Asia propane-naphtha swaps in crosshairs of rising LPG, naphtha exports and slowing demand

We deconstruct our contrarian view of summer Asia pro-naps being wider than current market action given increasing LPG and naphtha supplies from the US and Middle East as demand for both stagnate

In our recent Q2 LPG report, we made a bold statement: Asia propane-naphtha swaps would trade this summer in a tight range between -$35-$65/t, or $15 on either side of the critical steam cracker feedstock switching threshold of -$50/t.

Bold because the current Asia pro-nap forward curve is trading around –$20-35/t (as of May 21 settlement prices), which is a clear signal that regional steam cracker operators should continue to maximise naphtha as their feedstock of choice. What we are instead suggesting is that the to-and-fro around the $50/t mark effectively means there will be no clear winner between LPG and naphtha and these operators will effectively have to pick their poison and stick with it.

What we are seeing right now are the following:

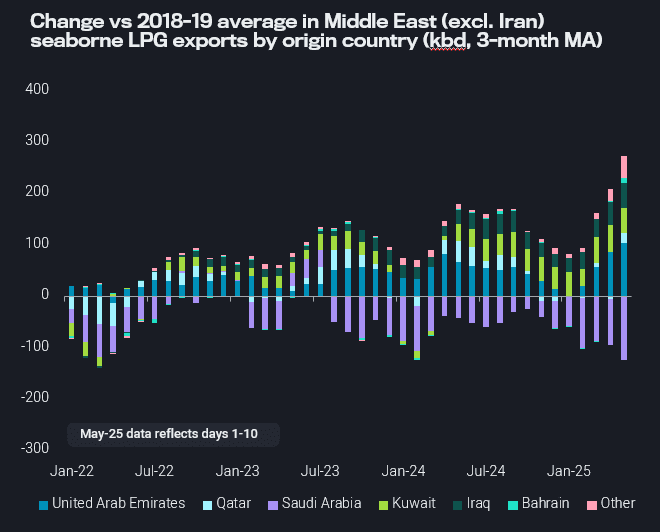

Middle East LPG seaborne LPG exports are surging past previous highs set before OPEC+ production curbs

- Rising US LPG export capacity (172 kbd) by year’s end of which 80-90% is fully contracted, meaning ~155 kbd of LPG supply (or nearly none VLGCs) will be let loose on the market

- UAE and Kuwait are already exporting far above the seasonal highs of 2018-19 in May, heralding the start of a more concerted supply push out of the Middle East

- Exports from Iran—one of China’s key suppliers—remain above historical averages

- LPG demand from Northwest Europe and Southeast Asia, two key regions that have been relied on in the past to soak up excess supply, appear to be stagnating

- On the naphtha side, the US, Middle East (excluding Iran) and Russia are all surging their waterborne volumes

Upcoming North American LPG export capacity expansion (source: company reports)

Asia petrochemical demand, especially from China, will be market’s tipping point

The tipping point this summer then becomes northeast Asian steam cracker demand for petrochemicals, as the primary source of incremental demand for either LPG or naphtha.

What we see there are deteriorating margins, for both steam cracker and PDH units, a function of olefins length after years of aggressive petrochemical buildout in the region. As a result, rationalization is starting to occur with some Japanese steam crackers shutting down, while other units remain idle and still others opt to prolong turnarounds.

This will ultimately morph into a cage match where LPG and naphtha duke it out price-wise so these excess barrels find homes.

Asian propane-naphtha historical and forward swaps in $/t (Source: Argus Media, CME prices)

While prompt-month pro-nap swaps are inching towards our target trading range, deferred months are still not fully reflecting our view. Why?

Current market action is still digesting and acting on the recent de-escalation of the US-China tariff war, which in our estimations should see a return of normal flows – specifically of LPG – by the second half of June, which is the current laycan being traded.

In much the same way that AFEI LPG prices crumbled when tariffs were hiked northwards of 100%, they are now rebounding sharply on the levy drop down to 10%. Prompt and deferred month prices are slowly giving way as LPG market players are coming around to market fundamentals. Conversely, similar market fundamentals are being reflected in naphtha markets, hence the current misalignment in these competing feedstocks’ forward curves.

Ultimately, we hold firm to our position that the tussle between LPG and naphtha in Asia will result in a tight trading range that will keep the market on its toes this summer.