Catch-22 for crude tanker markets

Catch-22 for crude tanker markets

Crude tanker freight markets remain a prisoner of challenging circumstances, even as the seasonally strongest quarter of the year is upon them. Fundamentals are in dire straits, with not only abundant underemployed tonnage globally, but also persistently weak oil demand. Nor has rumours of renewed interest in floating storage bookings translated into an increase in utilisation or stocks floating offshore, as we will show.

Rates over a barrel

- Superlatives have all but been exhausted to describe the current rock bottom-levels of tanker freight rates across geographical markets and tanker segments. The global crude demand collapse is not new, yet the extent of it as the world faces new restrictions and extended periods of lower activity has hit shipowners hard. Specifically within crude tanker markets, it has even pushed rates below OPEX levels in some cases as owners grapple with this prolonged reality.

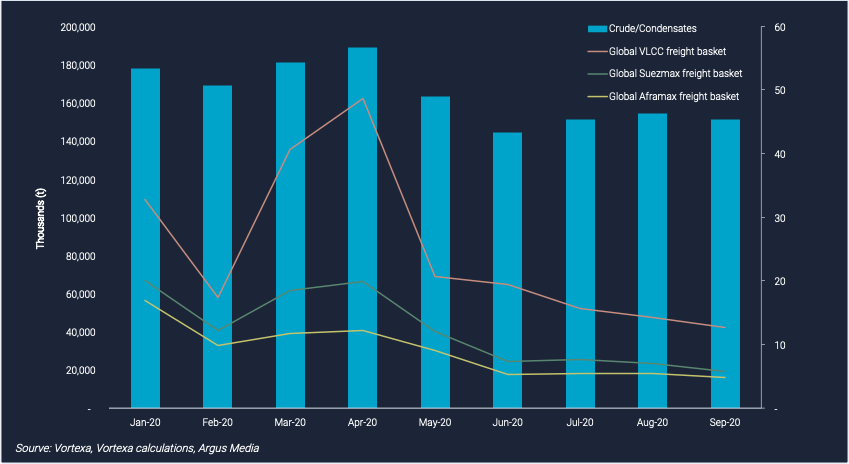

- We have averaged freight rates pertaining to the most liquid crude tanker trade routes globally across the following 3 segments: VLCC, Suezmax and Aframax to conjure an accurate representation of tanker freight rates worldwide, using Argus Media freight pricing data. As of September 2020, the value of our Global VLCC freight basket stood at $12.63/mt, down 74% from April highs. Suezmax and Aframax indices fared similarly, down 71% and 72% respectively from their yearly-highs.

- The drawing down of floating storage inventories has continued to release tonnage into an already oversupplied market (see chart below). The lack of cargoes in the market continues to translate into weak demand for tankers, further weighing down on rates. Whilst Q4 is historically a driver of firmer rates in tanker markets – due to factors such as heating demand and the need for ice-class tonnage in North-West Europe – any uptick in rates might still prove to be too little too late for owners.

Global crude/condensates flows year-to-date (mt) vs. crude tanker freight rates baskets ($/t)

Floating storage: the market bellwether no more

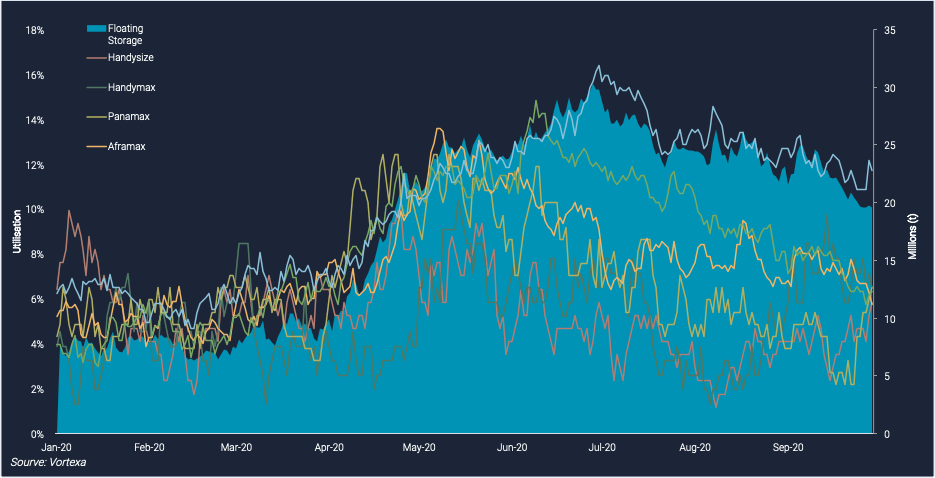

Floating storage demand continues to act like the scales of justice, maintaining an illusion of high utilisation across tanker segments whilst every stock drawdown leads to the release of further tonnage into the spot market.

- For all tanker market segments bar VLCCs, floating storage as a spot rate market driver is a story of the past. Looking at percentages of fleet utilised in floating storage as of October 6, the Suezmax class is down by half from a high of 12% to 6%, Aframax are down by more than half from a high of 14% to 6% and other tanker segments have reverted close to pre-pandemic levels according to Vortexa data. Market participants have expressed doubts towards a resurgence of interest in floating storage with the most recent flurry of time-charter bookings simply a roll-over of existing bookings at much more favourable rates for charterers.

- The volume of crude oil in floating storage is also on the decline. Having peaked at 27.8 mn mt in July 2020, offshore crude inventories have since fallen to 16.6 mn mt in floating storage as of October 6, a decrease of 40% from its yearly high. The bulk of offshore crude inventory remains concentrated in Asia, accounting for more than 80% of total volumes, or 13.5 mn mt.

- Looking ahead, with Asia remaining the dominant demand region for crude markets, refiners and traders may choose to continue drawing down from existing offshore/onshore stocks, or charter a cargo from overseas. In either case, both scenarios bode ill for tanker earnings as the former will only lead to further tonnage released into the market whilst in the latter, competing tonnage will give charterers the upper hand – owners typically lower their offers to secure cargoes. On the other hand, a drawdown in crude floating storage will revive freight demand but will be capped by refining rates which is likely to stay low due to weak margins. At least for this year, Q4 strength in tanker markets may not play out to seasonal norms.

Fleet utilised in floating storage year-to-date versus crude offshore stocks (mn mt)