The Atlantic Basin’s increasingly important role in the global diesel reshuffle

As diesel imports surge into West Africa, we take a look at the growing Russian share and explore flows moving to LatAm after STS activity in Lome.

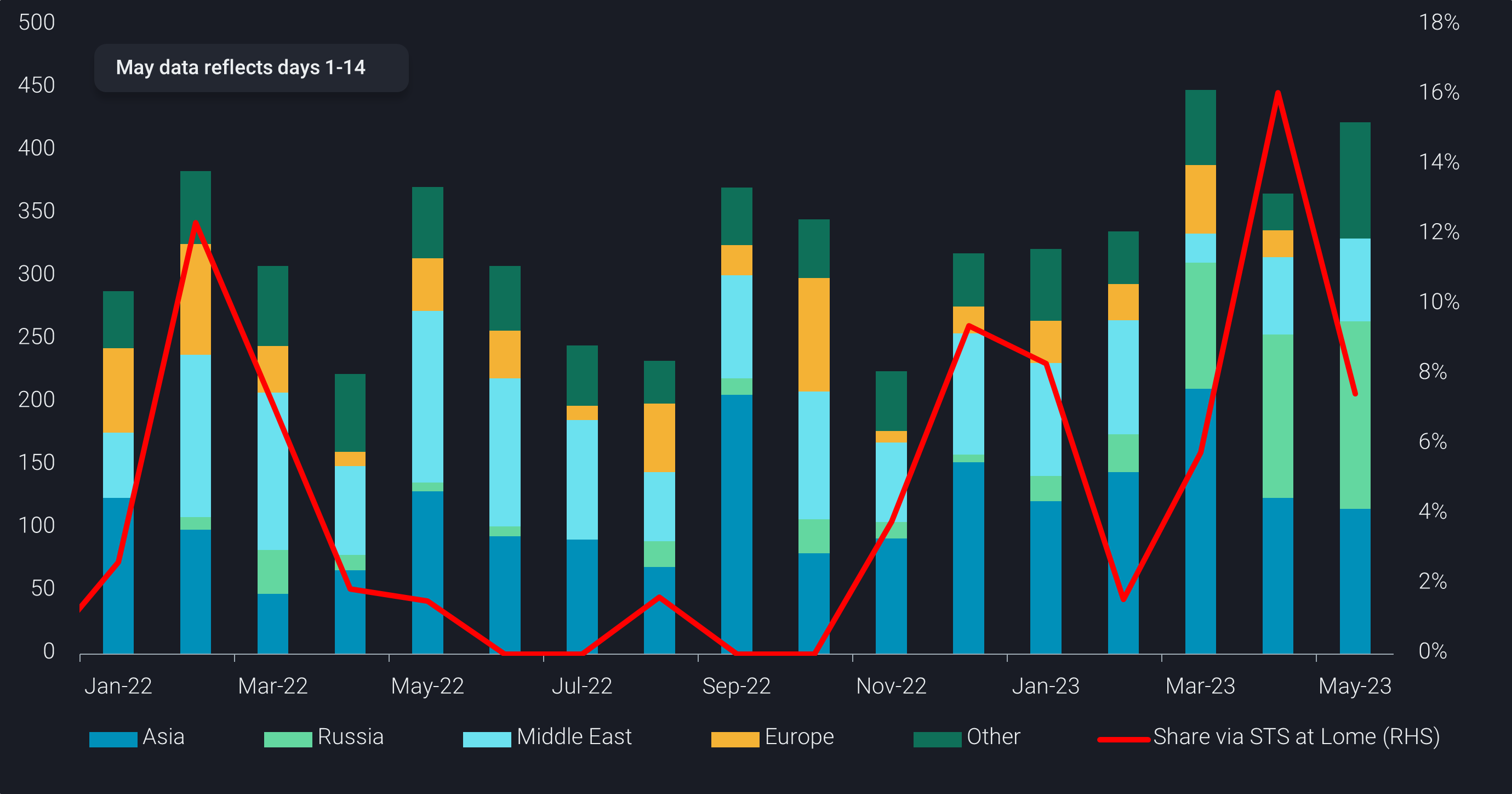

Diesel imports have been pouring into West Africa and growing consistently for the last three consecutive months pushing May to reach a likely multi-year high. At the same time, Latin America diesel imports via STS from Lome surged in April, pointing to the emergence of an increasingly prominent role for the Atlantic Basin as a key point in the ongoing diesel reshuffling.

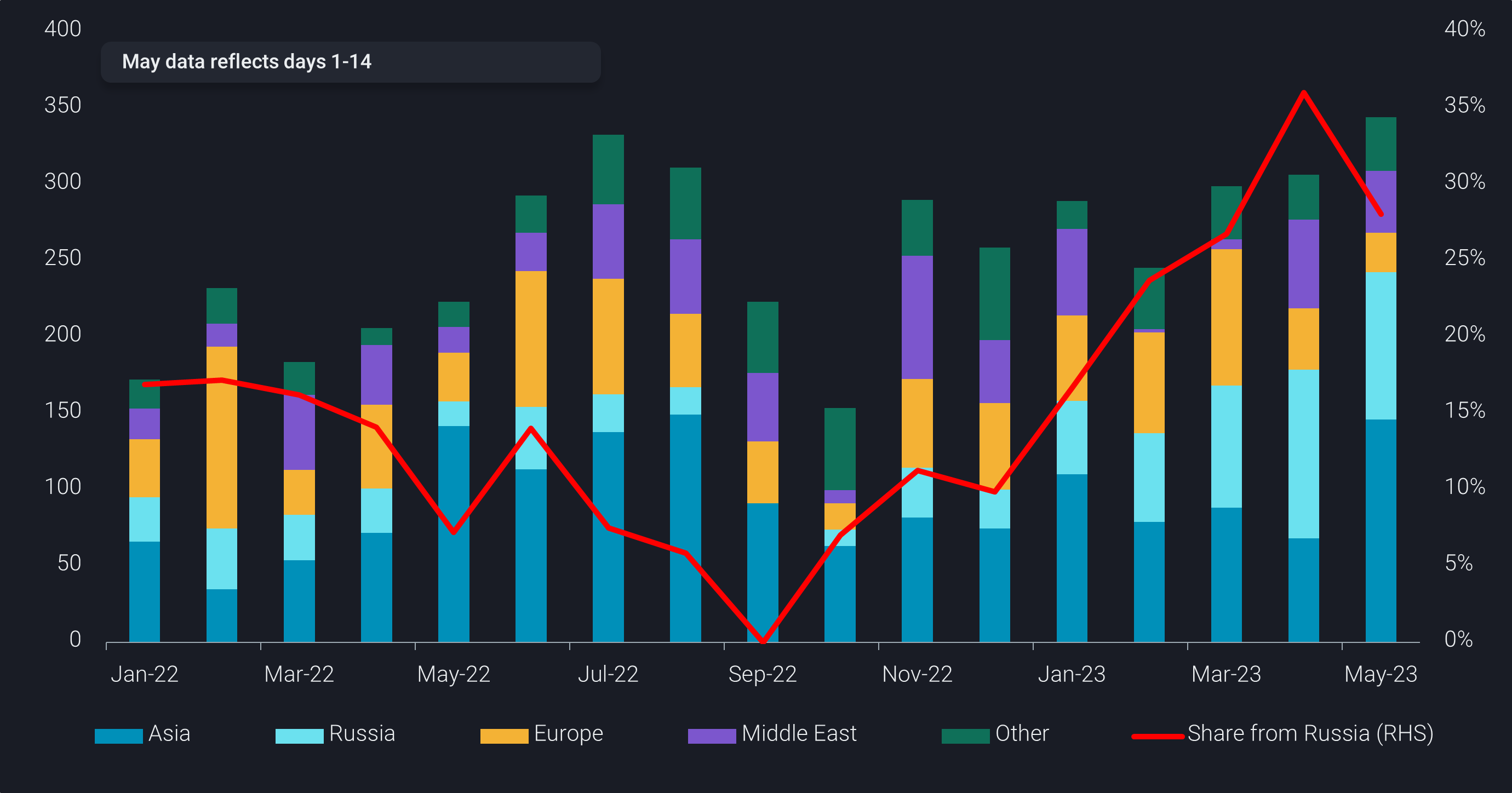

While WAf imports from Asia have been relatively steady for Q1 2023 (dark blue), Russian diesel imports into the region have been escalating for three consecutive months since January 2023, coinciding with the February EU ban on Russian clean products and the need to find alternative markets. Despite Russian imports to WAf more than doubling Jan-May 2023 compared to the same period in 2022, the Sikka (India) origin diesel dominates the STS activity at Lome in May.

The coast of West Africa is an important location for diesel STS, where it is divided into smaller parcel sizes and either discharged into West African destinations or moved to Latin America. This again shows the increasing role of the Atlantic Basin for Russian diesel cargoes. Producers can maximize their optionality and find buyers in WAf or continue on to LatAm.

Although LatAm has historically covered 70% of its diesel short from PADD 3, non-North American diesel imports constitute a sizable and growing share. In March 2023, LatAm diesel imports loading directly from Russia tripled m-o-m, mainly discharging in Brazil. And in April, STS transfers at Lome doubled m-o-m, mainly driven by cargoes originating from India and Saudi Arabia.

LatAm diesel imports by non-North American origins (kbd, LHS) and percentage share via STS at Lome (%, RHS)

Older tankers underpin the economics of the trade

The vessels which unload these Russian diesel imports mostly discharge in LatAm and ballast back to Europe and the Baltics. This voyage of nearly 7,000 nautical miles each way is a new development. In a pre-sanctioned market, it is unlikely MRs would be involved in these uneconomical voyages, and would go on to load from PADD 3 after discharging in LatAm. In current circumstances these round voyages are actually performed and repeated, reflecting the stickiness that is underpinning the profitability of owners choosing to stay in the trade. Furthermore, most of the vessels in this trade are MR tankers with an average age of 15 years old.

Looking forward, it is questionable whether the current levels of high Russian diesel imports into WAf and LatAm can be maintained. Russian diesel exports are already observed declining from the March peaks (7% m-o-m in April with further declines in May) due to a heavy refinery maintenance season, especially for hydrocrackers. In addition, Russian domestic demand starts to kick in for agriculture and transportation around this time of year, which will likely keep a lid somewhat on total Russian diesel exports. And even though clean freight rates are low, reduced Russian exports will likely be felt in the East of Suez markets first and then possibly into the Atlantic Basin.