Demand indicators point to a clean product slowdown in LatAm

Recent demand indicators point to a recent slow down in Atlantic Basin clean product demand, in this insight we explore the regions underpinning the slowdown with a focus on LatAm.

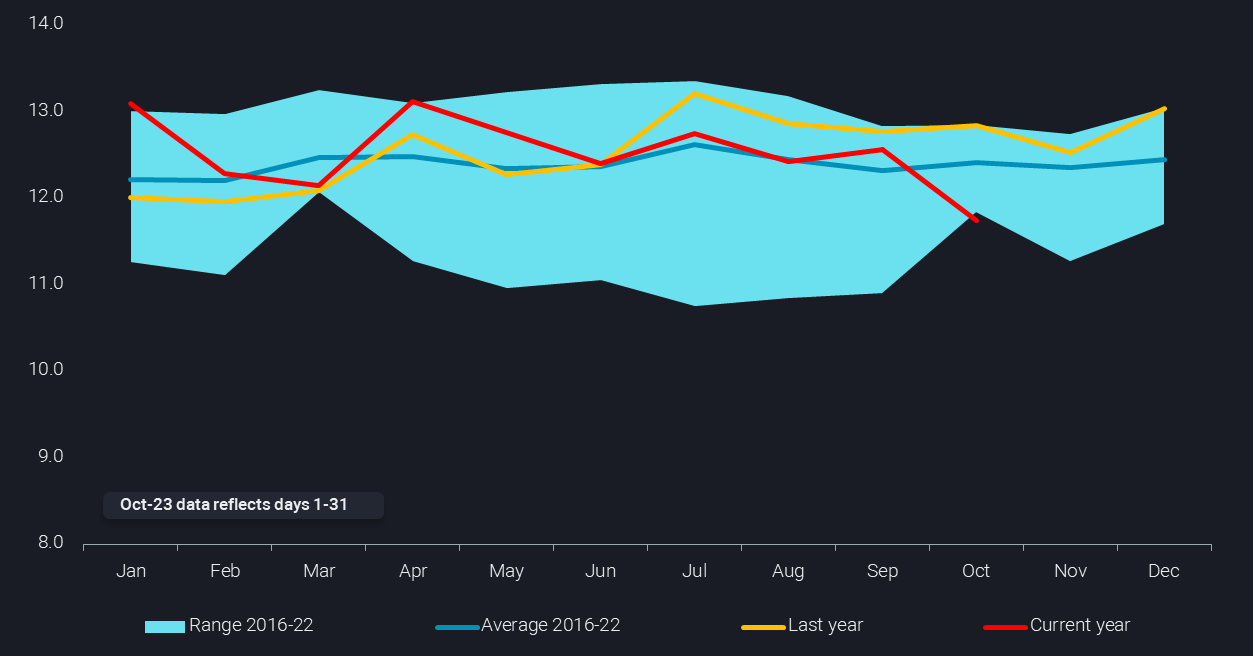

While we witnessed a strong recovery year in 2022, especially for transportation fuels, seaborne clean product demand is on the downturn in the Atlantic Basin with indications pointed to a recent slowdown from June 2023 onwards.

This decline, visible in the red line, has largely been underpinned by a drop in European seaborne clean product imports (-3% when comparing June-Oct 2023 to Jan-May 2023 and -6% compared to June-Oct 2022) due to a closed diesel arb from East of Suez markets and declining naphtha imports from Algeria. In addition, Nigeria slashed gasoline imports by 36% from April-Oct 2023 compared to the same period in 2022 due to the removal of the gasoline subsidy, backing out nearly 200kbd of European gasoline before the Dangote refinery starts up.

Meanwhile, the 6% increase in gasoline flows into US and Canada East Coast during peak driving season (refinery hiccups) and strong diesel imports into Brazil for September and October were not enough to prop up total clean product imports during the second half of 2023. As we take a closer look, further indications into the second largest market (Central and South America) for gasoline and diesel imports reveal indications of a further slowdown.

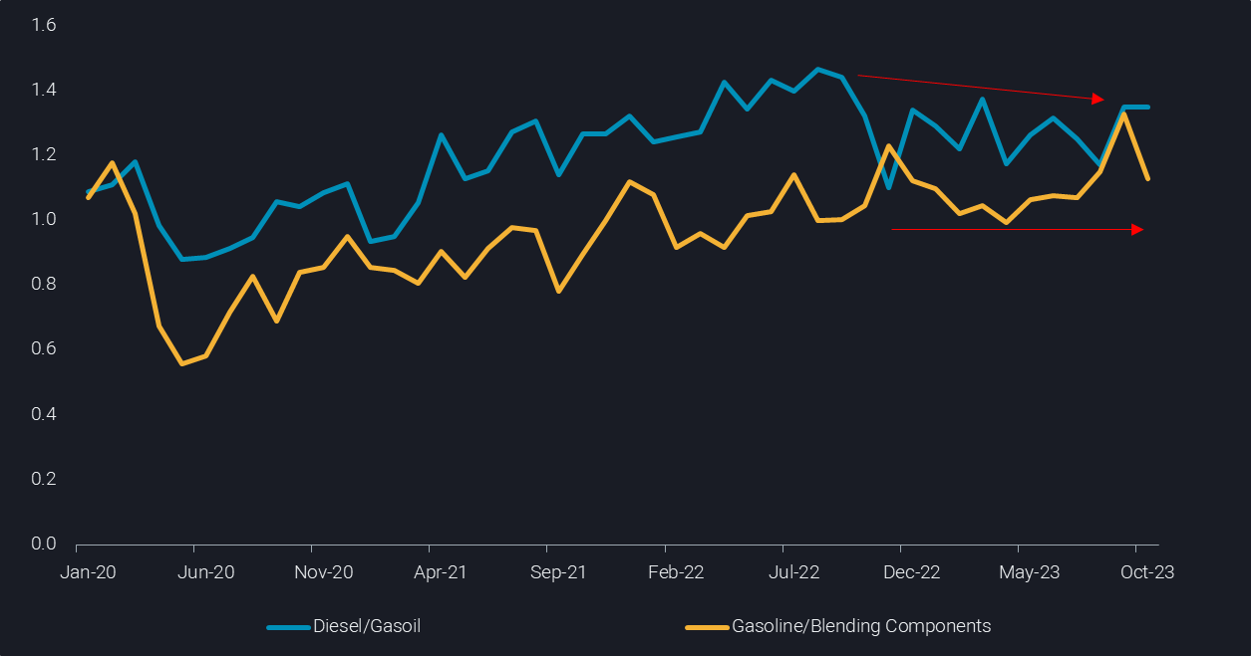

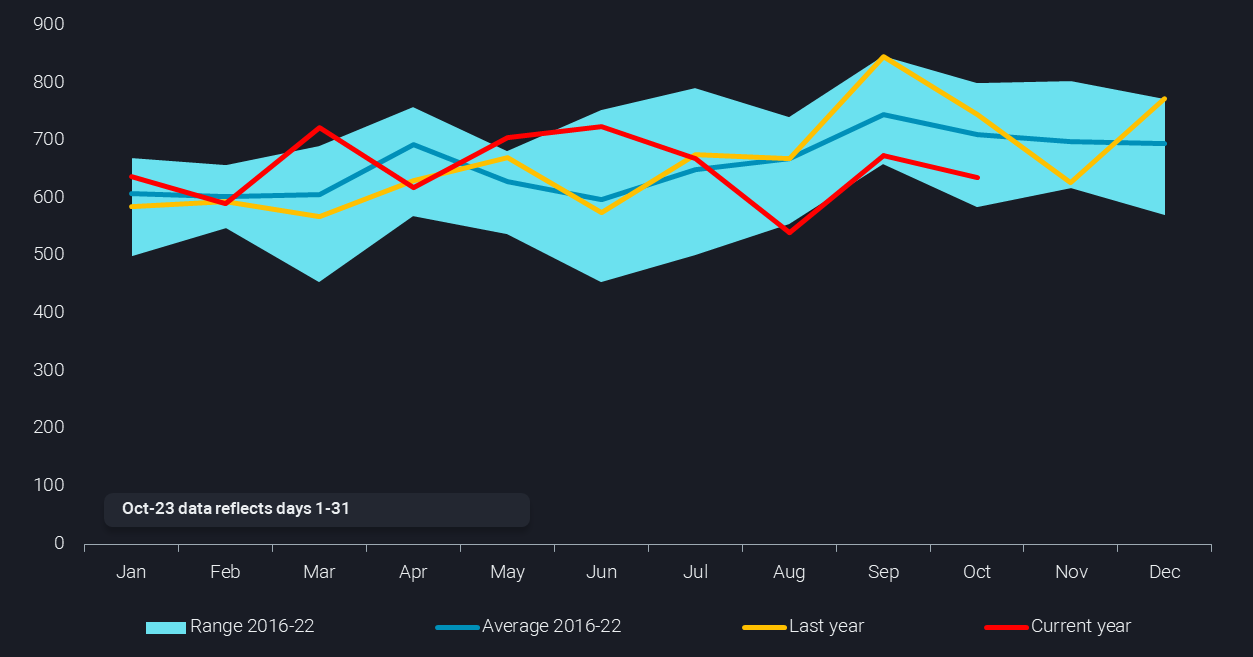

Road transportation fuels constitute 56% of the total volume of clean product seaborne imports into the Atlantic Basin in 2023 and are showing signs of stagnation despite strong economic indicators in Mexico (declining inflation, strong PMIs, low unemployment) and improving financial barometers in Brazil (strong agricultural demand, relatively high PMI levels).

The downtrend in diesel (blue line), the largest Latam clean product import by volume, is especially compelling (-8% Jan-Oct 2023 vs Jan – Oct 2022) after having enjoyed a three year upward trend. Despite Brazil’s diesel import strength during the first half of the year, the drop in July moved average diesel imports for 2023 8% below 2022 levels.

Meanwhile, gasoline imports, the dominant clean product import into Mexico, flatlined in 2023 compared to the five months of rising volumes into LatAm observed from February – July 2022. This sideways trend occurred despite six of Mexico’s state refineries running at below 50% capacity for the last five months, and there is talk in the market that some US Gulf Coast refineries are expected to shut in gasoline-making fluid catalytic crackers until markets can absorb excess barrels.

While some of the slowing momentum for these imports into LatAm can possibly be attributed to the drought causing Panama Canal congestion and thus fewer shipping options, the problem will not likely be solved anytime soon, and the product oversupply will continue to weigh on PADD 3 product margins, especially gasoline.

It does look fairly certain however that the post-covid recovery is behind us, and the demand for road fuels is slowing down.