LatAm gasoline and diesel markets diversify suppliers

Despite the panic buying in late 2022 triggered by diesel shortage fears due to the impending EU ban on Russian clean product imports, the world has witnessed an oversupply of clean products in 2023. We look at what these changes have meant for Latin America, a well known short for both diesel and gasoline.

LatAm’s West Coast – Asia gasoline oversupply finds a home

Gasoline import demand has been relatively subdued on the Latin America West Coast in H1 2023 compared to H1 2022 (-15%), however it has provided an important outlet for the oversupply of gasoline in the East of Suez markets. Led by Singapore and China, there has been a push from the region, tripling volumes H1 2023 into LatAm West Coast due to lackluster regional demand combined with a counter seasonal oversupply from the Wider Arabian Sea. Although gasoline demand in China is expected to rise during the school holidays, which could curtail gasoline exports, refineries are also returning from maintenance which will likely increase overall gasoline production.

Higher diesel imports favor USWC and USGC suppliers

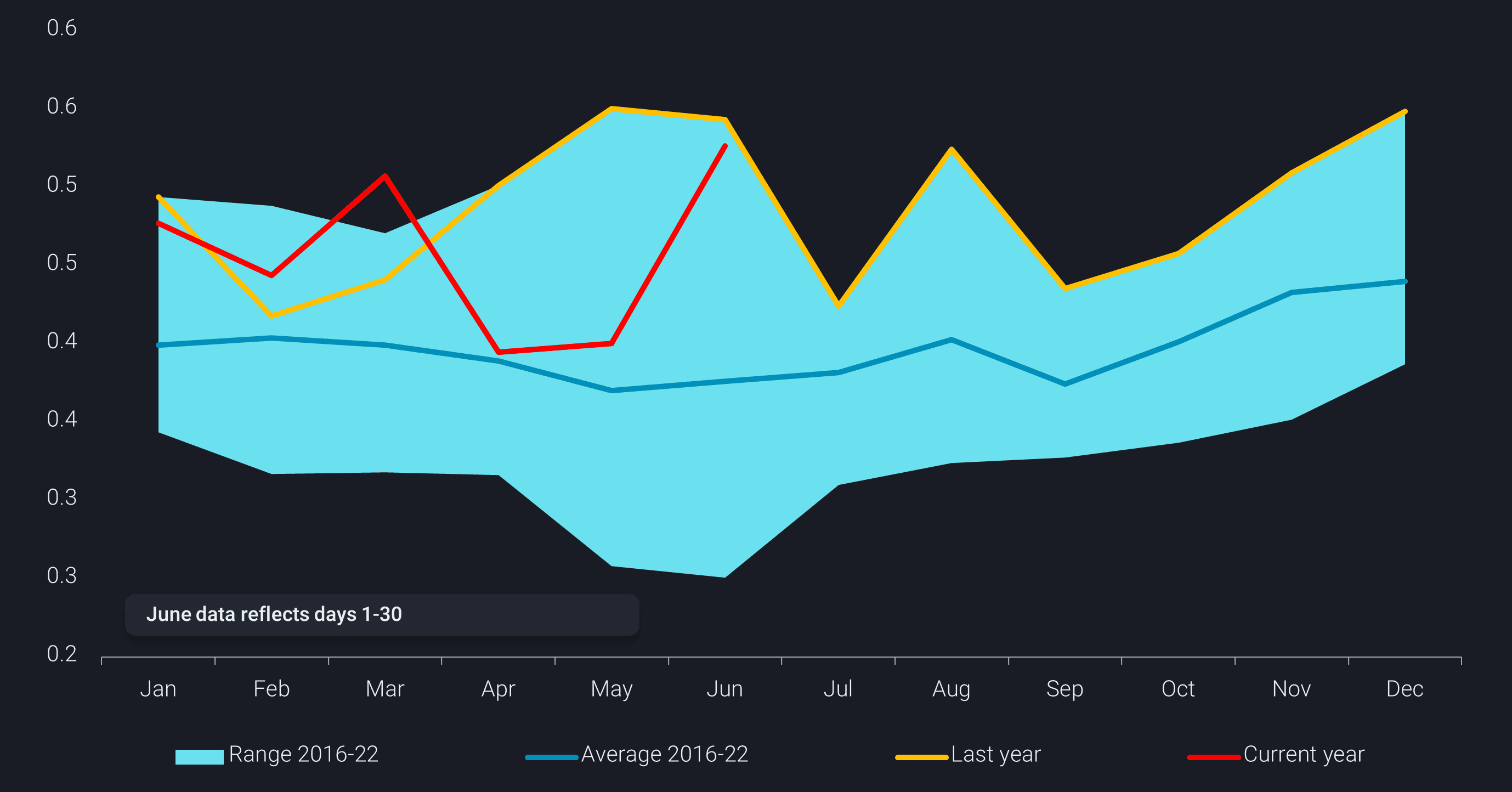

On the other hand, diesel import demand into LatAm West Coast is surging, moving closer to the counterseasonal highs witnessed in 2022 (yellow line). Mexico is largely the driving factor for the increase in imports likely due to a wave of unplanned refinery outages in May. On the supply side, while the USGC remains the dominant supplier, the USWC share jumped up to 20% from only 10% during this same time in 2022 while arrivals from the USGC dropped 26% y-o-y (Jan-July).

LatAm East Coast – Gasoline import demand offers growing support to European refiners

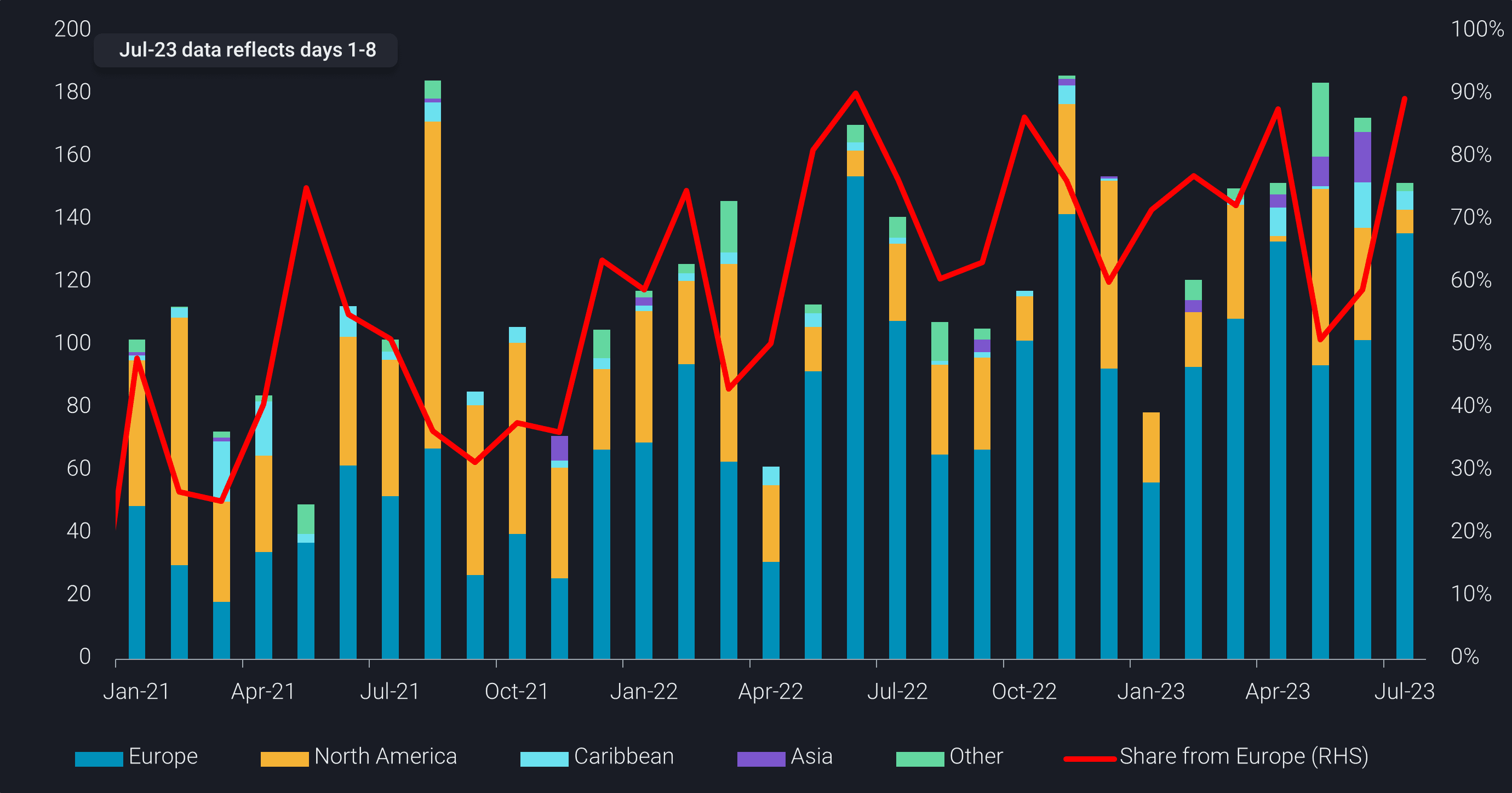

Moving over to the Latin America East Coast, we can see that gasoline import demand has proven robust for 2023 (+15% H1 2023 vs H1 2022). From the supply side, a steady rise in gasoline flows from Europe has backed out USGC gasoline barrels into the region. Gasoline import demand on the LatAm East Coast is led by Brazil where naphtha is also used as gasoline by blending with ethanol. It is likely this increase in gasoline import demand is partly due to lack of naphtha availability from PADD 3. Another factor driving Brazilian domestic gasoline demand higher is a recent reduction in Petrobras wholesale prices which has incentivised drivers to favor gasoline over the hydrous ethanol at the pump (Argus).

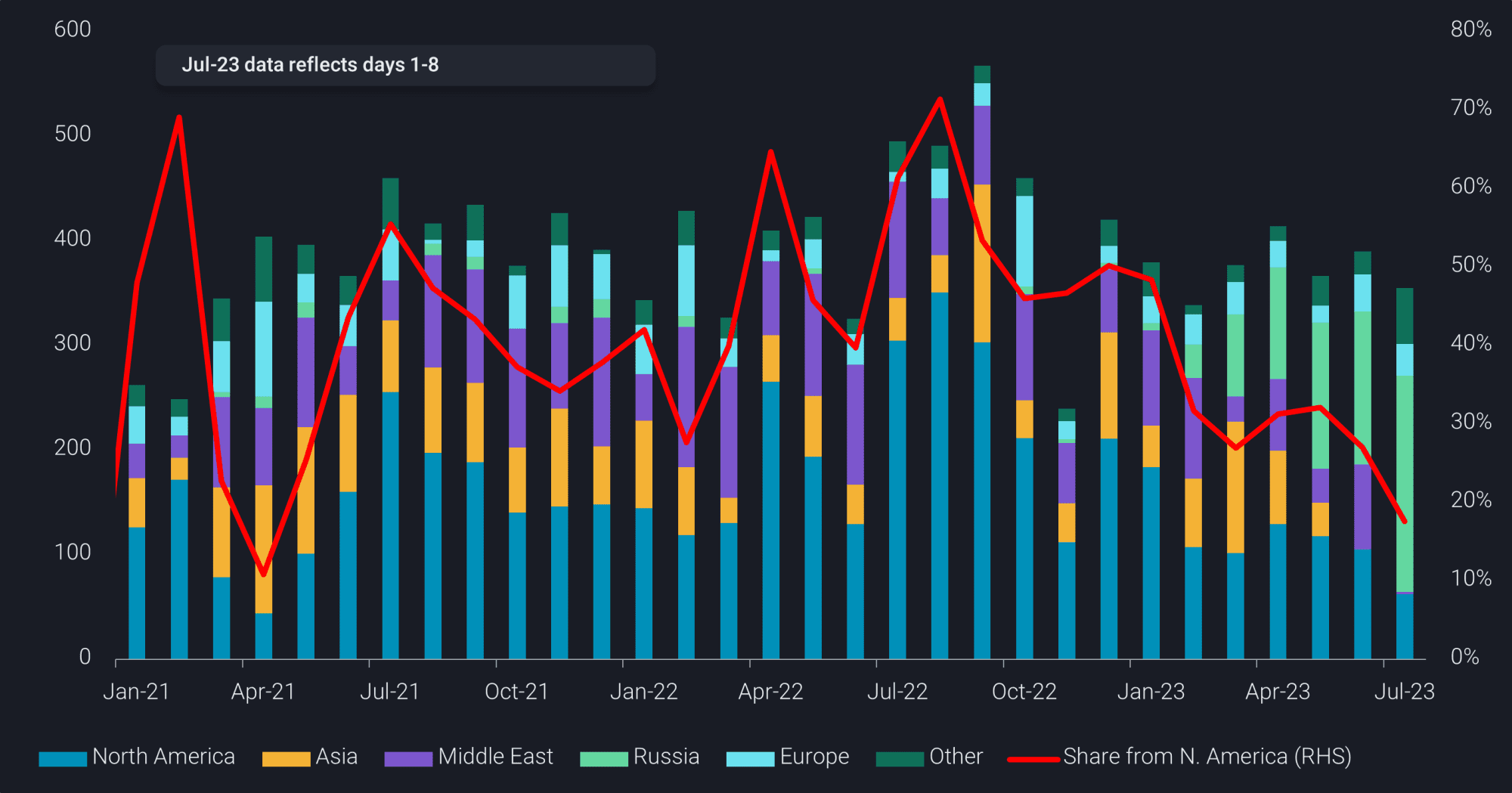

Brazil takes in growing share of Russian diesel, pushing US diesel toward Europe

One of the biggest questions at the end of 2022 was whether Russia could find outlets for its large diesel exports. We have since seen flows settle into moving into three dominant areas including Turkey, East of Suez and Brazil. The move into the latter has created a domino impact and incentivised the USGC to send higher diesel flows to Europe, crowding out Wider Arabian Sea suppliers. In May, Brazil took 50% of its total diesel imports from Russia while the first eight days of July look to increase that share as Russian refineries return from maintenance season and additional barrels are expected to hit the water.

Considering all of the recent reshuffling amid a well supplied market, we have already seen some East Asian refiners announce run cuts or reduce run rates and it is likely that Atlantic Basin refineries will follow suit as supply overhang is expected to haunt product markets going forward.