Massive global product exports herald easing of refining economics

World product exports have been surging over the last two months, pointing to ample refining capacity and easing supply pressure. Whether the demand is actually holding up is questionable.

While many market participants enjoyed year-end holidays, clean tanker operators lifted and delivered lofty amounts of refined products in the last month of 2022. According to latest Vortexa data, worldwide seaborne exports of all products, including everything from ethane to asphalt, jumped to a new record of 35.4mbd.

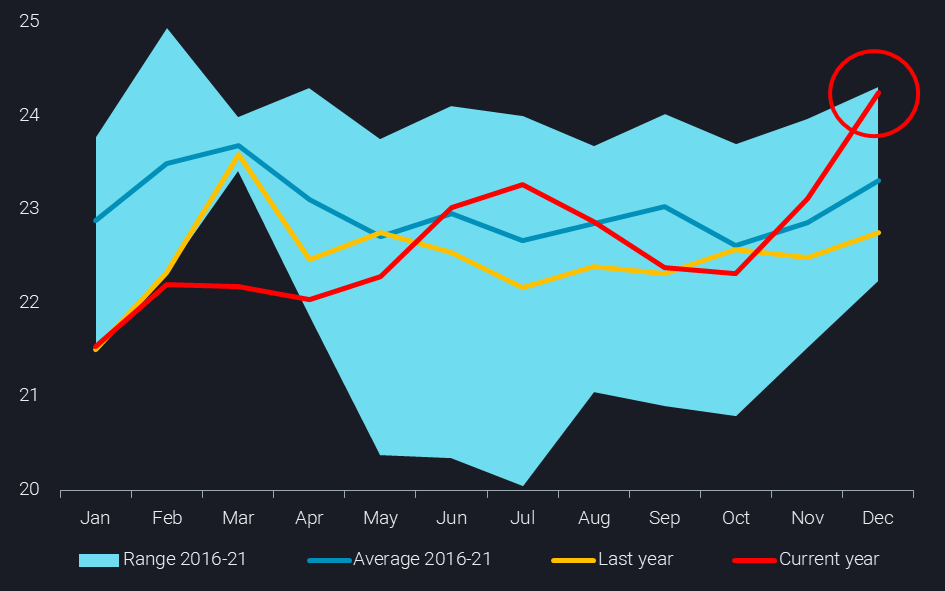

But also core refined product (naphtha, gasoline, jet/kero, diesel, fuel oil and refinery feedstocks) exports reached a multi-year high of 24.2mbd, up by nearly 2mbd vs October levels (see chart). Touching for the first time in 39 months a seasonal high, this speaks for healthy refinery operations towards the end of the year. China, India and Middle East – that is East of Suez markets – were the dominant contributors to the export surge, which has been also reflected in the relatively weaker pricing in that market.

World refined product exports (naphtha, gasoline, jet/kero, diesel, fuel oil, refinery feedstocks; mbd)

Rising exports over the last two months were driven by a 1.4mbd hike in diesel exports, as Europe and Russia maximised flows ahead of the 5th February ban, while alternative suppliers have been hiking their replacement barrels, following very clear economic incentives.

Strong import demand across the barrel, especially in the Atlantic Basin

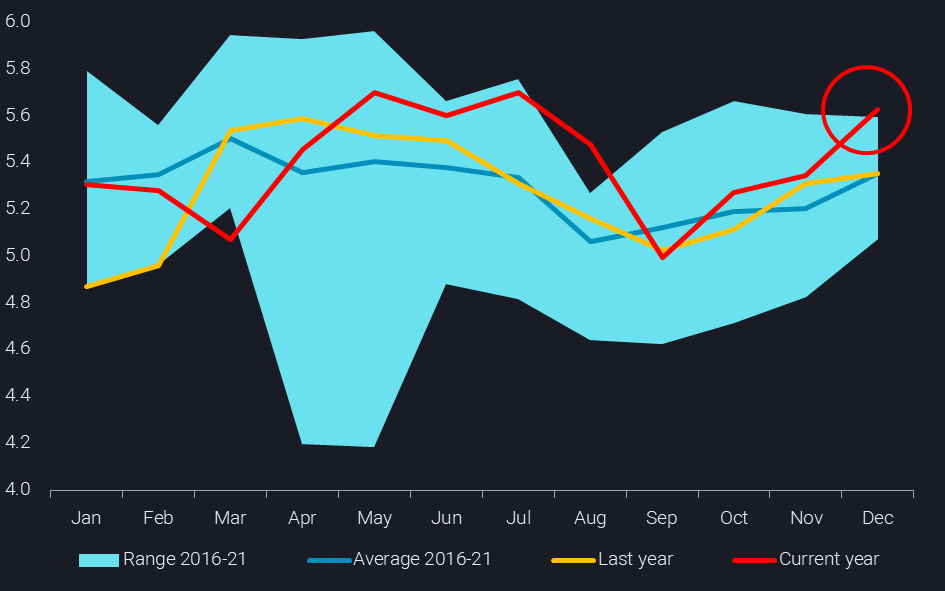

The recent export trend allowed product imports to recover across the board, including segments other than diesel. Helped also by easing pump prices and seasonal travel activity, world gasoline and blending component imports hit their second seasonal high in 2022, the first since August (see chart). Similarly, combined global imports of naphtha, LPG and ethane reached a new all-time high of 8mbd.

World gasoline imports (mbd)

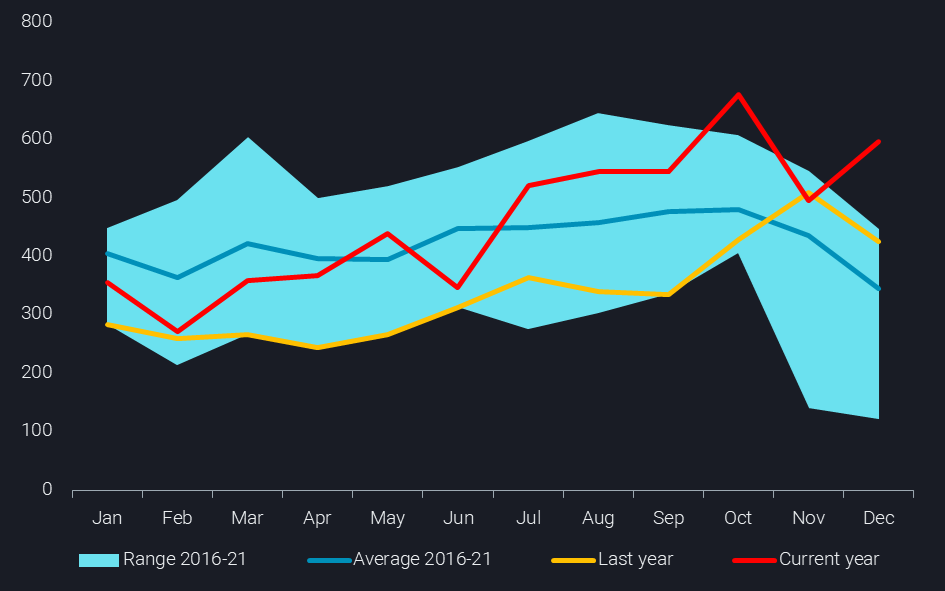

Product imports were particularly strong in the Atlantic Basin, especially for the motor fuels diesel, gasoline and jet/kero. Combined they reached close to 8.5mbd, a new dataset high. Jet/kero net-imports in the Atlantic Basin reached the second seasonal high in 2022 in December, just two months after the October record, being a strong testimony of the recovery of the aviation industry in that part of the world (see chart). East of Suez markets could follow suit if and once China overcomes its Covid struggles.

Jet/kero net-imports into Atlantic Basin (kbd)

Mixed outlook for 2023

Healthy December product trade flows have been well aligned with surging clean freight rates in Q4. But the recent easing of shipping costs suggests that the market is slowing in January. It is also somewhat questionable whether strong December import readings are a reflection of healthy and consistent end-consumer demand. This would be a bit surprising against the backdrop of recessionary trends. It is more likely that buyers took advantage of easing prices to restock, something that is for instance already reflected in ARA hub product stocks.

At any rate, the recent hike in product flows heralds likely poorer refining economics to come this year, as a function of range-bound demand, new grassroots capacity, and substantial yield shifts increasingly denting the diesel upside. However, there are still the wildcards of EU sanctions on Russian product imports materialising as of 5 February, potential pockets of cold winter weather as experienced in the US late last year, and a particularly speedy and strong recovery in Chinese demand.