Will China boost diesel exports without additional quotas in Q4?

We review the possibility of China raising diesel exports in light of Russia’s export ban and a lack of a fourth batch of export quotas.

More product export quotas over fewer batches in 2023

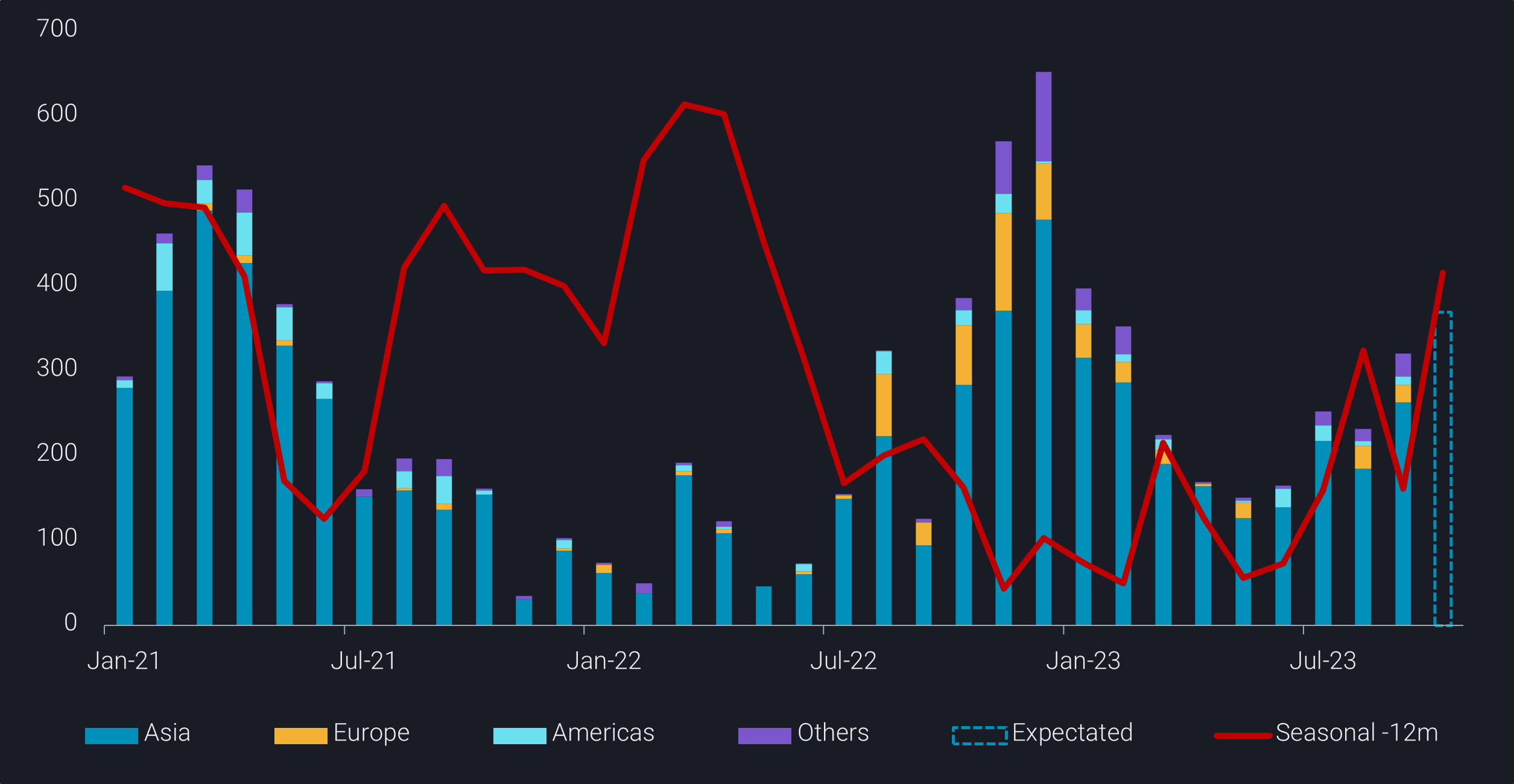

Market participants have suggested that China will not issue a fourth batch of clean fuel export quotas this year after the government issued the third batch of 12mt in early September. Still, the first three batches of quota issued this year (40.79mt) are up nearly 10% y-o-y, as more volumes were issued in the first two batches to allow refiners to boost exports from the beginning of the year.

Despite this, China’s exports of gasoline, diesel and jet fuel remained moderate in 1H this year, amid rapid recovery in domestic fuel demand after China’s re-opening and relatively weak export margins. Exports only started picking up in Q3 after Asia’s product cracks rebounded from nadirs in end May.

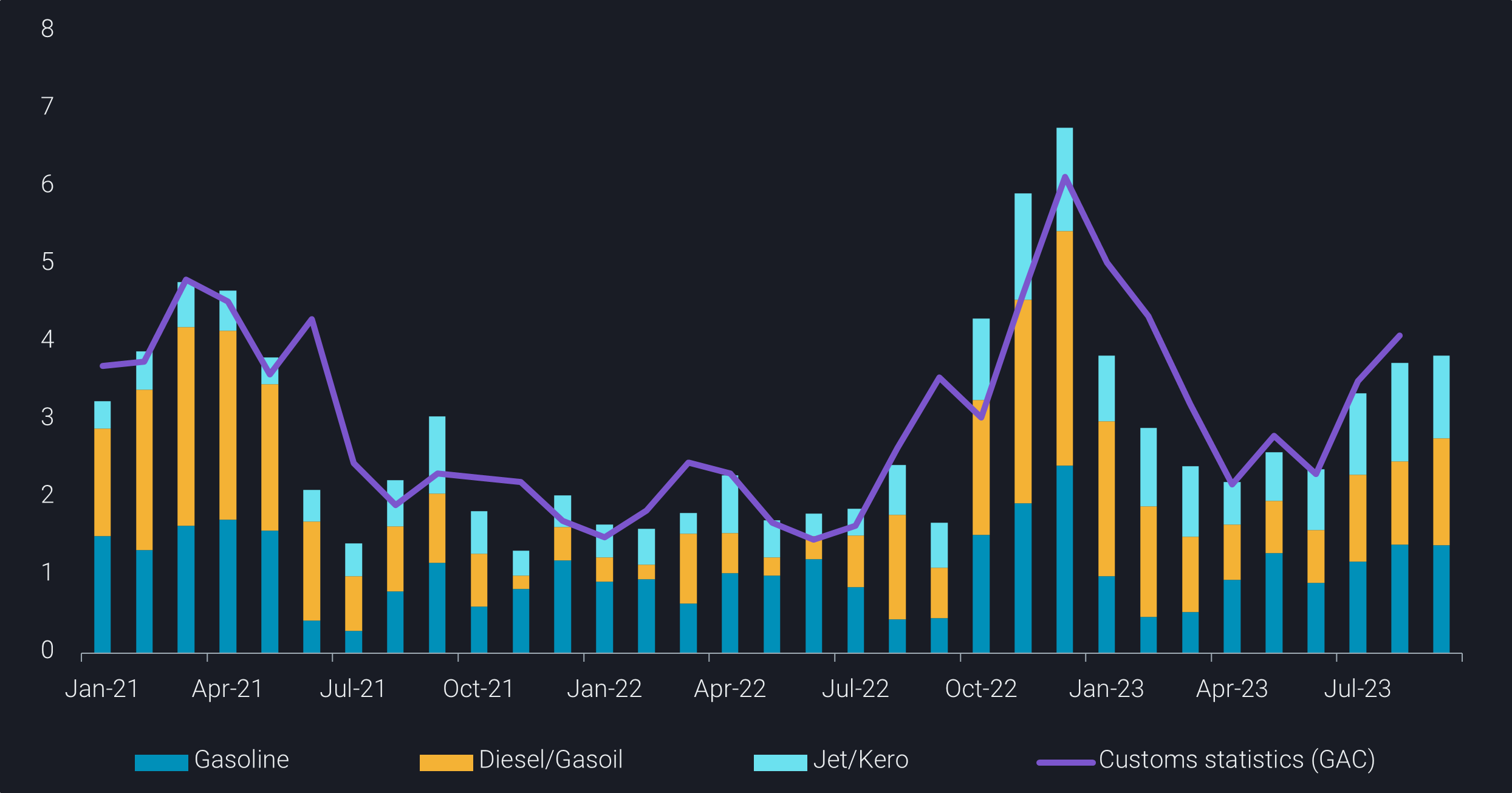

China’s clean fuel exports by product vs. Customs statistics (mt)

Chinese refiners may continue to boost exports in October, as the remaining quotas for Q4 are estimated at above 10mt, and some refiners may still be allowed to convert some remaining export quotas for LSFO to CPP quotas.

The sharp decline in Asian gasoline cracks in recent weeks, contrasting against stable middle distillate cracks, is also incentivising refiners to increase exports of diesel and jet fuel at the expense of gasoline. We estimate that China’s middle distillate exports will remain above 2mt/month in Q4, compared to around 1mt/month in Q2, albeit below the 3.5mt/month average in Q4 a year ago.

Russian diesel export ban may spur China’s exports (indirectly)

The recent Russian announcement to ban gasoline and diesel product exports have put Turkey’s diesel supply at risk, as Russian barrels accounted for 80% of the country’s seaborne imports in the first nine months of this year. If the ban is prolonged, Turkey will need to import more barrels from other regions, likely the Middle East and India. Although Chinese refiners are generally unable to produce European winter-spec diesel, they may increase diesel exports to the East of Suez market, as Middle East and Indian diesel supplies are redirected towards Turkey.

Relatively stable Asian diesel cracks in recent weeks likely suggests that a large-scale supply reshuffle has yet to materialise, with the market generally anticipating a short-lived Russian export ban. Russia’s prime minister Alexander Novak has been reported to meet with domestic oil companies to discuss the possibility of partially lifting the ban, which would reduce Turkey’s diesel supply woes.

China’s diesel exports play catch-up after lagging jet fuel exports this year

China’s jet fuel exports have seen the largest y-o-y gains in Q3 among the clean products exported, as exports to Hong Kong, the top jet fuel destination, have jumped over 150% year-on-year, while sales of jet fuel for outbound international flights (included in customs statistics) also picked up this year.

Diesel exports, on the other hand, were driven by lower-than-expected domestic diesel demand growth, due to deepening property sector woes and disappointing overall export activity. China’s diesel production will pick up in Q4 amidst seasonal demand strengths in the country, and Chinese refineries may prioritise diesel production and exports over jet fuel based on jet regrade signals.