US, European naphtha glut finds home in Asia

Vortexa Snapshot: US, European naphtha glut finds home in Asia

Naphtha arrivals into Asia are set to rise to their highest in at least four years in May, Vortexa data show. Lackluster global gasoline blending demand helped to drive a recent rise in naphtha exports eastwards, particularly from the US and wider European region, as the naphtha discount to LPG made it an attractive feedstock for cracker operators. A rise in petrochemical demand offers one sign of emerging recovery in the Asian region amid the gradual lifting of travel restrictions.

Naphtha arrivals in May

- North Asia appetite: Around 6.5mn t of naphtha is expected to arrive in Asia from outside the Asia region in May, Vortexa provisional data show, up nearly 50% from the previous month, and 20% versus January – April monthly average volumes.

- Of this, 4.8mn t is expected to arrive in North Asia, 20% higher than the January- April monthly average volumes. This figure could be revised further upwards, as a portion of naphtha cargoes currently heading towards Singapore could eventually discharge their cargoes in North Asia.

- Condensate imports rise: It is also worth noting that North Asia condensate imports had risen in April by 40% month-on-month to 1.4mn t. Still, this is still lower compared to year-ago volumes, as competitive naphtha and LPG feedstocks dampen condensate demand appetite in North Asia as compared with prior years.

- Demand shift signs: This rise in petrochemical feedstocks demand from North Asia offer early indications of a demand recovery in Asia, as economic activities take a cautious return towards normalcy.

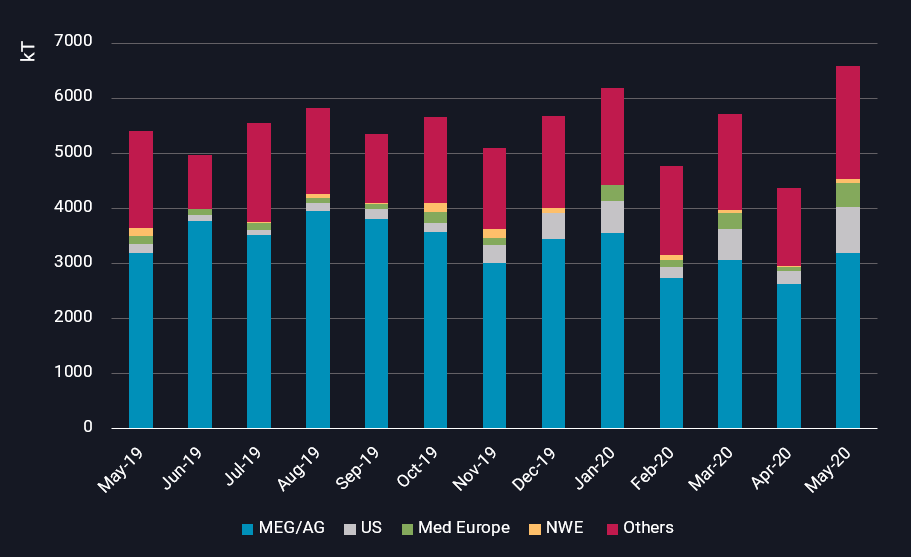

Asia naphtha imports by region, May 2019 – May 2020

Imports by region

- US exports jump in April: Around 700,000 t of naphtha -predominantly full range or heavy- was loaded from the US to Asia in April, a near 40% rise over March volumes, and an 80% rise versus January – March monthly average volumes. These higher outflows are reflected in the higher Asia imports in May.

- While US Gulf coast exports dominated exports in April, two MR-sized cargoes were also loaded from the US west coast for delivery in South Korea in May. US naphtha cargoes typically load from the US Gulf Coast and transit via the Panama Canal, taking 40-45 days to be delivered to North Asia, compared with 20-25 days for deliveries to North Asia from the Middle East.

- That said, loading activities from the US to Asia slowed significantly in the first two weeks of May, as the arbitrage window narrowed and the US Gulf coast to Asia LR1/MR freight rates soared.

- Exports from Med Europe surge: The recent slump in domestic petrochemical demand in the Mediterranean region led to multi-year high naphtha exports of 500,000 mt to Asia in April. Provisional fixtures indicate another 350,000 t to be loaded from the Med this month for delivery to east of Suez. Exports from north west Europe to Asia stood at around 150,000 mt, the highest since October.

- Mideast Gulf exports steady: Naphtha exports from the Mideast Gulf to Asia held steady at 3.1mn t in April, as higher loadings from Qatar and Saudi Arabia offset declines from the UAE, on account of planned refinery maintenance.

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}

Want to see more refined products storage analysis?