Fleet constraints unlikely despite Urals price increase

Lower Russian crude exports mean constraints on the fleet trading Russian crude look unlikely despite the Urals price increase.

The price of Urals surpassed the $60/bbl price cap for the first time last month according to Argus Media assessments, highlighting the role of Greek tanker operators, who control well over one-third of tankers which have lifted Russian crude post-ban.

Apart from the rising challenges in remaining sanctions-compliant amid higher Urals prices, the apparent decline of Russian crude exports means Greek operators are further disincentivised from remaining in the Russian trade. Subsequently, increasing numbers of Greek-controlled ballasters are heading to the Middle East Gulf after discharging Russian crude, and are likely to increase competition in the mainstream trade.

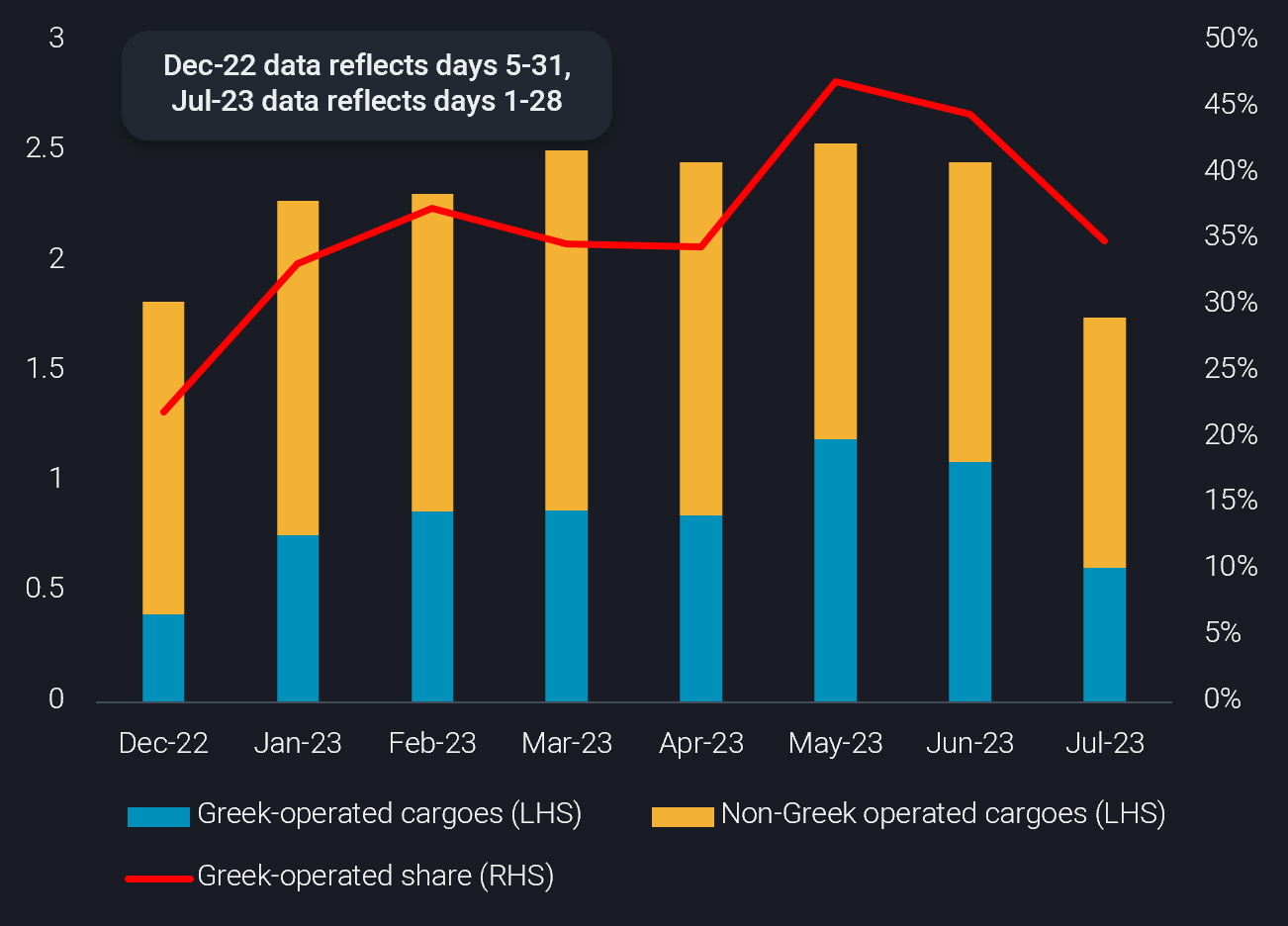

Russian crude exports and Greek-operators’ share

Russian crude volumes (excl. Russia Far East) lifted by Greek operators in July decreased by around 482 kbd m-o-m to a level equivalent to around 35% of all cargoes. In comparison, Greek operators lifted around 45% of June cargoes, when Urals was still under the price cap.

Post-ban Russian crude exports (excl. Russia Far East) by vessel operator (mbd, LHS) vs. Greek-operated share (%, RHS)

Russian crude exports from the Baltic and Black Sea decreased by around 24% m-o-m in July, indicating that reduced tanker demand partially drove the Greek operators away from the Russian trade. As Urals became more expensive, Chinese buyers turned their attention elsewhere, while Russia is prioritising higher value products. This is reflected in July’s Russian diesel exports, which were just 2.5% lower than the record-setting number seen in January in advance of the 5 February ban and are well-above seasonal levels. As clean products are pricing above caps, this begs the question whether a similar shift away from the trade will occur for Greek-operated vessels trading Russian CPP.

Impact on mainstream freight rates

If Greek operators continue to lift fewer Russian cargoes there could be added tonnage in mainstream tanker supply, which is currently manifesting in the Mediterranean. Both Suezmax and Aframax availability remain at high levels, indicating further pressure is likely on Aframax freight rates, which are already at lows not seen since before the Russian invasion in February 2022 (TD19).

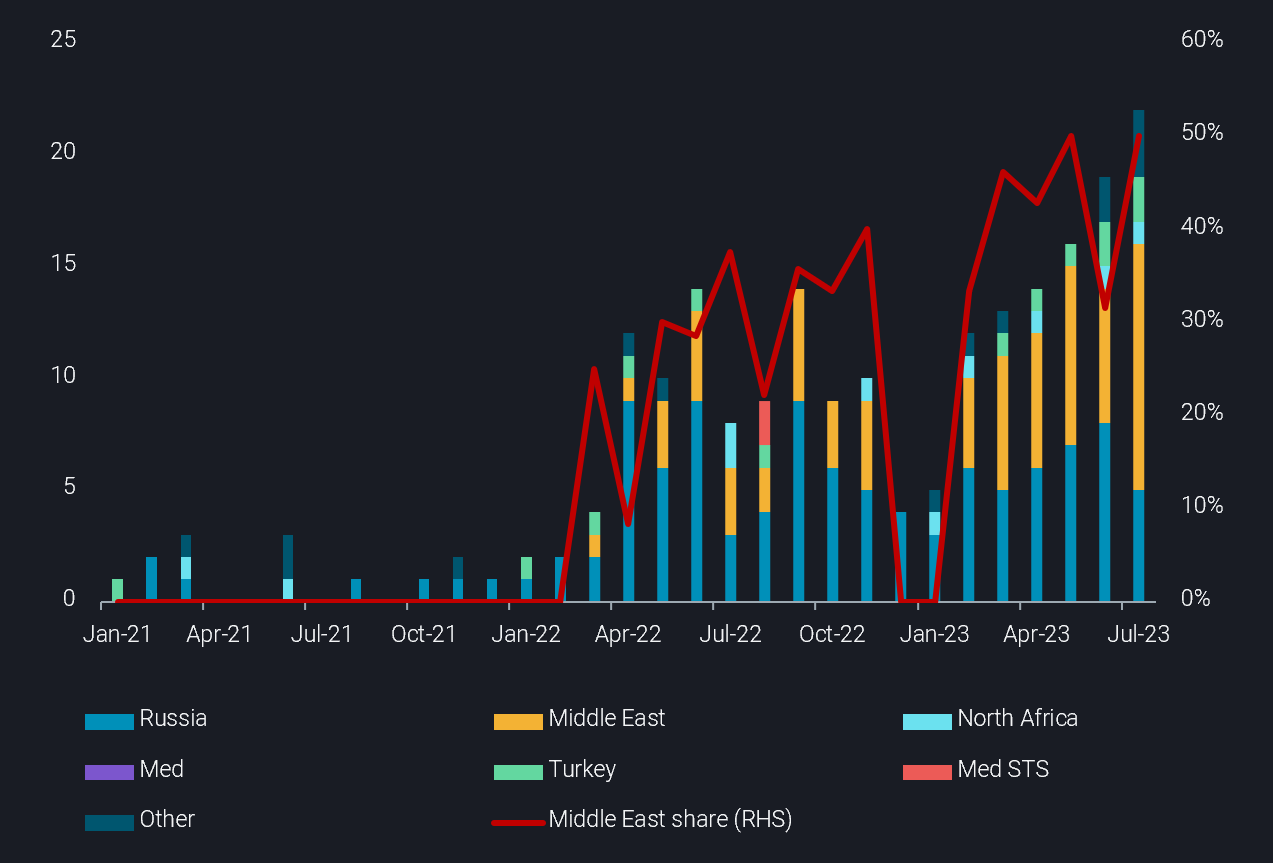

Additionally, Greek-operated tankers are increasingly ballasting to the MEG after discharging Russian crude, instead of ballasting back to load again in Russia. This is especially pronounced for Suezmaxes. Since the start of May, on average 40% of Greek-operated Suezmaxes ballast back to the MEG. As OPEC+ voluntary cuts from Saudi Arabia persist, putting further downward pressure on tanker demand, extra competition from Greek-operated vessels could put further pressure on rates hovering near one-year lows (TD23). Since June this behaviour has also been observed in Greek-operated Aframaxes. From May to July, the number of ballast Aframax voyages heading directly to Russia after discharging Russian crude sharply declined, about 40% from May levels.

Ballast voyages of Greek-controlled Suezmaxes after discharging Russian crude per destination (no. of voyages, LHS) vs the share of voyages heading to the Middle East (%, RHS)

Impact on Russian crude exports

Since Greek operators were covering a significant part of Russian trade, could Urals exports be capped by limited fleet availability? It is rather unlikely for now as Russian exports are declining but even if volumes bounce back, transportational bottlenecks would be short-spelled. Historically high prices of old Aframax and Suezmax tonnage give optionality to Greek operators to sell vessels to newly created commercial entities which could in turn keep those vessels active in the Russian trade. A string of sales by Greek operators this summer of older tonnage, averaging 17 years, shows this trend may already be materialising.

Even if a highly unlikely scenario occurs where high Russian exports cannot materialise due to the lack of tonnage, which eventually could lead to global rise in crude prices, the European Commission and the G7 have the ability to review the cap mechanism. Lifting the cap could in turn attract Greek operated vessels back to the Russian trade. Ultimately, the price mechanism was put in place to continue to facilitate Russian volumes.