What’s behind Asia’s gasoline crack surge?

The surge in Asian gasoline cracks appears to be to some extent a knock-on effect on large net-outflows from the region in September and October.

Asian gasoline cracks have surged dramatically over the last month. Strong regional demand following relaxed Covid-19 restrictions and relatively weaker sour crude prices are among the drivers. But seaborne trade flows also provide valuable insights.

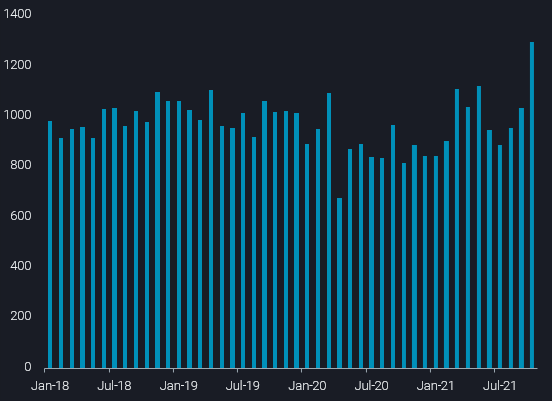

What makes the gasoline crack rally even more impressive is that it comes against the backdrop of a spike in global exports, rising by more than 0.5mbd mom in October. And the key players behind this surge are typical regional suppliers. Saudi Arabia, Singapore and South Korea have hiked exports by more than a quarter mom to 1.3mbd. Such an increase is unlikely to have come purely from yield shifts, albeit naphtha and jet/kero exports have been falling mom, probably make use of blending operations and stockdraws of components.

Gasoline/blending component exports from Saudi Arabia, Singapore and South Korea (kbd)

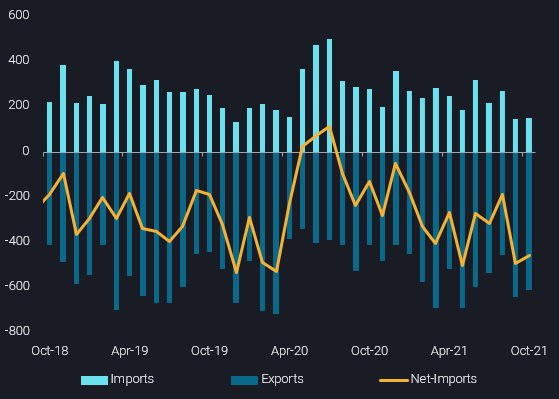

So this would speak for pull factors being at play, such as a boost in regional demand. However, a look at net-flows into and out of the region (excluding intra-regional trade) yields interesting insights. September and October imports have been at a dataset low (starting 2016) of just 150kbd. At the same time, exports hit 630kbd over the same two months, marking the highest level since Feb/Mar 2020, when the first wave of Covid-19 inflated exports.

Asian gasoline trade flows with other regions (kbd)

Accordingly, Sep/Oct Asian gasoline net-exports reached a 19-month high of close to 0.5mbd. This was encouraged by strong discount in regional prices to Atlantic Basin valuations over August and early September. Evidently, Asia has been starved of supplies by this substantial outflow over two months, keeping it sensitive even to minor regional demand improvements.

But the correction may already be underway, including a re-arrangement of arbitrage flows towards Asia. For instance, PADD 3 gasoline and component arrivals into Japan could reach a 4-year high in November of 44kbd. And from Europe only the second LR1 tanker in five months’ time appears to reach Asia this month (both from Amsterdam to Pakistan).

At any rate, the recent surge in Asian gasoline cracks is unlikely to have been the last one during the current Northern Hemisphere winter season, given the wide set of challenges and outages in the global refining system. All clean products should have room for rallies, both from demand and supply signals, and especially in Europe and Asia, where the oil & gas supply situation is particularly constrained.

More from Vortexa Analysis

- Nov 3, 2021 A sweet-sour situation for OPEC+

- Nov 2, 2021 China scrambles for diesel to avert another power crunch

- Oct 28, 2021 FSU fuel oil exports decline in October

- Oct 27, 2021 Asia’s chase for naphtha amidst a global shortage

- Oct 26, 2021 Crude floating storage shows diverging trends

- Oct 21, 2021 The case for higher refinery margins

- Oct 20, 2021 A last hurrah for global gasoline cracks? Probably not

- Oct 20, 2021 Flow highlights (EMEA): Supplies pick up on record pricing

- Oct 14, 2021 Scrubber-fitted VLCCs quietly gain market share