Planned storm still only a breeze in tanker markets

So far the OPEC+ announcement to stick to an increase in supply of crude throughout the summer months has failed to add fuel to tanker freight rates and kickstart a morose market.

Using Argus Media pricing and Vortexa flows and freight data we explore whether the expected second half of the year rally is due to materialise.

So far the OPEC+ announcement to stick to an increase in supply of crude throughout the summer months has failed to add fuel to tanker freight rates and kickstart a morose market. Using Argus Media pricing and Vortexa flows and freight data we explore whether the expected second half of the year rally is due to materialise.

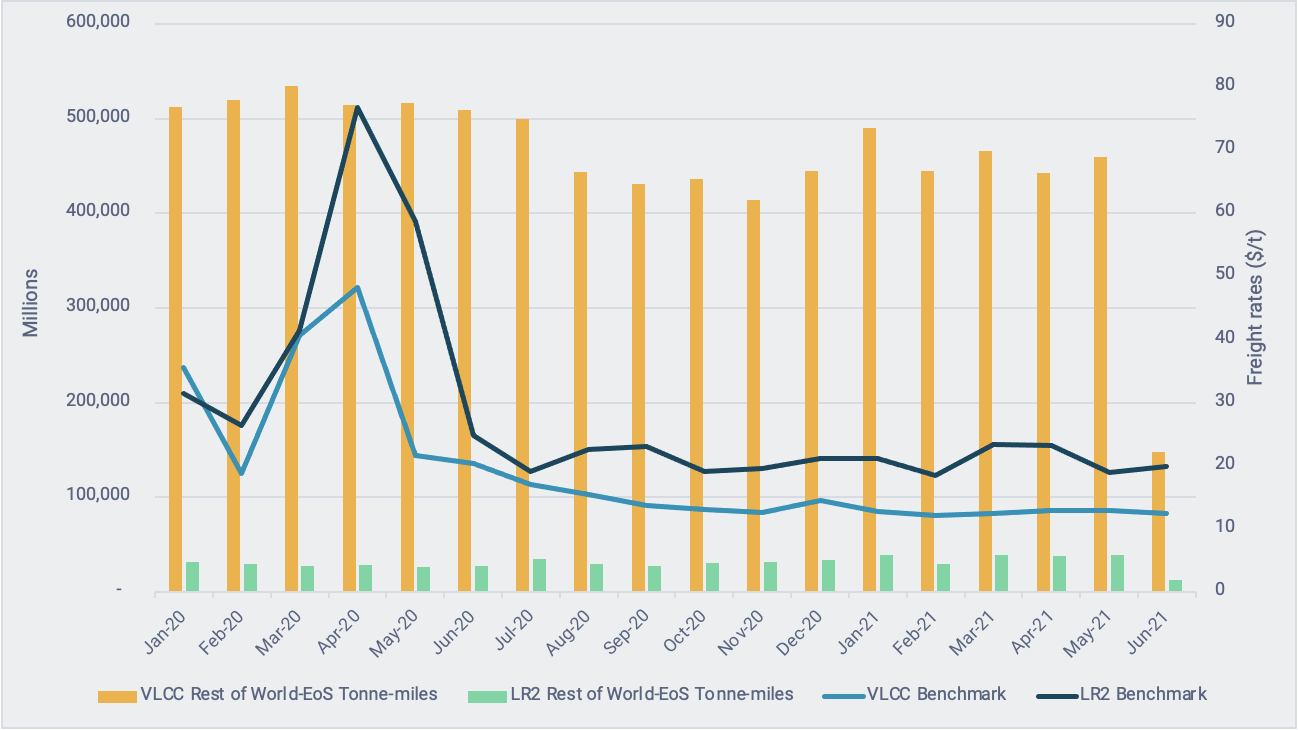

Volumes and freight rates flat for VLCCs, marginal uptick for LR2s

- A benchmark freight rate basket for VLCCs according to Argus Media pricing data shows a 3% decrease as of June compared to January 2021. VLCC earnings continue to languish at yearly-lows even as tonne-miles for aggregated loadings worlwide to East of Suez in the VLCC segment have increased to 460 bn in May 2021 according to our data, up 4% month-on-month.

- Vortexa data shows crude flows along the key VLCC Middle East to China route have been marginally lower, by around 3%, for the first four months of this year when compared to the same period in 2020, but 4% higher than January to April 2019. The relatively mild year-on-year changes reflect the balance of two diverging trends: 1) recovering domestic fuels consumption but 2) weaker demand from opportunistic Chinese crude buyers due to a backwardated market structure and higher flat price.

- In contrast, flows reflecting the key clean tanker routes are in a much stronger position than a year ago and close to or slightly above pre-Covid levels. Naphtha flows via LR1/2 tankers from the Middle East to the Far East are up 20% (or 160,000 b/d) versus January to April 2020 and 6% versus January to April 2019.

- Momentary spikes in LR2, such as the one experienced during the grounding of the Ever Given, have been just that, momentary. In April 2021, a benchmark index of key LR2 freight rates was able to maintain itself at its highest level in 2021 following an increase of near 30% in March month-on-month. This has since reverted back and declined 15% as of June compared to its 2021-high in March 2021.

- Drilling into the LR1/2 naphtha market, Vortexa latest flows data underpins the decline in rates observed after an especially strong April. Middle East LR1/2 naphtha flows to the Far East – the key target market for the product – fell by 80,000 b/d in the month to around 840,000 b/d in May, marking the lowest monthly flow along that route since September 2020.

Rest of the World to East of Suez flows vs. Benchmark freight rates

Economies re-open in an uneven and sparse way, hindering tanker market recovery

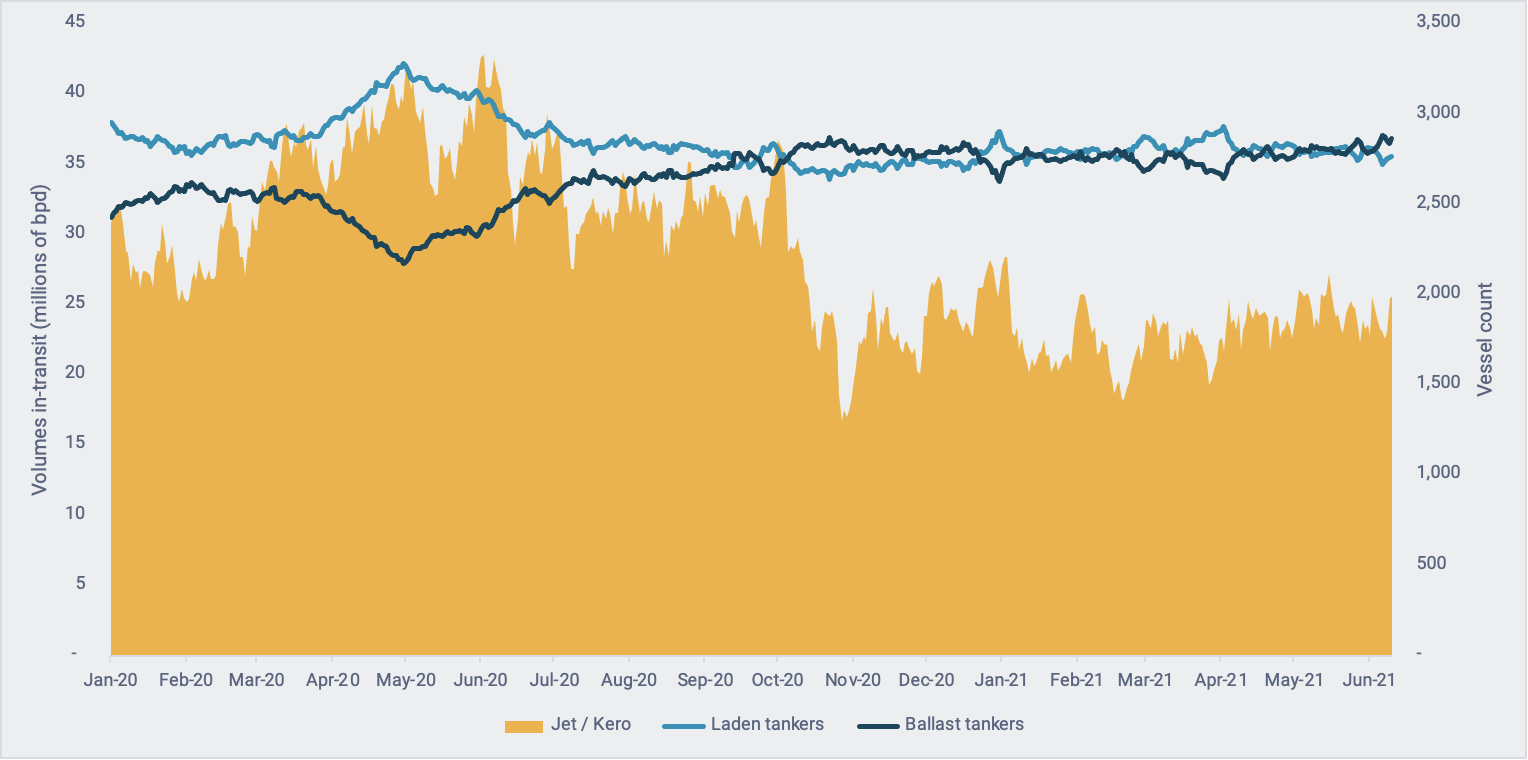

- The slow recovery is severely limiting the upside for tanker markets as demand remains uneven across the world. This is evident when it comes to assessing the ratio of laden and ballast tankers worldwide using our data as seen in the graph below.

- The exceptional scenario that unfolded in 2020 – the market share battle between Russia and Saudi Arabia making refining feedstock extremely cheap at a time of collapsing demand – led to a clear majority of laden tankers, further underpinned by the strength of floating storage economics at the time. The split has been much more volatile in the last 12 months and has flipped often between a majority of laden versus a majority of ballast tankers. As it stands today, tankers in ballast are once again the majority, highlighting the chronic state of overtonnage in the market and not at all heralding a market supposed to catch fire in the second half of 2021.

- The clearest indication of the limited recovery in oil products consumption can be seen in global seaborne jet fuel movements. As of early June, global jet fuel in transit volumes stood at around 24mn bbl, around 10mn bbl below pre-covid levels – i.e. the same period in 2019 as seen in the chart below.

- The lack of demand and overall weak fundamentals can also be attributed to a decrease in imports from the world’s largest buyers. Vortexa flows data shows a large, steady downtrend in crude imports from key buyers China and India since the start of the year. Combined crude arrivals for both countries peaked already in January at just under 15mn b/d, and have fallen consistently for every single month since, hitting just under 13mn b/d in May. China’s recent tax changes for various products (see our most recent insight on the topic) could further hinder imports going forward, while India continues to contend with slower-but-still-rising numbers of Covid 19 even though the situation shows signs of improvement.

Jet/Kero volumes in-transit vs. Global tanker fleet split by status

Looking ahead, improvements likely, record market unlikely

- Firstly, a strong divide exists between activity levels between the two main shipping regions, West and East of Suez, especially when shining the light on crude flows (see our latest insight article here). This can help provide a hint as to what may lie ahead with confidence. We see volumes on the water, and thus demand for tankers, increasing as the economic recovery continues in the West of Suez and a renewed pick-up in crude imports from the East and countries such as China and India, bar a worsening Covid crisis.

- On refined products, CPP flows remain the bellwether of true economic recovery, as planes start taking to the skies again and holiday seasons bring about renewed demand for gasoline and diesel.

- To summarise, given how weak the current tanker freight market is as a whole, and how much more upside there is for transport fuels consumption as the world continues to recover from Covid-19, rates can only improve. It remains to be seen whether that will be to the levels hoped by shipping market participants.

Click here to register for our Freight Analytics launch now!

More from Vortexa Analysis

- Jun 10, 2021 Transatlantic gasoline flows are here to stay

- Jun 7, 2021 Role reversal? West of Suez in the driving seat

- Jun 4, 2021 North American LPG shipments to Asia face pressure

- June 2, 2021 China’s new consumption tax turns tide of gasoline and diesel exports

- Jun 2, 2021 Suezmax tankers infiltrate Europe-bound transatlantic crude flows

- May 27, 2021 European naphtha exports boost LR2 demand

- May 26, 2021 Diverging trends behind stable supertanker utilisation

- May 26, 2021 US DPP imports climb amid rising gasoline demand