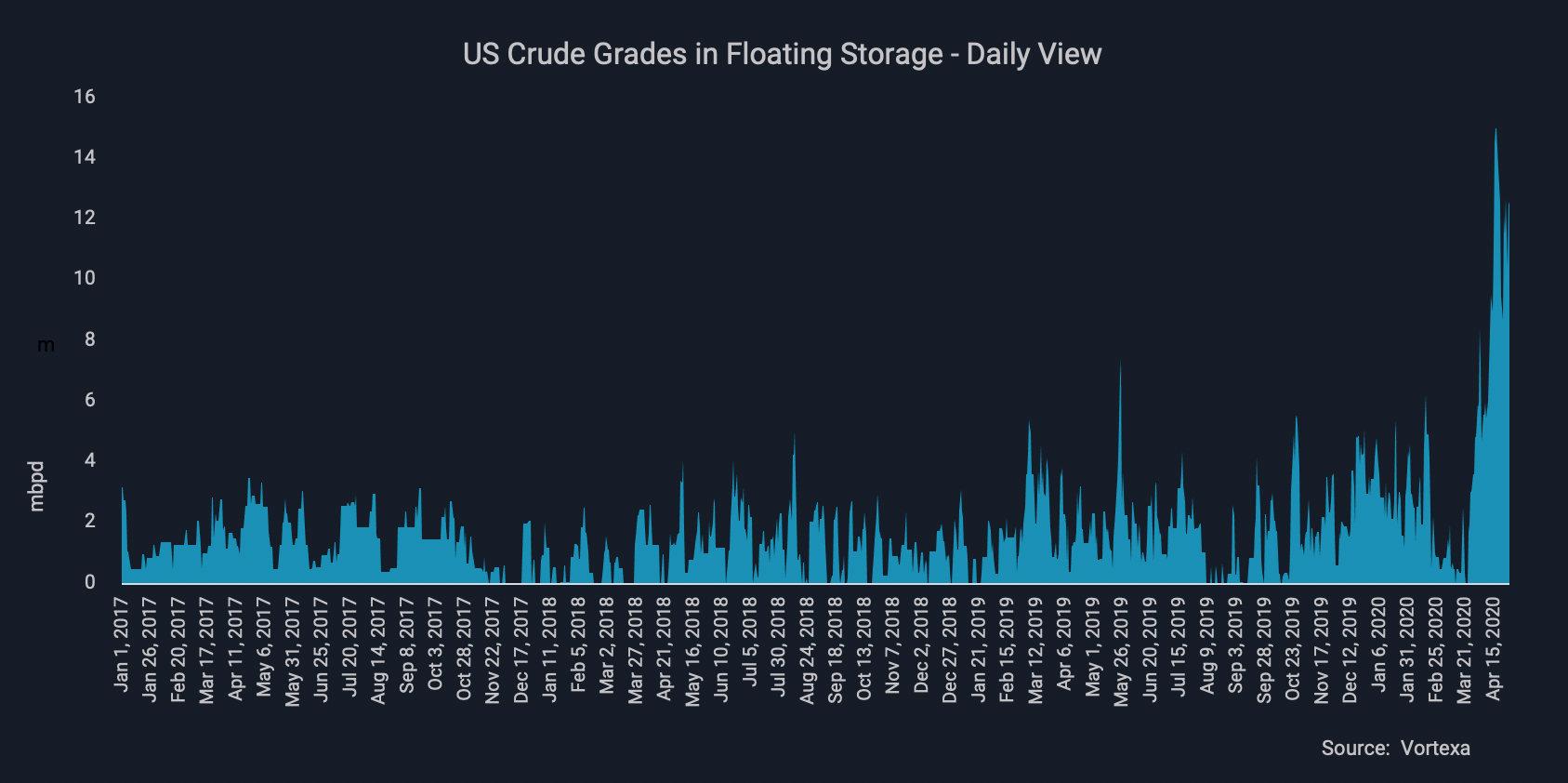

- US crude in floating storage stands at 11mn bl, equating to around 9% of the total offshore stocks on 30 April. It hit a recent daily peak of 15mn bl on 17-18 April, our data show (see below).

Waiting around the world

The diversification of US crude buyers in the past few years means that US crude is spread all across the world, waiting to discharge in locations including:

- Australia: A VLCC has newly entered floating storage off western Australia, laden with WTM crude that loaded at the end of February.

- South America: An Aframax each is waiting off Peru and Colombia, having loaded from the US Gulf coast in early April.

- Europe/Med: In Europe, an Aframax waits off Fos in France, a Suezmax off Italy’s Trieste and a VLCC off Rotterdam in the Netherlands.

The next build for US crude?

Asia

- Some 18 VLCCs laden with US crude are provisionally expected to arrive in Asia during May. As hubs of floating storage build in this region due to onshore inventories filling, the subsequent discharge delays and the exercise of storage options could see more yet US crude stored here. The VLCC Maran Corona, which recently loaded crude from LOOP was provisionally booked for an Asia voyage with storage options, but has yet to depart the US Gulf coast.

- India continues its hunger for US grades despite current conditions, with around 10mn bl due to arrive in April, close to the last record seen in October last year. Another 6-7mn bl is expected in May 2020. Given that India is home to one of the main clusters of floating storage in Asia, it is expected that some of the incoming US crude barrels would also clear at a slower pace than previously.

- South Korea: South Korea has been one the fastest growing buyers of US grades in recent years, and some 13-14 mn bl is expected to arrive in April, and another provisional 10-11mn bl in May. But there too, rising storage levels could risk a slower discharge rate.

Europe

US crude exports to the wider European region stand at just over 1mn b/d in April , and while down from nearer 1.35mn b/d in Q1, some cargoes could also end up waiting to discharge, given what we observe today.

- Reflecting the search for storage, we note that an Aframax tanker which loaded US crude in Houston in mid-April switched its destination a few days into its journey, diverting from the UK’s Pembroke to Bantry Bay, Ireland, home to a crude and refined products storage site.

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}