US Gasoline – Driving the road to recovery

Vortexa Snapshot: US Gasoline – Driving the road to recovery

The market is watching closely for nascent signs of road fuel demand recovery as the US eases certain lockdown restrictions. We ask if gasoline could lead the re-balancing of the clean products glut in the run up to the beginning of the US driving season and highlight key signals to watch for the demand upturn.

US gasoline exports

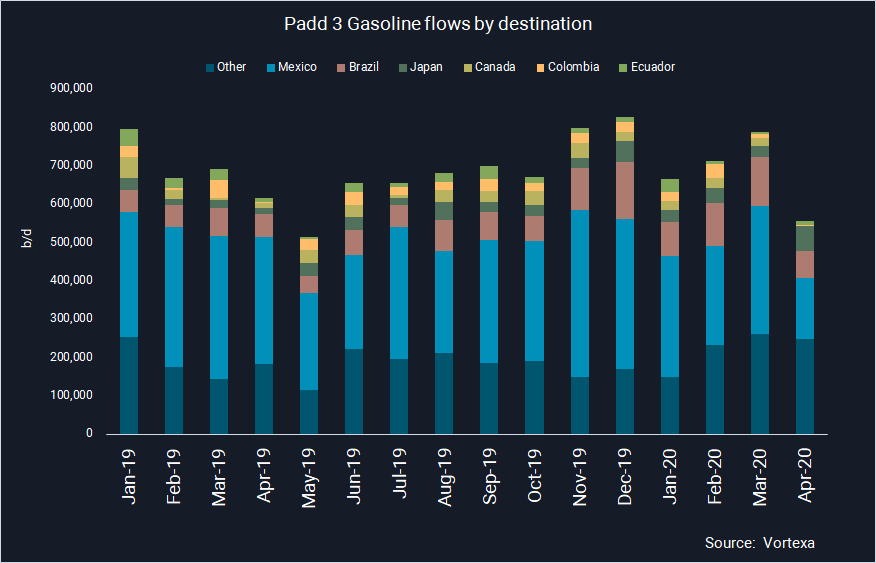

- Seaborne exports decrease: Just over 2mn bl of gasoline/blending components loaded from the US Gulf coast (PADD 3) on 1-13 May, compared to almost 10mn bl the same time a month earlier, according to Vortexa data.

- The export profile for May exports so far follows typical trends, with Mexico in the top spot (see historical data below).

EIA signals

- The decline in PADD 3 gasoline exports month-on-month noted above sits alongside US EIA data on gasoline stock builds, forward day coverage, as well demand and refinery run rates.

- US gasoline stock builds flatten: Week-on-week stock builds slowed to 0.4% for the DoE week ending 17 April, according to the EIA, after peaking at a rate of 4.24% DOE week ending 3 April. Stock draws have been observed for two consecutive weeks ending 24 April and 1 May.

- US gasoline forward cover days reduces for on-land storage: The first reduction of gasoline forward cover days was reported for the week ending 1 May – at 44.8 days supply, down from the 48.7 days cover reported for the previous week.

- US implied gasoline demand up: Implied gasoline demand was up to 6.67mn b/d for the DoE week ending 1 May, up by 14% after falling to a historic low of 5.06 mn b/d for DoE week ending 3 April.

- PADD 3 increasing refinery run rates: As of 1 May, refinery run rates stood at 75.1%, a second consecutive week-on-week rise after after the year to date low of 73.8% reported 17 April.

The global picture

- Although an important portion of the US refinery system remains offline or is running at lower rates due to weak demand and limited storage availability, the impact of the pick up in road fuels will see the drawdown of offshore and onshore storage, as well as higher refinery production. But refiners producing too much too soon would prolong the oversupply – potentially leading to further stock builds.

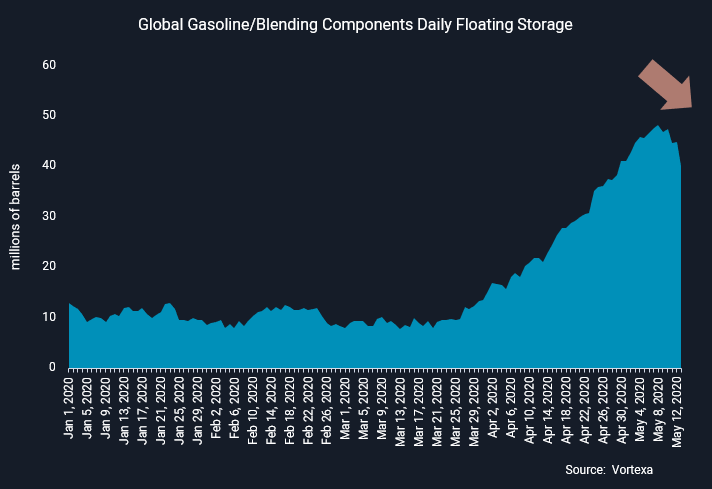

- Easing in trapped volumes: Our data show around 8mn bl of global gasoline that was previously trapped in floating storage cleared between 8-13 May, after the peak of 48mn bl earlier this month (see below).

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}

Want to see more refined products storage analysis?