Tankers leave the Russian CPP trade: what does this mean for the clean tanker market?

Following declining product exports after Ukrainian strikes hit Russian refinery infrastructure, vessels are increasingly leaving the Russian CPP trade and heading to other markets.

Refinery outages caused by Ukrainian drone strikes on Russian refinery infrastructure have significantly reduced Russian refined product output over the last month. These outages coincide with already reduced seasonally clean product exports due to refinery maintenance season. Although some affected refineries have reportedly managed to restore partial operations (Argus), strikes continue. As a result, Russian diesel exports in April were around 20% lower y-o-y and 13% lower m-o-m.

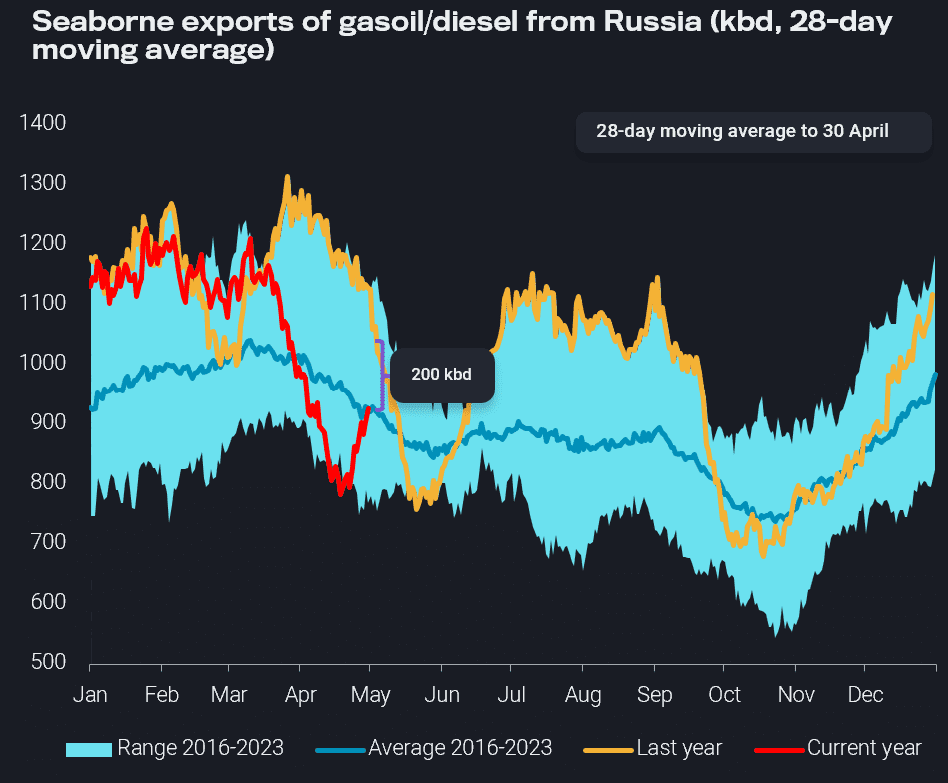

However, there are early signs a nadir may have been reached. On a 28-day moving average basis, diesel exports in the last ten days of April began creeping up, reaching the seasonal average (2016-2023) by the end of April. Despite the increase, at this point volumes remain only 200kbd below last year’s levels, when we witnessed exports at the top of the seasonal range (yellow line below).

Seaborne exports of gasoil/diesel from Russia (kbd, 28-day moving average)

The fall in Russia diesel exports due to recent attacks appears to be a catalyst or a “push” factor for some tankers in the Russian CPP trade. The number of tankers which left Russian trade in March and April is much higher than it has been at any point since the introduction of the price cap. The size of the fleet trading Russian CPP remained relatively consistent from Aug-23 to Feb-24, with a net change in fleet size of -1.5 tankers each month on average. However, in the last two months, the average net fleet change was -32.5 tankers per month. These signs point to a significant loss in fleet capacity, at a time when there are preliminary signs Russian diesel exports might be recovering.

Net fleet growth per month for fleet trading Russian CPP (no. of vessels) (Retrieved via Freight API/SDK)

Concurrent issue: lack of buyers for Russian diesel

Despite significant curtailments in Russian diesel exports over the last few months, there is currently increasing evidence that Russia is having difficulty placing its diesel currently on the water.

Russian diesel in floating storage (defined as a vessel remaining stationary over 7 days) was exceptionally high from late March to late April. At the same time Russia was looking to place their lucrative diesel barrels, increasing departures of Pacific Basin diesel towards Atlantic Basin markets through March and April increased diesel supply in an already declining demand market.

A surge in Russian diesel sitting stationary around Gibraltar over the last few weeks attests to the above: vessels are waiting in a strategic position to find a buyer before heading to Brazil or turning around and going towards Turkey or Africa. Some of these vessels are signalling “Off Gibraltar for orders”, clear evidence there is a lack of buyers despite Russia’s low output.

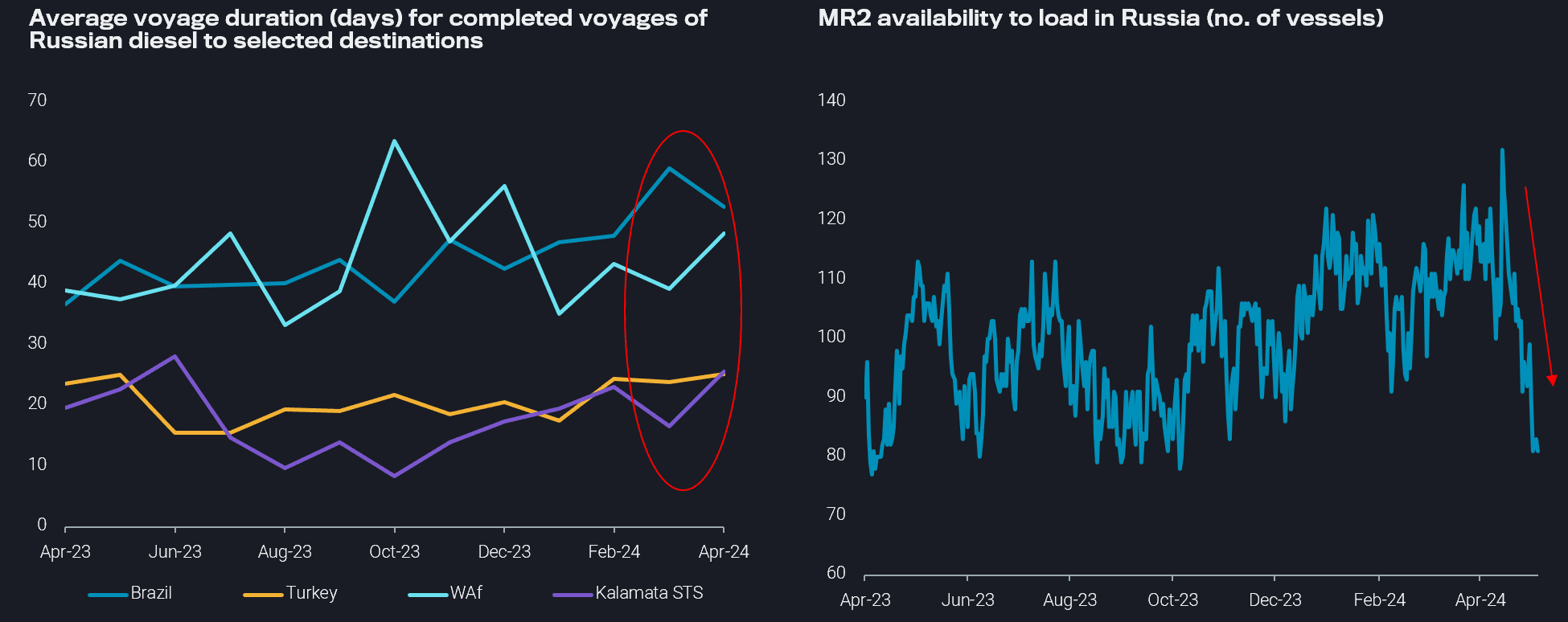

Apart from vessels yet to discharge, average voyage duration for completed voyages in March and April to key diesel discharge points has increased (Brazil, Turkey, WAf, Kalamata STS). Prolongation of voyages coupled with challenges in finding buyers that leave laden vessels stranded could cap fleet capacity. Within natural fixing windows, MR2 availability in Russia hovers near a seven-month low.

Average voyage duration (days) for completed voyages of Russian diesel to selected destinations (LHS chart) and MR2 availability to load in Russia (no. of vessels) (RHS chart)

Clean tankers leaving Russian trade: implication for global clean tanker outlook

The large number of tankers leaving the Russian CPP trade in the last few months has significant global implications for the MR2 and LR segments.

Shipping region for first laden voyage after leaving the Russian trade for MR2 tankers (no. of vessels) (LHS chart) and Shipping region for first laden voyage after leaving the Russian trade for LR tankers (no. of vessels) (RHS chart) (Retrieved via Freight API/SDK)

Over the last 6 months, on average 56% of the tankers which have left Russian trade each month and not returned are MR2s. The vessel class is the primary operative in the Russian diesel trade, and 47 MR2s that were trading in Russia have loaded in other markets in March and April, likely pushed out due to lower export volumes after attacks on Russian refineries.

This is a significant amount of tonnage to be competing for employment in an MR2 market that has recently been under pressure (read more here), especially in the Atlantic Basin. The most popular new market for MR2s looking for employment has been the Med, likely an opportunity after a Turkey discharge. However, increasing numbers of tankers recently went to East Asia, likely because of strong demand in the region. Also of interest are the tankers which have begun trading in the Atlantic Basin, both in WAf and in Brazil. Extra vessel supply in the Americas East Coast will likely be weighing on a market that is suffering from decreased tanker demand due to flagging PADD 3 CPP exports.

Globally, all this extra MR2 tonnage is weighing on MR2 freight rates, which are lacklustre across the board for a few key reasons: reduced demand for USG CPP exports, refinery maintenance season and economic run cuts in NE/SE Asia, muted diesel demand in Europe, and a lagged demand for transatlantic gasoline barrels.

In contrast to the MR2s, the LRs which left the Russian CPP trade are likely to have done so temporarily, in an attempt to optimise their laden times by switching between mainstream and Russian trade. These LRs which discharged Russian cargo East of Suez are reloading middle distillates in the region with Europe as a destination. This extra vessel supply in the East of Suez can be absorbed much easier in the context of continued rerouting around the Cape of Good Hope which prompted LR rates to oscillate around historic highs and well above 2023 averages.

Although East Asian naphtha demand and European diesel demand is currently muted, Europe does not have a replacement source for the EoS jet/kero volumes, suggesting there could be continued high tonne-mile demand for jet cargoes.