One week ago, the Biden administration announced a historic SPR release initiative, outside the IEA framework and explicitly targeting lower prices rather than coping with a supply outage. Last Friday, the news of Omicron spread much faster than the actual virus variant. Now indications by Federal Reserve Chair Jerome Powell of a likely faster monetary tightening brought the Omicron toll on Brent crude prices to $12/b. And later this week OPEC+ is due to decide on its official production path. A lot to digest – possibly simply too much?

We will try to sort things somewhat in this blog piece, bringing in the latest seaborne energy trade flows that show tides in the oil market have already shifted well ahead of the appearance of Omicron. The oil price tends to move in cycles or waves, and for now bearish momentum has taken over after the bull stampede ran out of steam already in late October.

How different the market looked just two months back

Let’s move back one or two months in time. Back in September and early October the following items ranked high on the analyst watchlist:

- strong demand recovery observed pretty much across the globe, with Latin America’s call for external energy amid severe droughts being met by a solid recovery from Covid-19 in Europe and Asia amid others

- widespread hopes that we would be largely through the Covid-19 era

- a natural gas and coal price rally, giving rise to gas-to-oil switching expectations of 0.5mbd or more over a six month period

- rallying refining margins, widespread product shortages, and the perception that the global refining system would run into capacity limitations soon

- stagnating crude exports out of OPEC+ countries, raising questions about spare capacity and the lack of investments

All this has contributed to rising oil prices, partly even faster rising price forecasts ($100, $120, $150, you name it), spiking margins and product differentials, and above all steep increases in backwardation. All these price signals went to work, and combined with seasonal factors generated a surprisingly strong market supply reaction.

A breaking wave of oil & gas hits the sea in November

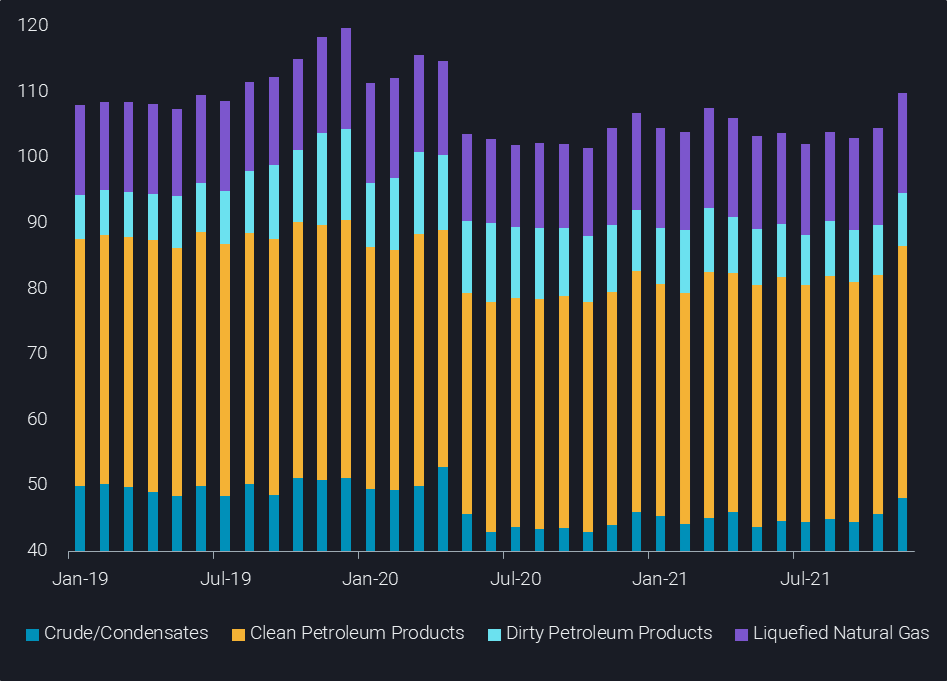

In fact, we currently assess global loadings of oil and gas on tankers above 5kt capacity at 110mbd in November (including intra-country flows). This is up a massive 5.3mbd from October and even close to 7mbd from September. It is also 1.5mbd higher than the average observed over the first half of 2019. Especially the 3.7mbd increase in crude loadings vs Sep and a mom increase of 2mbd in clean product loadings (including ethane and LPGs) helped to cool prices already in the weeks before Omicron was detected.

World oil and gas loadings incl. intra-country flows (mbd)

The strong price signals and steepening backwardation in particular have likely boosted loadings quite a bit beyond underlying supply rates, meaning that not all of the observed upside will be sustained into December and beyond. At the same time, demand uncertainties amid still high prices are now likely to hold back procurement, weakening margins and incentives to maintain the supply wave. The pressure on prices may be amplified by a lack of risk taking appetite on the financial/speculation side of the market just about 4 weeks ahead of the end of the year. Accordingly, some of the market weakening is a function of a bit unfortunate timing.

With Omicron the market looks now very different

So how does the analyst watchlist look now at the start of December? Of the five items above, gas prices are still sky-high, and spare capacity remains some concern, but not for the near future. Instead we have other items on the list:

- Albeit Omicron will need weeks or months to be properly understood, travel restrictions are already a reality and social distancing is surely en vogue, with another Delta wave being the bigger concern for now in many countries

- In line with the above, consumption is likely to tilt again from services and mobility towards goods

- Renewed supply chain issues are likely, especially in Asia were the Covid containment strategy may be severely challenged by Omicron

- In combination with high natural gas and electricity prices with peak winter still ahead of us, inflation or rather stagflation poses a growing risk, especially as monetary policy options are limited or even rolled back

- Emerging markets are under particular risk with lower vaccination rates and weakening domestic currencies vs the USD

- Given the recent strength of oil demand, the direction may well be southwards at least for the next 3-6 months, with the extent of the decline being dependent on the ultimate effects of Omicron on transmission, infection rate and severity of Covid-19 cases

- How much length do SPR releases add to the oil market balance, already seen long for 2022 by the IEA and other agencies ahead of the latest Corona virus variant

- How does OPEC+ react to this challenge?

How does OPEC+ react?

Against the extreme developments of recent days and weeks, the question whether OPEC+ pauses its 400kbd monthly increase schedule or not becomes nearly irrelevant. Ultimately, actual cuts may well be needed, but it appears too early to assess and implement such a measure. The core challenge appears to be Omicron and that is an anticipated demand shock. In combination with by now very weak refining margins in Asia and Europe, it can be expected that refiners will pull back their inquiries for crude oil.

What may be more crucial in the short term than the OPEC+ decision is the next round of Saudi OSPs, probably due for early next week. If the Saudis follow their standard guide – the change in the Dubai market backwardation over the last month (Nov vs Oct) – OSPs for January loading would be hiked again substantially after a massive increase already last month. Accordingly, term barrels would become very expensive and nominations are set plummet in line with agreed contract flexibilities. Production may be maintained but could easily rest in domestic or overseas storage without really reaching the market.

Long story short: supplies of OPEC+ barrels to end-consumers are set to slow substantially in all likelihood latest as of January irrespective of the formal production decision. What is needed in terms of deeper-going, mid-term market management will only be known once the repercussions of Omicron are better understood, which may very well be weeks or even months away.

Each week, Vortexa Market Analysts produce exclusive reports highlighting product flows in Asia, Europe, and Americas. Receive these directly to your inbox, and see how effective data using Vortexa Analytics can be. Sign up here!

More from Vortexa Analysis

- Nov 25, 2021 Clean tankers battle it out in the Atlantic and the Middle East

- Nov 23, 2021 How helpful is the US-led SPR release

- Nov 23, 2021 Asia’s gasoline cracks make an unexpected U-turn

- Nov 18, 2021 Asia’s crude appetite sweetens in November

- Nov 16, 2021 Musings on OPEC+ spare capacity

- Nov 11, 2021 Tonne-miles need to pick up to sustain rally in dirty freight rates

- Nov 10, 2021 Does supply provide a cure for record LPG prices?

- Nov 10, 2021 Global diesel market braces for tight winter as inventories draw

- Nov 4, 2021 What’s behind Asia’s gasoline crack surge?

- Nov 3, 2021 A sweet-sour situation for OPEC+