European jet/kero demand remains strong while major resupply points look fragile

As jet/kero import demand surges in Europe, we take a look at the dominant origins of resupply and what it could mean for the near term, amid a backdrop of lower exports globally.

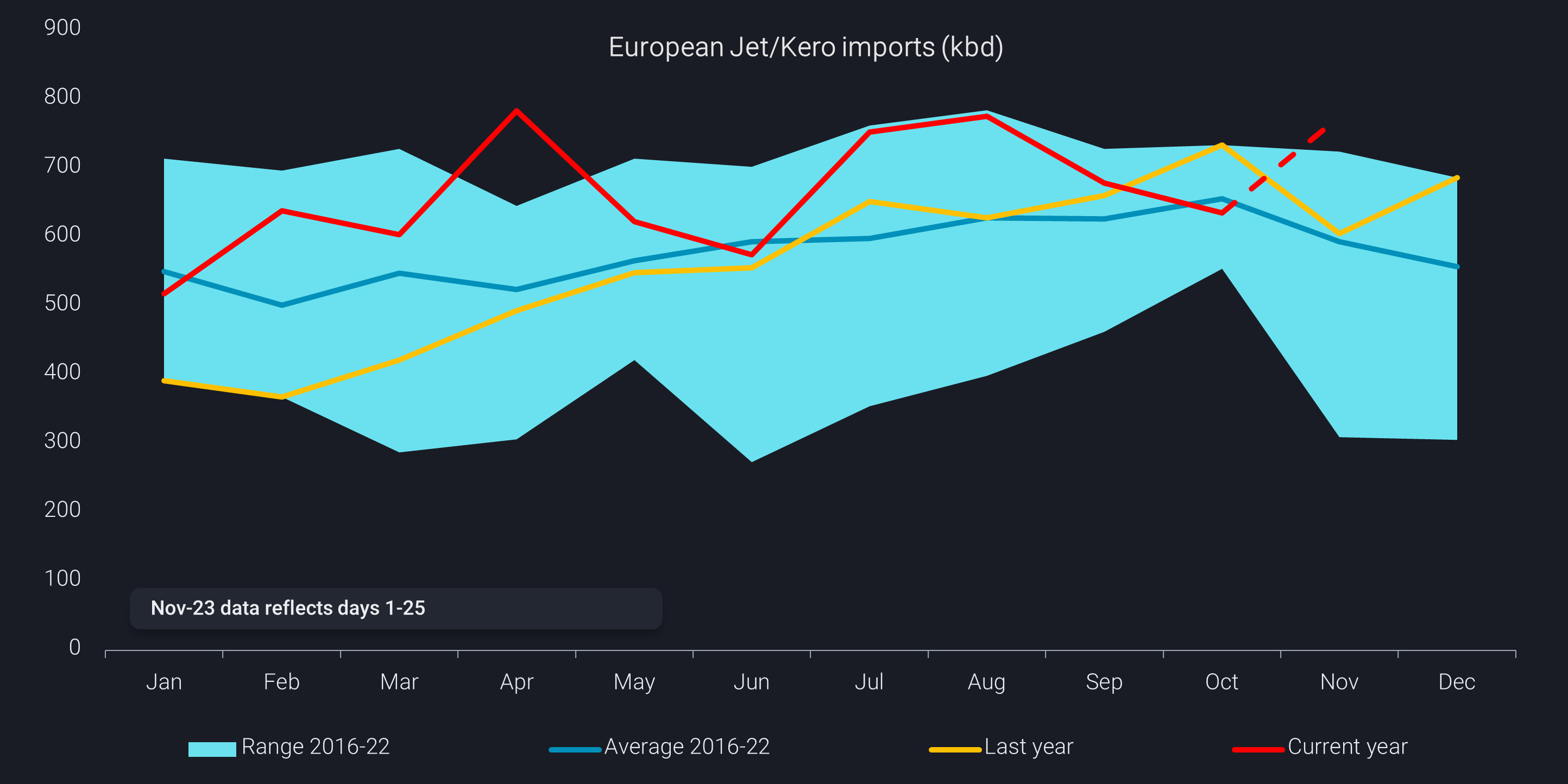

Europe’s jet kero demand is climbing above the seven-year range in November and remains 100kbd on average higher than 2022 (see chart below). We hear across Europe, the US and South Korea that refineries are responding by tweaking yields towards higher jet production, over diesel, to capitalise on strong margins.

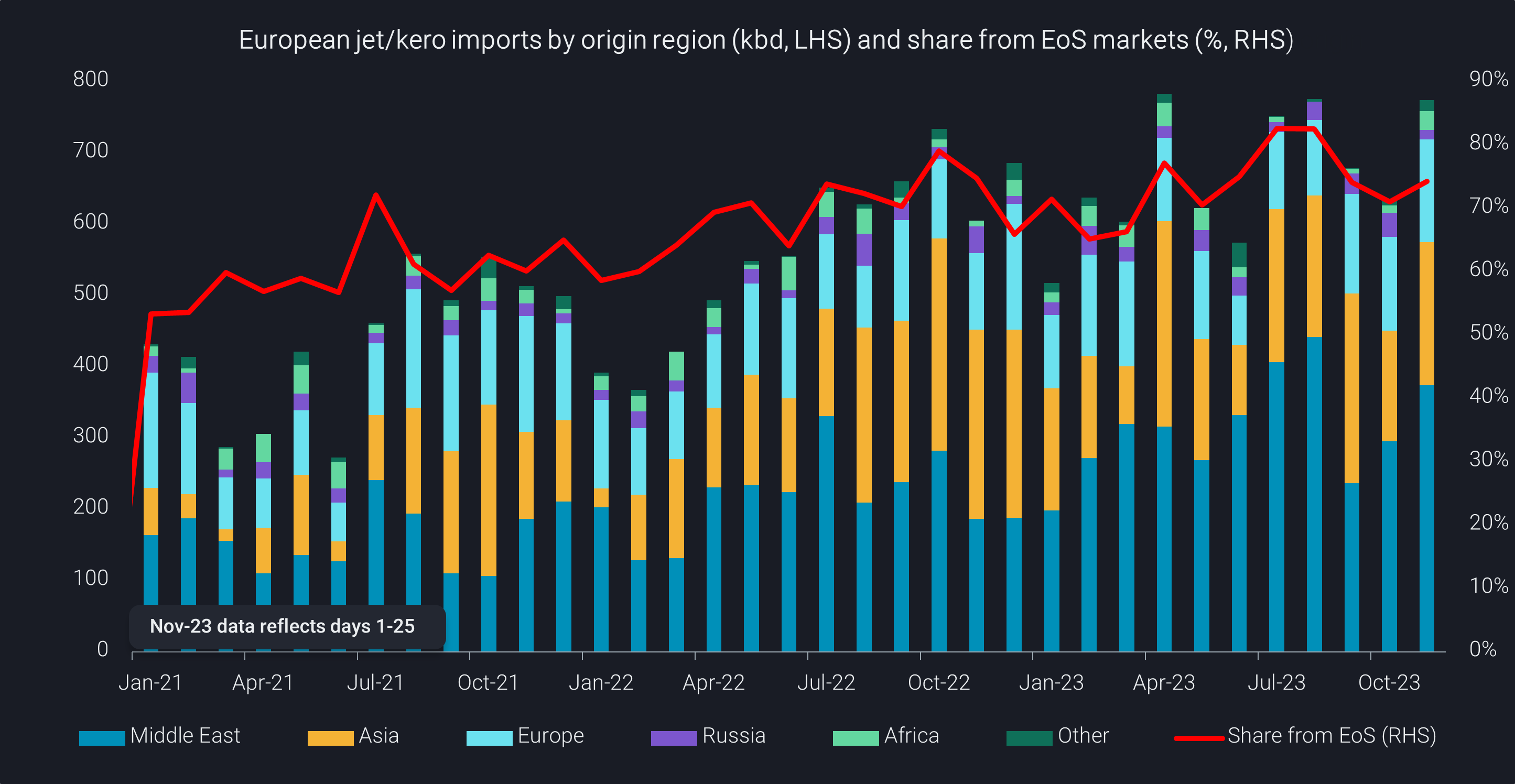

However, despite this inter-regional optimisation and considering European refineries are likely running at or close to maximum throughputs, concerning factors are emerging from the East of Suez markets. As of November, 70-80% of European jet/kero supply is accounted for by imports from the East of Suez. Though this is a slight reduction from a peak of 83% in August, it still remains exceptionally high over a longer term trend (see chart below).

East of Suez supply drags down global jet/kero exports

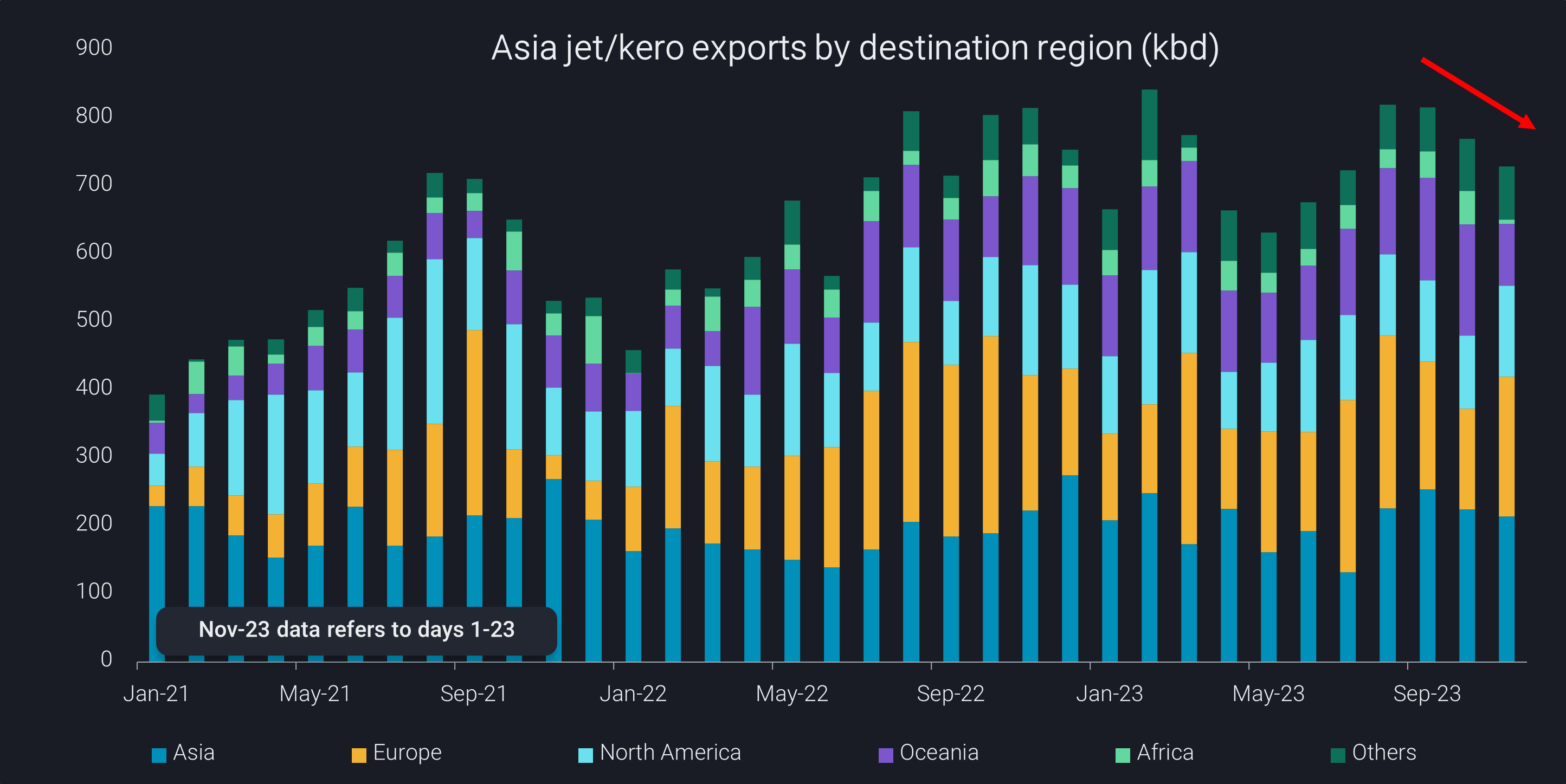

The slowdown in jet/kero exports observed from the East of Suez has dragged down global exports by almost 250kbd in November y-o-y and 160kbd below the seven-year average.

A closer look reveals that Asia jet/kero exports have fallen for the second consecutive month in November and are down 15% y-o-y. Meanwhile, Chinese exports declined for three straight months hitting a five-month low due to a lack of clean product export quotas despite the jet/kero regrade reaching highs unseen since January 2023. And although demand from Oceania and Africa has waned, East Asian demand will likely remain strong due to seasonal demand for heating.

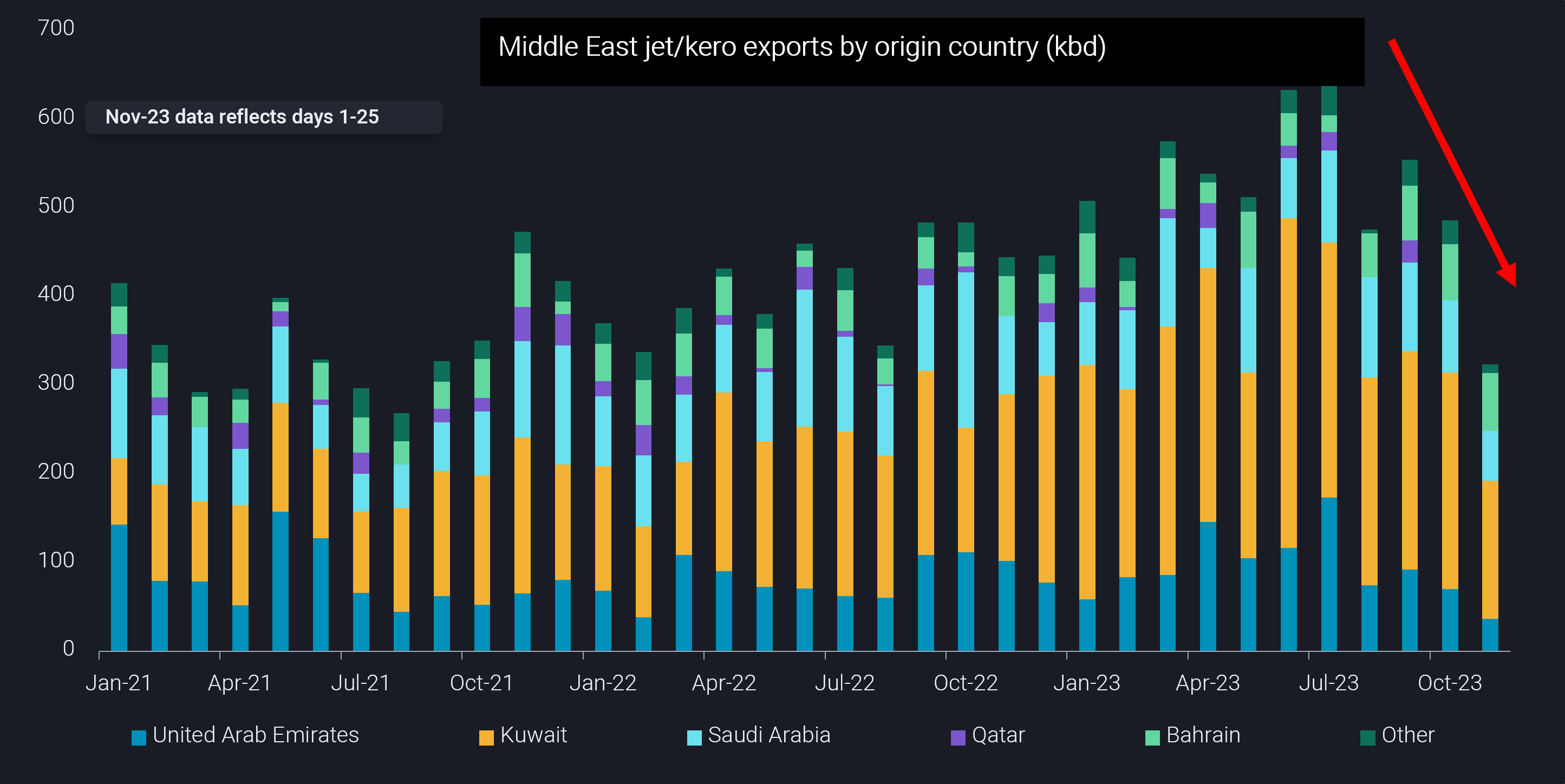

Meanwhile, Middle East jet/kero exports have been on a sharp decline since June due to extensive refinery maintenance in the region which has reduced overall jet/kero exports to the lows of 2021.

European imports from the UAE have dropped by 50% during Sept-Nov 2023 compared to Sept-Nov 2022, though the decline has somewhat been offset by slightly higher y-o-y volumes from Kuwait and Saudi Arabia, despite the maintenance. However, expectations in the market are that the 817kbd Ruwais refinery will be on a partial planned maintenance mid-January – mid-February 2024, potentially sustaining the problem of exceptionally low loadings expected from the region to cover European demand.