Pacific MRs slide, but promising fundamentals set the stage for a rebound

Freight rates in the Asia-Pacific took a downturn in the start of Q4 but driving factors on both supply and demand display encouraging signals for owners/operators in the region.

MR tanker rates in Asia experienced a strong comeback at the end of the previous quarter, however they have softened in the beginning of this one. Freight rates for the Singapore-to-Australia (TC7) and South Korea-to-Singapore (TC11) routes have declined by around 20% and 25% respectively since mid-October.

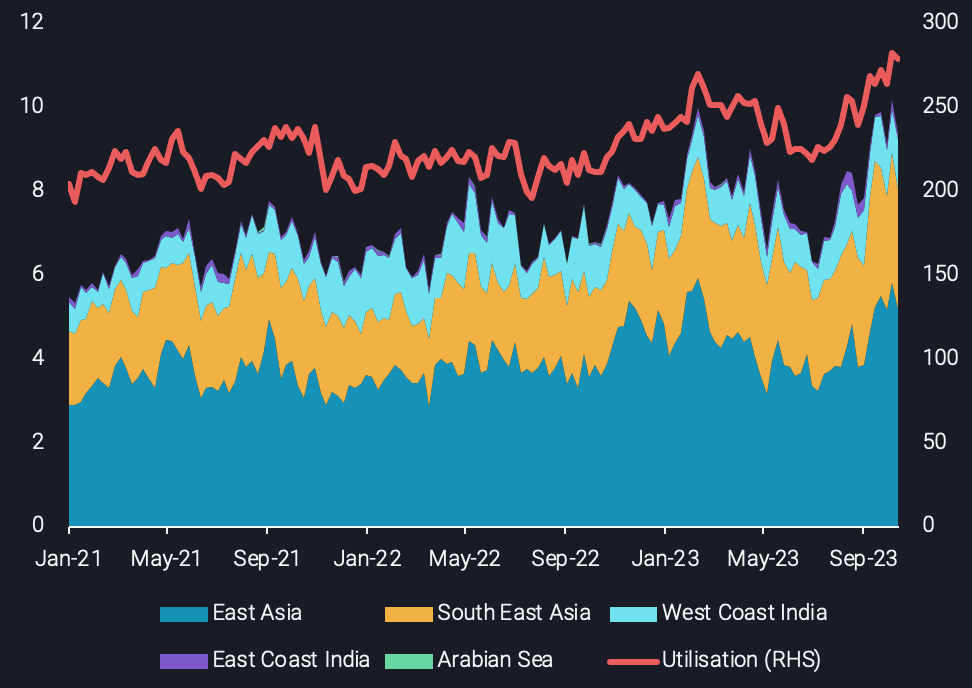

Certain moving parts need to be examined to understand whether this trend will continue or if a rebound in rates is on the cards for the remainder of the year. From a tanker demand perspective, the support for rates has been driven mainly by the strong flows of transport fuels since-mid July, which brought MR2 utilisation loading in Asia to record-high levels.

.

MR2 tonne-miles from Asia carrying diesel/gasoline/jet-kero by origin shipping region (bn, LHS) vs utilisation (no. of vessels, RHS)

Tonne-mile demand trends followed in tandem, supported mainly by strong flows out of East Asia to South East Asia and Australia, and marginally by excess middle distillate flows to the West Coast of the Americas as well as South Africa.

Longer-haul supplies from India to the rest of Asia have dropped since August, on the back of a heavy refinery maintenance season in the country. These are traditionally carried on LR tankers, hence the demand of this vessel segment dropped in the region. Conversely, a rebound Chinese CPP exports post-June has played a vital role in the strength of MRs in the Pacific. That raises questions about MR demand once Indian refinery turnarounds come to completion, especially since China is not showing indications of releasing an additional product export batch until the year end. Nevertheless, these developments do not necessarily point to a downside for MR freight levels. Chinese CPP exports are not projected to reach levels seen in Q4 2022, yet as East/West arbitrage flows during the winter months will likely be supported by India and the Middle East on LR2s, excess volumes from China will satisfy demand in neighbouring markets, thus supporting MR demand.

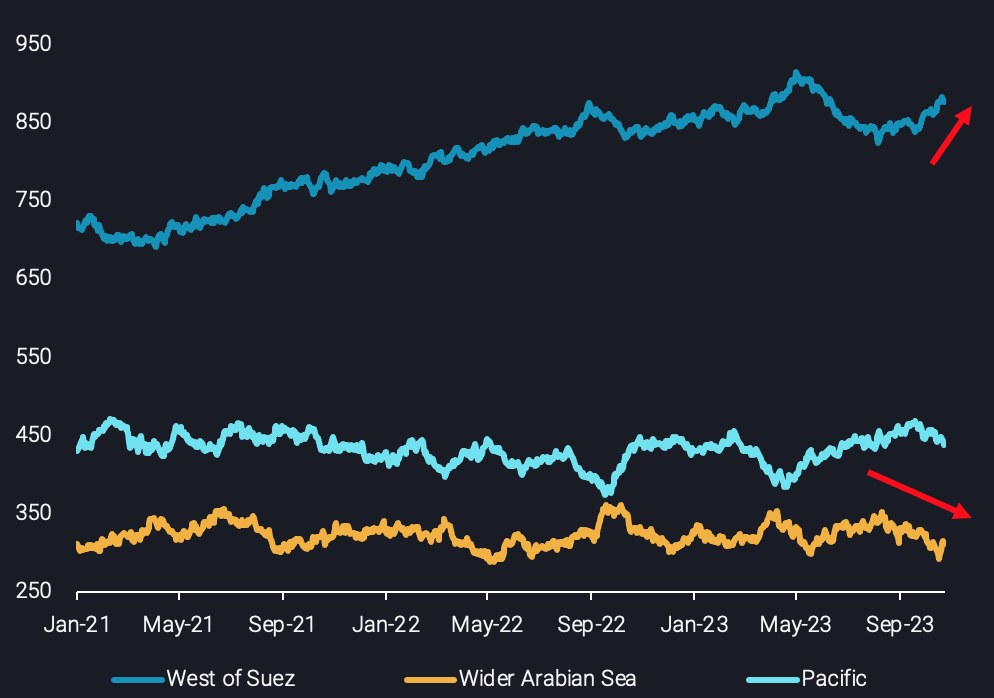

From a vessel supply-side point of view, a recent decline in congestion issues in the Panama Canal as well as subdued tanker demand observed in the Wider Arabian Sea, have triggered a wave of MR tanker migration from the East to the West of Suez since the beginning of August, as illustrated on the chart below.

MR fleet distribution per region (no. of vessels)

Nevertheless, with congestion in Panama bouncing back up and stricter regulation on the number of transits looming from the start of November, the fluidity of traffic between the Atltantic and the Pacific could be hampered, leaving the latter region undersupplied. Moreover, persistent congestion issues are likely to continue to prompt West Coast Americas buyers to find excess barrels from the Pacific instead of the US Gulf, underpinning CPP trans-Pacific voyages.