The gap between diesel and light distillates opens up further

Vortexa trade flow data shows a consistent trend over recent months of rising diesel and falling light distillate imports. That is particularly true for Europe but also for other markets around the globe.

There is little doubt that diesel is a product in strong demand. Latin America and other Southern Hemisphere markets have set the tone, with diesel imports into the former market growing consistently ever since they hit rock bottom at the height of the Covid crisis in Q2 2020. Observed inventories, located mostly in trading hubs are at historically low levels, as the market is gearing up for peak winter demand. This would already be a challenge in a normal year, but with Russia’s war on Ukraine leading to massive gas supply curtailments to Europe and a string of power shortfalls throughout 2022, extra requirements for diesel are widely expected to be substantial.

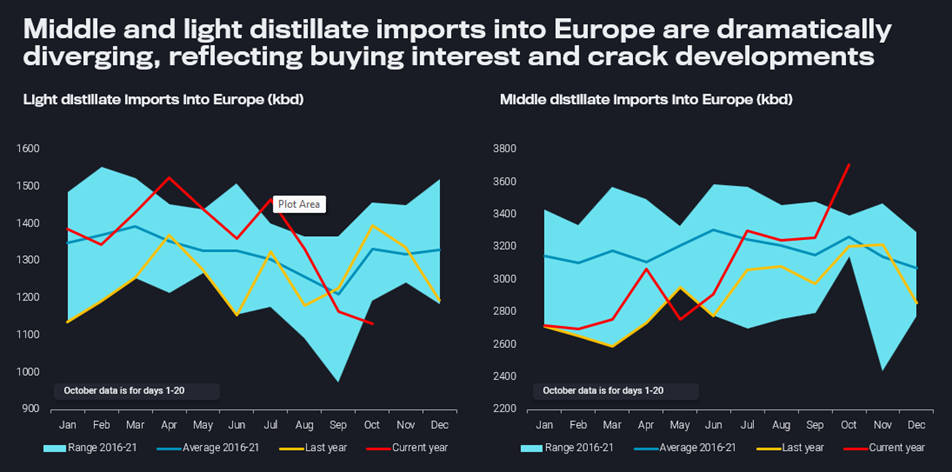

European diesel and jet/kero imports were already above long-term averages over July-September, before widespread refinery outages in France led to a spike far above the seasonal range, with Vortexa recording 3.7mbd of diesel imports into European countries over 1-20 October (see right-hand chart below). This is a massive 1mbd higher than the Q1 2022 average, when demand was under pressure from high prices and some remaining Covid restrictions.

European imports of middle (diesel & jet/kero) and light distillate (gasoline, blending components & naphtha) (kbd)

The big question is to what extent the spike in imports is reflective of actual consumption, known forward bookings and a speculative surge in future demand. While it is clear that the winter 2022/23 will see extra demand for diesel/gasoil for heat and power generation, the extent and persistence is very hard to estimate. But there is a clear risk that it will be largely counterbalanced by lower demand in all other segments, as inflation, a slowing economy, the related shrinking disposable incomes, and voluntary efforts driven by climate change and geopolitical reasons (Russia), all join forces in a previously unseen, powerful cocktail. To phrase it differently, short-term spikes in niches applications may have a hard time to make up for the more persistent loss in demand in industrial, commercial, residential, agricultural and road transportation sectors.

It may well be that we are already seeing the repercussions of the economic slowdown in European light distillate imports. Within just three months, gasoline/blending component and naphtha imports fell from a seasonal high of close to 1.5mbd in July to just above 1.1mbd over 1-20 October, in spite of unusually heavy buying from France (see left-hand chart above).

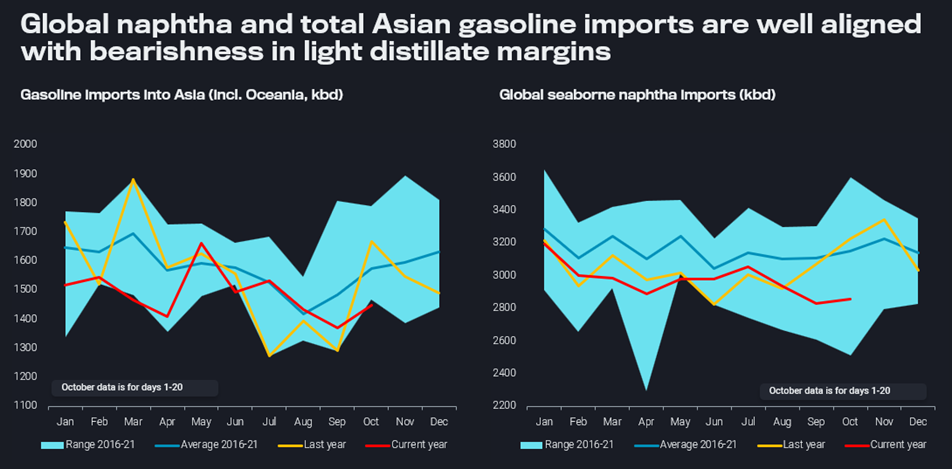

Asian gasoline and global naphtha seaborne imports (kbd)

Having a look at other markets underpins weakness in light distillate imports, probably driven by disappointing demand. Asian gasoline imports diverged from the seasonal path in September and are, in spite of a m-o-m increase, at a seasonal low so far in October (days 1-20) (left-hand chart above). Global naphtha imports have been below the 6-year average throughout the year, but the shortfall has widened notably over the last three months, with Sep/Oct imports averaging at a year-to-date low of just above 2.8mbd (right-hand chart above). Naphtha is suffering from weak petrochemical activity and the replacement by cheaper LPG, both in Europe and Northeast Asia.

As most forecasters are reckoning with a recession from here onwards or in 2023, there is little hope for a trend reversal in marginal oil demand developments. And while the lack of Russian gas will provide for some upside in oil-to-heat&power demand, the uncertainties related to Russian crude and product exports as a function of the European import and third-party shipping/insurance bans may well drive outright prices higher in the coming months, leading to further demand destruction.