Summer of 2021 brings LNG players heatwaves, empty dams and a longing for Nord Stream 2

Summer LNG market supply demand remain tight after strong demand in 1Q 2021, European markets have significant shortfall in storage capacity, Brazilian LNG demand jumps based on low hydro power capacity and Korea summer intake is up based on above average weather calling for additional power generation.

It was a dramatic start to 2021 when freezing conditions in the Northern Hemisphere caught buyers unprepared. Their struggle to keep up with energy demand resulted in record highs for the market through February. Following that, one might have expected a more settled summer period. However, several key factors have generated an extremely interesting market in the past few months. Vortexa reviews these developments to distil key drivers and emerging trends across the global LNG markets.

To understand the market movements of summer in 2021, we need to reflect on the lows of 2020, when the Covid-19-induced demand slump magnified the supply overhang, and a majority of US Gulf Coast export facilities were forced to curtail production. Through 2020, 18 MTA (million tonnes per annum) of new capacity was commissioned and the market had expected the supply overhang to continue into the shoulder and summer months of 2021.

Europe unlikely to refill natural gas storage to historic levels before winter arrives

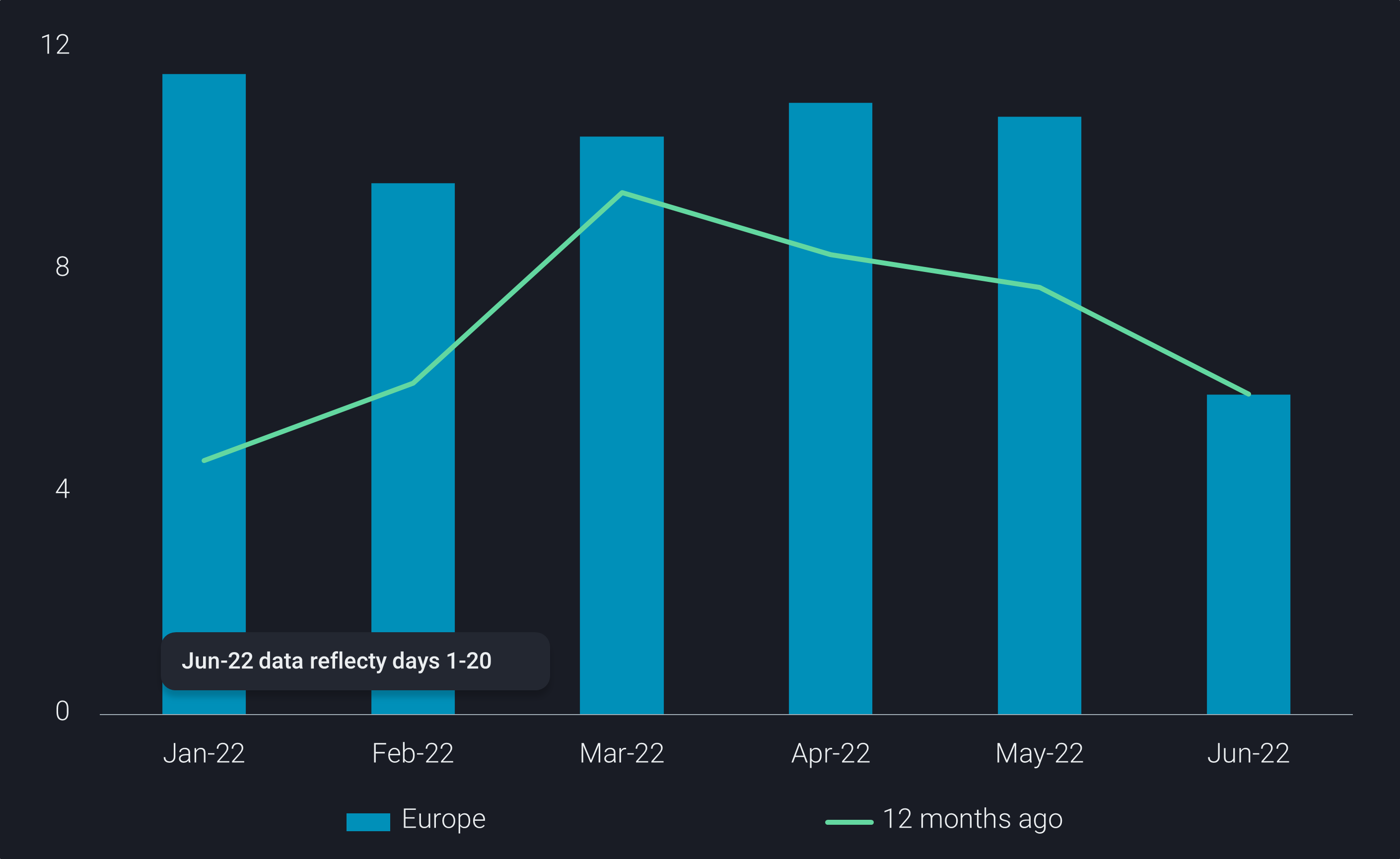

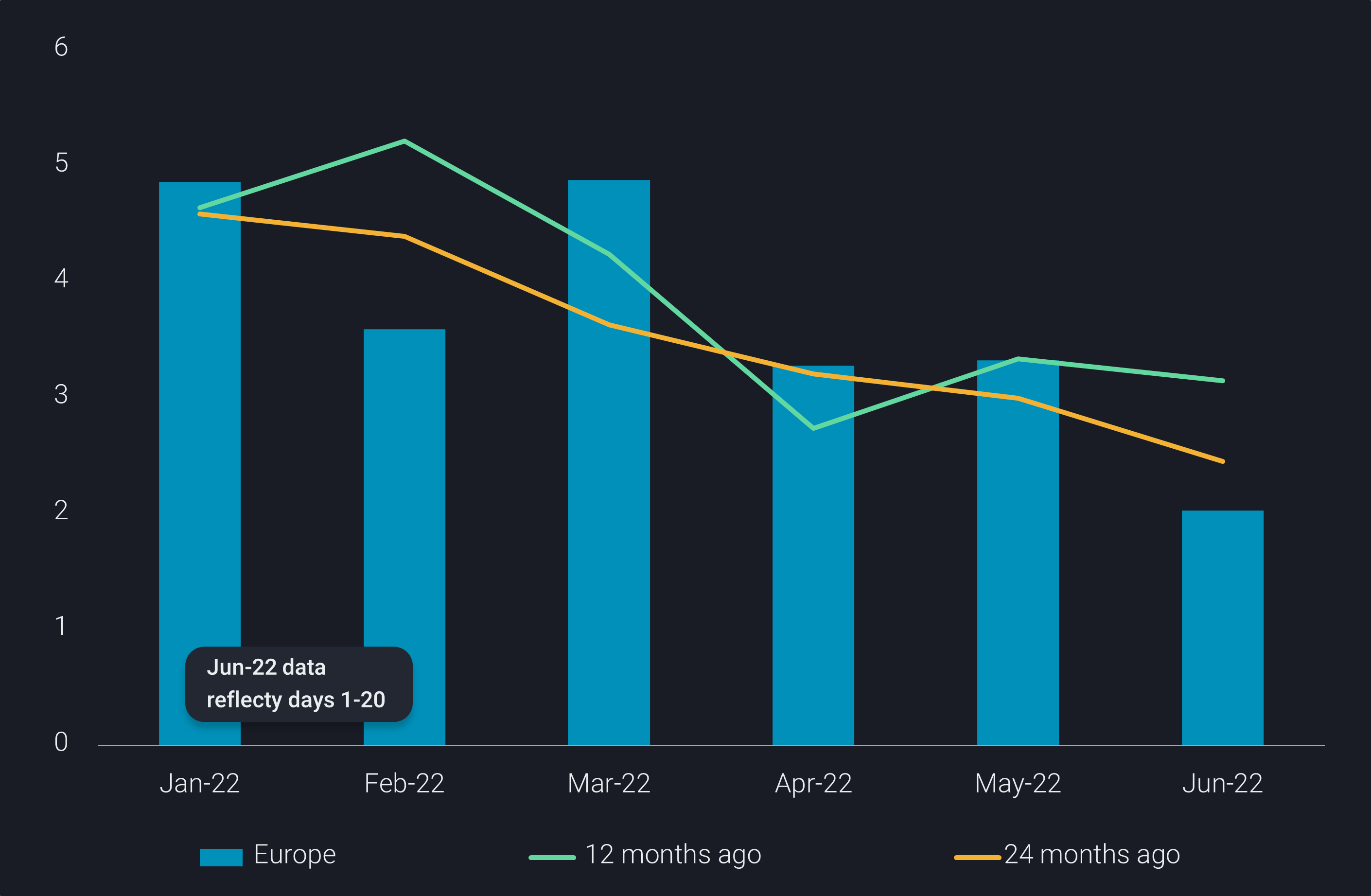

In and out of summer 2021, European storage is lagging historic refill levels. Natural gas demand continued to be strong across the region and called upon LNG imports into May despite high prices. Afterwards, European imports dropped off significantly, as strong South American and Asian demand pulled cargoes away. This leaves underground gas storage in an uncomfortable state as winter preparation begins. It also places more reliance on incremental supply arriving from the start up of Nord Stream 2 in coming months.

Brazilian LNG imports continue to soar, as droughts impact hydro generation capacity

As the much publicised report from the IPCC (Intergovernmental Panel on Climate Change) gave notice of a ‘code red for humanity’, climate change was already taking its toll on Brazil this year. A ‘one in a hundred year’ drought has placed the nation into a power crisis, as up to 77% of the country’s power generation is sourced from hydro-electric. With reservoir levels at historic lows, gas-fired power generation has been heavily called upon to keep pace with electricity demand.

For the LNG markets, South America imports rates are equivalent to 25 MTA of LNG capacity during July. This market has seen massive growth in 2021, up 215% year-to-date and high import levels are expected until the wet season begins in October.

Qatar has resorted to using Q-flex deliveries to keep up with Brazilian LNG demand at the Serpige terminal. This unusual route was taken by some of the largest LNG vessels in the world, which have run into discharge limits of the conventional-size Golar Nanook FSRU. The subsequent two separate discharges were 14 days apart, adding an incremental $1mn to freight costs based on Argus Media’s freight rate assessment.

Above average cooling needs and pre-winter preparation boosts Asian demand

Growth in Northeast Asian markets continued through the summer with overall demand up 10% year-to-date. On the back of above-average temperatures and changes to minimum storage requirements, South Korea boosted imports in July (+1.7mn tonnes from 2020 and +1.0mn tonnes from 2019), even though Asian LNG prices reached $10.50/mmBtu based on Argus’ ANEA marker for July deliveries.

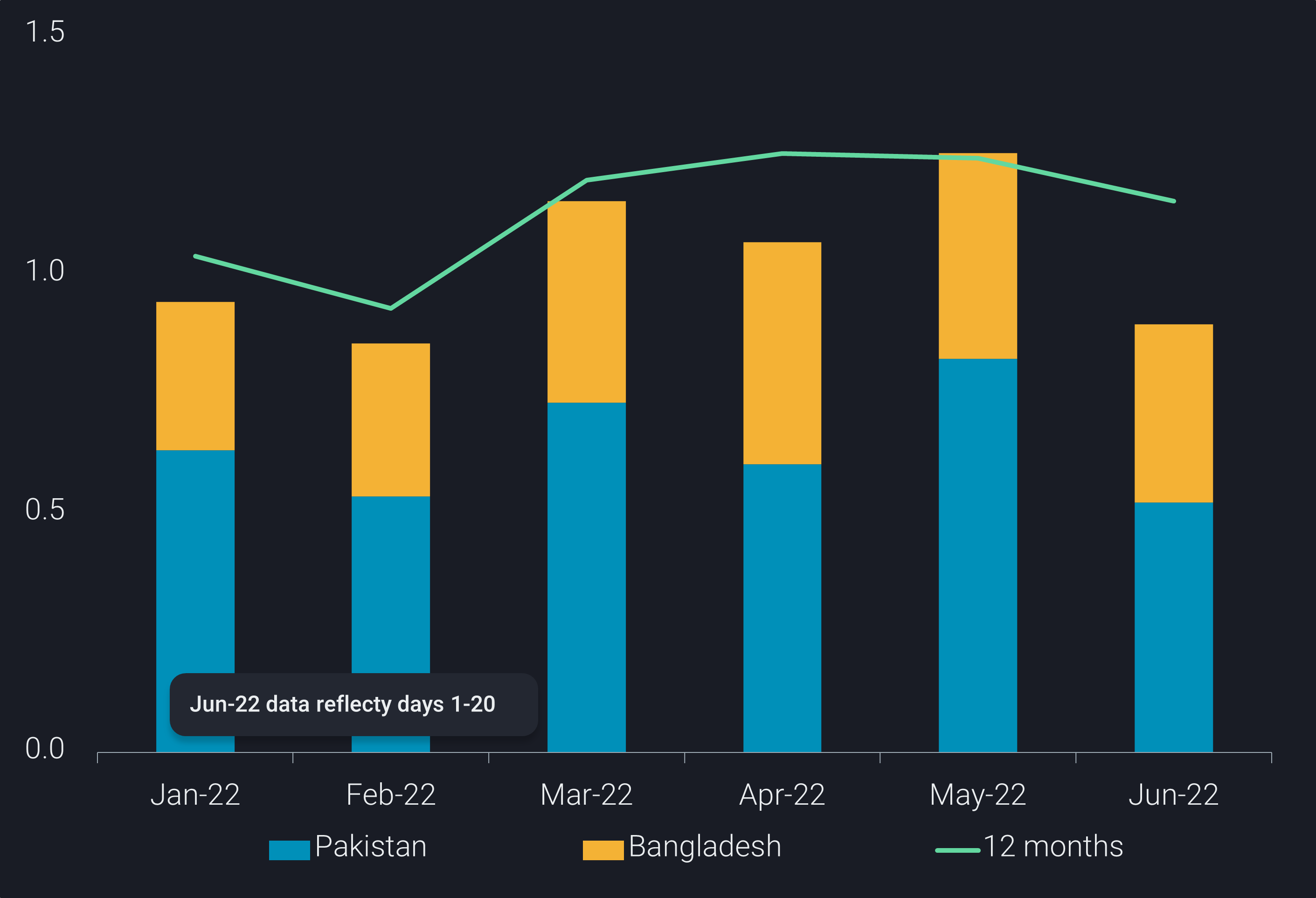

LNG imports have continued to be resilient into Pakistan and Bangladesh – the two markets with the most potential to switch between natural gas and fuel oil as power generation feedstock. Power needs have remained high through summer and continue to draw upon capacity from both sources. It will be interesting to see, whether a switch in economics, favouring fuel oil over LNG, will have repercussions in the months to come. August may show an emerging trend with potentially three fewer cargoes hitting Pakistan and Bangladesh.

Outlook for the months to come

The discussed factors have combined to produce a highly competitive summer market, fueling tight sentiment into the shoulder months. Buying patterns of the key markets suggest winter preparation is occurring earlier than usual this year, reflecting concerns on availablity as no significant increases in supply are coming before the end of the year. However, historically October and November have seen lower LNG demand and Nord Stream 2 is scheduled for commissioning. These factors have the potential to slow the upward trend in pricing, before actual weather patterns set the fate of the supply and demand balance for the winter period.