US Tier 3 gasoline rules shift gasoline flows

Vortexa Snapshot: US Tier 3 gasoline rules shift gasoline flows

The full transition to Tier 3 gasoline standards in the US from the beginning of this year further shifted the dynamics between the country’s gasoline and blending component imports and exports during the first quarter of this year. In order to comply with the new standards, we note that high-octane blending component imports into the US in Q1 rose compared with the previous year as exports fell, while US naphtha has also been increasingly pushed out for exports. Tier 3 regulations will continue to impact the breakdown of flows between finished gasoline-types and blending components, adding another layer of nuance to the dramatic impact of the demand crash in gasoline due to the pandemic. We outline the key Tier 3 impacts in Q1 below.

Regulatory change and blending component flow shifts

- As of January 2020, all US refiners and importers must fully comply with the the US Environmental Protection Agency’s Tier 3 fuel program’s gasoline requirements. These were initially introduced in 2017 to help combat air pollution and mandate on sulphur content to be on average at 10 parts per million (ppm), down from 30ppm previously.

- While many of the largest US refiners had already adopted the shift to low sulphur gasoline in the years running up to the transition deadline, numerous smaller plants were able to apply for exemptions and continue to produce and distribute higher sulphur components.

- Refiners or importers can also buy and sell Standard Tier 3 credits to and from other participants in the program to help meet compliance.

PADD 3 high octane exports curbed

- As a major refining and products export hub for the US, the Gulf coast (PADD3) exports its surplus gasoline, largely to Mexico and other Central and South American countries, as well as west Africa. Finished gasoline-types make up the predominant mix of exports, but the region also exports various blending components, including high-octane components.

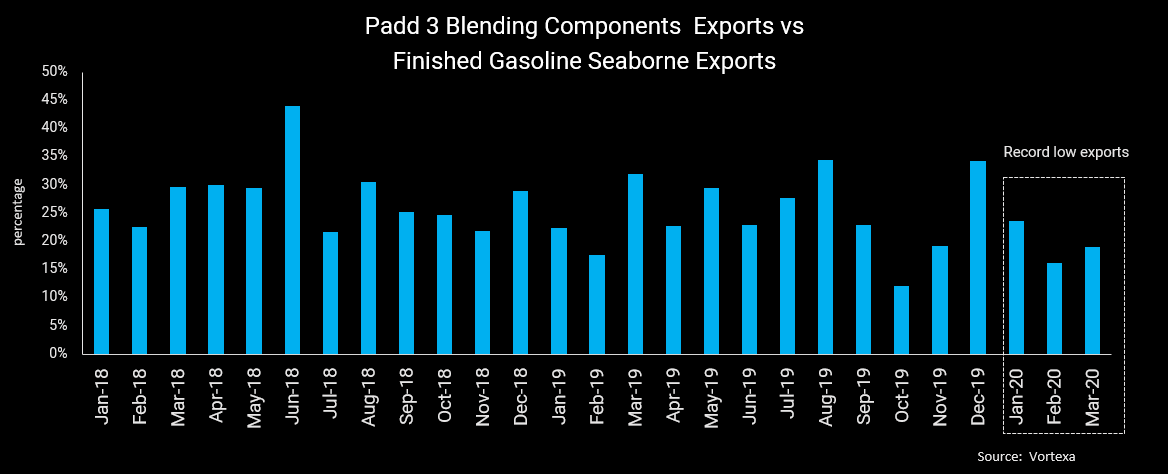

- Vortexa’s gasoline data show that PADD 3 seaborne blending component exports fell to an estimated 100,000 b/d in Q1, down by around 20% year-on-year.

- This decline points to US refiners retaining more high-octane material, given the new specifications, leaving less available for export. This argument is also supported by the lower share in recent months of blending components vs. finished gasoline exports (see chart below).

- Further, lower demand from blenders for naphtha as a blending component has supported export activity. US naphtha exports were some 15% higher in Q1 2020 compared with the same time last year.

Rising components flows into US, from Europe and India

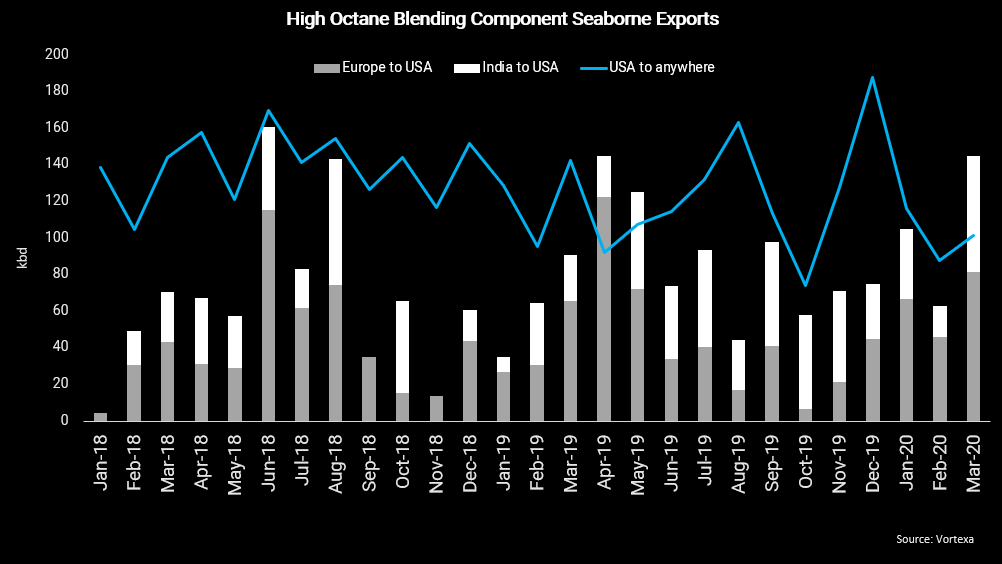

- Amidst the drop in PADD 3 blending components exports, total blending component flows to the US have been rising, to satisfy the need to meet specifications. These include products such as alkylate, reformate, and other gasoline blending components.

- Europe, the world’s largest exporter of blending components, ramped up flows to the US in Q1 to 64,000 b/d, compared to 41,000 b/d in Q1 2019 and 26,000 b/d in Q1 2018, our data show.

- India, second only to Europe in blending component exports, supplied around 40,000 b/d in Q1 to the US, up by around a third from first quarter exports in 2018 and 2019.

- Meanwhile seaborne naphtha imports into the US have slumped, with March arrivals down year on year by around 90,000 b/d to 110,000 b/d, amid poor reformate margins and the low octane element of the blendstock.

=

Tier 3 gasoline adds to covid-19 impact in gasoline flow shifts

- The gasoline picture in the US of course has dramatically shifted in recent weeks. As the fallout of the pandemic deepens, the global gasoline glut is building yet further, forcing refiners to further reduce rates. In the US, the EIA reports the latest gasoline inventory levels for April 17 at 263mn bbls, an all time recorded high.

- At the same time, gasoline production from blenders and refiners stood at 6.2mn b/d in the week ended 17 April, according to the EIA, a dramatic 37% drop year-on-year, reflecting poor demand due to shut-ins.

- We can expect that Tier 3 gasoline sulphur credits will become even more illiquid in this climate as refiners reduce rates to limit gasoline production amid the pandemic.

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}