North American LPG shipments to Asia face pressure

North American LPG shipments to Asia may come at a higher price this summer due to multiple forces pressuring the economics of the trade.

North American LPG shipments to Asia may come at a higher price this summer due to multiple forces pressuring the economics of the trade.

Counter to what many expected when lockdowns began, North American LPG exports to Asia grew YoY in 14 of the last 17 months dating back to the beginning of 2020. Flows that averaged 527,000 b/d in 2019 grew 25% in 2020 to 659,000 b/d and have held steady year-to-date at 664,000 b/d.

The increase in North American flows has largely been driven by the emergence of shipments to China, which grew from virtually none to average 209,000 b/d since trade tensions with China thawed in Q1 2020, on par with flows to traditional destination markets Japan and South Korea.

Low inventories in the US could prop up LPG prices at Mont Belvieu, while ongoing delays at the Panama Canal and looming seasonal increases in utilization could buoy freight. Combined, these forces could squeeze the arb for taking LPG from North America to Asia this summer, meaning Asian prices could face relative upward pressure, or risk additional barrels remaining onshore in US storage.

- Domestic pricing pressure from lagging US inventories could squeeze international arbs. Growing exports out of the US, especially to Asia, have pulled stocks from the top of historical ranges to the bottom. In past years (such as the 2016-17 & 2017-18 heating seasons), inventories at these levels set off concerns of looming winter shortages, especially in the Midcontinent. Using last year’s build path as an analog, if we expect a similar 2.1mn bbl per week build for the 18 weeks between now and the beginning of the traditional draw in early October, US propane inventories would enter winter at right around 80mn bbl. This would be well short of 100mn bbl, the volume traditionally thought to be comfortable. Of course, with exports now larger than US residential-commercial consumption, that 100mn bbl mark may need rebasing as US stocks may be more vulnerable to swings in international pricing.

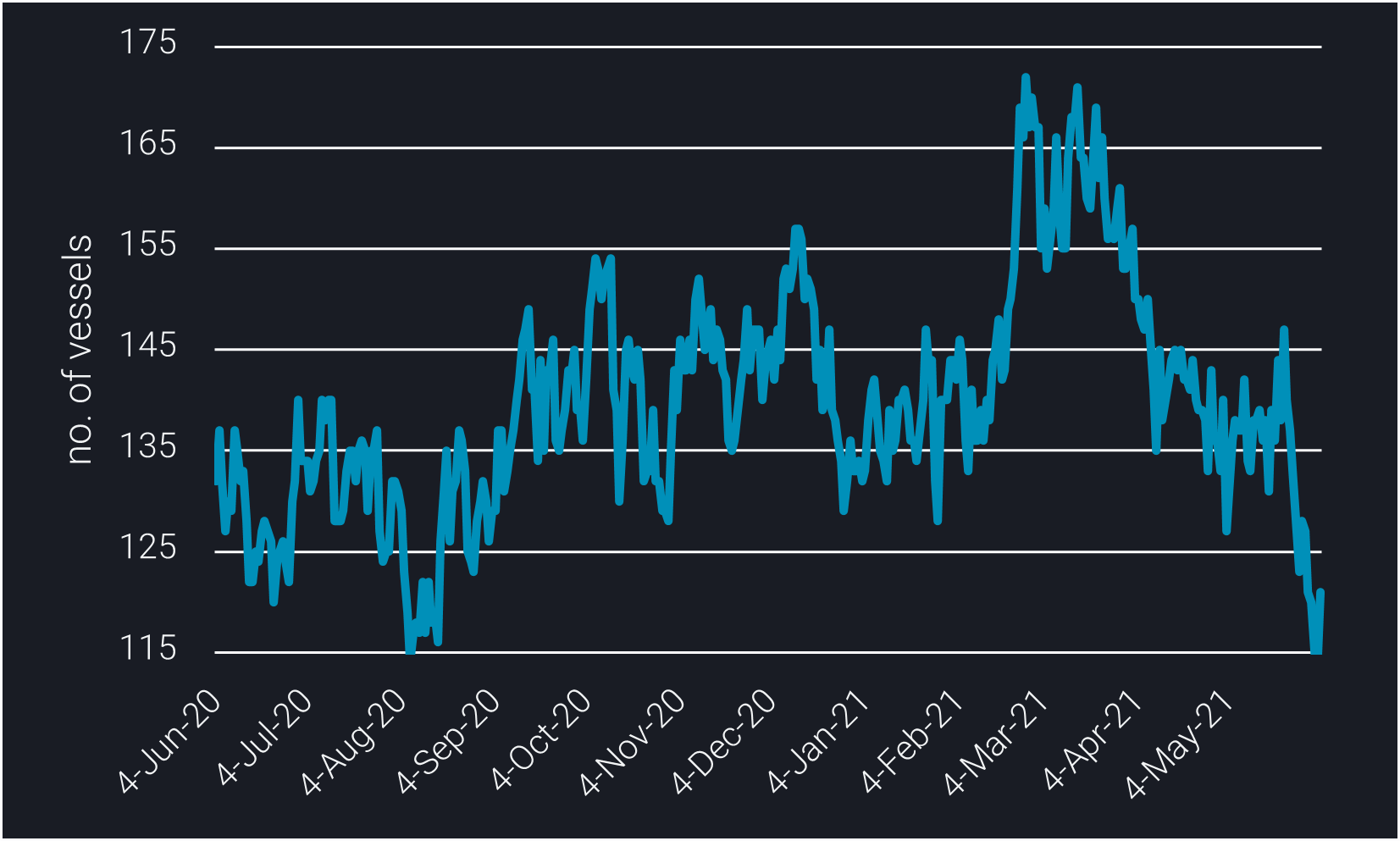

- Freight pressures from ongoing delays at the Panama Canal are widely cited as propping up rates on the crucial Houston-Chiba route. As PADD 3 remains the source for 93% of North American LPG exports to China, continued delays will translate into upward pressure on freight rates. Using Vortexa’s vessel availability data we can see that the number of VLGCs capable of calling on PADD 3 has fallen nearly 30% after peaking in March, as logistical constraints due to freezing weather unwound. Availability currently sits at the lowest level in almost a year, propping up freight rates that have increased 50% since early March and now sit around $90/mt (basis Houston-Chiba).

VLGC availability in PADD 3

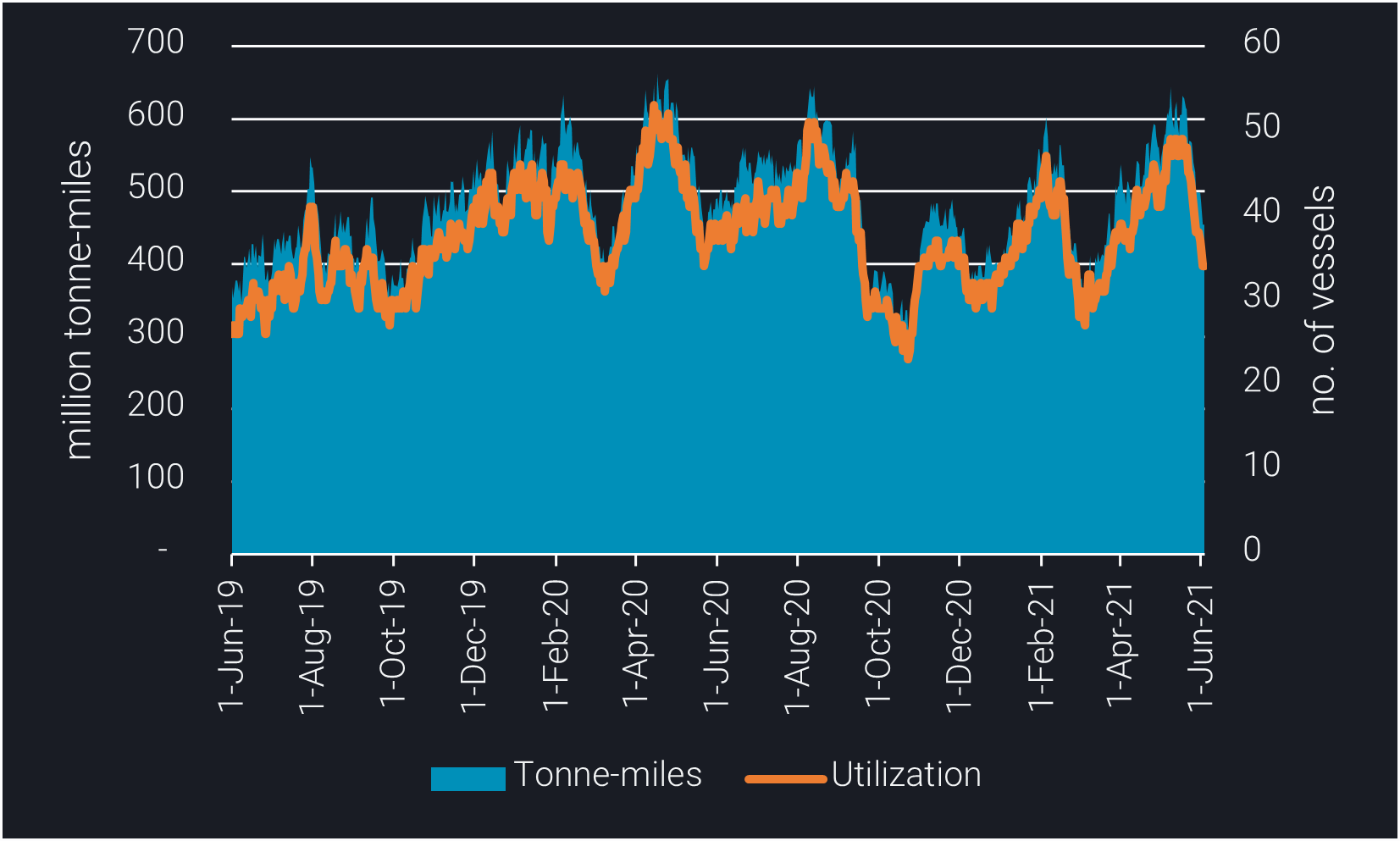

- VLGC utilization and tonne-miles usually increase through the summer as Asian buyers fill their inventories in anticipation of the coming heating season. Considering China’s growing role in the North America to Asia LPG market, even if utilization were to follow last year’s path, tonne-miles should increase as China requires longer sailing times from North America than Japan and South Korea, further supporting freight rates.

VLGC tonne-miles from North America to Asia

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa Analysis

- June 2, 2021 China’s new consumption tax turns tide of gasoline and diesel exports

- Jun 2, 2021 Suezmax tankers infiltrate Europe-bound transatlantic crude flows

- May 27, 2021 European naphtha exports boost LR2 demand

- May 26, 2021 Diverging trends behind stable supertanker utilisation

- May 26, 2021 US DPP imports climb amid rising gasoline demand