Extreme volatility in freight markets is granting owners of coated tankers opportunities to maximise earnings by switching quickly between dirty petroleum products (DPP) and clean petroleum products (CPP). In our case study of the Aframax/LR2 fleet, we highlight how some owners captured higher earnings late last year by switching to carrying dirty products, and how we also see some owners reverting back to clean cargoes, explained by the more recent surge in CPP tanker rates.

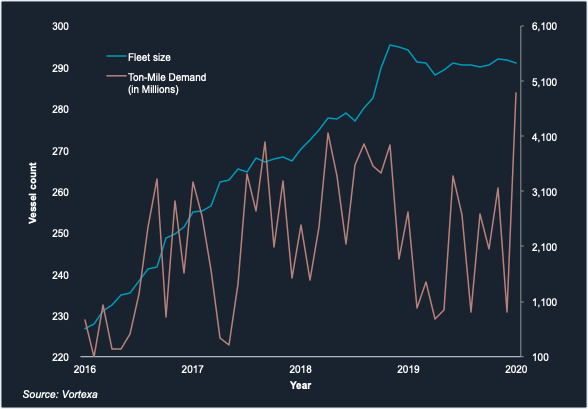

LR2 fleet & ton-mile growth

- Vortexa data shows that the share of coated tankers is close to 30% in the global Aframax/LR2 fleet – the largest tanker class commonly used for CPP transportation.

- The Aframax/LR2 fleet has grown in years in response to the structural rise in ton-mile demand – defined as laden distance travelled, multiplied by total cargo volume.

- To take as an example: along the Europe to Asia route, LR2 ton-mile demand for CPP increased from 770 to 4,900 million ton-miles over the last four years (see chart), according to our data. The LR2 fleet is by far the most used tanker class for this route, accounting for 43% of arrived cargoes from June 2016 to May 2020.

LR2 Fleet Growth vs. Ton-Mile Demand (June 2016-May 2020)

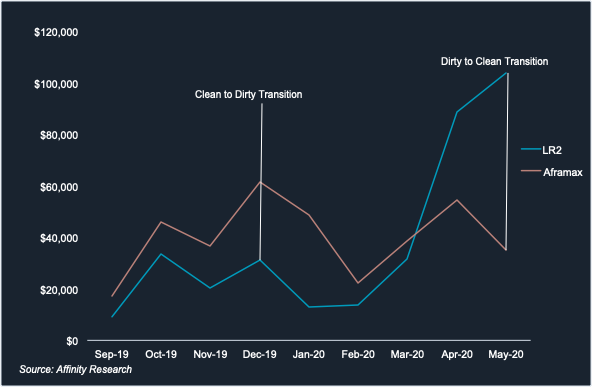

CPP vs DPP earnings

The spread between earnings for tankers operating in the CPP and DPP markets widened to all-time highs in the last nine months, thereby opening up a switching arbitrage, as shown by data from Affinity Research (see below). A significant number of owners were seen switching when earnings hit at least a multiple of 2 between markets.

Average TCE Earnings per day for LR2 and Aframax Tankers

Making the Switch

- Vortexa data shows 35 tankers transitioning in Q4 2019 into the dirty tanker market, from being clean previously. This coincided with DPP tanker earnings hitting a 59% premium to CPP tanker earnings.

- But the tables turned in May 2020. Earnings for LR2 tankers deployed for CPP have outgrown those of their DPP-service Aframax counterparts by close to 200% for the month.

- Vortexa data shows 19 such LR2 tankers switching to CPP service in the last 60 days to maximise earnings potential.

- Of these 19, it is noteworthy that nine tankers were part of both transition periods, riding the spikes in freight rates across both markets.

- Though less common, coated tankers have also been chartered to store crude amid the sharp rise in demand for offshore storage. Around 20 coated tankers were deployed in DPP and/or crude floating storage on 28 May, our data showed.

- But the relative earning potential of the clean fleet may be ebbing. The drawdown of CPP floating storage, as well as the impact of more coated-tanker transitions into the clean market, will increase tonnage availability and apply downward pressure on rates in the coming weeks.

Interested in a more detailed view of our freight data and these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}