Red Sea Update: Global LR fleet most affected, while Russia-origin oil continues to transit

We investigate the impact of the Red Sea situation on the LR fleet and contextualise Red Sea diversions in light of the recent attack.

LRs and the outsized impact from Red Sea attacks

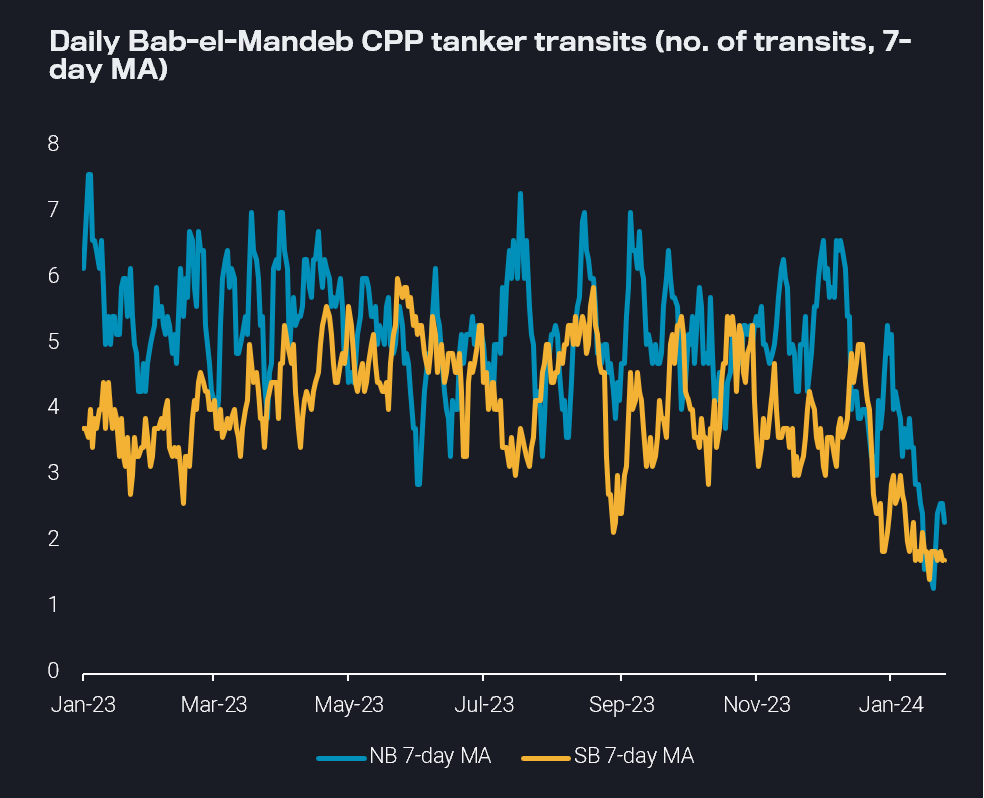

Clean tanker transits via the Bab-el-Mandeb have continued to decline since Red Sea attacks on non-Israeli vessels began mid-December. Southbound transits have largely stopped, hovering at slightly over one transit per day on a moving average basis. CPP volumes still going through are almost all Russian-origin heading East. Northbound CPP tanker transits slightly recovered going into the New Year but declined precipitously following the US/UK-led strikes on 12 January. Some tankers were initially adopting a ‘wait and see’ approach in the Arabian Sea, but virtually all have now made the decision to divert around the Cape of Good Hope (COGH).

Daily Bab-el-Mandeb CPP tanker transits (7-day MA, no. of transits) (Retrieved via Freight API/SDK)

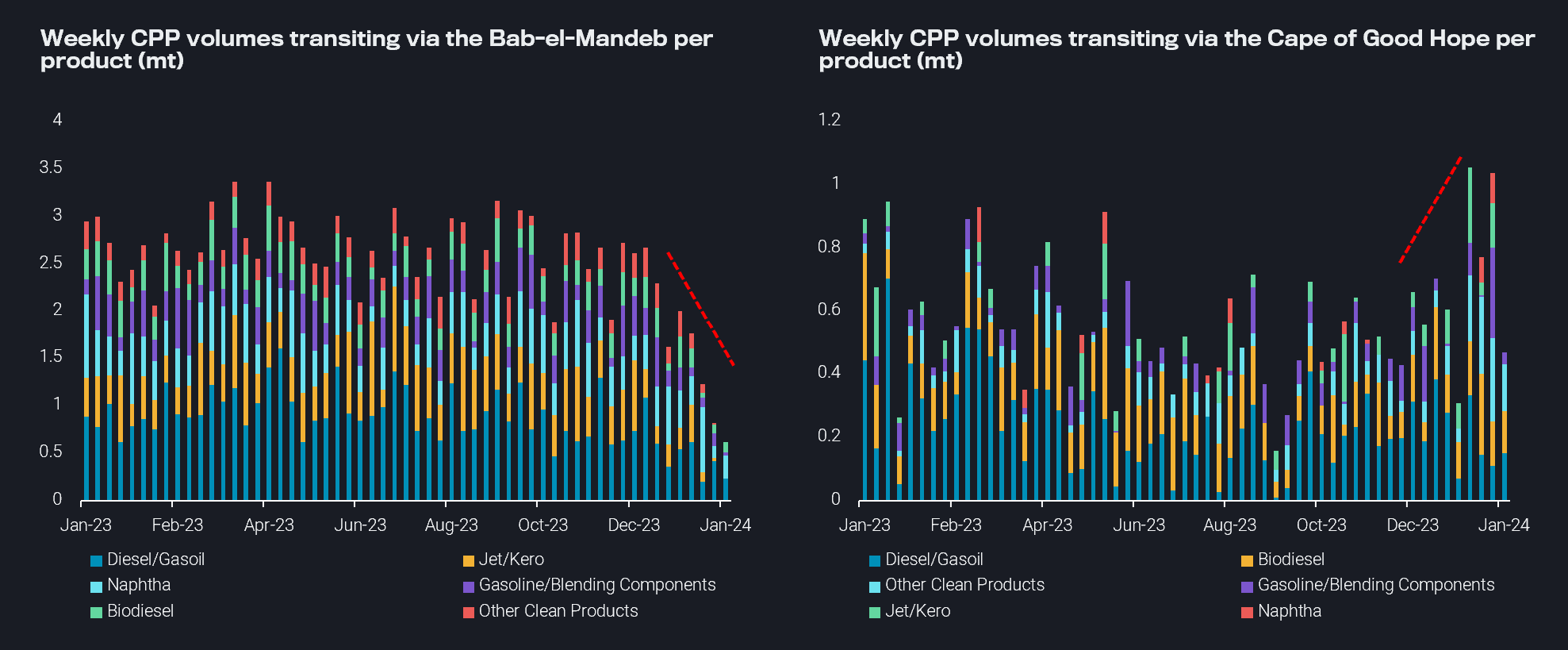

The flow most affected by these northbound diversions are middle distillates from West Coast (WC) India or the Middle East heading to Europe. Beginning a steady decline in December, the drastic curtailment of volumes transiting via Bab-el-Mandeb has gathered pace since the US/UK strikes began on 12 January, with no jet/kero cargoes transiting the route through last week, and diesel cargo volumes 75% lower than the 2023 weekly average. Though there has been a pickup of volumes passing COGH since Red Sea attacks started, there has not yet been a noticeable uptick in middle distillate volumes transiting past the waypoint. This will shortly occur, as these volumes have not yet physically reached the COGH but are currently in transit in the Indian Ocean.

Weekly CPP volumes transiting via the Bab-el-Mandeb per product (mt, LHS chart) and Weekly CPP volumes transiting via COGH per product (mt, RHS chart) (Retrieved via Freight API/SDK)

Middle distillate cargoes from the Middle East and West Coast India are traditionally carried on the bigger LR tankers. Freight rates from India-to-UK Cont (TC8 for LR1s and TC20 for LR2s) for these vessel classes have increased 87% and 95% respectively since US/UK strikes. The transit via the COGH instead of via the Red Sea adds around 75% in tonne-miles to a voyage from Sikka to Europe for both LR1s and LR2s. If all LRs carrying middle distillates from WC India/MEG to Europe were diverted, this would add 8% to global LR1 tonne-miles per month and 18% to global LR2 tonne-miles per month, significantly increasing global fleet requirements.

Furthermore, for the vessels currently in transit carrying middle distillates to Europe, repositioning back to the EoS after discharge will be a lengthy procedure, as vessels will likely choose to ballast back to the East around the COGH. We are already observing these higher turnaround times materialising for a handful of tankers, and as this continues, we will see a further tightening of LR supply, keeping freight rates elevated.

Which transits continue, and does the recent attack change anything?

This evidence around low CPP transits through the Red Sea begs the question, which tankers are still transiting the route? From 23 – 27 Jan (inclusive), 44% of all transits via the Bab-el-Mandeb were Russian-origin cargoes, mostly either crude or DPP. 30% were ballast tankers, and the rest were mostly voyages within the MEG plus a few North African and Caspian origin crude cargoes. Overall, few Northbound laden transits via the Bab-el-Mandeb are continuing aside from intra-Middle East voyages and one biodiesel cargo from SE Asia.

At the time of writing, the strike on the MARLIN LUANDA does not appear to have changed much in the short-term. However, a handful of vessels linked to UK-based entities which were heading Southbound in the Red Sea have turned around to transit back through the Suez Canal. Though the MARLIN LUANDA’s naphtha cargo originated in Russia, the vessel’s reported ties to both US and UK corporate entities were the motive for the attack. This suggests that other Russian cargoes that are not carried by EU/UK based individuals would likely not be running the same risk.

What will happen to Baltic/Black Sea-origin Russian cargoes moving forward remains a question mark, as these rely on the Red Sea to access EoS. For the moment, these appear to still be transiting, but this could change if the situation escalates. However, what is increasingly likely is that the attack will further reduce overall transits in the Red Sea, and especially cement the trend for CPP heading to WoS to divert via COGH.