US led resupply needs give a boost to waterborne gasoline cargoes

As the US Colonial pipeline system restarts after its historic outage and panic buying subsides in the East Coast and Southeastern markets, we look towards waterbourne gasoline cargos to solve the regional stock imbalances.

As the US Colonial pipeline system restarts after its historic outage and panic buying subsides in the East Coast and Southeastern markets, we look to the water as a cure for hiccups related to regional stock imbalances.

Waterborne led supply skyrockets

Global gasoline in transit is up 40% y-o-y as a response to the demand side recovery led by the US and healthy gasoline cracks around the globe.

-

- ARA, US, China, Saudi Arabia, India and South Korea are the main supply drivers as refiners return from maintenance. See data in platform.

- European refiners will continue to find opportunities to sell clean product cargoes into PADD 1 as restocking will take a while. European gasoline/blending component loadings are already reaching 1.63 mn b/d for the first half of May with the largest portion of the volume pointed towards USAC (NYH). See data in platform.

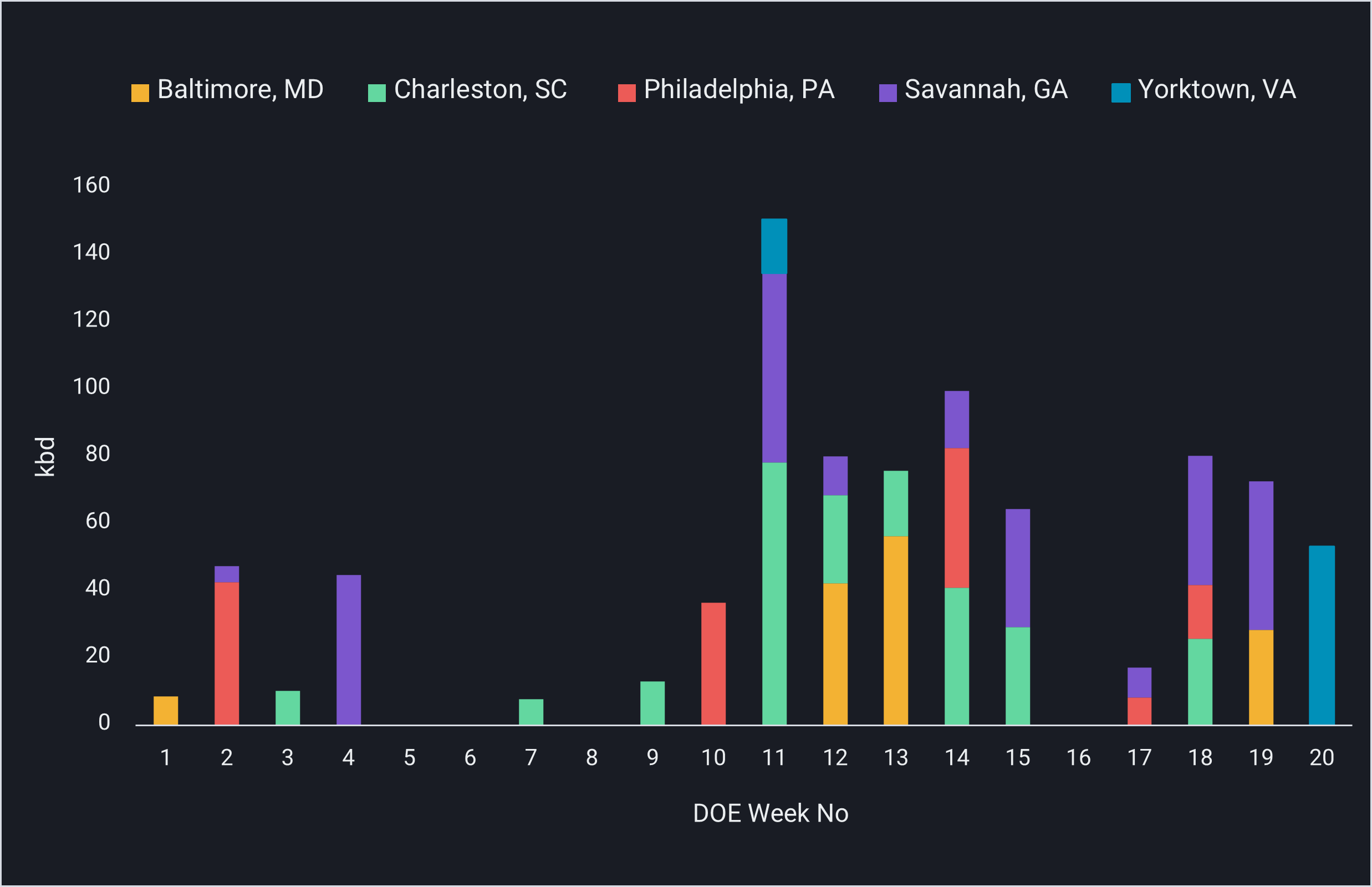

- Lesser known ports take in vessels. Two cargoes of gasoline/blend components arrived into the port of Savannah, Georgia in DOE week 19 (May 7-14), while the following DOE week, the vessel Tavrichesky Bridge made a rarely seen arrival in Yorktown, Virginia.

Gasoline arrivals into five ports between New York and Jacksonville that receive MR2 tankers

PADD 3 clears the glut

Higher than normal loadings are witnessed from the US Gulf Coast (PADD 3) as sellers are incentivised to clear accumulating supply, mainly destined for South America and Mexico.

- The largest volumes are loading in Houston from Kinder Morgan terminals.

- Brazil and Mexico look to be the principal recipients of these cargoes.

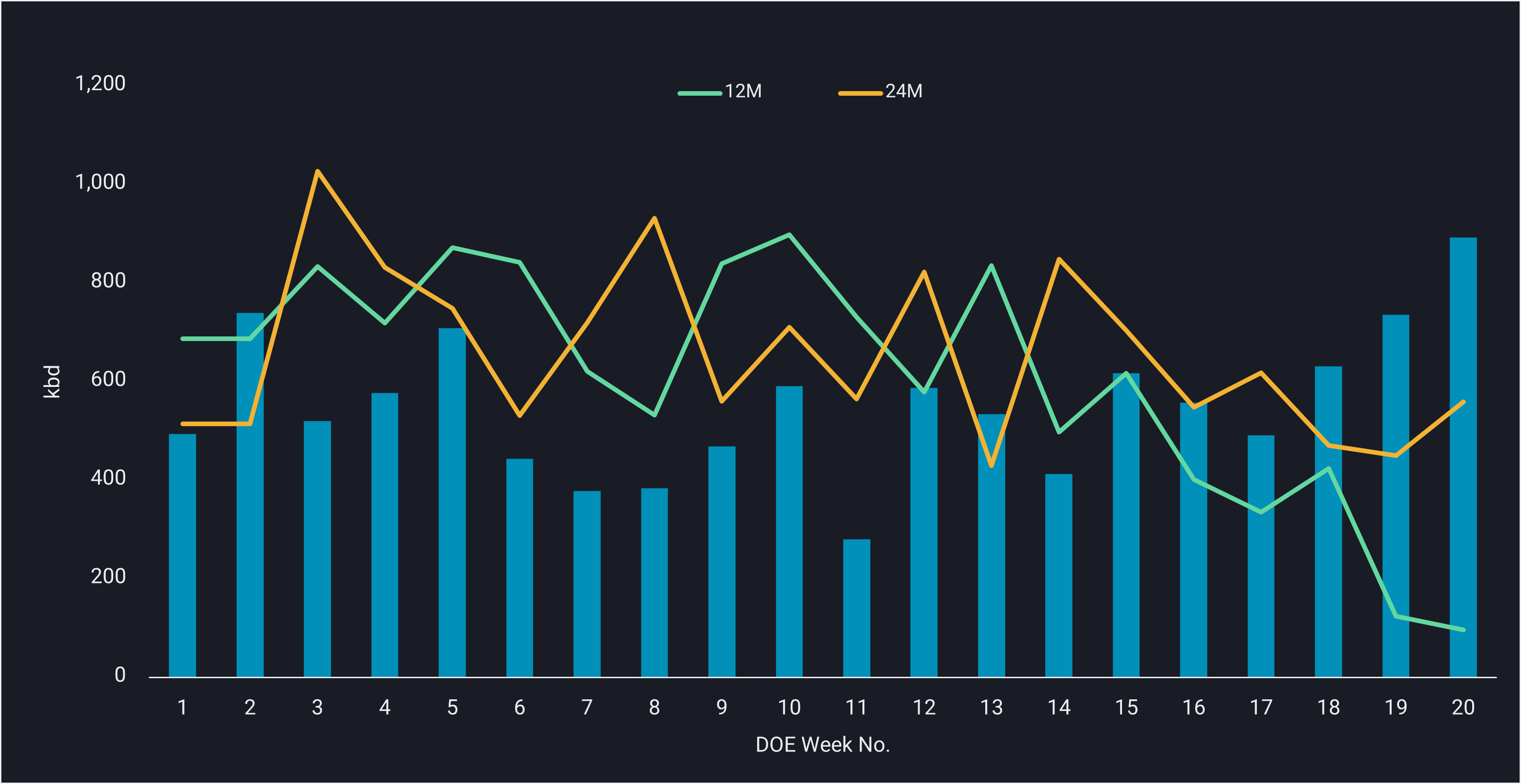

PADD 3 loadings gasoline/blending components by DOE Week

Freight impact

- As the Houston area is attracting a huge number of clean cargoes, relevant freight rates remain elevated, although already having receded from a recent spike.

- Nevertheless, the restart of the pipeline, which gradually ramps up its volumes, will ease the need for these alternative longer shipments going forward, cooling freight rates further. But North America will remain a hot spot for clean product trade throughout the summer driving season.

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa Analysis

- May 6 2021, China’s crude imports slow. Due for an imminent rebound?

- May 5, 2021 Saudi Arabia ramps up DPP imports in April

- Apr 29, 2021 Oil markets on track to recovery? Only time (and freight) will tell

- Apr 22, 2021, Global gasoline outlook 2021

- Apr 21, 2021 Latin America road fuel oversupply growing in April