Could weak refined product demand signal refinery run cuts?

Falling product margins, historically high diesel exports and lower crude supplies, what does it mean for refineries?

Global refinery product margins are slipping, diesel imports are reaching historical levels and refined product import demand is hovering at the bottom of the six year range. With lower crude supplies looming, could we see the combination of expensive crude and weak demand for refined products signal refinery run cuts to rebalance the energy complex?

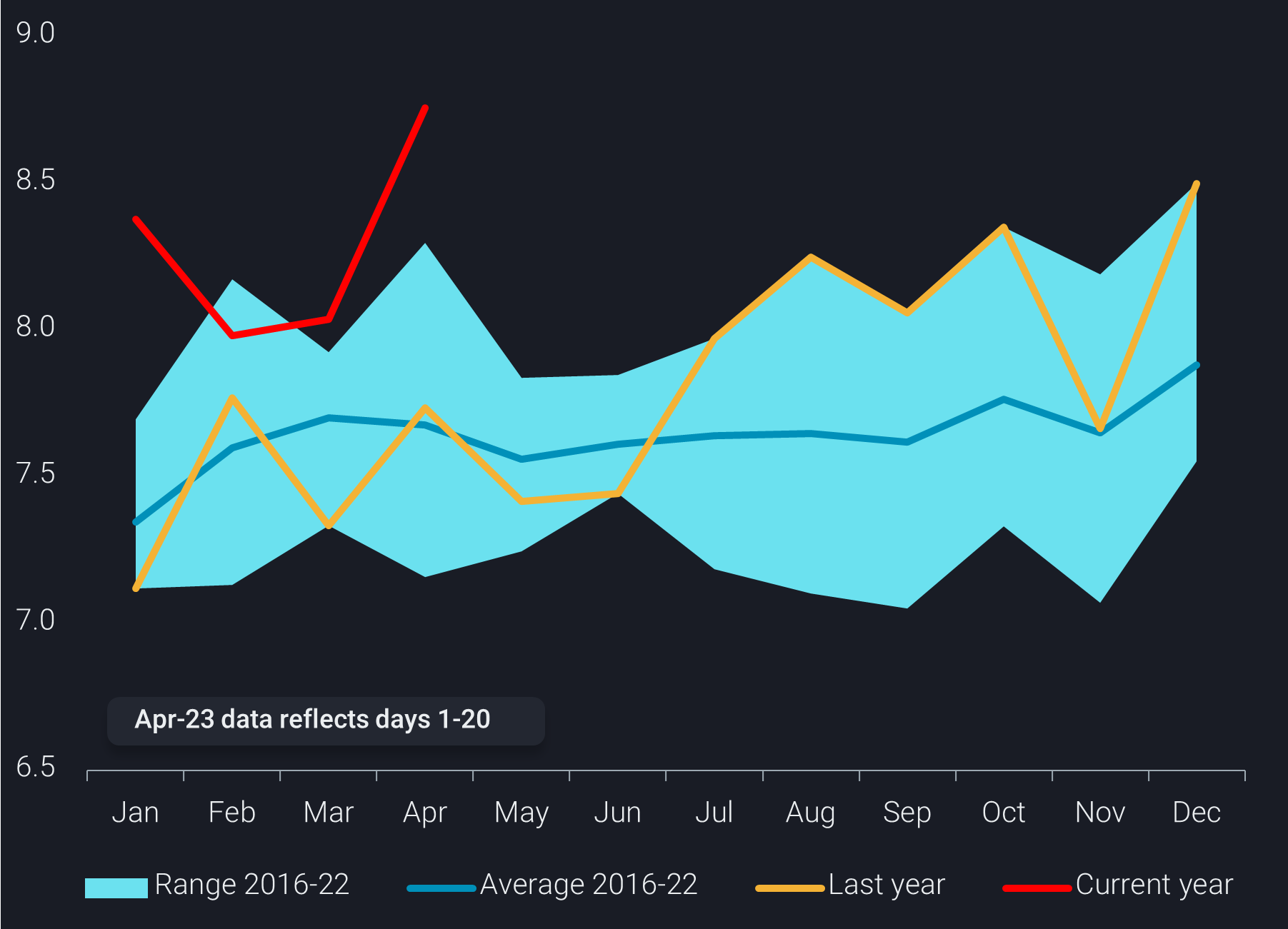

Although the exceptionally high volume in global diesel imports on the chart below could be seen as a sign of high demand, it is likely the result of too much supply and the increased flows have applied downward pressure on refining margins and will likely continue to do so in the near term.

As diesel imports reach new highs, we also see strong global diesel export growth during Jan-April 2023 compared to Jan-April 2022; particularly from Europe (20% y-o-y ), Russia (24%, y-o-y), and the Middle East (7% y-o-y). Along with this export surge, there is also the possibility that another round of Chinese refined product quotas and new refining capacity coming online in the US, Middle East, Asia, WAF and LatAm could push up diesel exports.

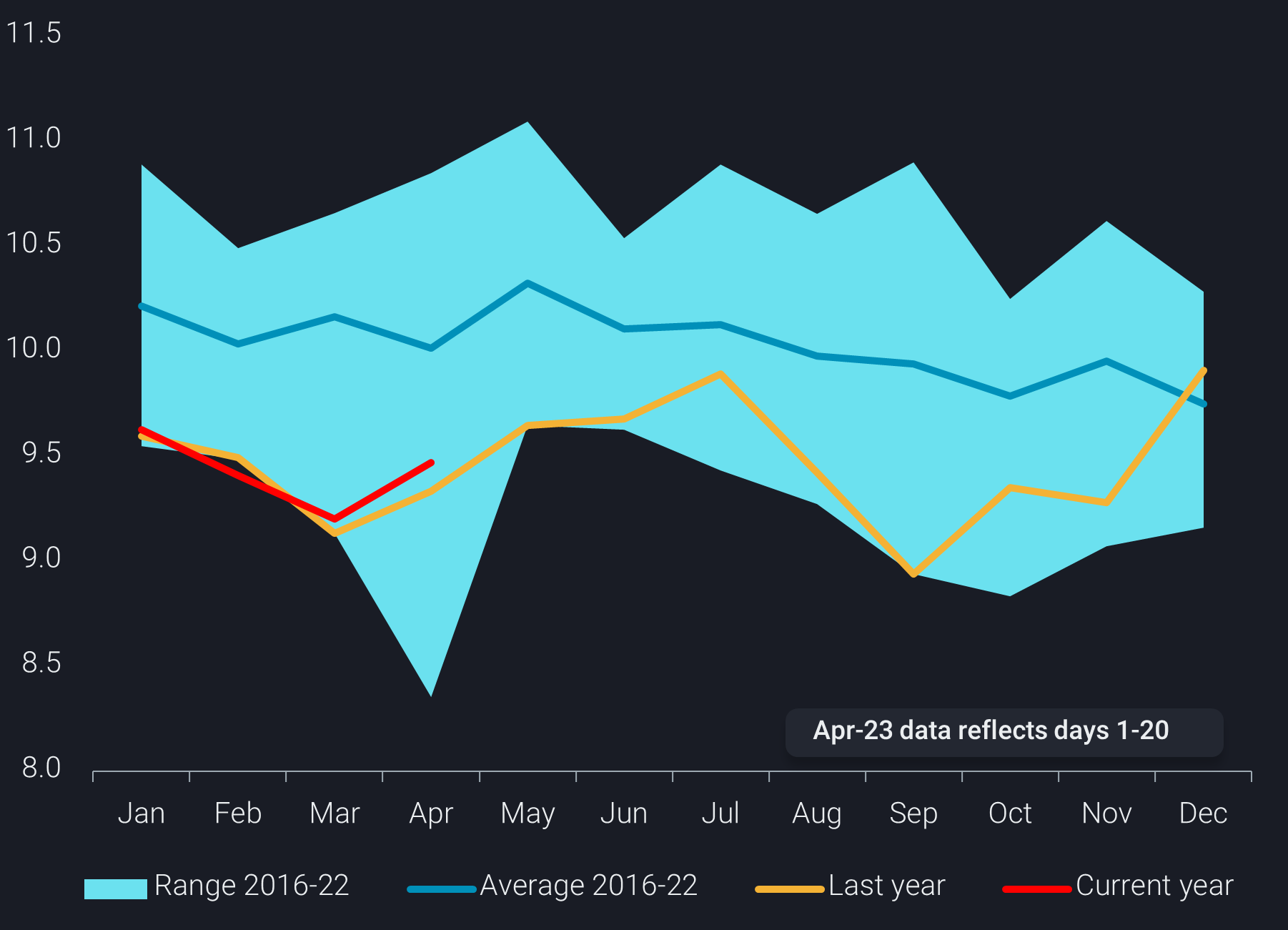

Meanwhile, imports of other refined products show a slow down in the main consumer regions including Asia, North America and Europe. Volumes have trended toward the lower end of the seasonal range especially in Q1(red line). And although April’s range was impacted by low demand due to Covid, imports continue to stay exceptionally low (5% below average for 2016-2022) suggesting that refined product demand has indeed softened.

Bright pockets

Although we are seeing indications of poor refined product demand globally through our flows data, there are pockets of strength, particularly in the Atlantic Bain. Transportation fuel imports (diesel, gasoline, jet) to Brazil, Mexico and PADD 1 are already up 39%, 23% and 18% respectively when comparing Jan-April 2023 to the same period in 2022. Considering this is the beginning of the driving/flying season and stocks (gasoline) are low especially in PADD 1, there is likely some upside potential in these areas. However, new refinery capacity having come in already, scaling currently up (e.g. Al Zour) and coming online in Mexico (Dos Bocas, 340kbd), Nigeria (Port Hartcourt 210kbd) and expansions in the US (Beaumont 250kbd), may lead us into a toppy Q2.

Looking forward, as we move into peak consumption in the 3rd and 4th quarter, we could see crude get tighter alongside persistent weakness from the refined product side. After refinery turnaround season ends for most of the world in Q2 we could see refineries cut runs in an effort to rebalance, especially in Asia.