Scrubber-fitted VLCCs quietly gain market share

How scrubber installations have shaped the employability and demand of VLCC tankers in a globally depressed crude freight market.

Vortexa analyses how scrubber installations have shaped the employability and demand of VLCC tankers in a globally depressed crude freight market.

The scrubber bet pays off for VLCCs

Prior to the pandemic the main questions related to the shipping industry revolved around IMO 2020. More specifically, the main concerns had to do with the supply levels of the newly introduced low sulphur fuel oil (LSFO), which gave birth to the dilemma: to scrub or not to scrub?

Fast forward to Q4 2021, following the devastating impact of the pandemic on shipping industry, earnings for energy carriers and IMO 2020 regulations have all but taken a backseat in the mind of market participants. Overall, VLCC earnings remain in the doldrums as we enter Q4. However, it seems those having made the bet to install/retrofit a scrubber, have been able to maximise their earning potential in the dire environment.

Using our freight analytics we were able to distinguish tonne-mile developments between VLCCs with and without scrubbers over the past 2 years.

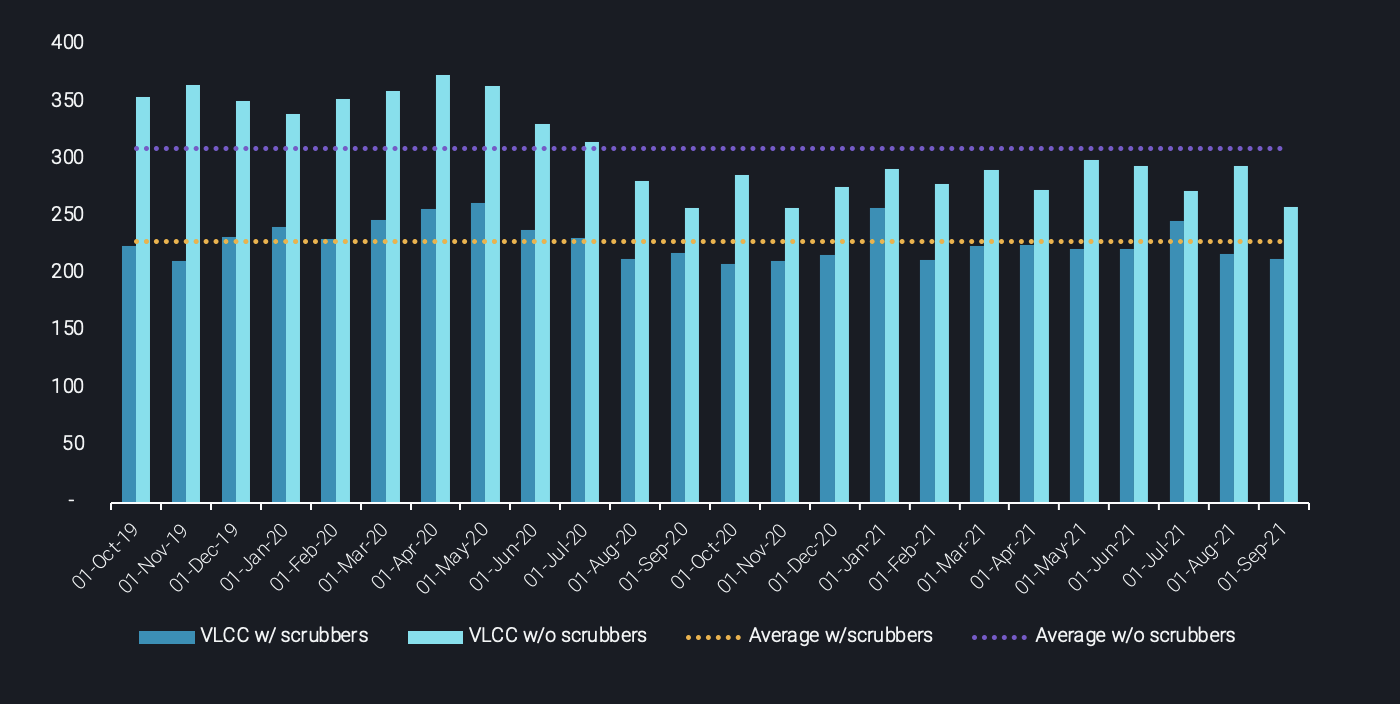

Global crude tonne-miles (in bn)

Global crude tonne-miles (in bn)

- During the floating storage boom in Q2 2020, when crude and in turn, bunker prices plummeted, tonne-miles of VLCCs without scrubbers peaked. This surge in employment was reflected in the skyrocketing freight rates at the time. Since then, however, demand for VLCCs running on LSFO has dropped drastically, (and have remained below 2-year averages)

- Conversely, tonne-miles for scrubber-fitted VLCCs exhibit more stable behaviour throughout this 2-year period, as they seem to fare better in the midst of current market fortunes.

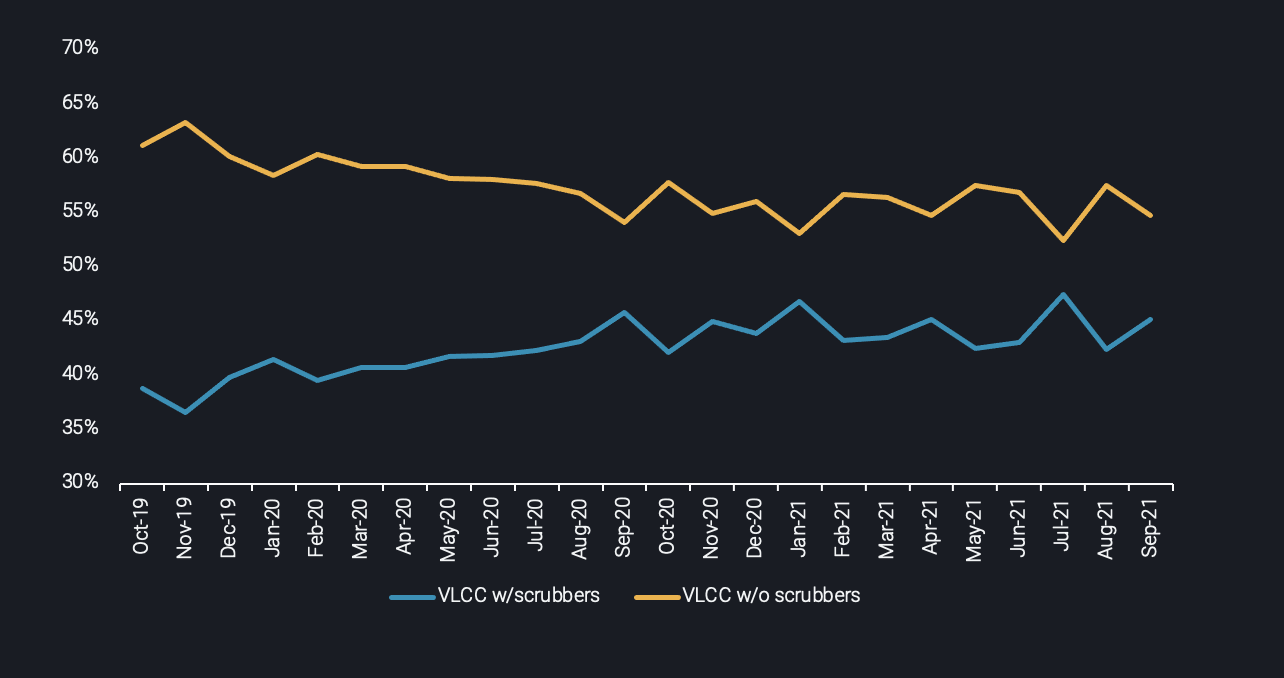

This is reflected by the following chart, where our data clearly reflects that as time progresses, scrubber-fitted VLCCs have gained market share against their non-scrubber counterparts.

Contribution to global tonne-miles

- The tonne-mile share of scrubber-equipped VLCCs reached a low of 37% in late 2019 due to higher VLCC rates during this period that allowed shipowners to withstand a higher LSFO-HSFO spread. Additionally, the lower market share can be partly attributed to the fact that an increasing number of scrubber installations was still underway prior to the implementation of IMO 2020.

- Yet, during 2021, the market share of scrubber-fitted VLCCs reached monthly highs of 47% twice, in an environment where market dynamics differed from a year ago. One the one hand, LSFO bunker prices are at higher levels once again, however rates are at their lowest for the past 3 years.

- This is an unwanted combination for the balance sheet of shipowners with non-scrubber VLCCs, as earnings for a major part of the year were in negative territories. Conversely, shipowners with scrubbers, gained competitive advantage in this environment, exposed to cheaper HSFO bunker prices. Thus, they are able to offer cheaper rates for the available cargoes in order to win business and maintain their employment.

- The increase in supply of scrubber-equipped VLCCs has also contributed to the growing market share of the latter. In 2021, out of 29 VLCCs delivered so far, 26 were scrubber fitted according to our data.

Bunker spreads at a competitive level for scrubber-equipped tankers

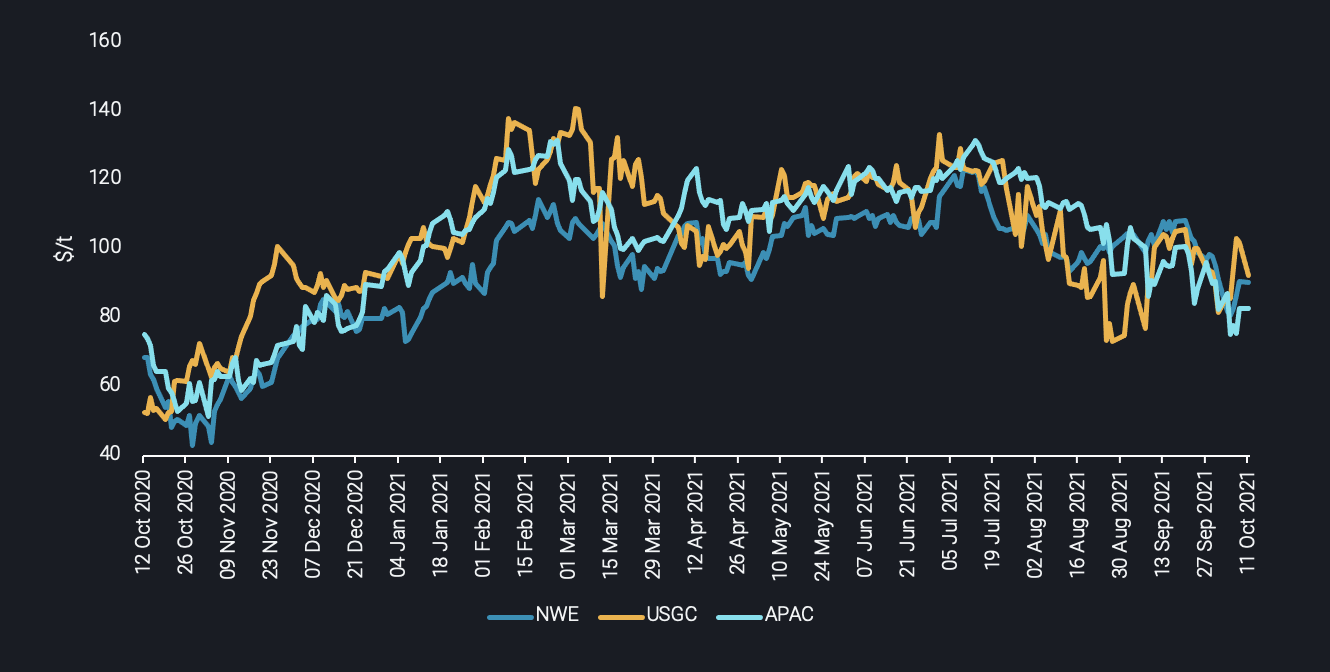

LSFO-HSFO spreads across major bunkering hubs (Source: Argus Media)

- By averaging the LSFO-HSFO spread across major bunkering hubs, using pricing data from Argus Media, we arrive at an average spread of approximately $85/t for the month of October 2021. That compares with around $120/t in August 2021 or a drop of 30% since. Overall, the average for the last 12 months remains at close to $100/t or 15% above current levels.

- Even as with a falling spread, prices remain at a competitive level when comparing to an investment in scrubbers with an attractive payback period. HSFO demand across major bunkering hubs has remained strong, ensuring a steady supply for scrubbed-equipped vessels.

Looking ahead, our data suggests scrubber-fitted VLCCs will continue to benefit from a depressed rate environment, a competitive spread between fuels at major bunkering hubs in favour of HSFO and an industry wide lack of investment in refineries upgrading to LFSO producing units. Whilst the earnings environment for shipowners remains weak, a market participant with a scrubber on board will have a stronger hand to play.

More from Vortexa Analysis

- Oct 13, 2021 Middle distillates take centre stage in Q4

- Oct 12, 2021 Reality check: Are surging oil and gas prices aligned with fundamentals?

- Oct 8, 2021 Event highlights: Redefining trading strategies with China’s new oil regime

- Oct 7, 2021 Q3 Freight Update: Momentum killed

- Oct 06, 2021 Flow highlights: Intriguing trends in crude & fuel oil, while light-end strength continues

- Oct 05, 2021 Puzzling trends in North Sea crude