What’s driving the Singapore fuel oil floating storage draw?

What’s driving the Singapore fuel oil floating storage draw?

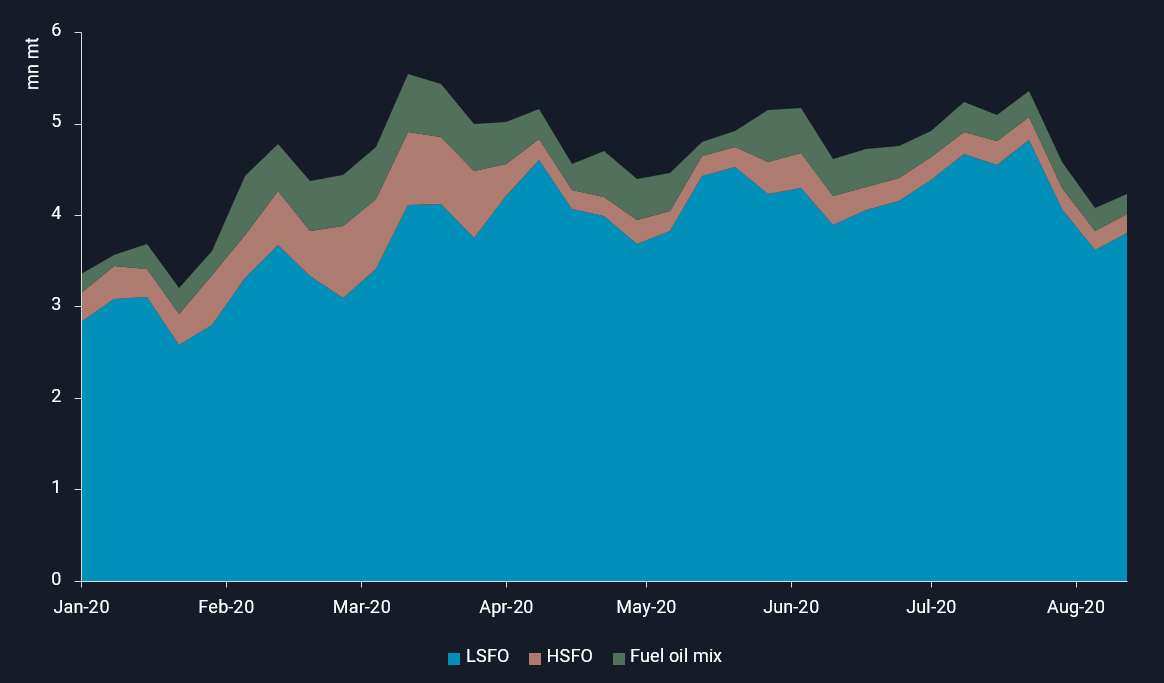

Singapore’s fuel oil floating storage inventories saw a 1.1mn mt drawdown over the last four weeks, reaching 4.2mn mt as of 17 August, the lowest since February, according to Vortexa data. Over 90% of this is estimated to be low sulphur fuel oil (LSFO). The decline in offshore volumes comes despite a slight 280,000 mt uptick of onshore fuel oil stocks over the same period, based on statistics from Enterprise Singapore. This insight explores the drivers behind the fuel oil floating storage draw and the outlook for storage dynamics in the coming weeks.

Singapore fuel oil floating storage by primary product (mn mt)

Drivers of the offshore decline

- Bunker demand rise: Singapore’s fuel oil bunker sales registered a 10% month-on-month rise in July to 3.9mn mt, continuing a steady recovery from the low seen in May, according to MPA statistics. But the country’s bunker sales remain under pressure from China where rising VLSFO production (encouraged through fuel oil bonded exports tax rebates) has reduced bunker prices, eroding the price advantage Singapore previously offered.

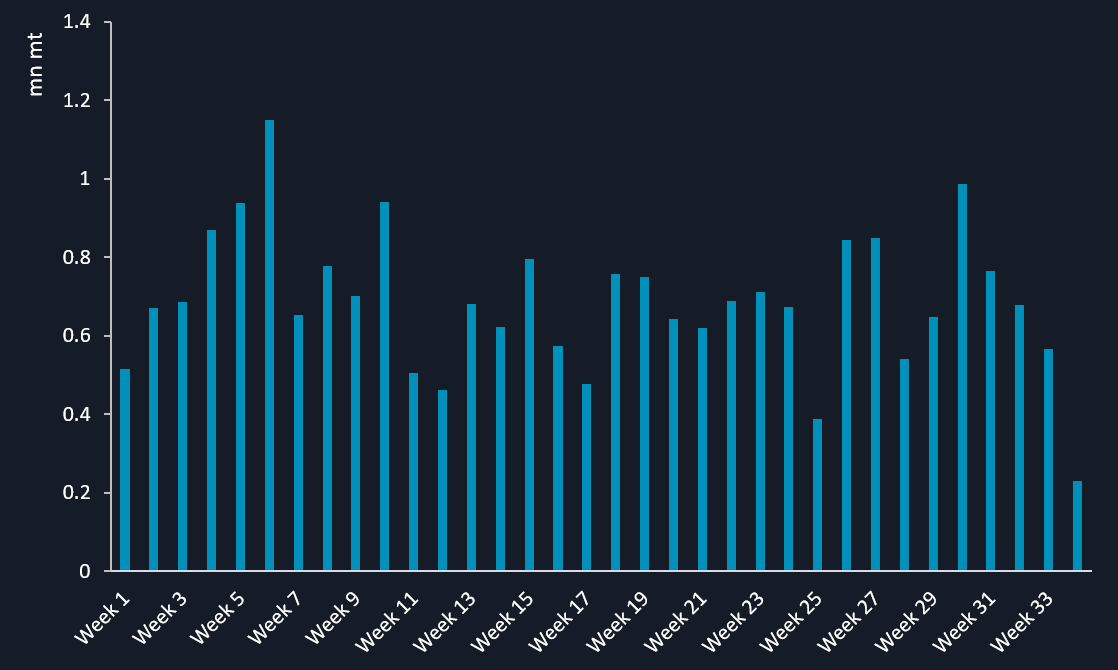

- Arbitrage imports fall, but upside emerges for September: Fuel oil arrivals into Singapore from outside Asia have registered four consecutive weekly declines, with the trend likely to continue this week (Week 34). Total arbitrage arrivals into Singapore are estimated at 2.6mn mt in August on a preliminary basis, down 20% from July. Looking on the upside, it is worth noting that at least 470,000 mt of Brazilian fuel oil is expected to arrive in Singapore in September, rebounding from the year-low arrival volumes in August. This volume includes the expected arrivals of two Suezmax tankers that were previously in floating storage during July and August, respectively.

Singapore fuel oil arrivals excluding Asia (mn mt)

- Exports uptick: Singapore’s fuel oil exports in August are provisionally estimated at 2.4mn mt, flat versus July. HSFO exports to Saudi Arabia have remained robust in August, with 460,000 mt exported so far, albeit lower than the 610,000 mt exports seen in July. Exports to China (excl. Hong Kong & Macau), Singapore’s largest export market, have totaled 390,000 mt so far in August, matching July’s levels. And more loadings may be expected in the coming weeks, potentially lifting full-month export volumes.

- Storage economics bearish: The current market structure is not providing a strong economic incentive for storage, unlike the contango structure in the run up to IMO 2020. The difference between front-month swaps and prompt physical prices for 0.5% LSFO is ranging between parity to slightly positive. For 3.5% HSFO, the spreads are also close to parity, easing from backwardation in previous weeks. The relatively flat price structure suggests an expectation of a balanced market outlook and stable inventories.

Interested in a more detailed view of our data?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}