Diesel, gasoline flows up on refinery yield shifts away from jet

Vortexa Snapshot: Diesel, gasoline flows up on refinery yield shifts away from jet

As coronavirus tore through many developed economies during the first quarter, the ensuing global lockdowns have decimated fuel demand, leaving many refiners in a difficult place. Crack spreads for transport fuels collapsed, falling into negative territory, which has hit jet fuel and gasoline hardest out of the clean products slate. One small glimmer of hope for the refining sector so far has been the relative strength of the gasoil crack spread in comparison to other products, as reflected in the change of loading distribution between the products last month.

Yield shifts

To dampen the impact of the jet fuel demand loss and capture some of the higher margin offered by gasoil, many refineries are likely already shifting their output yields to minimise jet production and maximise diesel.

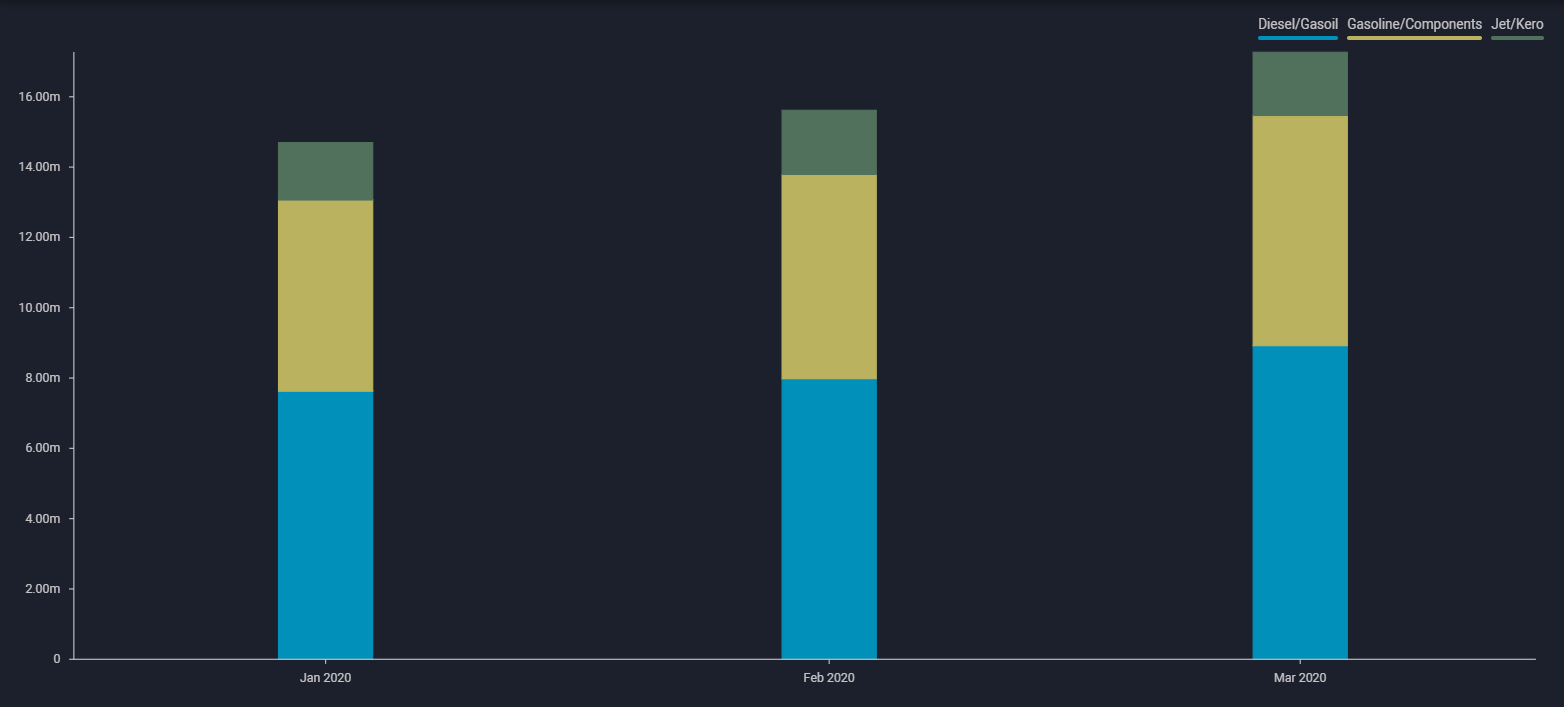

What we see in our data today is that loadings of diesel/gasoil globally in March were just over 9mn b/d, around 1mn b/d higher than the previous month. Gasoline loadings also rose by around 700,000 b/d compared to February, up to 6.5mn b/d. Only jet fuel loadings were down by just under 100,000 b/d to 1.77mn b/d over the same period.

Global diesel, jet and gasoline export distribution in b/d (excl. intra-country)

Global diesel, jet and gasoline export distribution in b/d (excl. intra-country)

Click to see it on the Vortexa platform

We also see this top level trend play out if we hone in on major exporters and importers. Looking at South Korea, the world’s largest jet fuel exporter, its jet fuel exports were down 20,000 b/d month-on-month to around 330,000 b/d, while diesel/gasoil exports rose by 100,000 bpd to 615,000 b/d, according to our data. Meanwhile in the US, we have seen two consecutive months of declining jet fuel exports, alongside increasing diesel/gasoil exports. And in China, February jet exports had also fallen compared with January, against a rise in gasoline outflows and steady diesel exports in the same period.

A balancing act

This shifting of yields between diesel and jet fuel does however come at a cost, since jet fuel has stringent requirements for fuel specification. One of the main difficulties in producing jet fuel is ensuring that the flash point and freezing point of the fuel are within the required limits. Generally, lighter material has a lower flash point and lower freezing point, heavier material has a higher flash point and higher freezing point.

A double edged sword

The implications of refiners minimising jet production is that they will do so by dropping heavier jet molecules into the gasoil stream. But due to the specification requirements of jet fuel, for every heavy molecule that is dropped into the gasoil stream, this must be compensated with lighter molecules lifted out from jet/kero and into the gasoline pool. This is to ensure that jet fuel is still ‘on-spec’ in terms of its flash point and freezing point.

Whilst many refineries are able to increase their distillate output, the downside to this may be more gasoline production – a point indicated above by the global March gasoline loadings. If refineries seek to wind down jet fuel further, without cuts to overall throughput, they could be adding to length in gasoline – adding further pressure to an already depressed market. In a world where mobility is limited and conventional market dynamics are increasingly out of sync, boosting refining margins through this activity alone may prove short-lived.

Interested in more of our data and analysis?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}