Limited seaborne trade volumes raise questions on demand and freight rates

In this big picture analysis, we look at recent indicators of stagnating seaborne flows, questioning healthy demand projection, while freight rates benefit from long-haul travel.

Various indicators in Vortexa datasets suggest that oil demand was not particularly dynamic over the last couple of months, at least with regards to crude oil and core refined products.

Three concerning observations

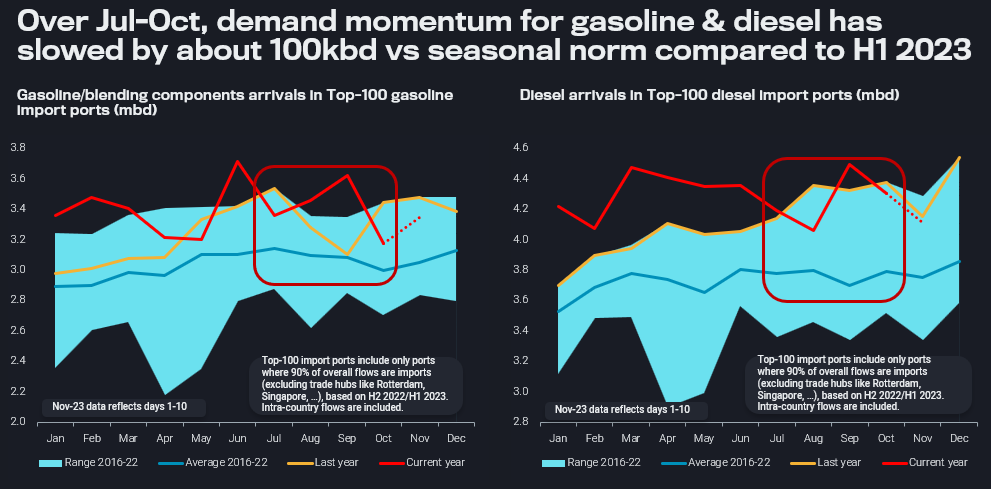

For instance, arrivals of gasoline/blending components and diesel in the Top-100 global import ports have come down over the last four months by about 100kbd each, when compared in relation to the seasonal average vs the first half of the year (see notes on chart for definitions). On a year-on-year basis, growth has also evaporated.

Gasoline/blending components and diesel arrivals in Top-100 import ports (mbd)

Imports of seaborne crude/condensate from the 19 OPEC+ countries with production targets fell to just 23.8mbd over September and October. This is down by 1.5mbd vs H1 2023, and only a very meagre 500kbd higher than average values over the Covid low period from July 2020 to September 2021.

It is true that the low OPEC+ production, export and arrival levels led to significant global stockdraws. But it will not be comforting to the group’s decision makers to see that this drawing trend has come to an end in spite of the very low arrival levels in October. Even more so, as refinery maintenance has not led to a tightening of refined product markets, with lacklustre margins triggering economic run cuts on top of the planned turnarounds.

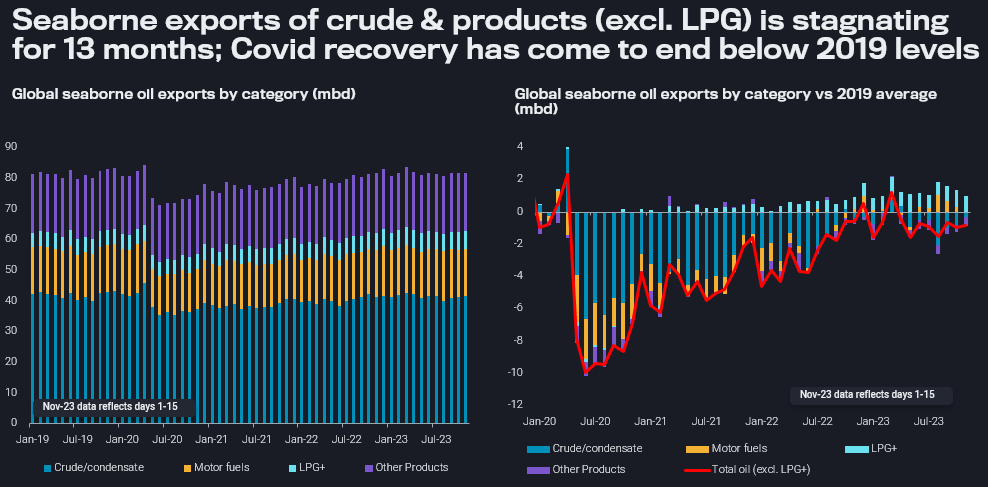

From an oil tanker perspective, combined dirty and clean load volumes have still not recovered to 2019 average levels, albeit clean product levels are close to that benchmark. However, so far in H2 2023 combined clean and dirty load volumes are just stagnant vs H2 2022.

Global seaborne oil exports by category and change vs 2019 average (mbd)

Implications for oil demand and freight rates

At least from a seaborne perspective the above observations raise some questions marks whether oil demand will really grow by roughly 4mbd over 2023 and 2024, as most projections indicate. China is key to these assessments, and while y-o-y import growth has been very healthy, momentum has slowed drastically over the last six months or so.

What is really helping out the overall demand figure are the very light ends from ethane to LPG. According to Vortexa data, exports of C2-C4 molecules have been up by close to 1mbd over recent months vs early 2020 levels. However, for many players in the industry these gaseous molecules are of little relevance.

Meanwhile, tanker owners benefit from longer travel routes across all tanker classes. Crude freight rates have temporarily spiked on massive American flows to Asia, but these dynamics are overall unlikely to be sustained. The Panama Canal water shortage is helping to lift clean and VLGC freight rates, while the former have also benefited from Northeast Asian refiners making up for maintenance-related shortfalls in global product markets. As Wider Arabian Sea refiners come back from outages, travel distances may shorten again a bit.

All in all, momentum is not looking healthy these days, and market observers, including OPEC+ players at their 26 November meeting, will strive to find out whether this is a coincidence of a couple of temporary weaker spots, or a more pronounced trend. It may well be that by now we have seen the very most of post-Covid comeback demand (some upside is likely left in Chinese jet fuel), and longer-term structural factors along an overall weak macro picture, especially in terms of inflationary pressures and slow manufacturing, are taking over.