Latin America road fuel oversupply growing in April

Vortexa outlines how Latin American countries are increasing imports of crude and refined products whilst simultaneously exporting refined products into storage hubs, suggesting an oversupplied region.

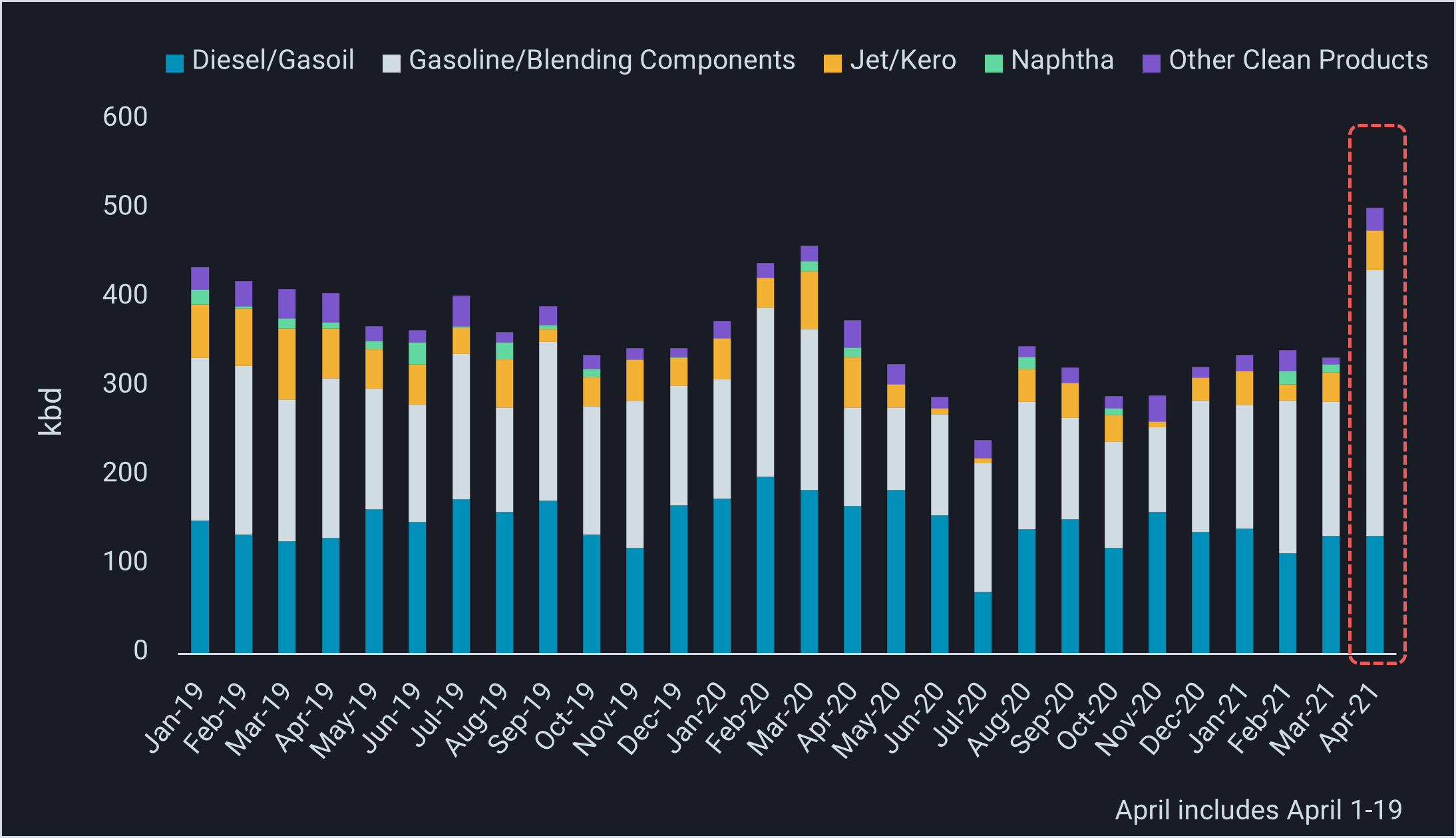

Latin America imports of gasoline & diesel are on track to hit a 13-month high of 1.93 mn b/d in April. We see the steady increase in Latin American clean refined product imports as more of a push from suppliers than a demand-driven pull, with growing volumes of gasoline and diesel already heading towards Caribbean storage.

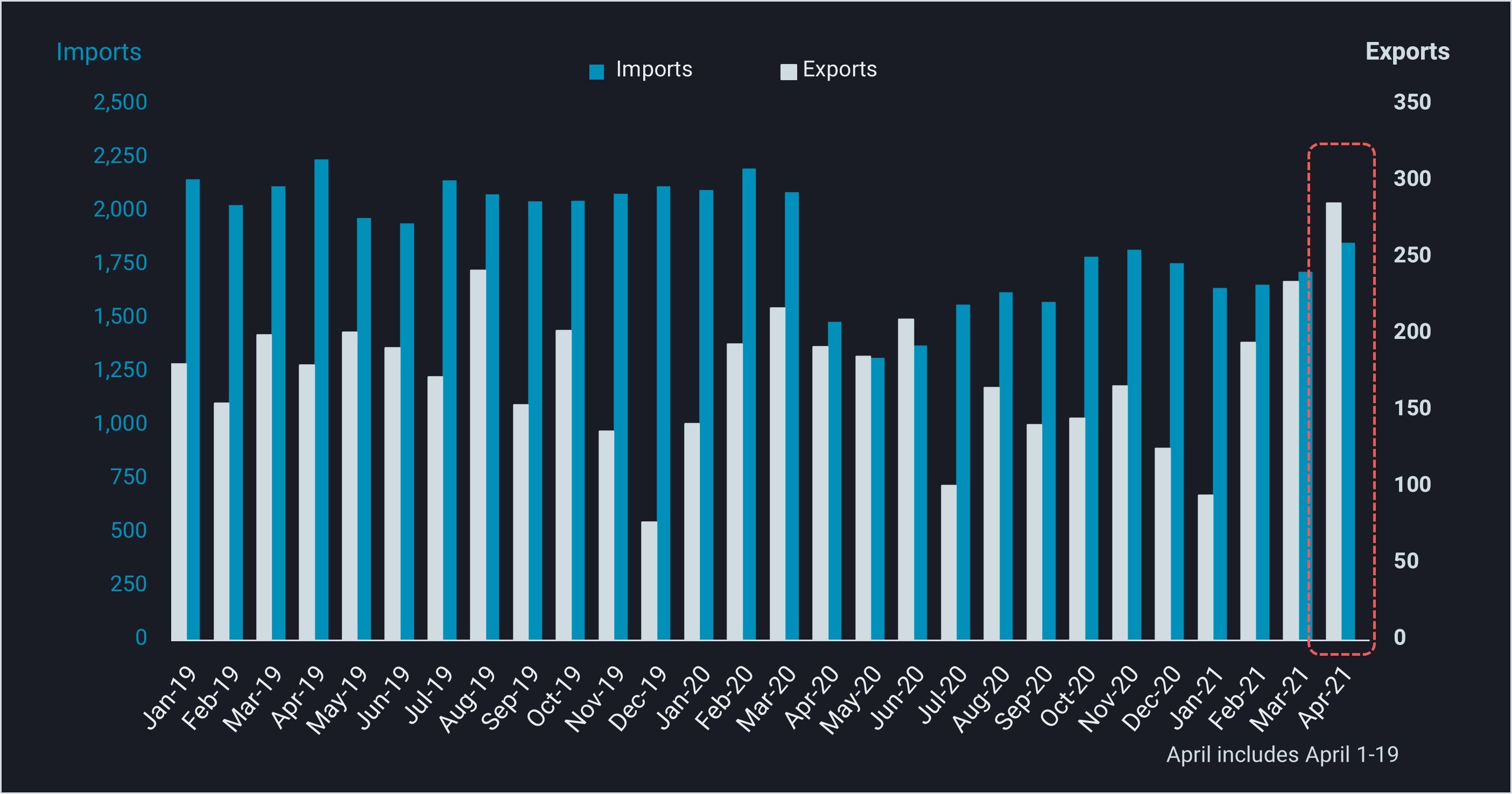

Latin America gasoline & diesel imports and exports (kbd)

See this data in platform – exports & imports

Where are imports of crude and clean refined products signalling a demand pull?

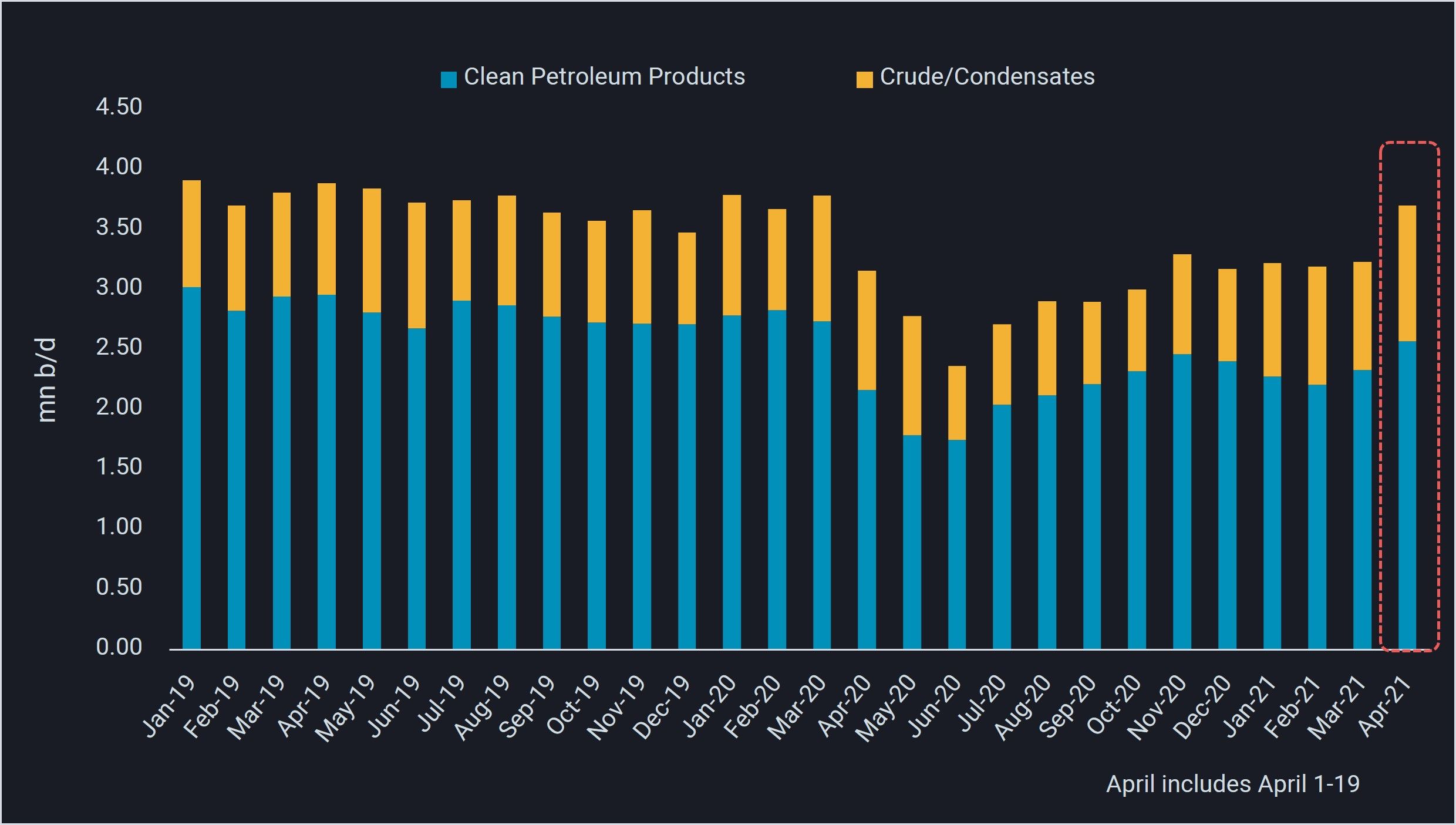

- Chile is the best candidate for an actual demand improvement, given that the country is descibed as being among world leaders in vaccination efforts. However, Google activity and aviation indicators are failing to show improvements. Neither did we find any particularly bullish news, while new Corona cases are surging again. Vortexa data reveals total hydrocarbon imports (crude, all products, LNG) over Feb-Apr at the highest 3-month level since Jul-Sep 2019, clearly hinting at some improvement in underlying economic activity. View this data in the platform.

- There are similar, but not as convincing, indications for strength in data for Brazil. There is a possibility that high crude imports and apparently solid refining operations are related to Petrobras efforts to sell refining assets. Overall, the evidence so far is not convincing that increasing imports into Latin America are driven by a clear-cut and/or widespread economic recovery.

Latin American imports of crude/condensate & clean products (ex. biofuels and LPG)

Latin America is at saturation point

- Increasing volumes of gasoline and diesel can be seen loading at the US Gulf Coast and signalling to Latin America, in tandem with PADD 3 refineries increasing crude runs. As of April 19, this volume stands at 1.2 mn b/d, up 17% from March 2021.

- European loadings of gasoline and diesel headed to Latin America surged in March, potentially leading to a 3-year high in arrivals in April at around 360,000 b/d. But April loadings already appear to be slowing down.

- Latin American gasoline and diesel departures (including intra-regional flows) surpassed 1 mn b/d in the last two months – for the first time in 1.5 years. Again, we see this as an indication of oversupply, and loadings appear to be easing sharply in April.

Caribbean storage filling up

Clean product flows into the Caribbean

- The confluence of high clean product imports and exports over recent weeks without clear-cut demand indications has led to a surge in movements into Caribbean storage. Over 1-19 April 425,000 b/d of gasoline and diesel have arrived in the region, reaching levels unseen since February 2020. Over half of the barrels imported into the Caribbean storage is gasoline, primarily from the Med.

- In conclusion, higher Latin American clean refined product trade activity is not yet a sign of a widespread demand recovery taking place, as we observe barrels getting backed out.

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa CPP Analysis

- 11 March 2021, US gasoline demand moulds the Altantic MR market

- 4 March 2021, Infographic: The freeze on Texas refined product exports

- 11 March 2021, US gasoline demand moulds the Atlantic MR market

Vortexa In the News – CPP

- Reuters, 16 March 2021 – Asia’s Fuel Exporters Target Sales Bump As Refineries Shut Down Under

- Argus Media, 10 March 2021 – BP to close Australia Kwinana refinery in March

- Reuters, 9 March 2021 – Diesel storage in Scandinavian caverns unwinding