Vortexa Snapshot: LR tankers buoyed by Asian petchem crackers

Following a strong October month for naphtha loadings from the Mediterranean and the Middle East Gulf heading East, LR tanker rates are seeing their recent upwards rally confirmed.

Long-range (LR) tanker rates are rallying higher following a strong month of October-loading naphtha exports from the Mediterranean and the Mideast Gulf heading East. Continued strength in naphtha loadings along this route in November is helping clear out tonnage in the region and providing a bright spot in otherwise weaker global tanker market conditions.

Future loadings lead the way

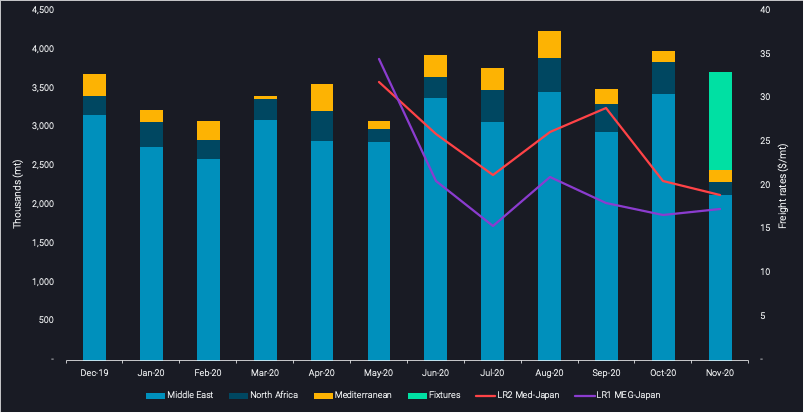

Taking into account future loadings based on future shipping fixture information, our data shows total November 2020 naphtha exports from the Mediterranean and Mideast Gulf to Asia rise to 3.7mn mt, the 4th highest total volume of 2020 and the 2nd since September.

As we predicted in our October webinar alongside Argus Media, strong appetite for naphtha from East Asian petrochemical crackers has helped fuel the firmness in future loading export volumes in the fourth quarter so far.

Naphtha exports to Asia for LR tankers and corresponding freight rates (Source: Argus Media)

See this on the Vortexa platform

LR1s tick higher, LR2s yet to benefit

- Naphtha loadings out of the Middle East, North Africa and the Mediterranean have averaged 3.6mn mt per month since December 2019. With 3.7mn mt predicted to load in November 2020 this represents a 3% increase from the monthly average YTD, spurred by buyers from the East.

- The increase in Asian spot naphtha demand has a more direct impact first on the LR1s loading from the Middle East – given it is the largest supplier region. The demand rise then filters through to the LR2 class, which is more active along the second most important supplier region – the Med and North Africa.

- According to Argus Media pricing data rates for LR2 Med to Japan and LR1 MEG to Japan are up respectively 18% and 28% since the beginning of November 2020. Although freight rates remain lower compared to YTD monthly averages, as tonnage continues to clear out, the firmer naphtha loadings could continue to provide a bright outlook for LR tankers in a market where global refinery run rates have yet to recover and have kept a tight lid on rates thus far.

Want to know more about these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}