Red Sea attacks and Panama Canal drought lead to gas carrier rerouting

We examine how gas carriers are affected by the Red Sea attacks.

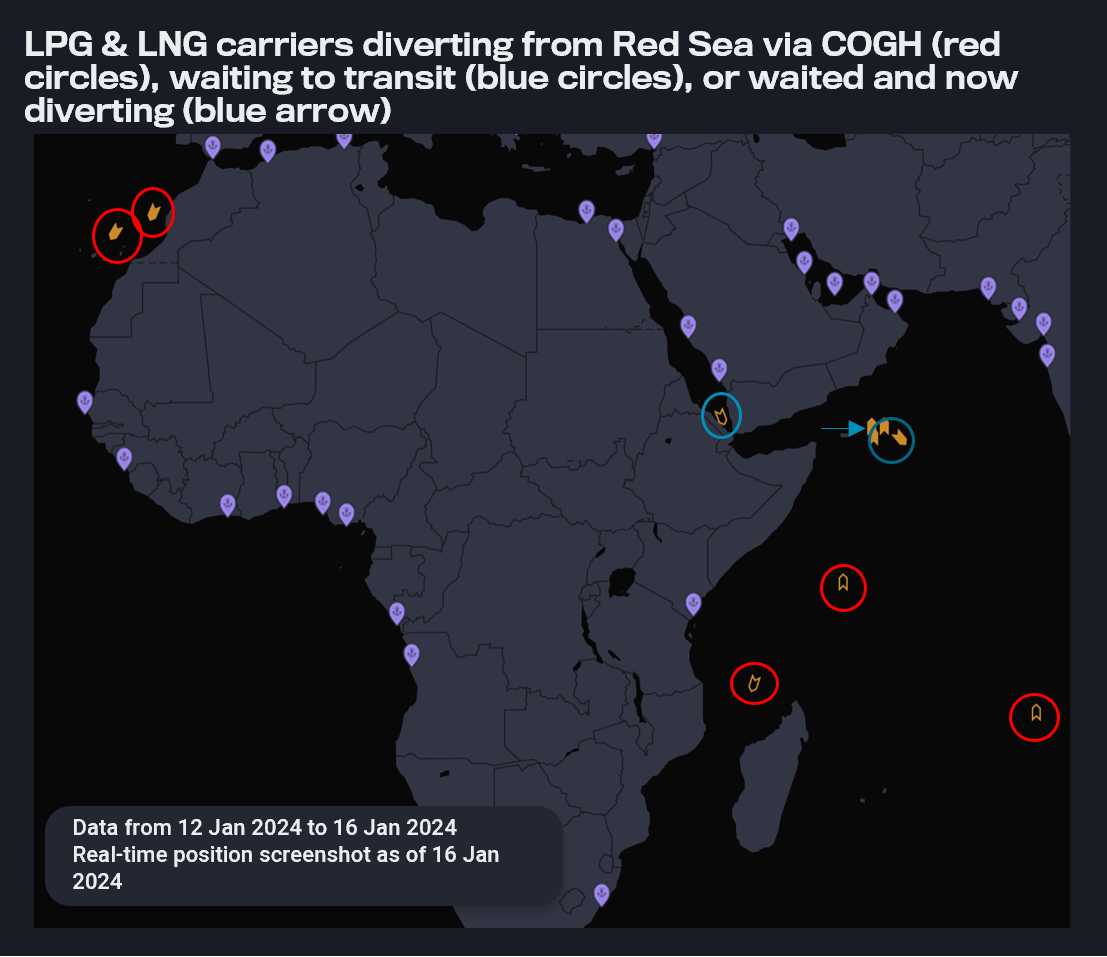

When faced with the two-pronged issue of Panama Canal transit difficulty plus the possibility of attacks in the Red Sea, gas carrier operators are driven to make altering navigational decisions, and the Cape of Good Hope (COGH) is proving a viable route. Since the attacks on non-Israeli vessels transiting the Red Sea began in mid-December, we are tracking 32 gas carriers (LPG and LNG carriers) transiting West of Suez-to-East of Suez via the Cape of Good Hope. 26 of these vessels are likely following this trajectory due to ongoing Panama Canal transit issues instead of geopolitical developments unfolding in the Middle East.

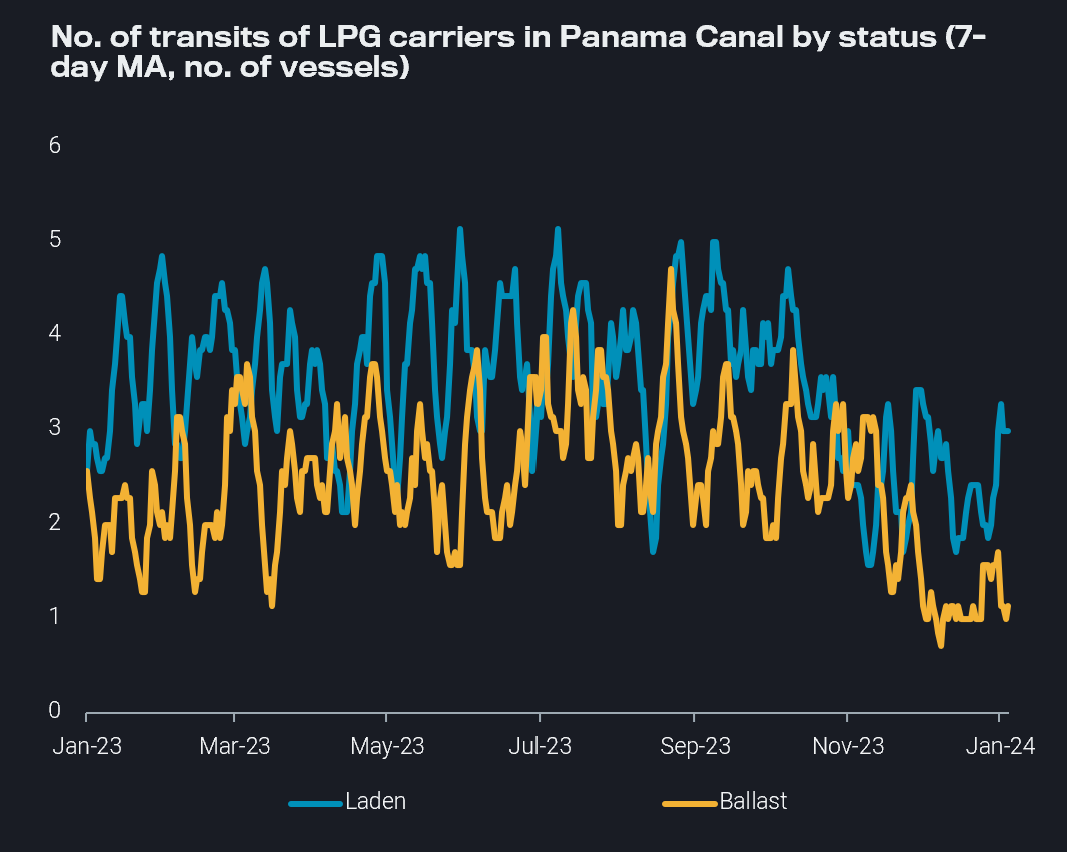

Panama Canal transits for LPG carriers remain low, though laden transits numbers are recovering slightly so far in January. Both alternate waypoints – COGH and Suez – have a similar duration for most East of Suez destinations for North American-origin voyages, so some operators may prefer the COGH to avoid Suez Canal costs. Similar numbers of LNG carriers are transiting via COGH. This behaviour is also occurring on the ballast leg from EoS-to-WoS, especially as Northbound transit numbers for ballast LPG carriers via the Panama Canal have remained under pressure, hovering around just 1 vessel per day.

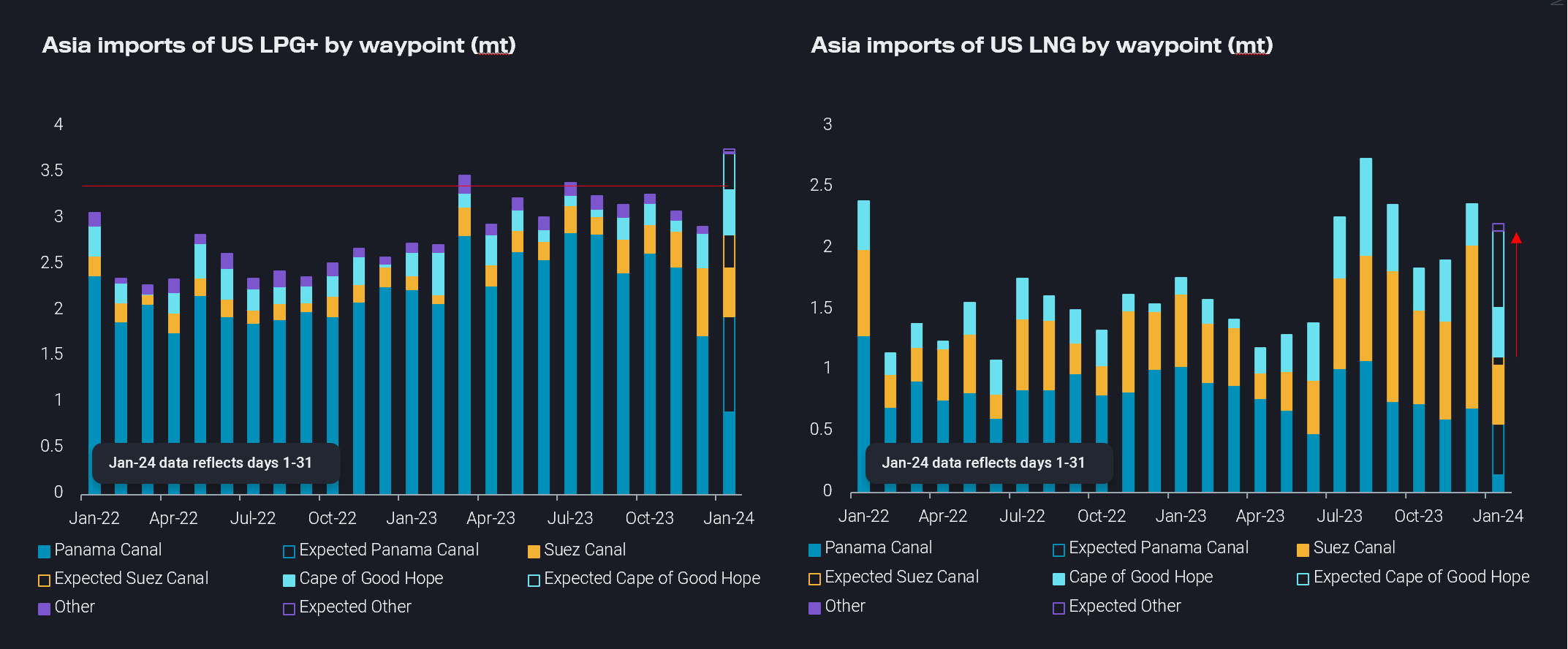

Since Panama Canal transit issues began, Asia’s LPG imports from the US have undergone a major reshuffling, with voyages via the Panama Canal declining in favour of transits via the Suez Canal and COGH. December imports were much reduced overall, though there were large increases via the Suez Canal and COGH. For arrivals throughout the entirety of January, imports are set to be much higher, a reflection of the longer voyage times for vessels transiting in December, which likely contributed to December’s low volumes. However, what is most striking is the large increase in volumes transiting via the COGH, set to increase by about 140% m-o-m. For Asia’s imports of US-origin LNG arriving in January, volumes transiting via COGH are set to increase by about 210% m-o-m, while volumes transiting via the Suez Canal are set to decrease by about 60%.

Asia imports of US LPG+ and LNG by waypoint (mt)

Though high COGH volumes for both LPG and LNG can be mostly attributed to factors such as Panama Canal transit issues and saving Suez Canal costs, the dramatic increase in volumes later in January is also in a smaller part driven by geopolitical decisions. Undoubtedly, several operators which cannot transit the Panama Canal are deciding to transit COGH due to it being a safer option. From mid-December to 11 January, we observed 11 diversions, where gas carriers avoided the Red Sea, most changing vessel trail or signals on or around 18 December. These were mainly linked to European or American corporate entities.

Since US led-strikes on Yemen on 12 January, 3 gas carriers have diverted from transiting the Red Sea. All three are ballast and were heading to the Red Sea transit Northbound. Additionally, two LNG carriers coming from Europe have diverted to avoid a Suez transit and are beginning transit around Africa. 5 gas carriers adopted a “wait and see approach” and have been waiting around the Bab el-Mandeb over the past few days. At the time of writing – morning of 16 January – these gas carriers seem to be picking up speed, and AIS signals are declaring destinations which indicate transit via the Bab el-Mandeb strait, with only 1 signalling a diversion. These early indications point to the resumption of Red Sea transit for these particular vessels, but in this rapidly changing environment vessel operators could change course again.